Management Based Reporting

Management of the financial aspects of the company operations is the vital aspect

of a company and the executives are in search throughout their functioning to bring

in tools and solutions which will aid to the easiness as well as efficiency of it.

The aspects of reporting as well as report generation will serve as a management

tool in understanding the status of the accounting aspects of your business. Moreover,

with the real-time functionality of reports, you will be able to understand the

on goings in regards to the financial operations of the company in no time just

by having a glance at the accounting-based reports.

The Odoo being an efficient management tool showcases various reporting as well

as report generation tools for the easiness of business operations and management.

In regards to the financial management of the company, there is a dedicated module

that is embedded with advanced reporting functions and tools of operations. In the

Accounting management module of Odoo, there are numerous reporting tools in regards

to the financial operations and for the Accounting management aspects, there are

reporting tools such as Invoice Analysis, Analytic Report, Unrealized Currency gains/losses,

Depreciation Schedule, Budget Analysis, and Product Margins. We will be discussing

these aspects of report generations in detail one by one in the upcoming sections.

Invoice Analysis

The Invoice Analysis report generation is the primary form of accounting management

report available in the Odoo Accounting module. This report will provide an Analysis

of the invoices which have been described and the ones which are in the created

stage of operation. All the invoices in regards to the customer-based operations

in the sales of the services as well as the products will fall under the Invoice

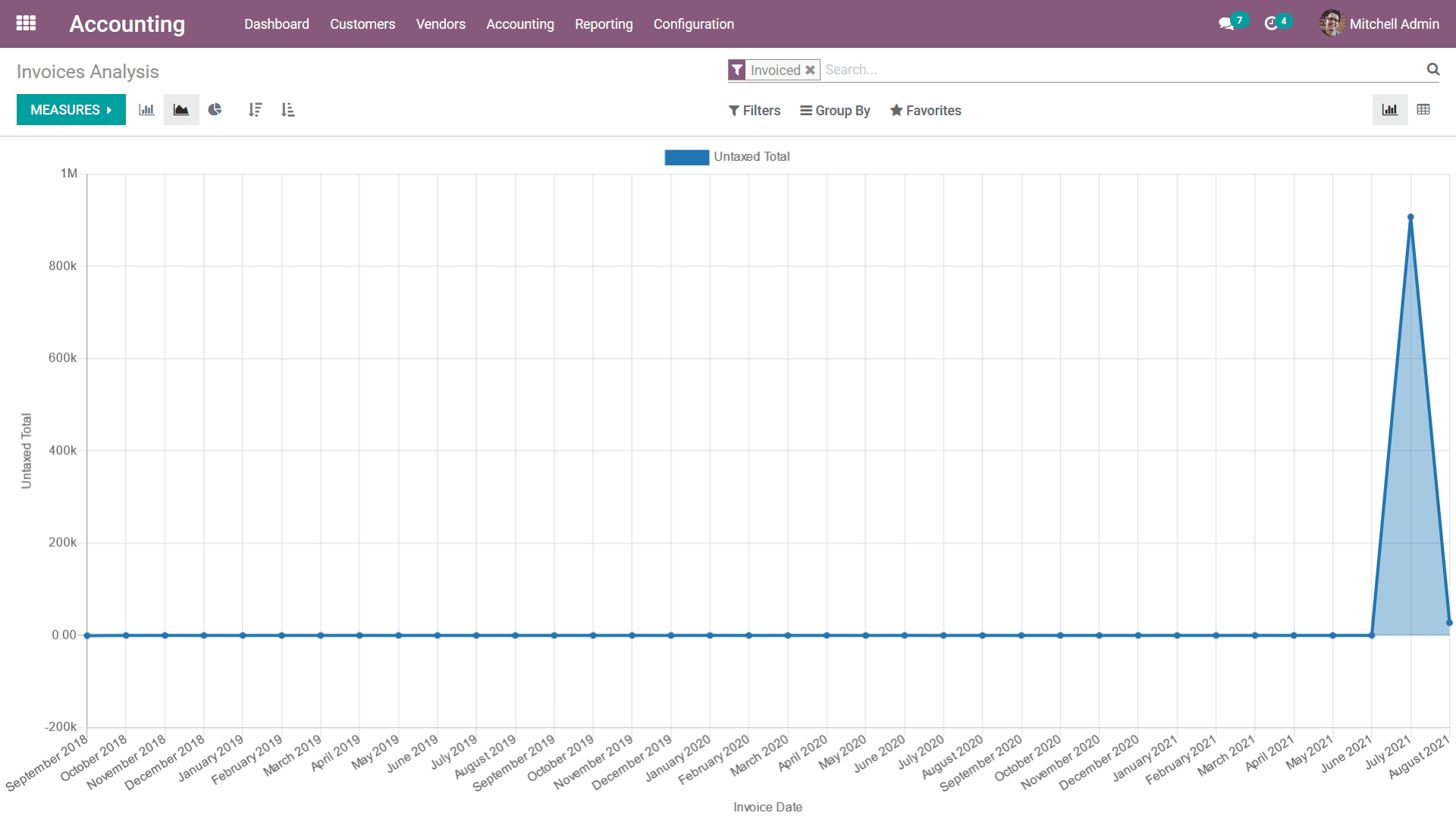

Analysis reporting. The Invoice Analysis reports can be viewed in the Line as well

as pie and the Bar charts. There are Filtering as well as Group by tools which are

available in the Invoice Analysis report will be helping you to view the analysis

report in regards to the invoices as per the need.

The following screenshot depicts the bar charts of the Invoice Analysis report which

will be depicted in color coordination based on the need. The Filtering, as well

as Group by available options, will help sort out the required details in regards

to the invoices which are being generated.

