Audit Reports

Auditing is an integral part of the Finance management operations in regards to

the company's accounting. This inevitable factor is considered a priority during

the fiscal periods which are being defined. Moreover, usually conducted once during

a financial year as per standards, the entire financial operations regarding a respective

fiscal year are being verified, recorded, filed, and audited. In Odoo, the Accounting

module provides you with dedicated Audit Reporting tools helping with the operations

of the financial management as well as the monitoring of the accounting operations

of the company.

Accessible from the reporting tab of the Odoo Accounting module you can see various

types of report generation tools among them there is a separate category of Audit

Reporting tools available such as General Ledger, Trial Balance, Consolidated Journals,

Tax Report, Intrastat Report, EC Sales List and Journal Audits. Let's now move on

to understand each of the Audit reports one by one from the next section onwards.

General Ledger

The General Ledger of the company will define all the aspects of the Accounting

related to the company operations. Moreover, the General ledger depicts all the

company transactions from all the Account Ledgers used in the company and the Dynamic

reports can be taken by applying filters. Here all the financial entries in respect

to the sales, purchase, and other operations of the company will be defined in a

distinctive format helping the viewer to understand the operations of the business

in a direct view. Furthermore, the well-defined menu can be used in understanding

and finding distinctive entries concerning the company's finance management operations.

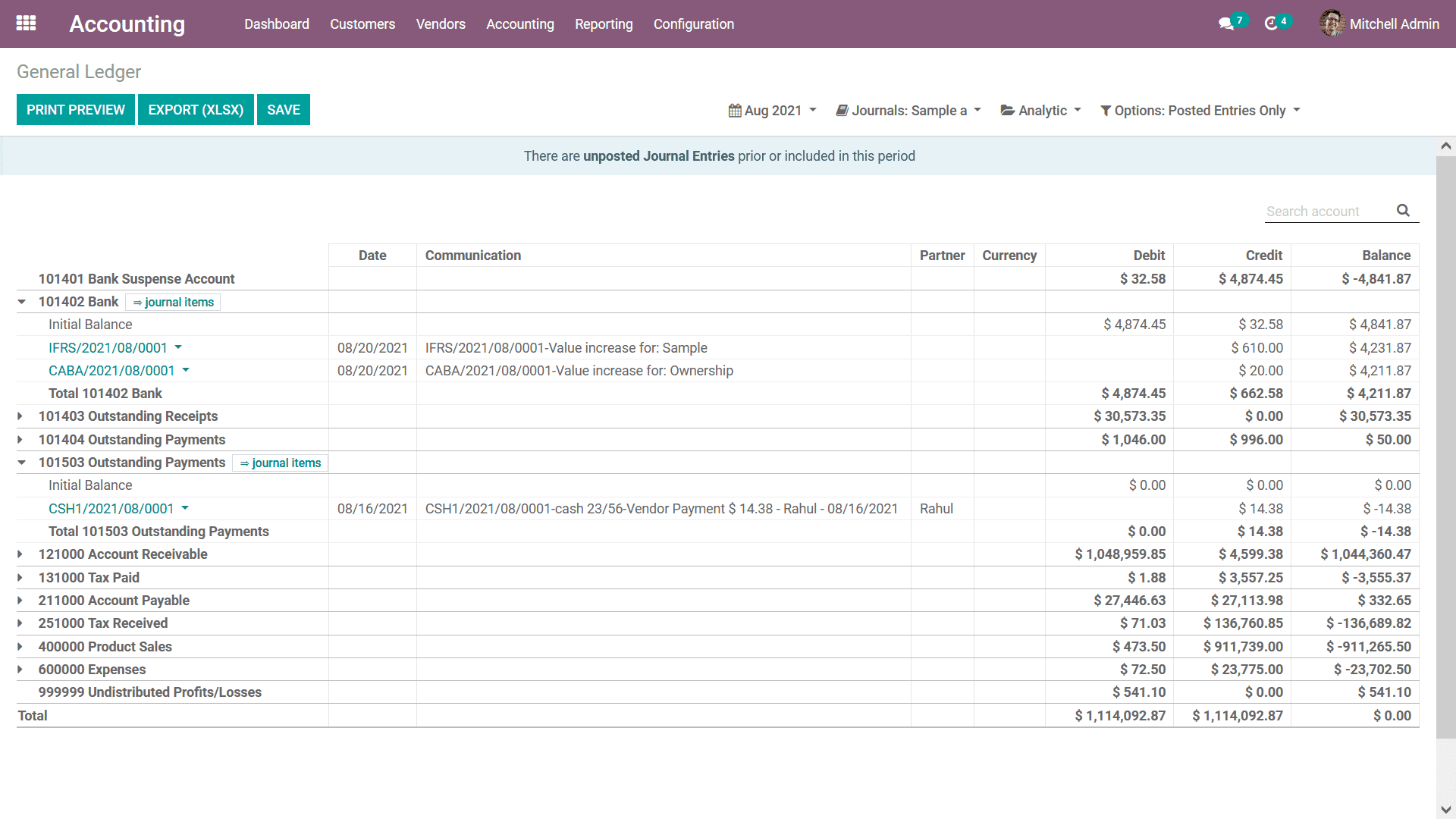

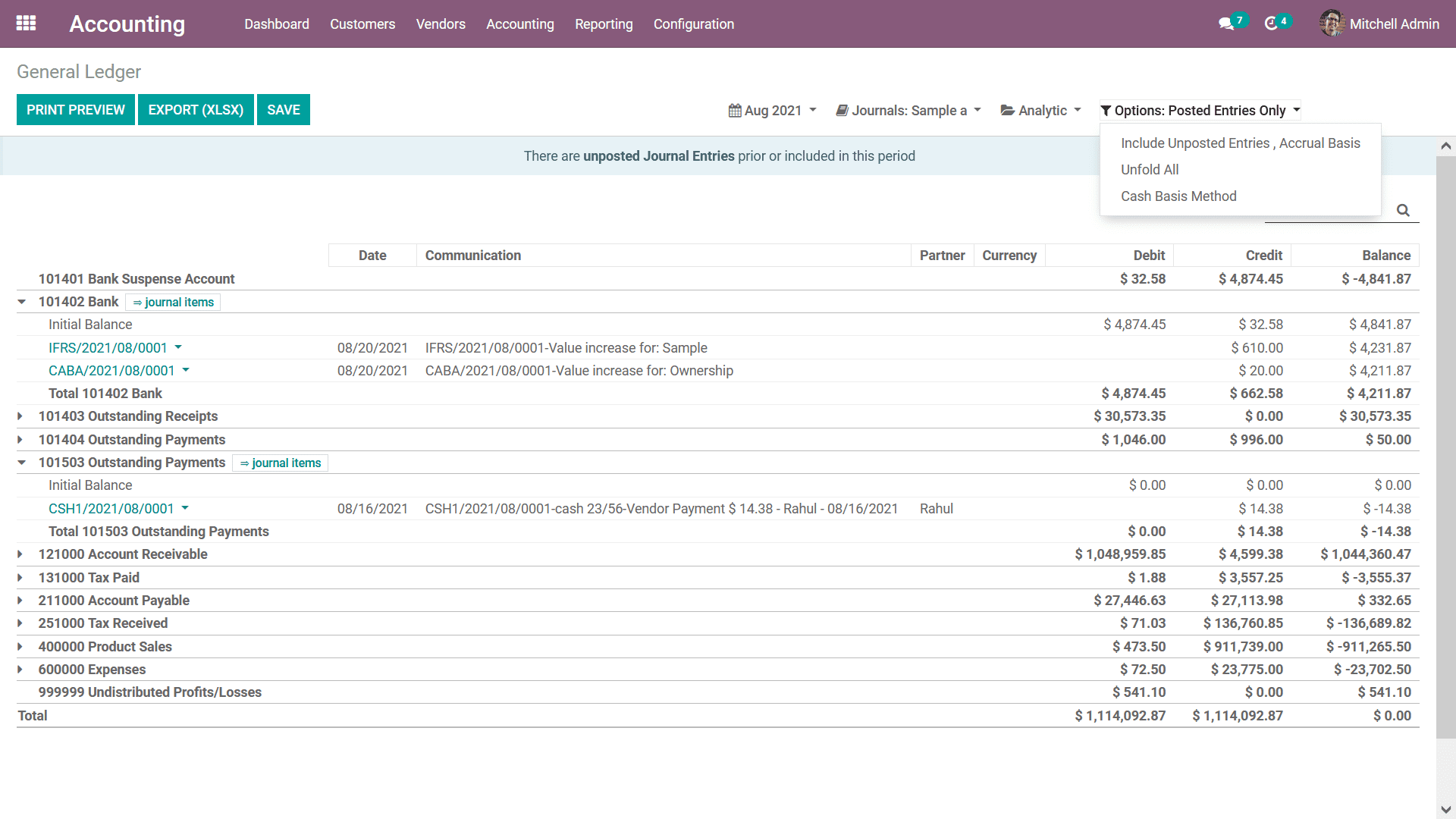

Accessible from the Reporting menu of the Accounting module, you will be able to

view the General Ledger of the company as depicted in the following screenshot.

Here all the entries regarding the financial operations of the respective period

which have been filtered to will be depicted. All the posted Journals will be defined

along with the invoice and bill details associated with the respective journals.

There is also a Print Preview option available which will provide you a preview

of the General Ledger Report upon being printed. Further to export the General Ledger

details, there is also an Export(XLSX) option available which will help you to export

the report in XLSX formats to be used in other aspects of the company operations.

The Save option ensures that the details which are configured along with the filtering

aspects are being saved in the reporting menu. You can select to expand a Journal

and will be depicted with the invoices and bills involved in it. In the below screenshot,

the Ledger entries have been filtered to the month of August of the year 2021, and

the Journal filtering of Sample is also done. Additionally, the Filtration of the

entries is done for the Posted Entries Only.

For each Account, when it is Unfolded, the Journal Entries affected on each account

can be viewed along with Date, Partner Details, Currency, Debit/Credit Amount, and

Balance as well. Additionally, you can view the Journal Entries upon a right-click

and also annotate (Add notes on each entry). The added notes on the Journal Items

can be viewed at the bottom of General Ledger and these notes can also be removed

as per the need.

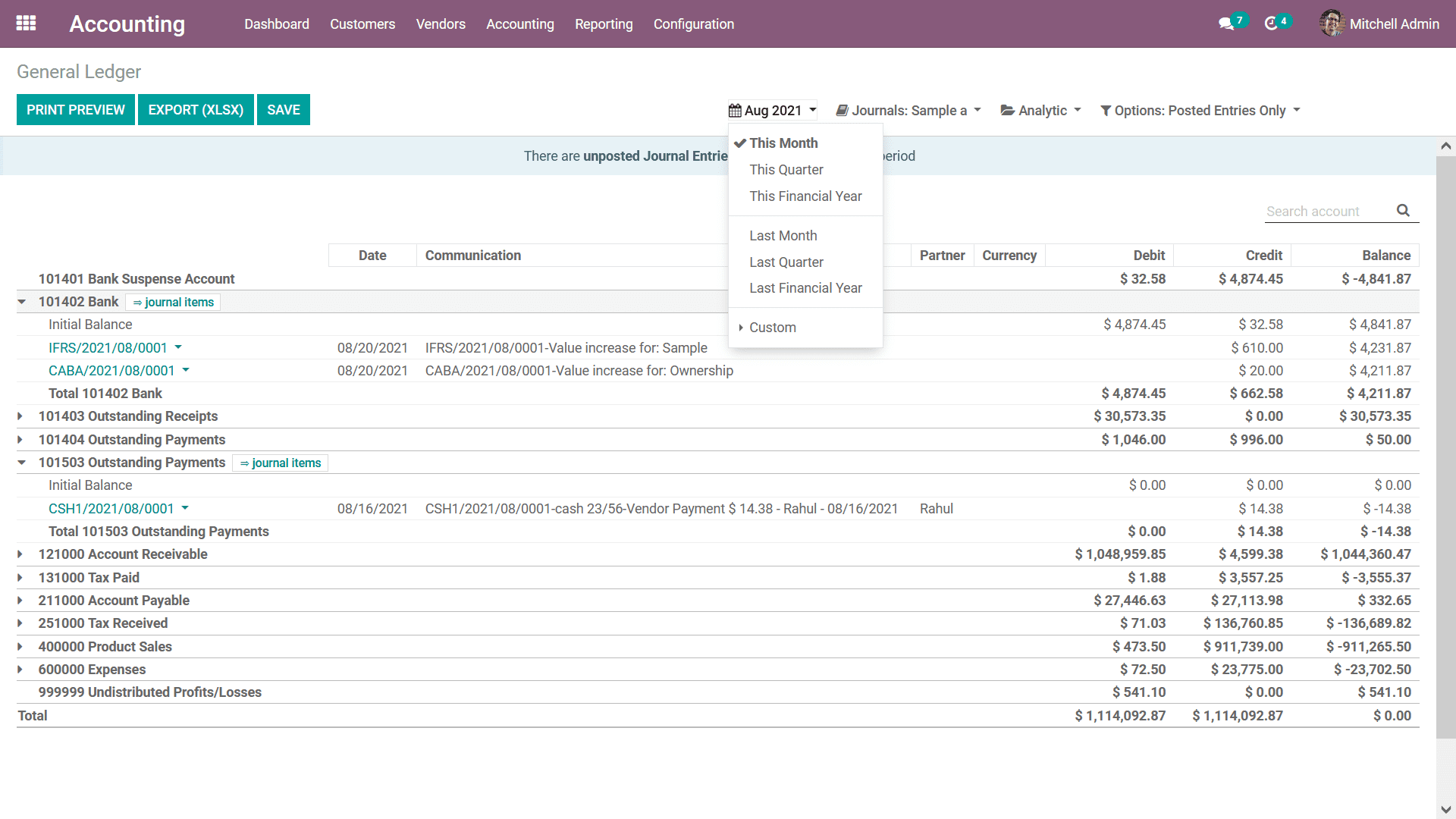

Regarding the Filtration, in regards to the date or month of operations, you can

filter it as This Month, This Quarter, This Financial Year, Last Month, Last Quarter,

Last Financial Year, or add Custom filter date of operations as needed. The Filtration

menu of the General Ledger menu is depicted in the following screenshot.