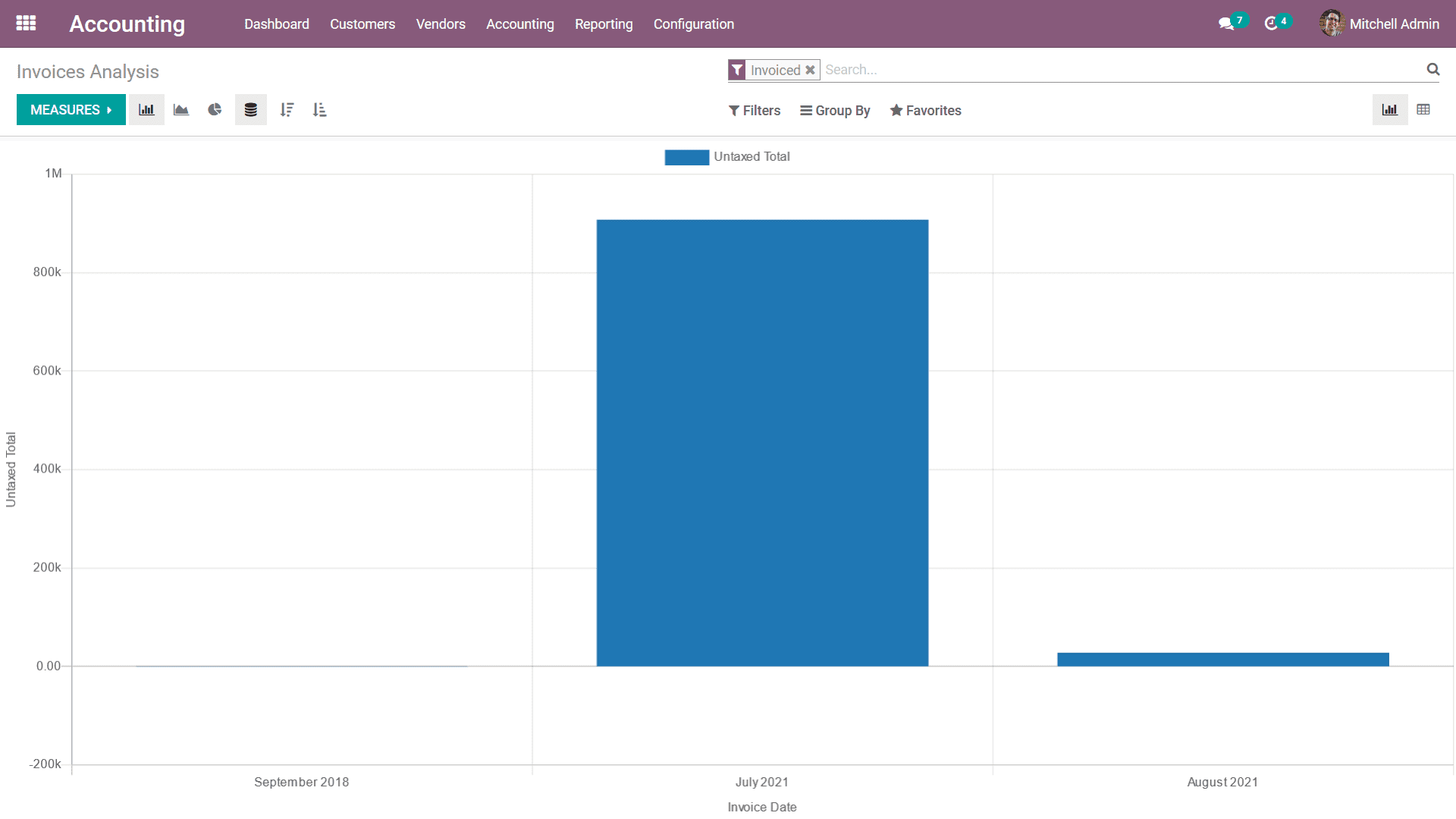

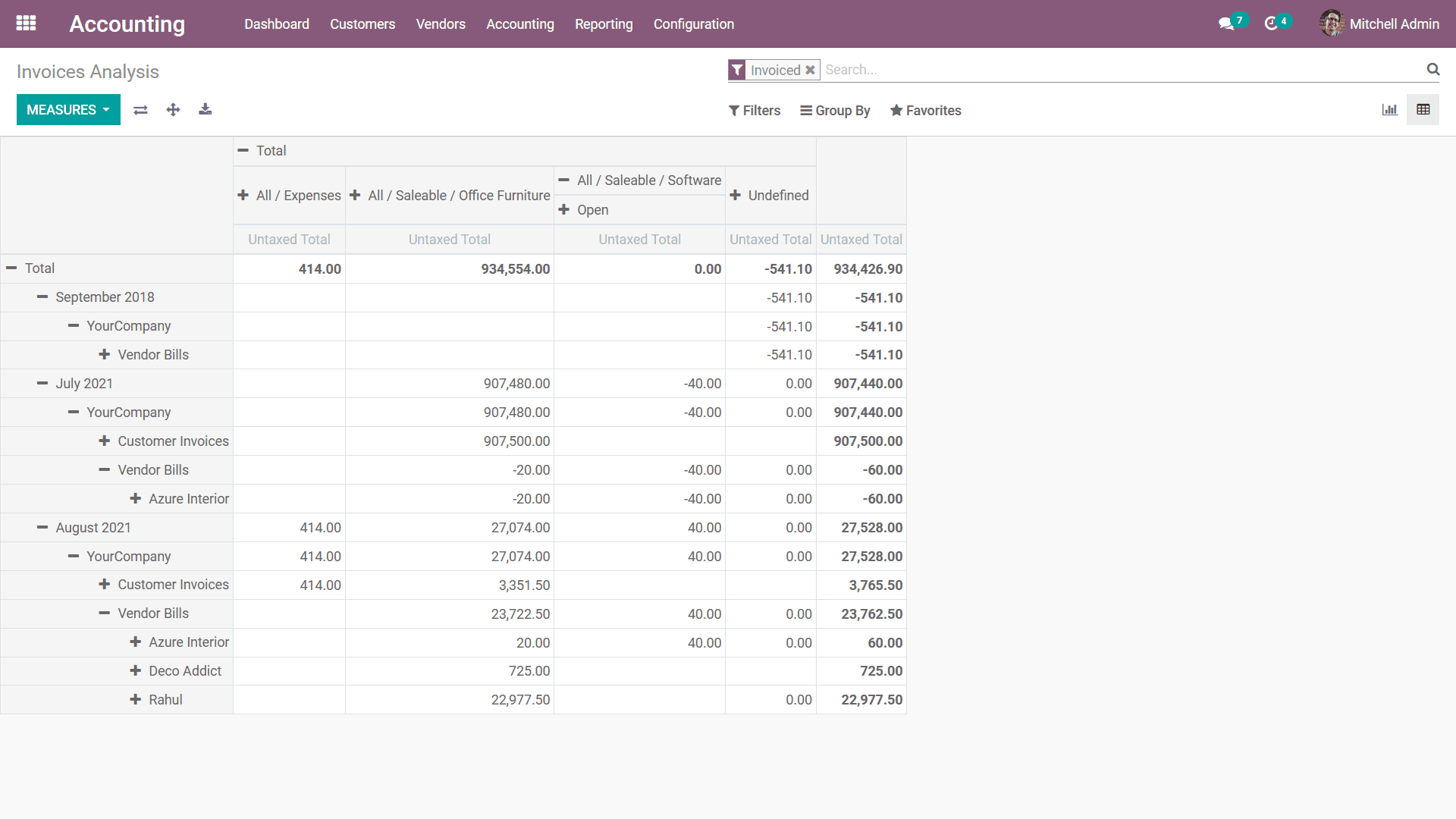

Furthermore, there is also a Kanban view available other than the graph view that

is available helping you to draft the reports in a different format. In the Kanban

format, the filtration can be done within the report helping you to depict only

the required aspect of the + sign, as well as the - sign, which will help you to

expand as well as depreciate the reporting aspects in regards to the entries which

have been defined. Furthermore, there are Filtering as well as Group by options

available helping you to craft the report using the default options as well as customizable

ones which are available. Additionally, there are Measures configuration options

that are available which will help you to define the measures on which the Invoice

Analysis reporting aspects have been defined.

The Invoice Analysis reporting is an exception tool that has been defined for the

operations of the Accounting management options of the business in regards to the

invoices which have been generated as well as the ones which are in function. As

we are clear on the Invoice Analysis reporting menu in the Odoo Accounting let's

now move on to the next section where the Analytic Report generation menu has been

defined.

Analytic Report

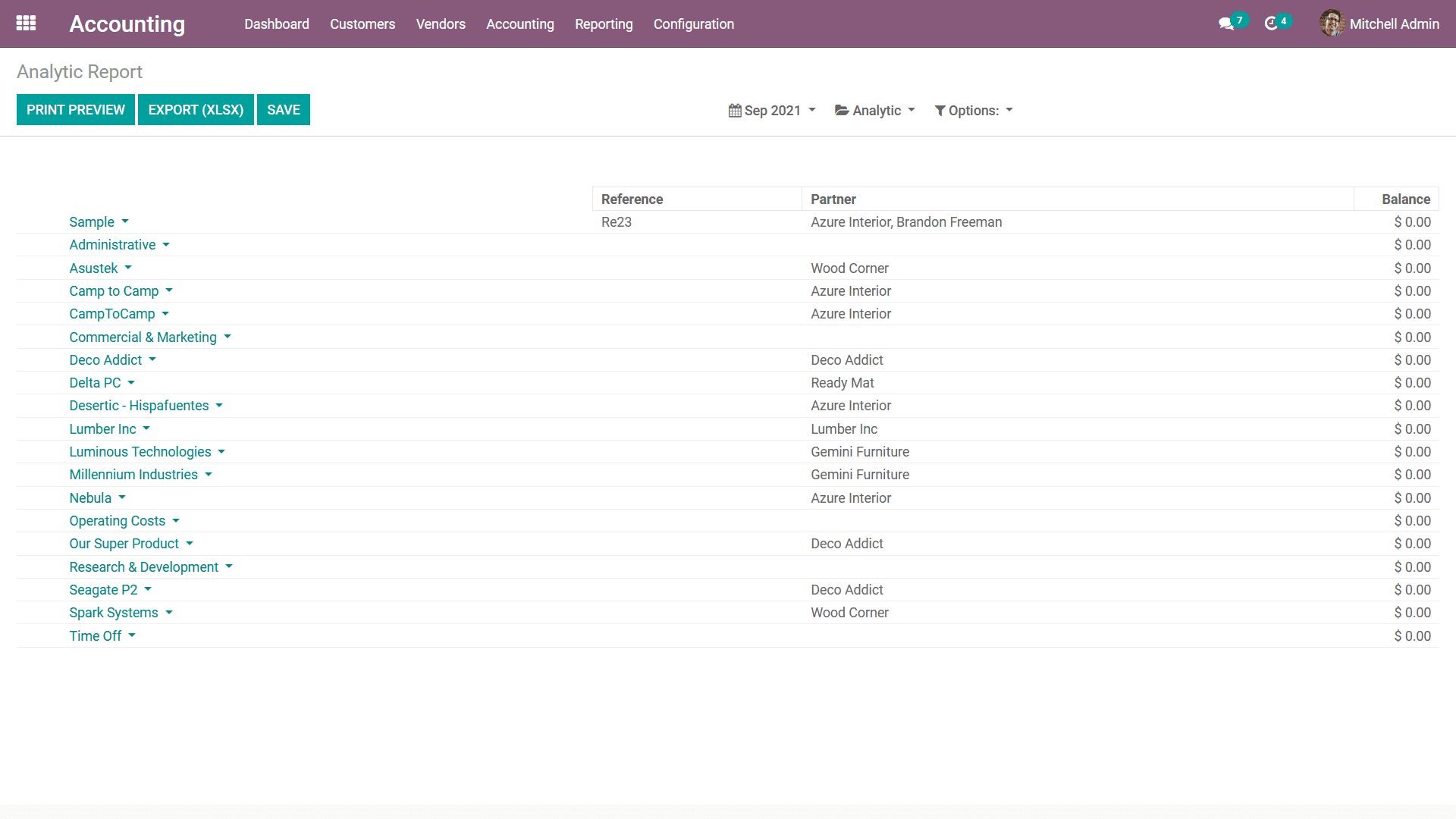

The Analytic Reporting tool of the Odoo platform will help you to define the analytic

operations regarding the accounting aspects of the company. Moreover, the report

will provide a quantitative analysis in regards to all aspects of the accounting

of the organization which has been defined. The following screenshot will describe

the window of the Analytic Report available in Odoo. Here all the aspects of the

Odoo accounting operations as well as the Reference of the financial operations,

Partner involved in it as well as the balance amount will be depicted as shown in

the following screenshot.

In addition, there is a Group by tool that will help you to group the entries based

on the Fiscal Period of operation as well as an Analytical Accounting filtration

tool that is available which will help with the filtration in respect to each of

the analytical accounts which have been defined. Furthermore, there is an advanced

filtration tool where the various options can be configured in regards to the Analytical

entries to be filtered.