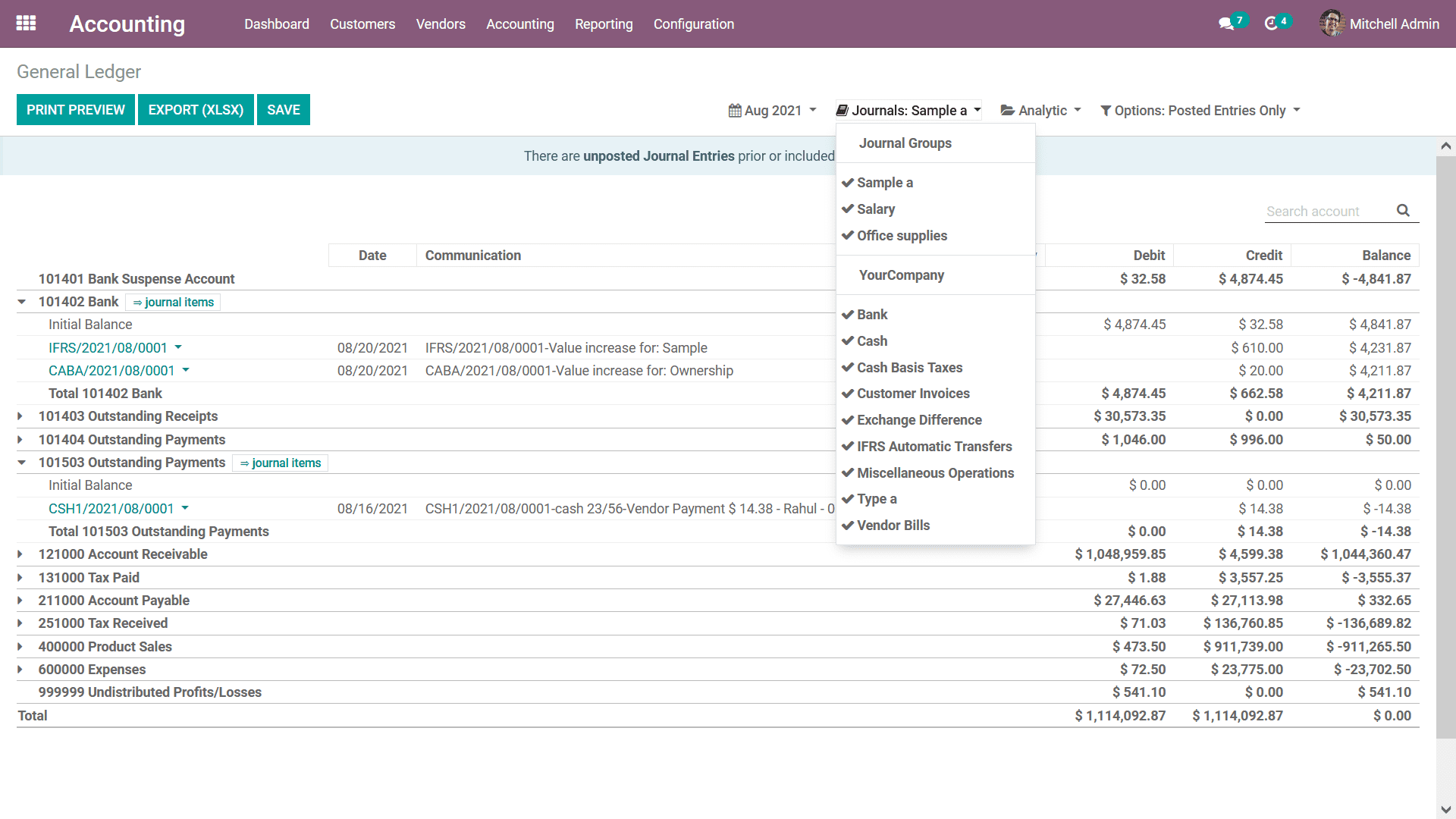

To Filter the Journals, you have a dedicated option where you can choose the respective

Journals to be filtered along with the are Journal Groups that are being defined

which can also be selected as the filter.

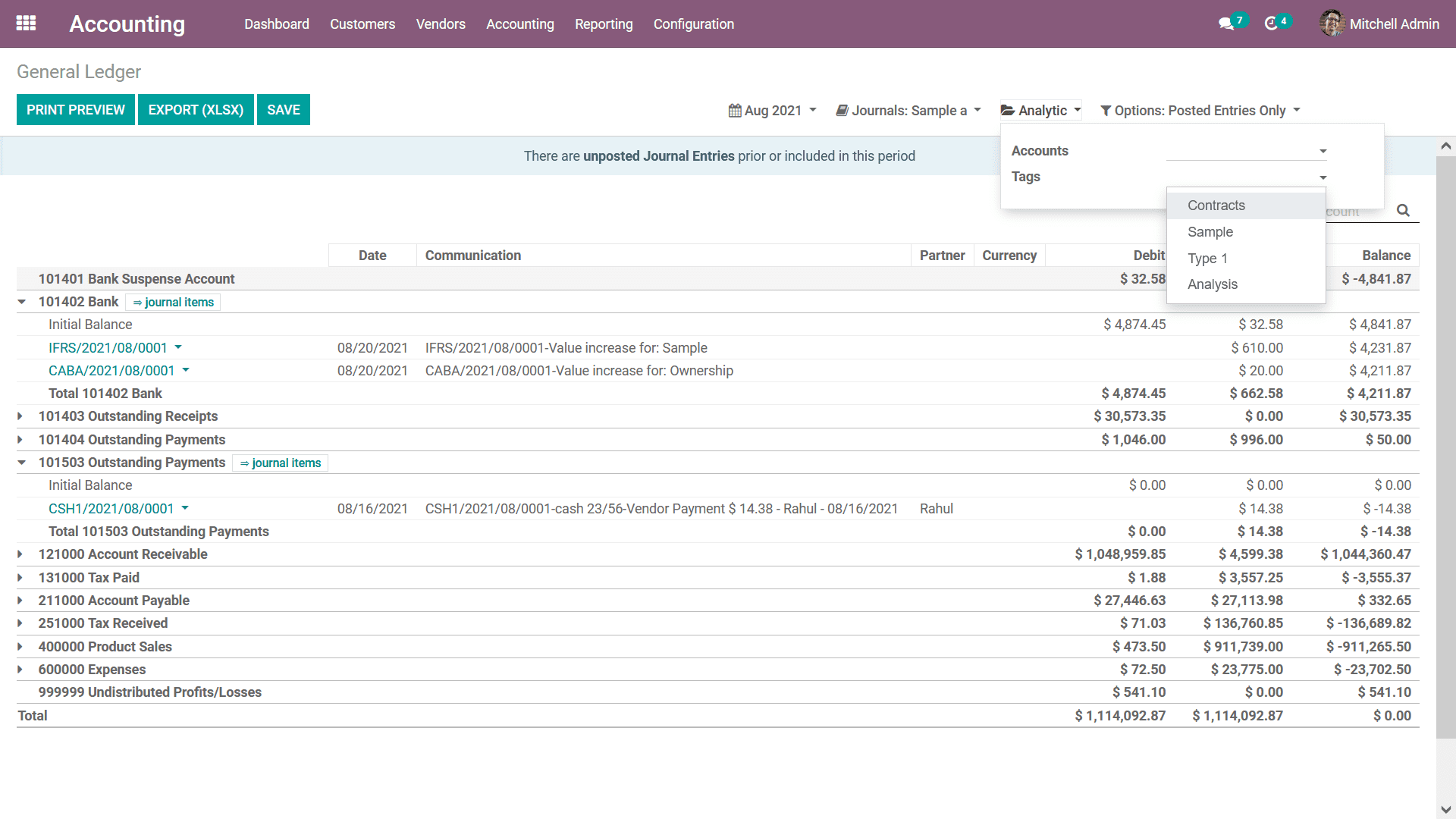

Furthermore, the filtration can be done with respect to the Analytical Accounting

aspects of the company financial management using the Analytic option available.

Here you can define the Analytical Accounts as well as the Tags to filter out the

entries in General Ledger.

Additionally, there is a dedicated Filtering tool available which will be already

filtered as the Posted Entries only further there are default options to Include

Unposted Entries, Accrual Basis, Unfold All and Cash Basis Method. This can be chosen

for the respective General Ledger entries to be defined in operation.

General Ledger is a form of report initiating the complete posted as well as unposted

Accounting operations which are in regards to the company functioning. Moreover,

in the earlier days of business functioning a dedicated book was kept as General

Ledger but with the Odoo Accounting module, you will have all the entries auto depicted

with respect to the company operations of the respective Journals. As we are clear

on the General Ledger reporting menu of the Odoo Accounting module let's now move

on to the next section where the Trial Balance Report of the Odoo Accounting module

is being defined.

Trial Balance

Trial Balance is a form of bookkeeping tool in regards to the Accounting operations

of the company which defines the balance of each account in credits and debits.

The Odoo Accounting module defines a dedicated Trial Balance reporting tool in the

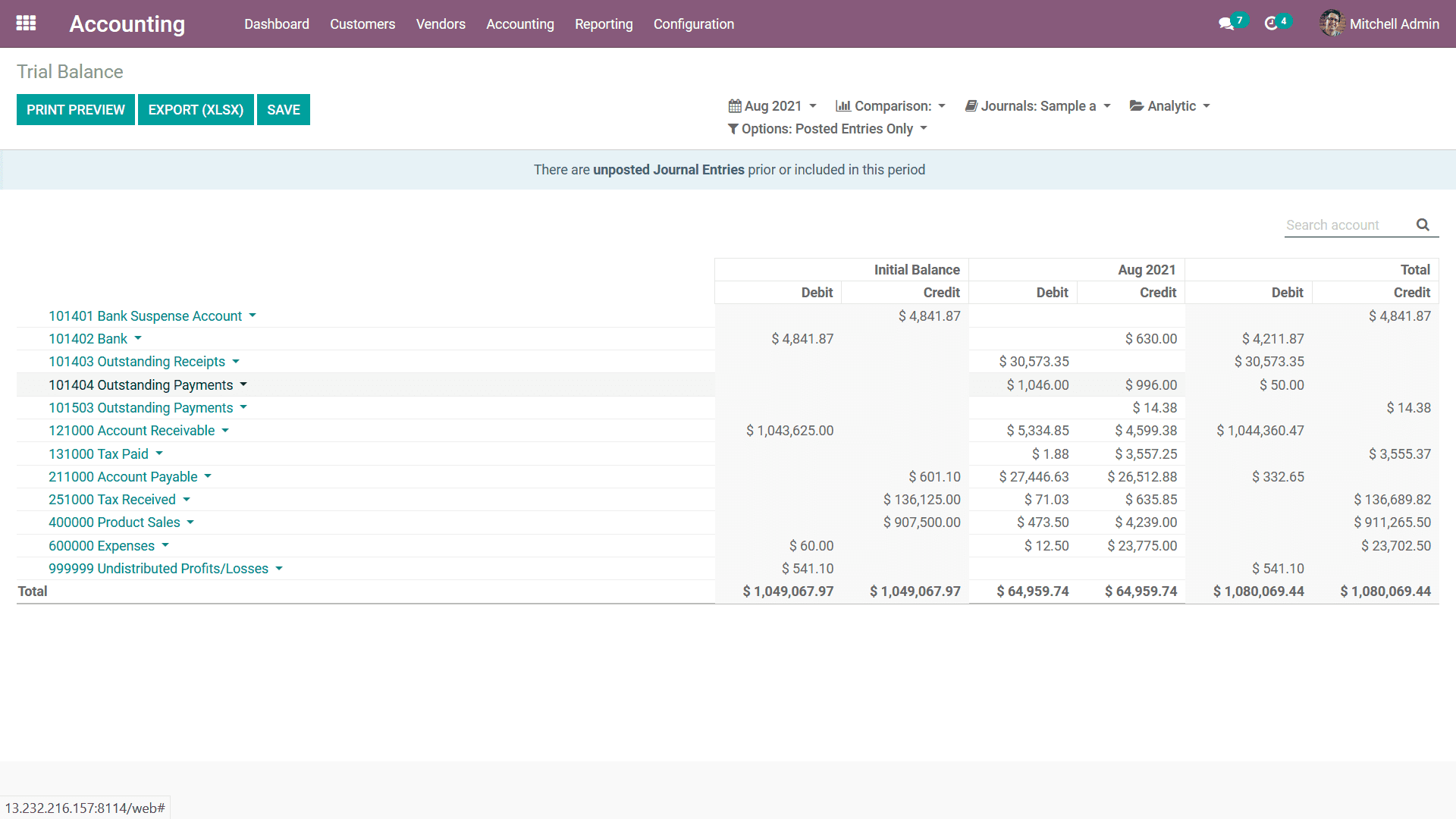

module accessible from the Reporting tab of the module. In the Trial Balance report

menu, all the Journals which have been filtered will be depicted along with the

Initial balance details in the form of Debit as well as Credit of the operations.

Further, the respective period's Debits, as well as the Credit amount of the entries,

will be depicted and finally, the Total Debit, as well as the Credit amount, will

be defined. You will also have a provision to Search for a respective Account in

the Trial Balance report.

There is also a Print Preview option available which will provide you a preview

of the Trial Balance Report upon being printed. Further to export the Trial Balance

details there is also an Export(XLSX) option available which will help you to export

the report in XLSX formats to be used in other aspects of the company operations.

The Save option ensures that the details which are configured along with the filtering

aspects are being saved in the reporting menu.

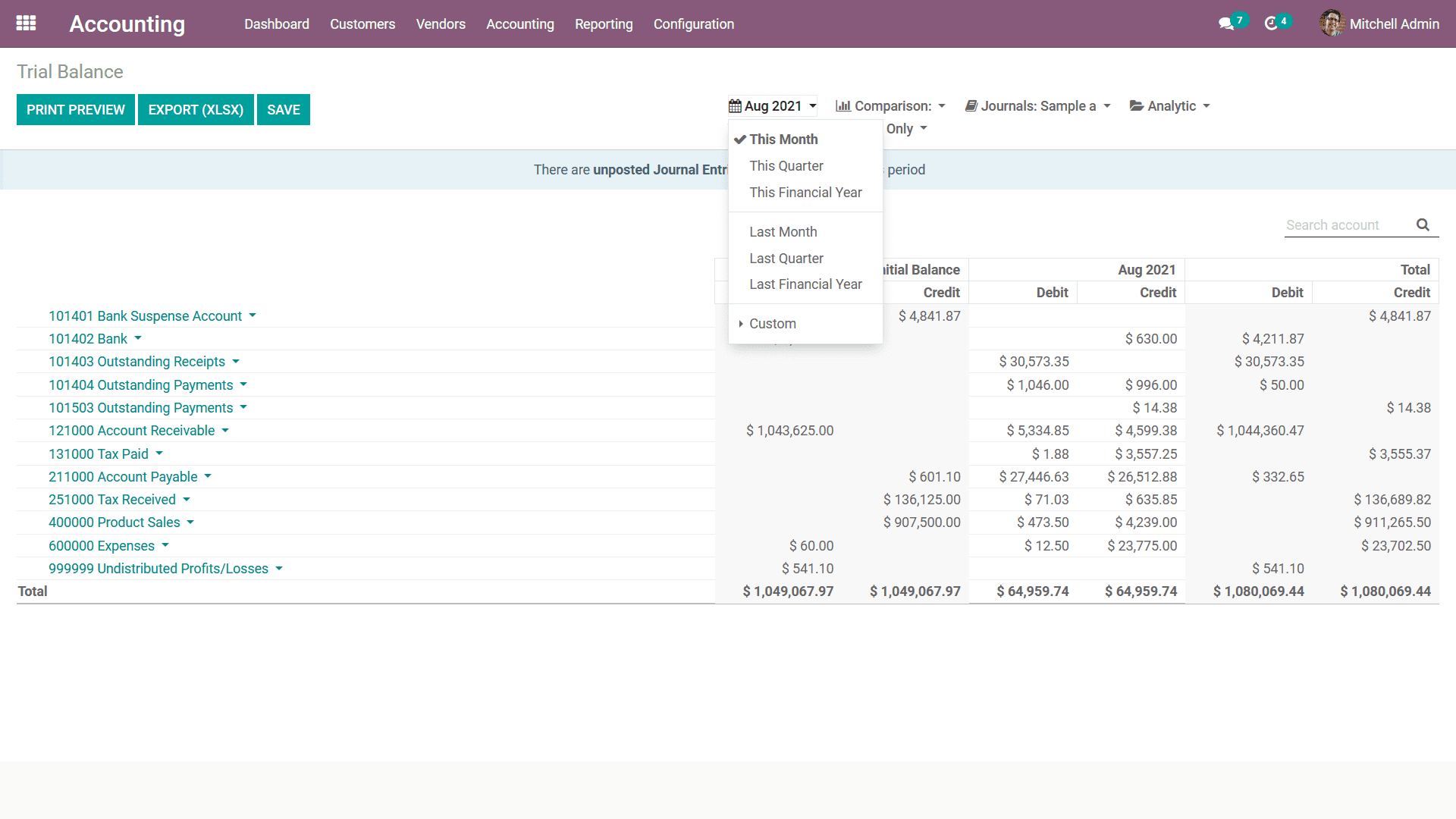

With regards to the Group by aspect, you will be able to define the Trial Balance