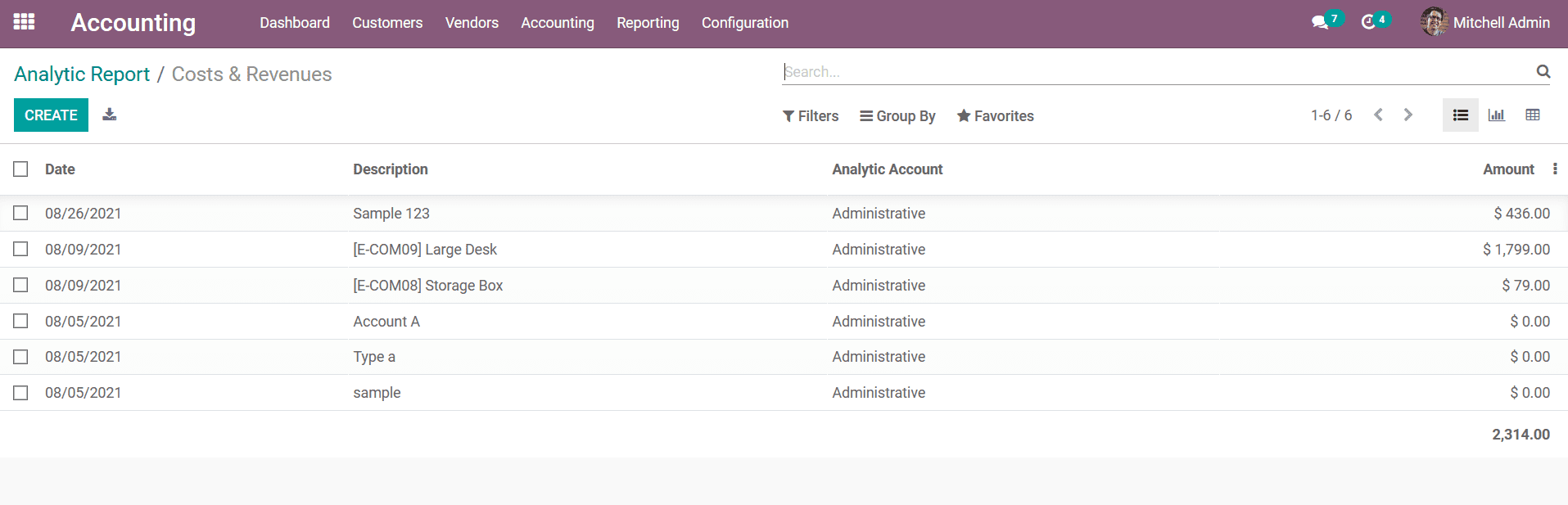

Upon selecting each of the entries of the Analytic Report, you will be depicted

with all financial operations in regards to the financial aspects as shown in the

following screenshot. Here we have selected the Cost & Revenues menu that is available.

In the menu, the Date, Description, Analytical Account, as well as the Amount allocated

with the operations, will be defined. In addition, there are Filtering as well as

Group by tools that are available which will aid in finding out the respective entry.

You will also have the provision to create new entries by selecting the Create option

that is available. Moreover, by selecting the respective entry which has been defined

you can edit it also.

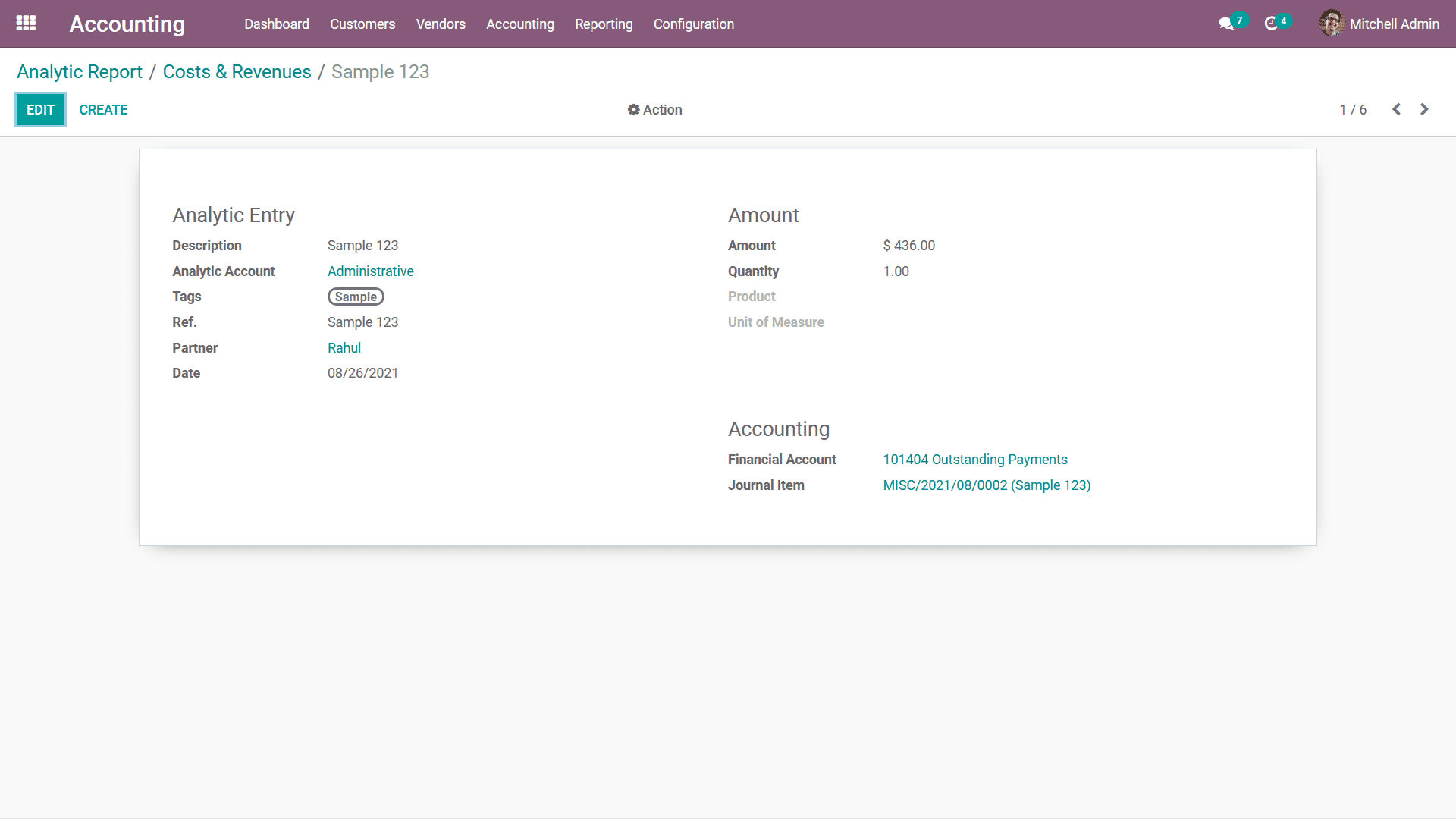

Upon selecting each of the entries you will get the information of the respective

Analytical Entry such as the Description, Analytical Account, Tags allocated, Reference

details, Partner name as well as the Date of the entry. Furthermore, the Amount

detail such as the Amount and the Quantity allocated with the respective Product

as well as the Unit of Measure of it will be defined. The Accounting aspects such

as the Financial Account and the Journal Item will be defined. You can choose the

edit option that is available which will help you to change the details which are

being defined here as per the need.

The Analytic Report tool will help you to manage the aspect of the Analytical Accounting

entries by having a greater insight on each of the operations which will be an effective

tool in the aspects of the financial management of the company. As we are clear

on the functioning of the Analytic Report let's now move on to the next section

where the Unrealized Currency gains/losses reporting aspects of the Odoo Accounting

is being described.

Unrealized Currency gains/losses

The Unrealized Currency gains/losses menu in Odoo accounting reporting aspects will

provide an insight on the gains or losses which the company has suffered during

the dedicated fiscal period which have been filtered. These Gains or Losses are

due to the exchange rates of the currency operations in regards to the company functioning.

Moreover, the Unrealized Currency gains/losses are mainly related to the international

business which functions across the world or the ones which are functioning with

multiple currencies in operations. This menu is available in Odoo reporting of the

Accounting aspects because the Odoo platform supports the operations of the company

with multiple currencies.