with respect to This Month, This Quarter, This Financial Year, Last Month, Last

Quarter, Last Financial Year, or add Custom filters as needed. The following screenshot

depicts the Group by options available, helping you to filter the Accounts based

on the duration of the company functioning.

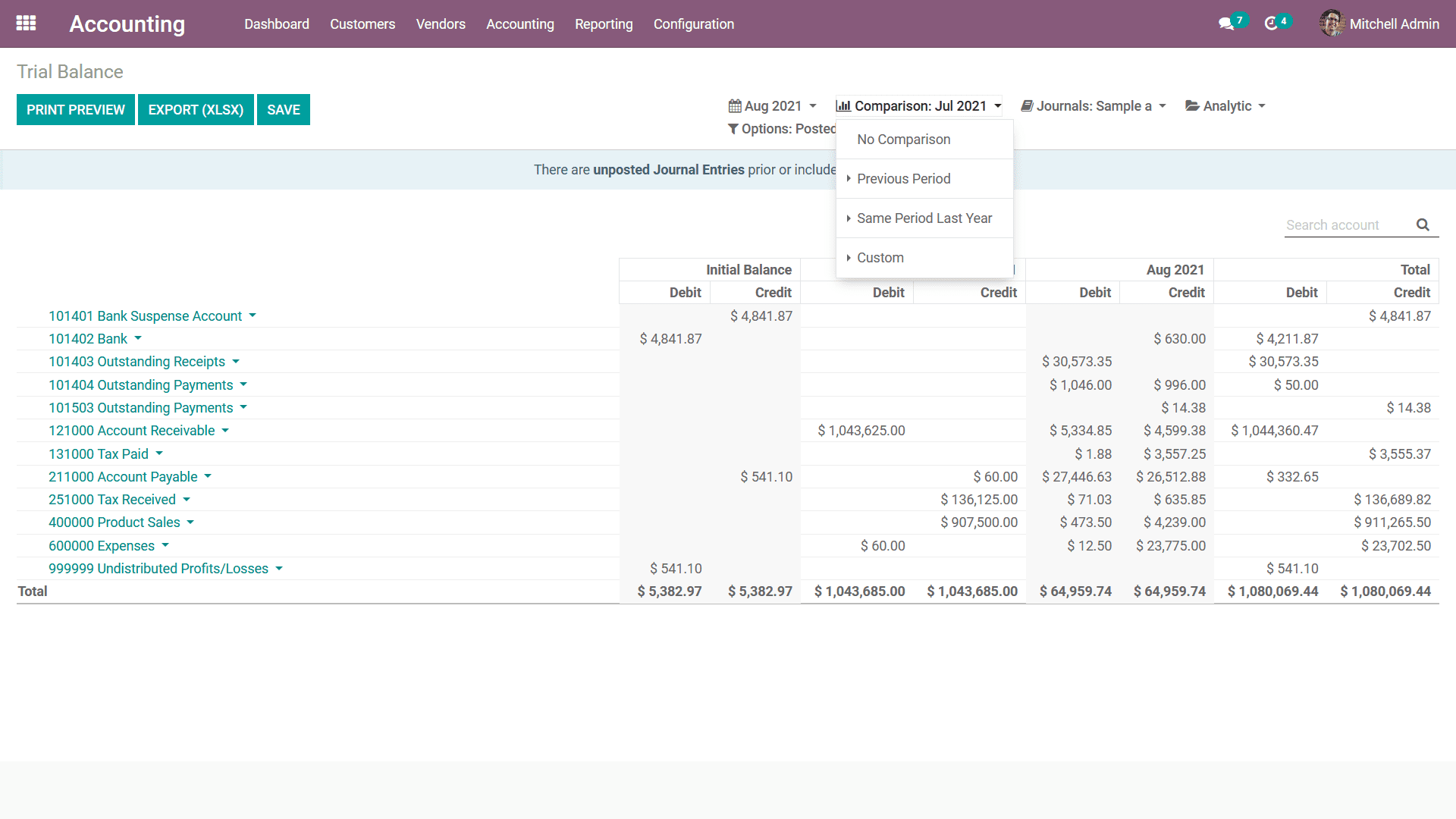

There is also an additional Comparison option available that will help you to define

the comparison between the Journal entries of the company. The Comparison can be

done with the Previous Period, with the Same Period Last Year or a Custom Comparison

can be defined based on the need. Once the Comparison is configured the two Periods,

the current one and the one you need to compare will be defined in the Trial Balance

Report as depicted in the following screenshot.