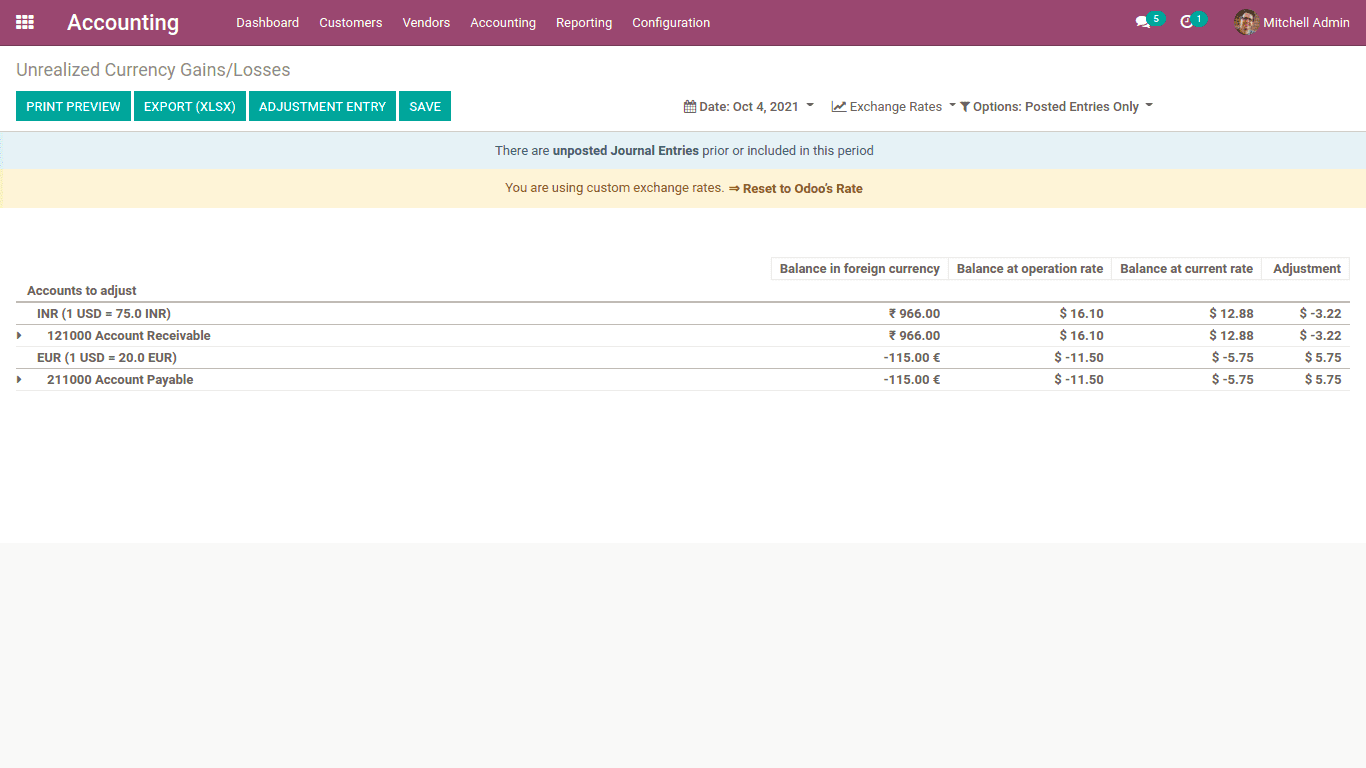

In the Unrealized Currency gains/losses reports the entries will be based on the

filtration done for the fiscal periods which have been set for the report. Furthermore,

there are distinctive filtering tools that are available which will be helping with

the filtration aspects as well as the Custom ones can be defined as per the need.

Filtration can be done based on the Exchange Rates which have been defined for the

currencies which have been in operation in your Odoo platform as well as the business.

The Options filtration will help you to sort out the data based on the entries with

the Draft entries as well as the Unposted entries which have been defined.

The Entries will be defined with Balance in Foreign Currency which is the amount

taken from Bill in respective currency, Balance in Operational Rate which is the

amount is calculated at the operation date i.e. calculated at the time you received

the bill in company currency, Balance in Current Rate It’s the current amount value

at the time of the report i.e. at the time the company gets paid. as well as the

Adjustment amount value should be added to the accounting in order to update your

accounting reports with this new information to be defined for the entries to be

defined in operation.

As we are clear on the aspect of the Unrealized Currency gains/losses reporting

tool that is available in the Odoo Accounting module, let's now move on to the next

section where the Depreciation Schedule based reporting is being described.

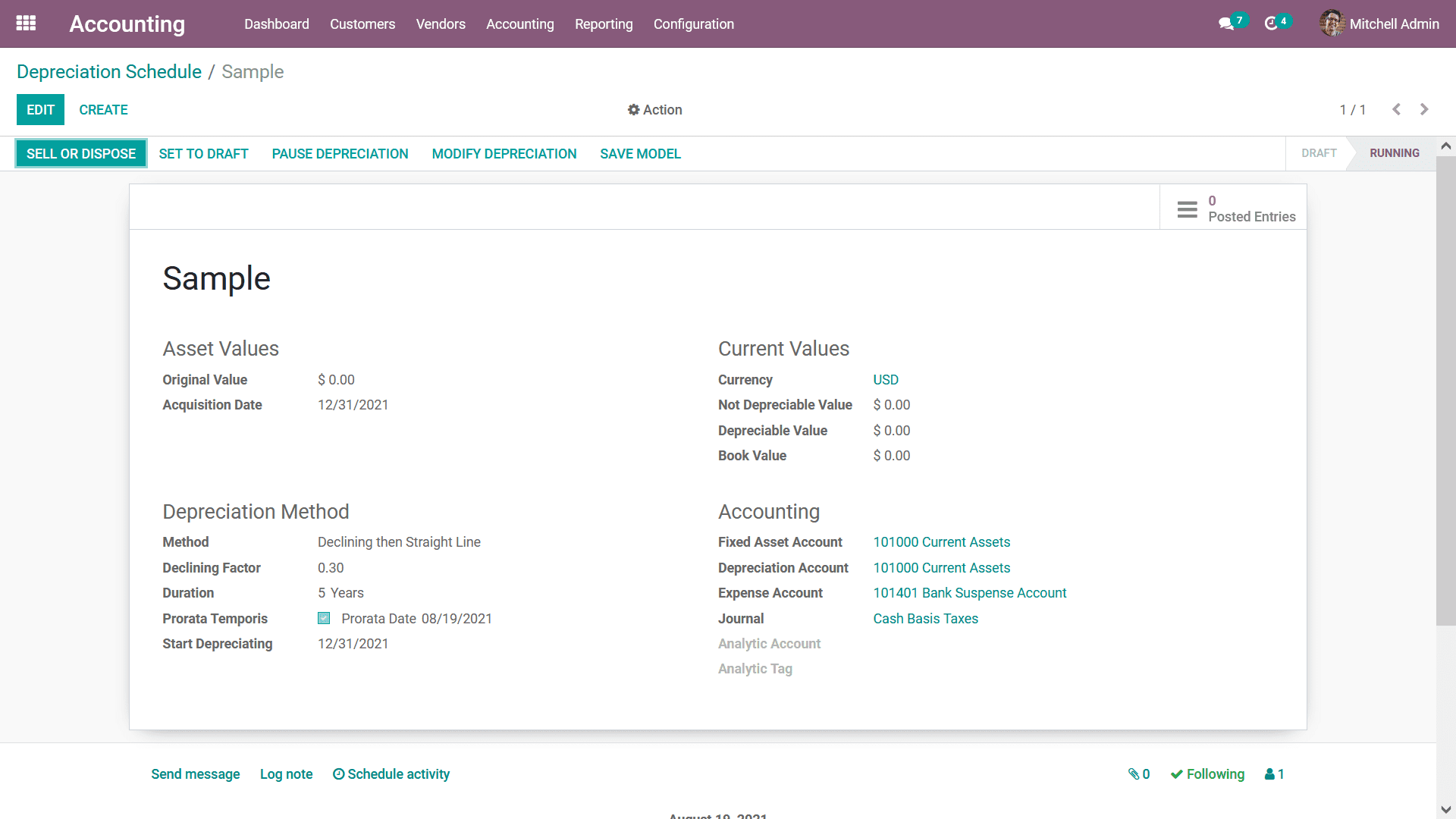

Depreciation Schedule

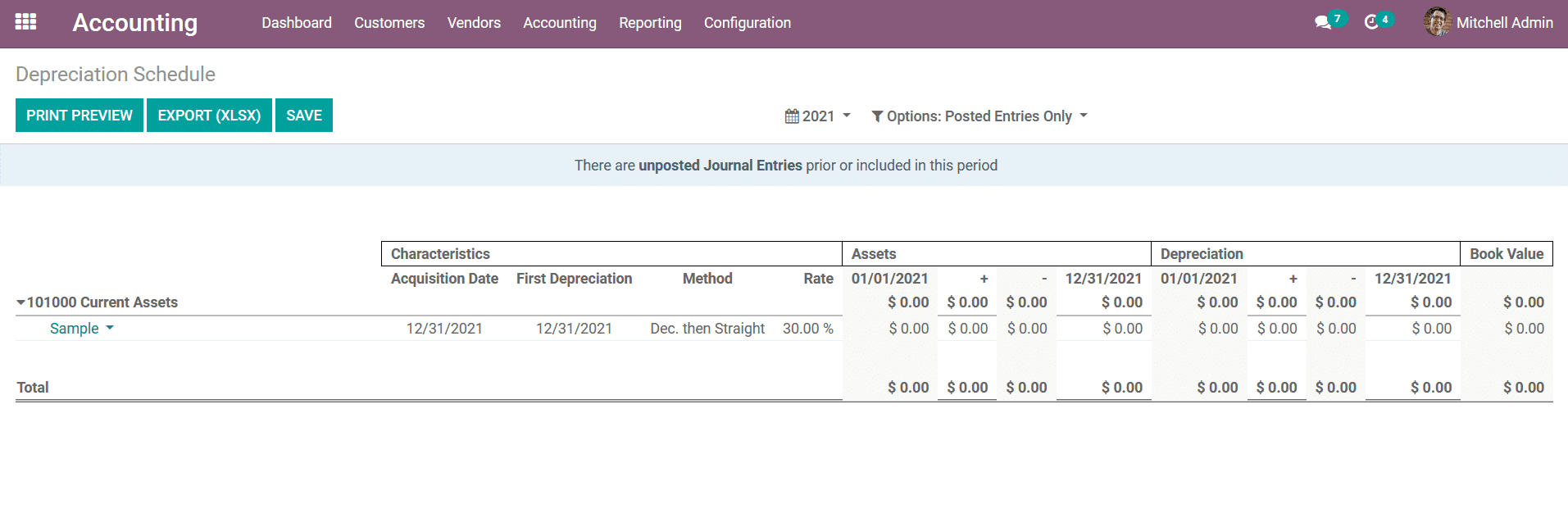

The Depreciation Schedule-based reporting will provide an insight on the depreciation

of the asset which has been defined in the business operation. The assets which

have been defined in your business can be defined in the business. The Depreciation

Schedule reporting menu can be accessed from the reporting tab of the Accounting

module. Once you select the menu you will be depicted with the reports on the Depreciation

Schedule as shown in the following screenshot. Here the Asset-based Chart of Accounts

will be defined in operations along with the Journals defined on it.