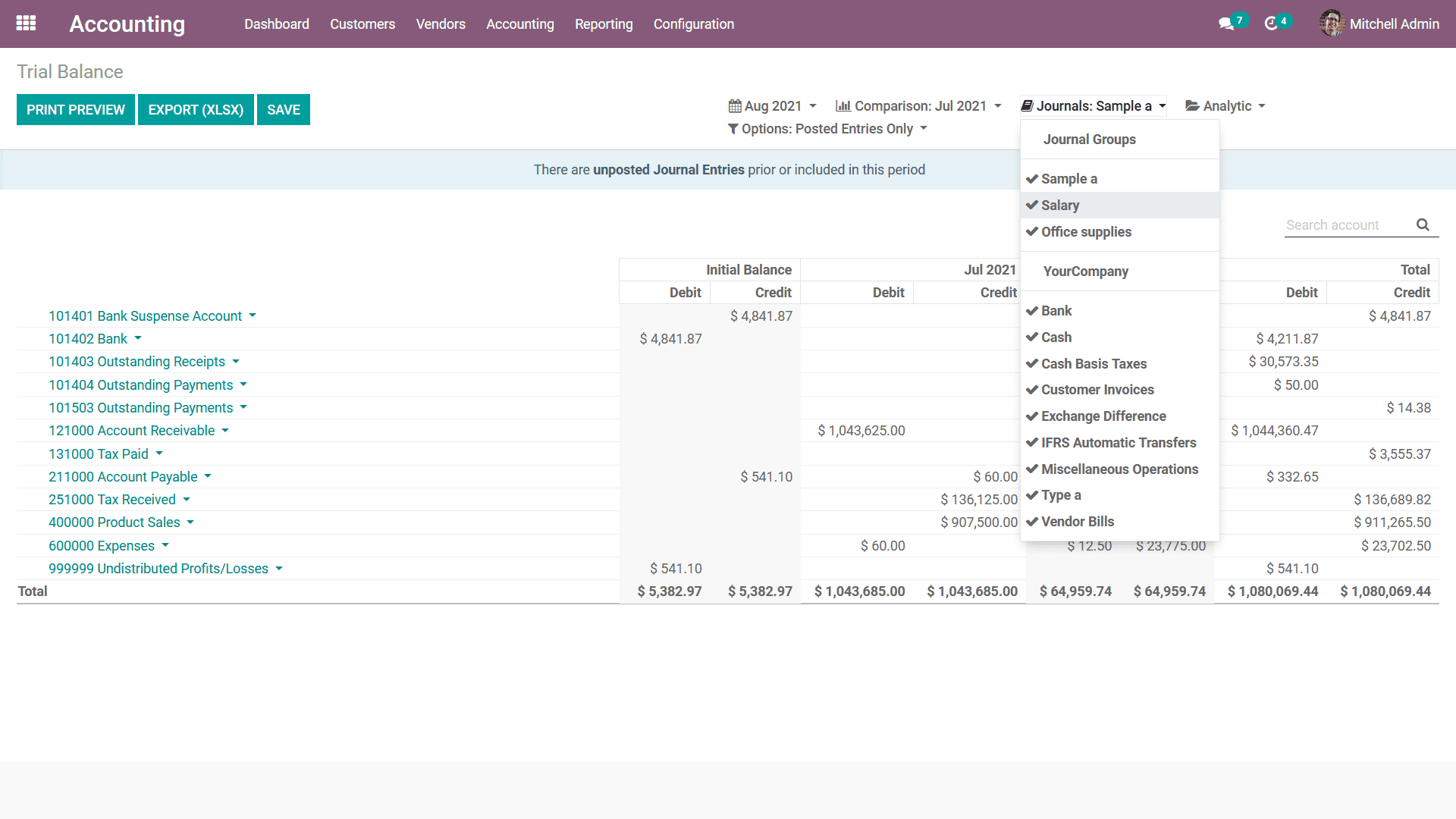

Furthermore, the Journals can be grouped by using the Journal Groups as well as

the respective Journals which have been defined. This methodology of grouping by

the Journals will help you to understand the Trial Balance aspects in respect to

each of the Journals of operation.

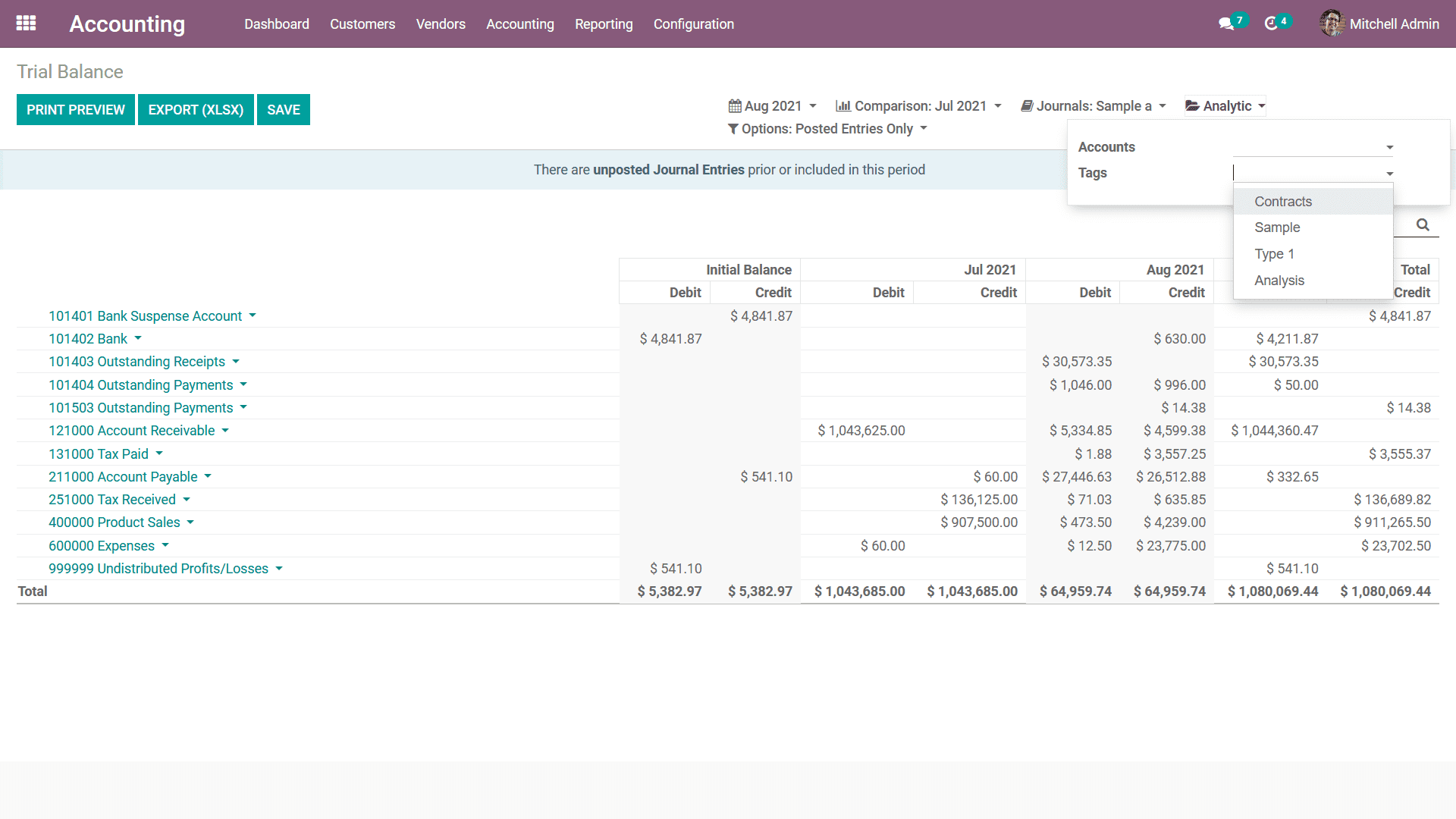

In addition, the filtration can be done with respect to the Analytical Accounting

aspects of the company's financial management using the Analytic option available.

Here you can define the Analytical Accounts as well as the Tags to filter out the

entries in the Trial Balance report.