Furthermore, the Characteristics aspects such as the Acquisition Date, First Depreciation,

Method, and the rate of depreciation will be defined. The Asset details in respect

to the months and duration of operation will be defined. In addition, the Depreciation

of the respective asset in the respective time period will be also depicted. The

book value details with respect to the Depreciation Schedule of each of the assets

will be also defined.

You will also have Filtering as well as Group by tools based on the Fiscal period

or based on the entries which are available just as in all other menus of the Odoo

platform. These Filtering and Grouping options are the ones that are available with

default and the custom ones can be defined using the dignified tools. These custom-defined

ones can be saved as Favourites for future uses in the filtration of the Depreciation

Schedule reporting aspects.

You can select each of the Journal entries under the respective Chart of accounts

to obtain detailed information regarding the Journal and the entries defined in

it. You also have the option to edit the details of the journal by selecting the

Edit option that is available. There are Sell Or Dispose of options available to

sell and dispose of the Asset. You can modify the depreciation with respect to the

asset by selecting the Modify Depreciation option that is available. The Posted

entries with respect to the Asset which is being defined.

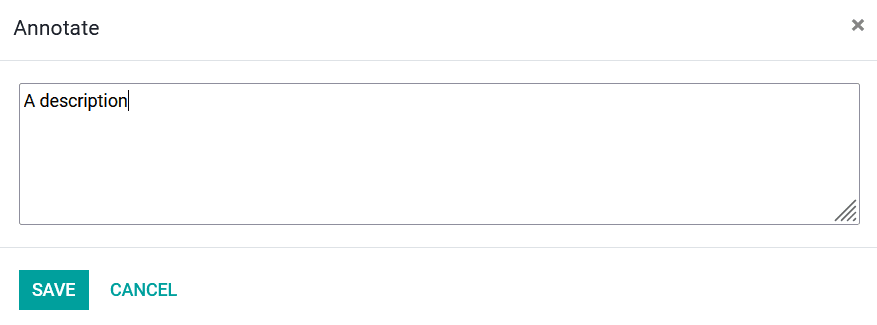

By selecting the respective Annotate option that is available with respect to the

Journal which is being defined in the Depreciation Schedule you will be depicted

with the Annotate window as shown in the following screenshot. A description of

the Annotate operations can be defined and you can save the operations with the

Save option.

The Depreciation Schedule reporting tool available in the Odoo platform will provide

you with complete insight on the aspects of depreciation of the assets of your company

which has been defined in the Odoo platform. As we are clear of the Depreciation

Schedule operations let's now move onto the next section where the Budget Analysis

reporting of the Odoo Accounting module will be defined.