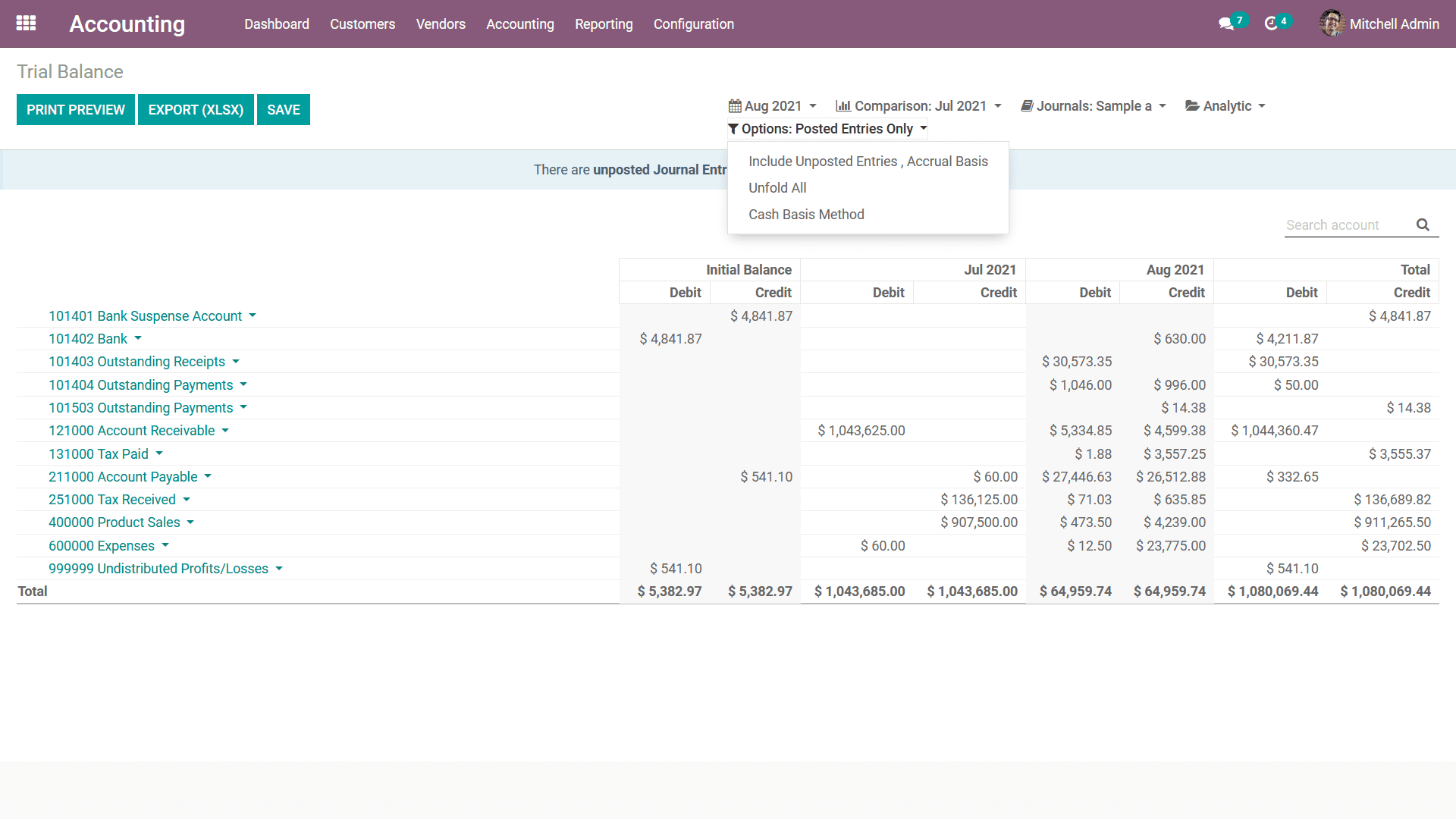

Additionally, there is a dedicated Filtering tool available which will be already

filtered as the Posted Entries only further there are default options to Include

Unposted Entries, Accrual Basis, Unfold All and Cash Basis Method. This can be chosen

for the respective Trial Balance entries to be defined in operation.

The Trial Balance report of the financial operations of the company will provide

complete information regarding the Credit and Debit amount regarding the operations

of the company. Moreover, the Trial Balance report will be useful to understand

and get an overview of all the financial operations of the company. Let's now move

on to the next section where the Consolidated Journals reporting in regards to the

accounting operation of the company is defined in Odoo.

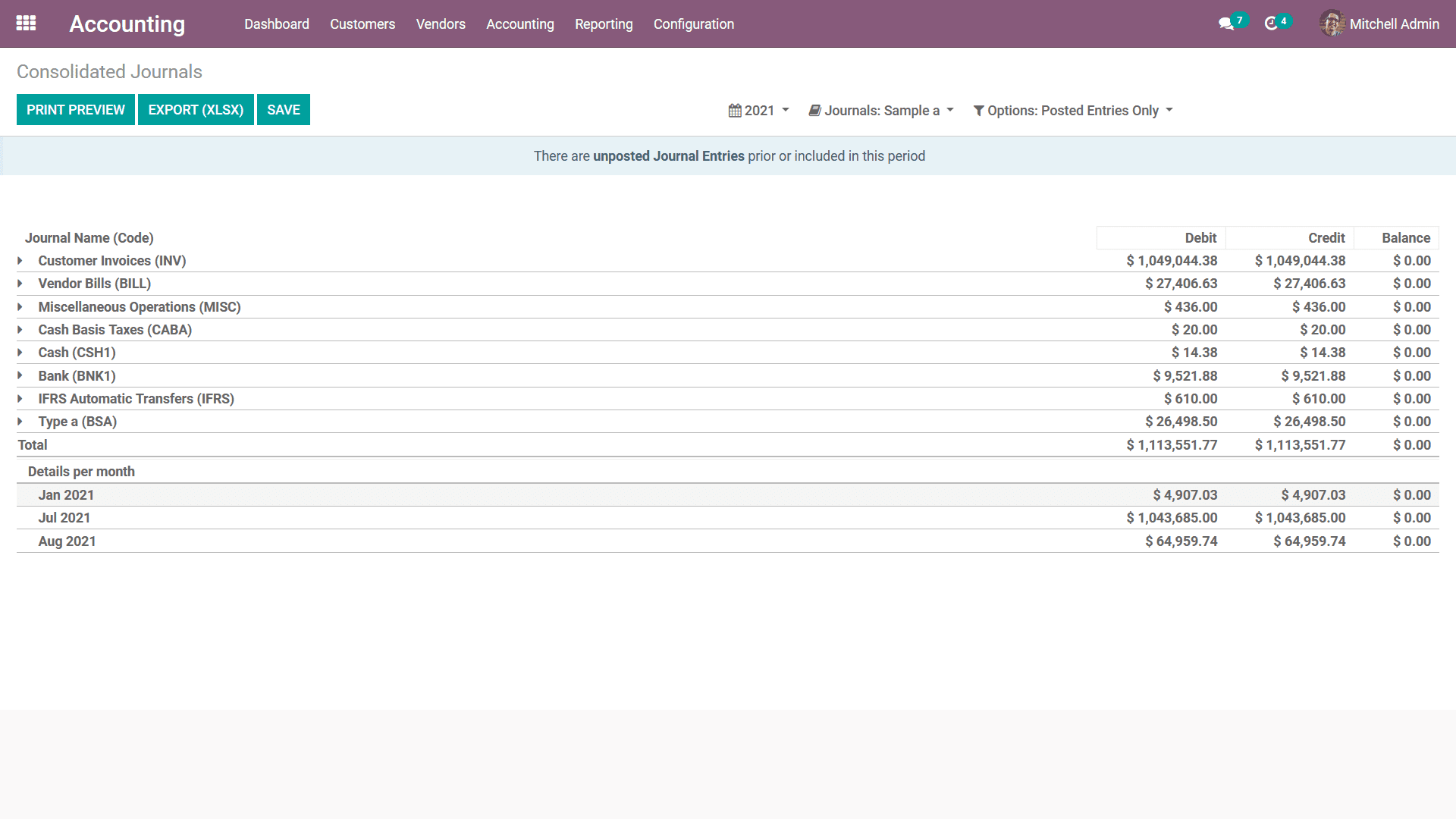

Consolidated Journals

The Consolidated Journals menu of the Odoo Accounting module will define the Journals

of your Accounting operations which are labeled as Consolidated for the operations.

In the menu, all the Journals of operation will be depicted with respective months

of functioning. In addition, there is a Print Preview option available which will

provide a preview of the Consolidated Journals report. Furthermore, you can choose

the Export(XSLX) option to export the Consolidated Journals in the XLSX report.

You can choose the Save option for the Consolidated Journals to report to be saved

after the Filtration, Group by another configurations aspect.