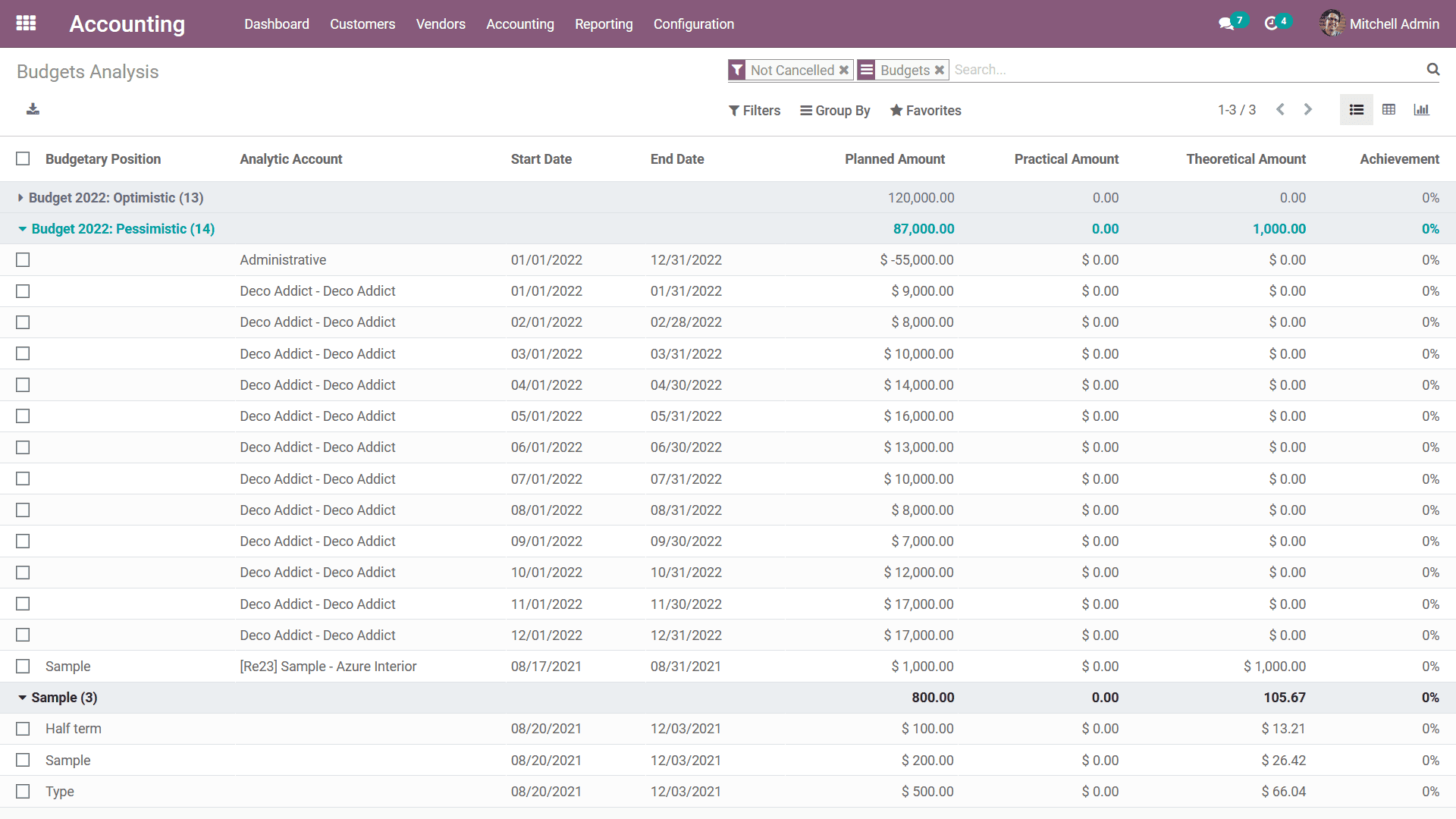

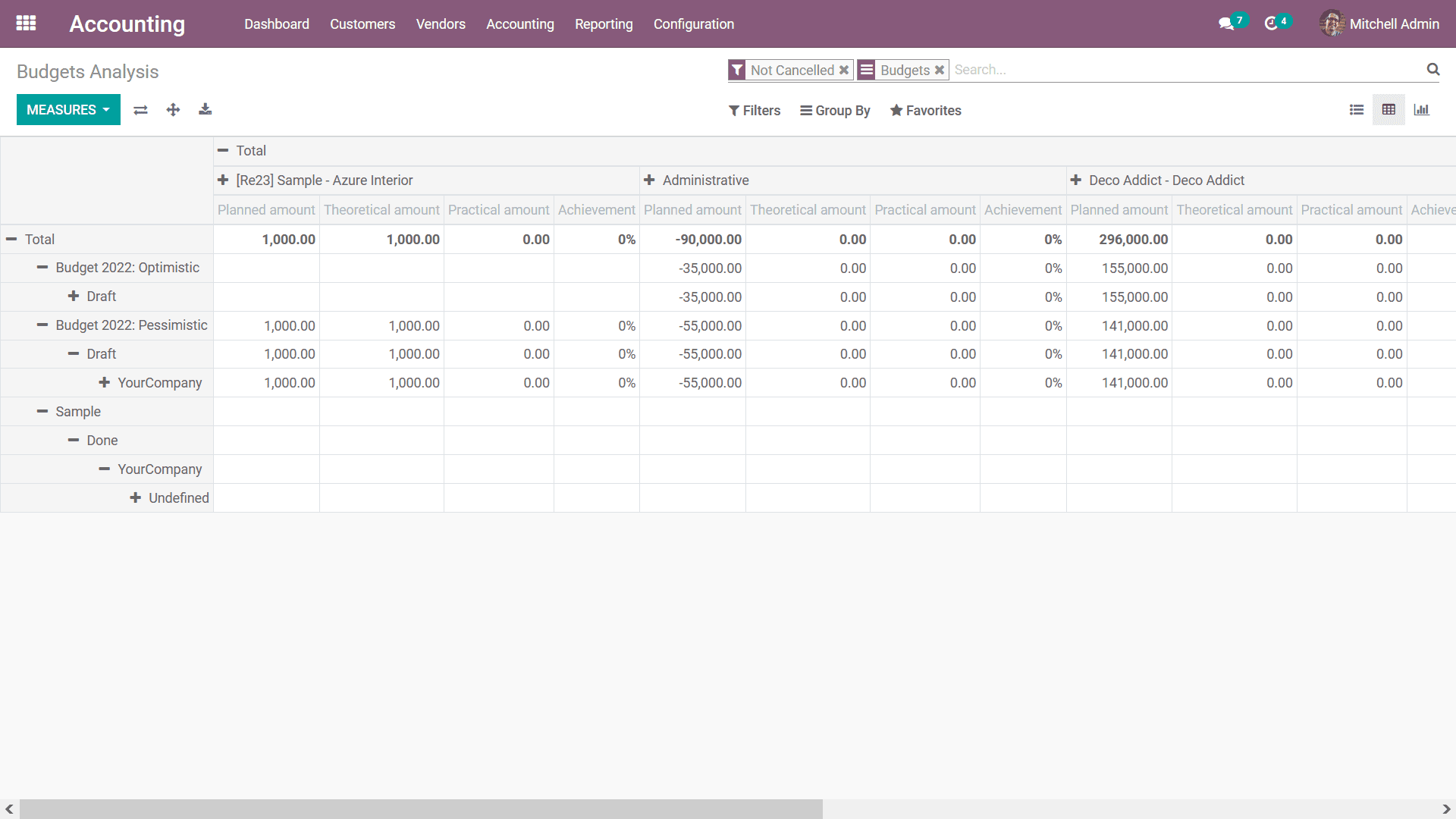

Budget Analysis

The Budget of a company is vital in regards to the financial planning of the business

operations of a particular fiscal term or period of the business operations. The

Fiscal department of an organization will define a single as well as multiple budgets

based on the operations and functional needs of the organization. The Odoo platform's

Accounting module puts forward a Budget Analysis reporting functional menu where

the reporting aspect of the different budgets has been defined. Accessible from

the reporting tab of the Accounting module the Budget Analysis Report will provide

a clear and clear image of the budgetary operations of the company.

The Filtering and Group by tools available, just as in all other menus of the Odoo

platform, will help in sorting out the entries of the Budget Analysis reports based

on the need. These Filtering and Grouping options are the ones that are available

with default and the custom ones can be defined using the dignified tools. These

custom-defined ones can be saved as Favourites for future uses in the filtration

of the Depreciation Schedule reporting aspects. In the report, all the Budget in

operations, one which is from the previous fiscal periods as well as the ongoing

ones will be defined. Furthermore, these entries can be expanded where the various

financial aspects of the budget will be defined. The Budgetary Position, Analytical

Account, Start Date, End Date, Planned Amount, Practical Amount, Theoretical Amount,

and the Achievement Percentage will be defined.

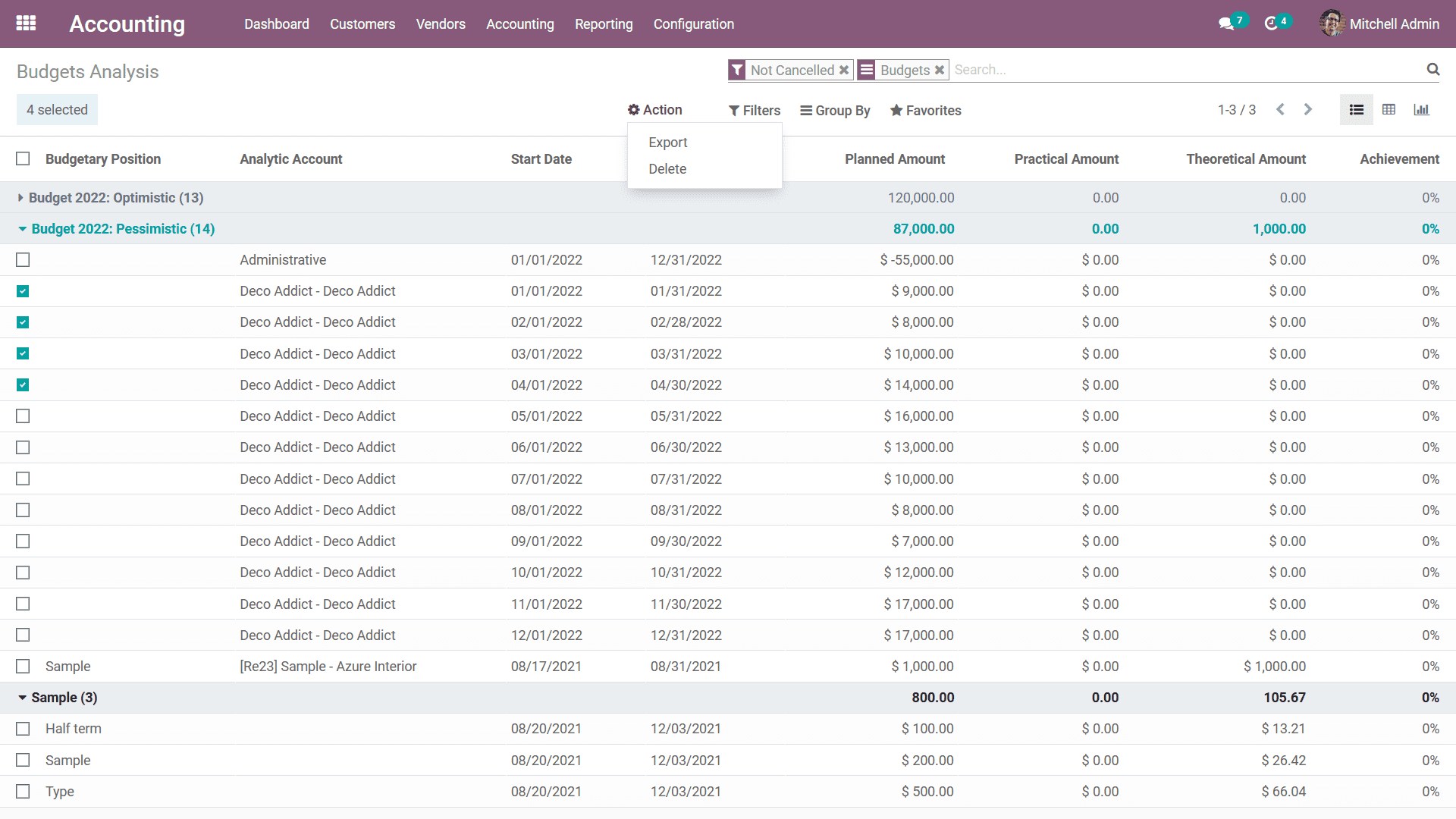

You can select each of the entries which are defined in the respective Budget by

using the Tick box option that is available. Upon selecting the respective entries,

you will be depicted with actions options in the menu as depicted in the following

screenshot. Here you will have an Export as well as Delete option that is available

which can choose for the respective operations.

Budget Analysis report can be viewed in List view, Pivot view as well as the Chart

view based on your need by selecting it from the right-hand side of the menu. The

previous screenshots depicted the list view of the Budget Analysis report. The following

screenshot will describe the Pivot View of the Budget Analysis report. In the Pivot

view, you will be able to define the Measures for the aspects which have been defined

for the various aspects of the entries to be sorted out as well as defined. Using

the + and - signs you will be able to add the default Measures That have been defined

in both the axis of the report. This functionality will ensure that you generate

and print out the reports based on the operational aspects of the Budget that you

need, the rescan be placed hidden and can be accessed upon need.

Along with the Graph view, the Budget Analysis Reporting will provide a complete

insight on the operations of the budget that have been defined in your company.

Moreover, with the distinctive as well as definite filtering and group by tools

that are available you will be able to sort out the required entries of each of

the reports that have been defined based on your need. As of now, you will be able

to understand the various aspects of the reporting in regards to the budget management

with Odoo with the distinctive Budget Analysis reporting management tool. Let's

now move on to the next section where the Project Margins reporting of Odoo Accounting

will be defined.

Product Margins

The Product Margin is the margin that you obtain on the sales of a product that

you have purchased or manufactured. The Product margins and analysis on them will

provide clear information on the product that the companies will attain based on

the sale of the product. In regards to mathematics operations, the Product margin

can be defined as:

Product margin= (selling price – cost of product) / selling price

If the sales price is more than the cost price the product will be profitable for

the company and the margin rate will be positive. However, if the Selling Price

is lower than the Cost price it will be a loss for the company and a negative margin

will be obtained for each of the sale operations. The Odoo platform understands

the importance of Product Margins in business operations and has defined a dedicated

reporting tool in regards to it in the Odoo Accounting module. Accessible from the

Reporting menu of the Odoo Accounting module, the Product Margins Reporting will

provide a distinctive overview of the Product Margin operations of the company.

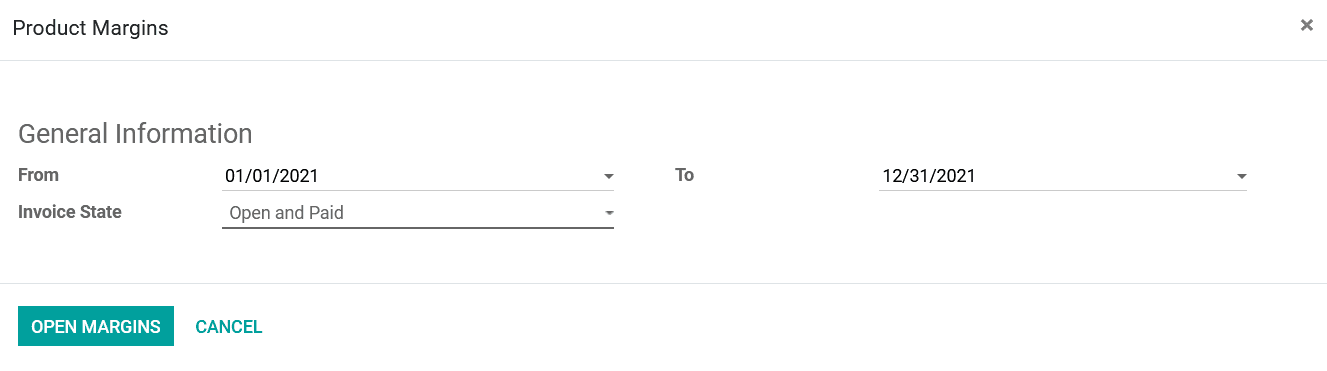

Upon selecting the Product Margins option you will be depicted with the pop-up window

as depicted in the following screenshot. Here you need to configure the General

Information details such as the From and To option should be defined further; the

Invoice State option can be selected from the available drop-down menu.

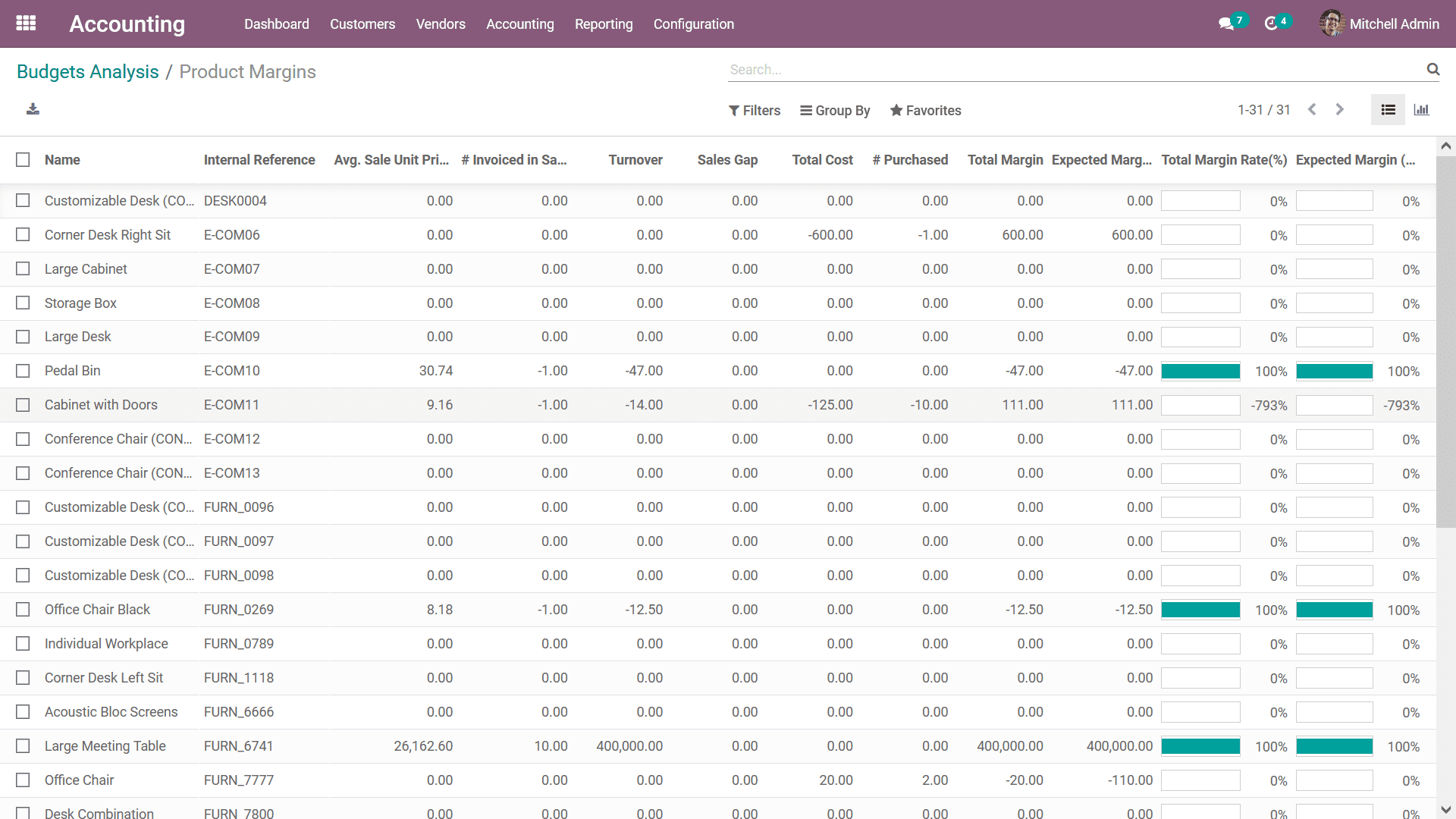

Once the operations aspects have been defined, select the Open Margins option that

is available which will depict the Product Margins report aspect and the configurations

aspect. The Product Margins reporting will be depicted based on the configurations

and the Budget Analysis that have been defined. Here, the Name of the products,

Internal Reference details, Average Sales Unit Price, Invoice in Sale, Turnover,

Sales Gap, Total Cost, Purchased, Total Margin, Expected Margin, Total Margin Rate

Percentage, and the Expected Margin Percentage will be displayed.

Furthermore, the Filtering as well as Group by tools available, just as in all other

menus of the Odoo platform, will help in sorting out the entries of the Product

Margins reports based on the need. These Filtering and Grouping options are the

ones that are available with default and the custom ones can be defined using the

dignified tools. These custom-defined ones can be saved as Favourites for future

uses in the filtration of the Product Margins reporting aspects.

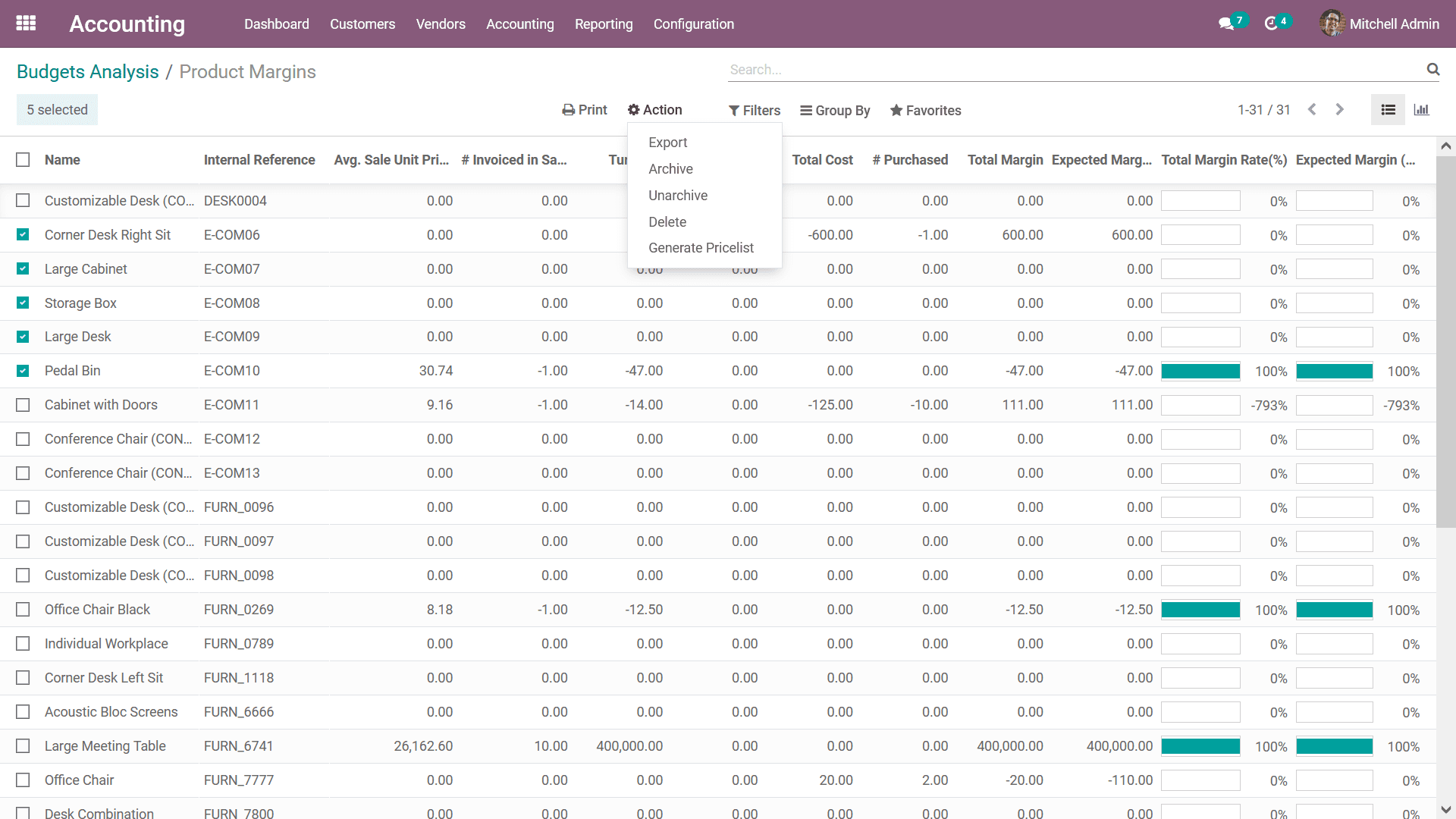

Additionally, you can select the various Products which are defined by using the

Tick box option that's is available which will depict the Action option that is

available which will depict you with the option with Export, Archive, Unarchive,

Delete, and the Generate Pricelist option that is available as shown in the following

screenshot.

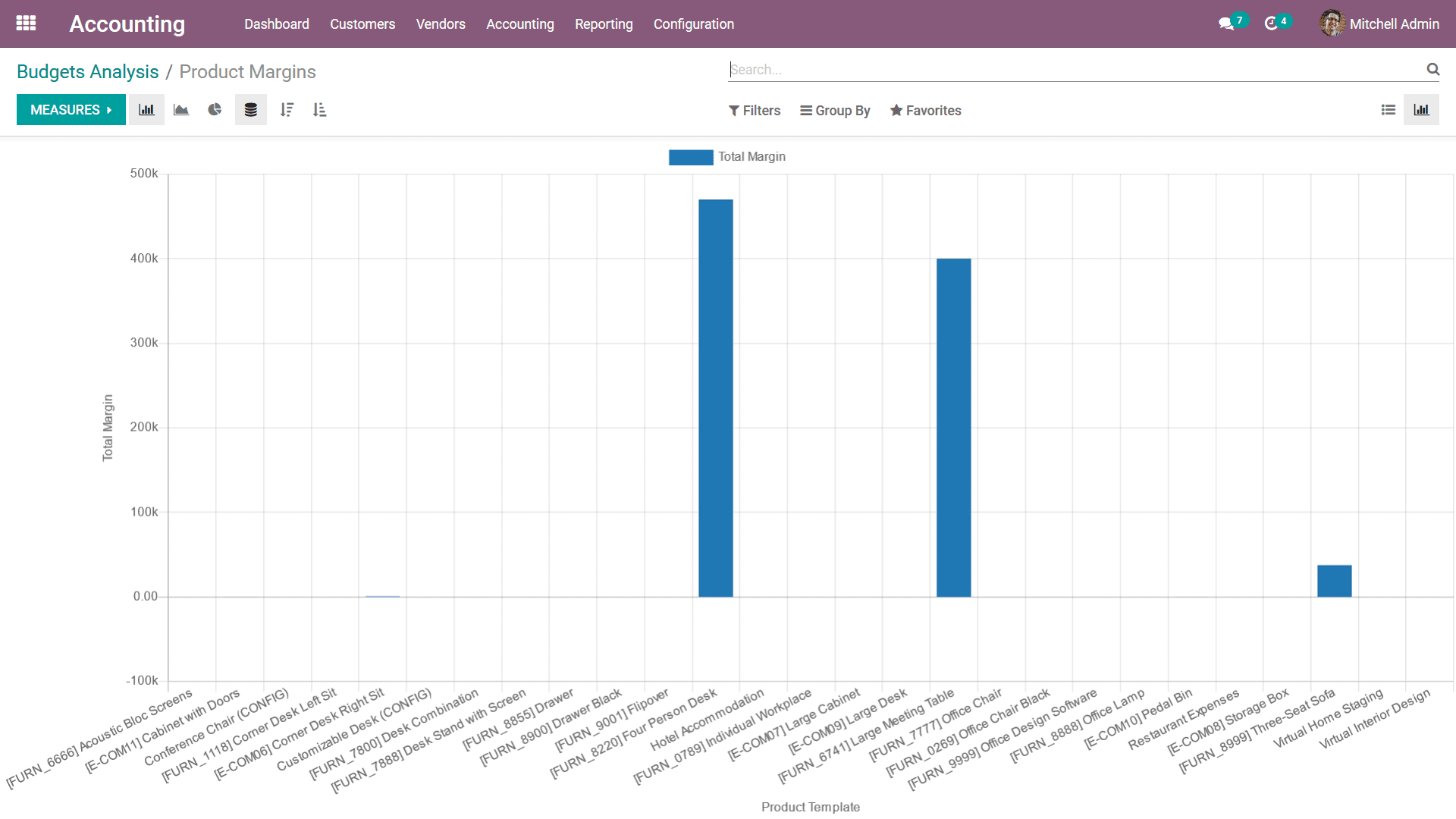

Moreover, the Product Margins reporting menu can be viewed in Graph View as well,

which will provide an insight on the Product Margins in a statistical aspect. The

following screenshot depicts the Bar Chart View of the Product Margins reporting.

Further, you can choose it to be depicted in Line as well as Pie chart as per the

need. There are default as well as custom filtering tools as well as a group by

options that have been defined. The Measures can be defined as per the need by choosing

from the default ones which have been defined.

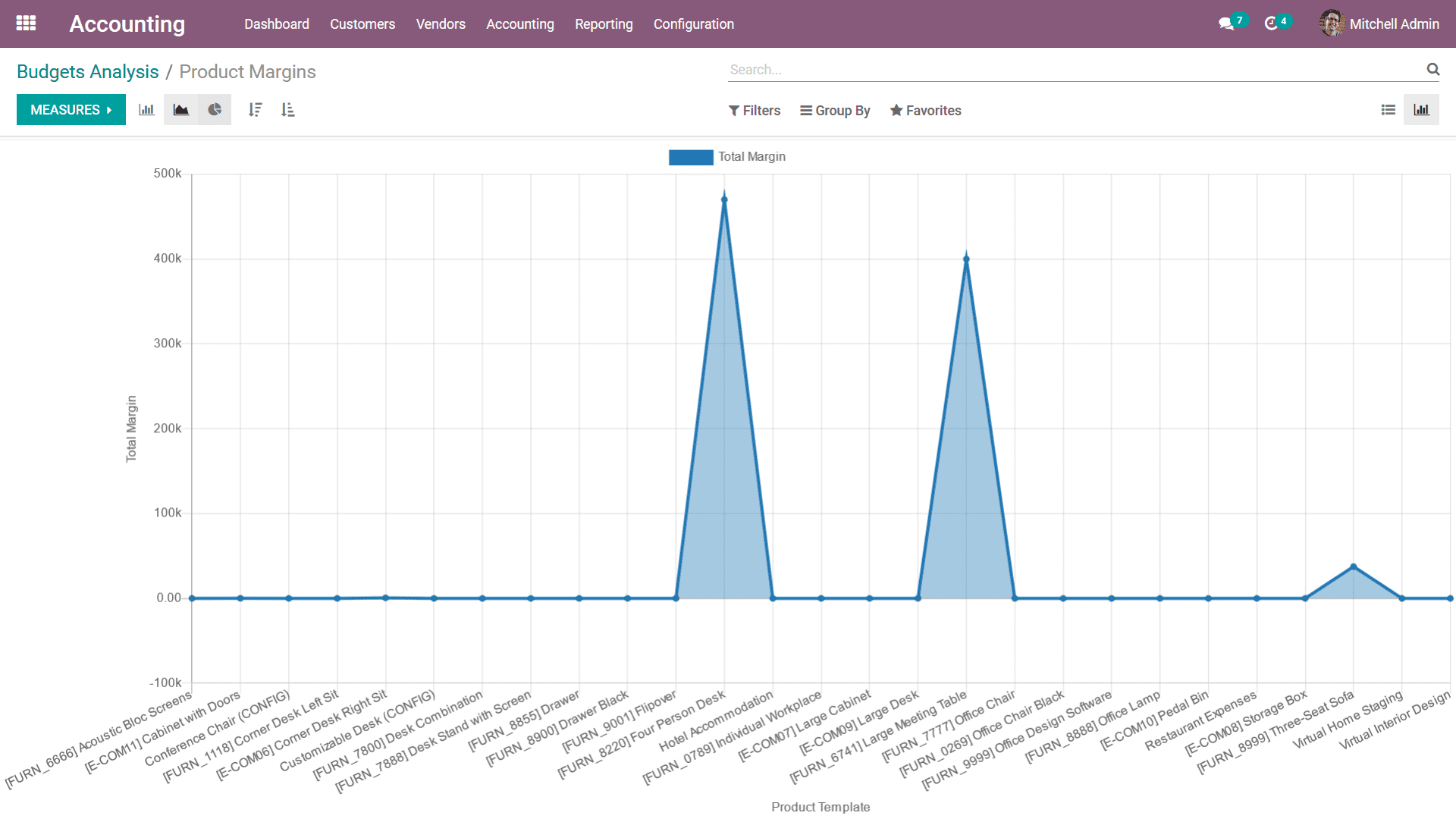

The following screenshot depicts the Line chart of the Product Margins reporting

where the various aspects of the entries defined will be depicted in lines as shown

in the following screenshot.

Up until now, we were discussing the Management based Reporting aspects of the Odoo

Accounting module. Let's now move on to the next section where the Partner Reports

of the Accounting module will be defined.