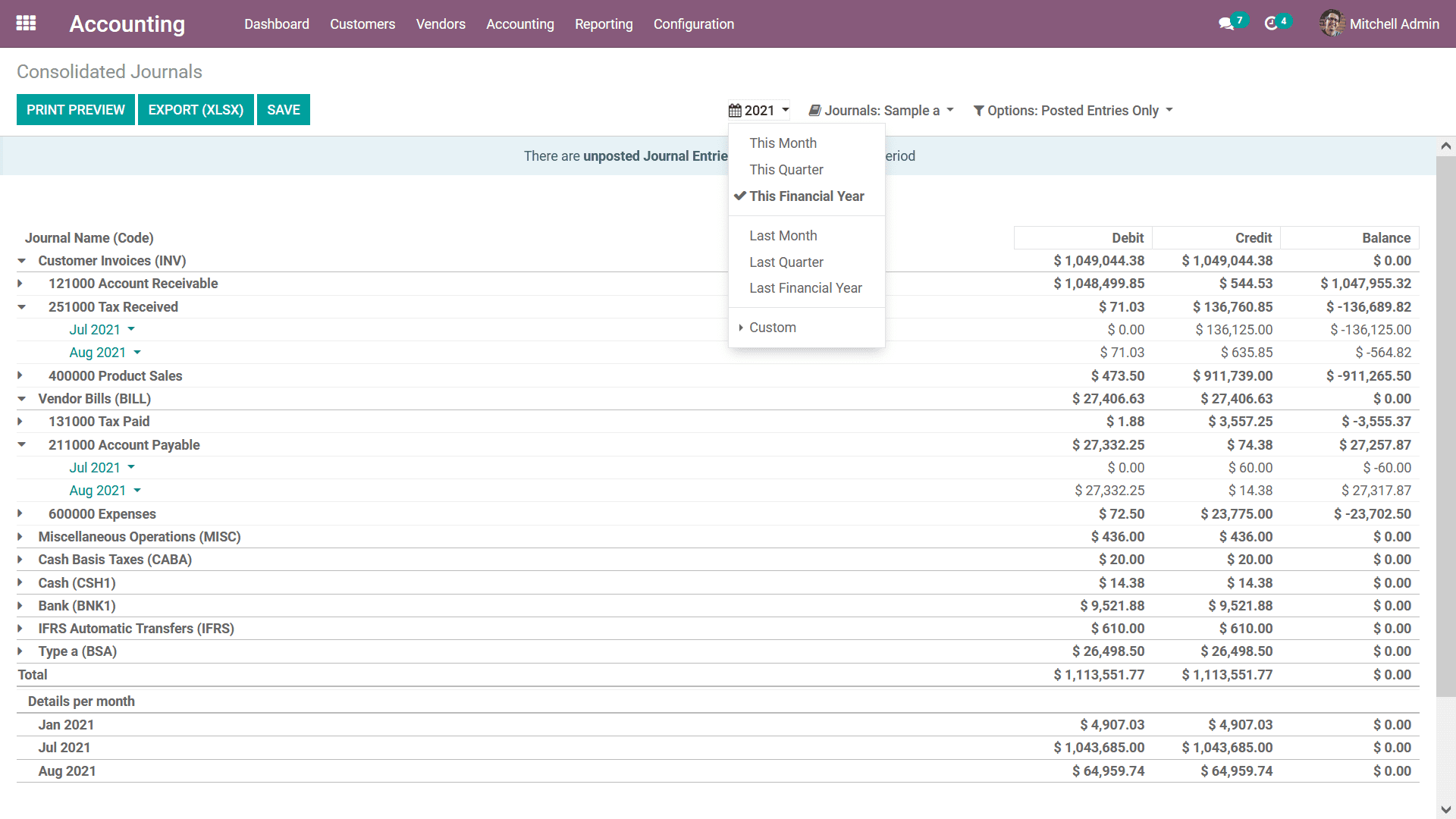

In regards to the sorting aspect of the entire depicted in the Consolidated Journals,

you will have a Group by options based on the period of the operation and you will

have filtration options such as This Month, This Quarter, This Financial Year, Last

Month, Last Quarter, Last Financial Year, or add Custom filters of operations as

needed. The following screenshot depicts the Group by options available helping

you to filter the Accounts based on the duration of the company functioning.

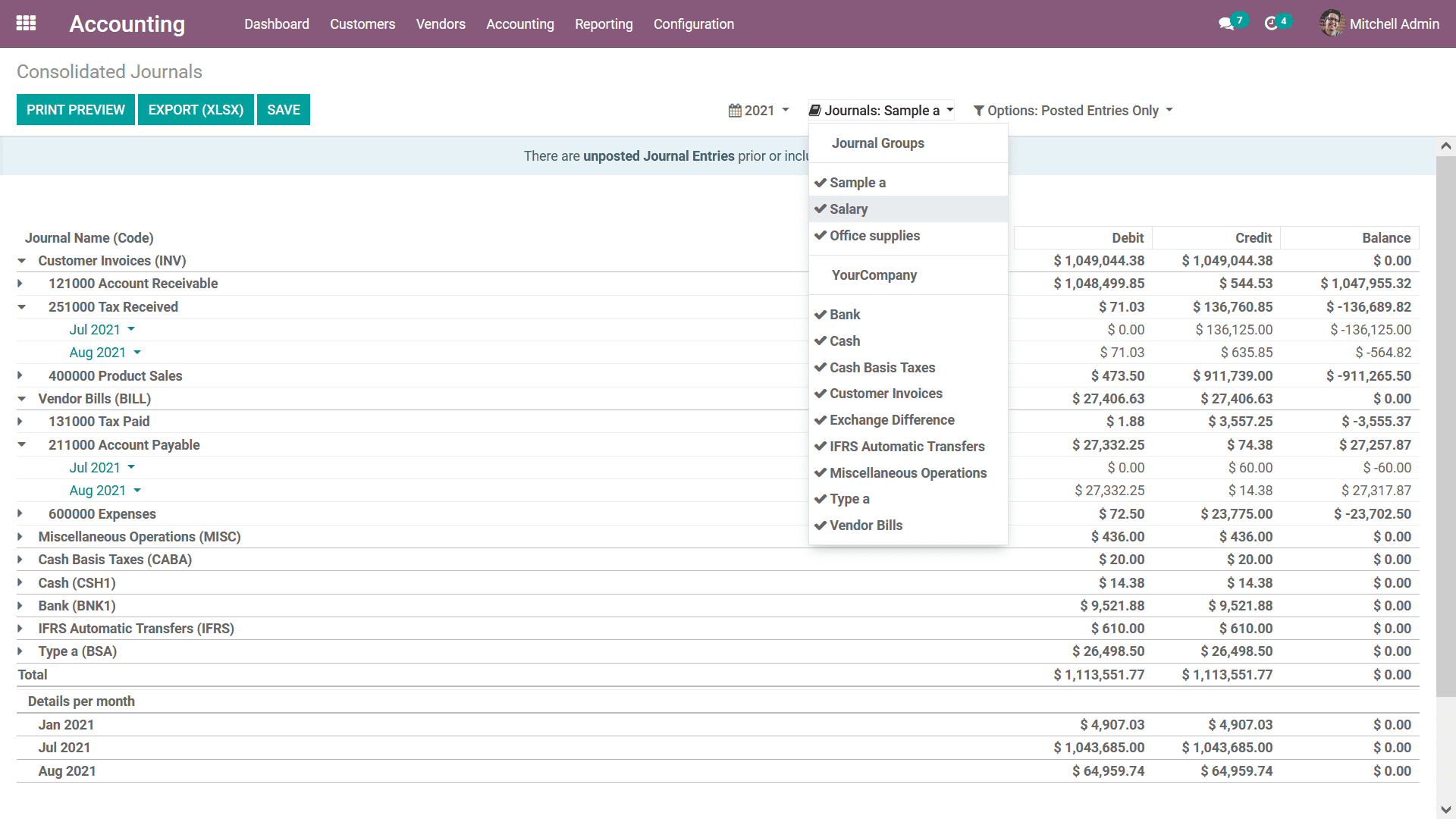

Furthermore, the Journals can be grouped by using the Journal Groups as well as

the respective Journals which have been defined. This methodology of grouping by

the Journals will help you to understand the Consolidated Journals aspects in respect

to each of the Journals of operation which are being defined.

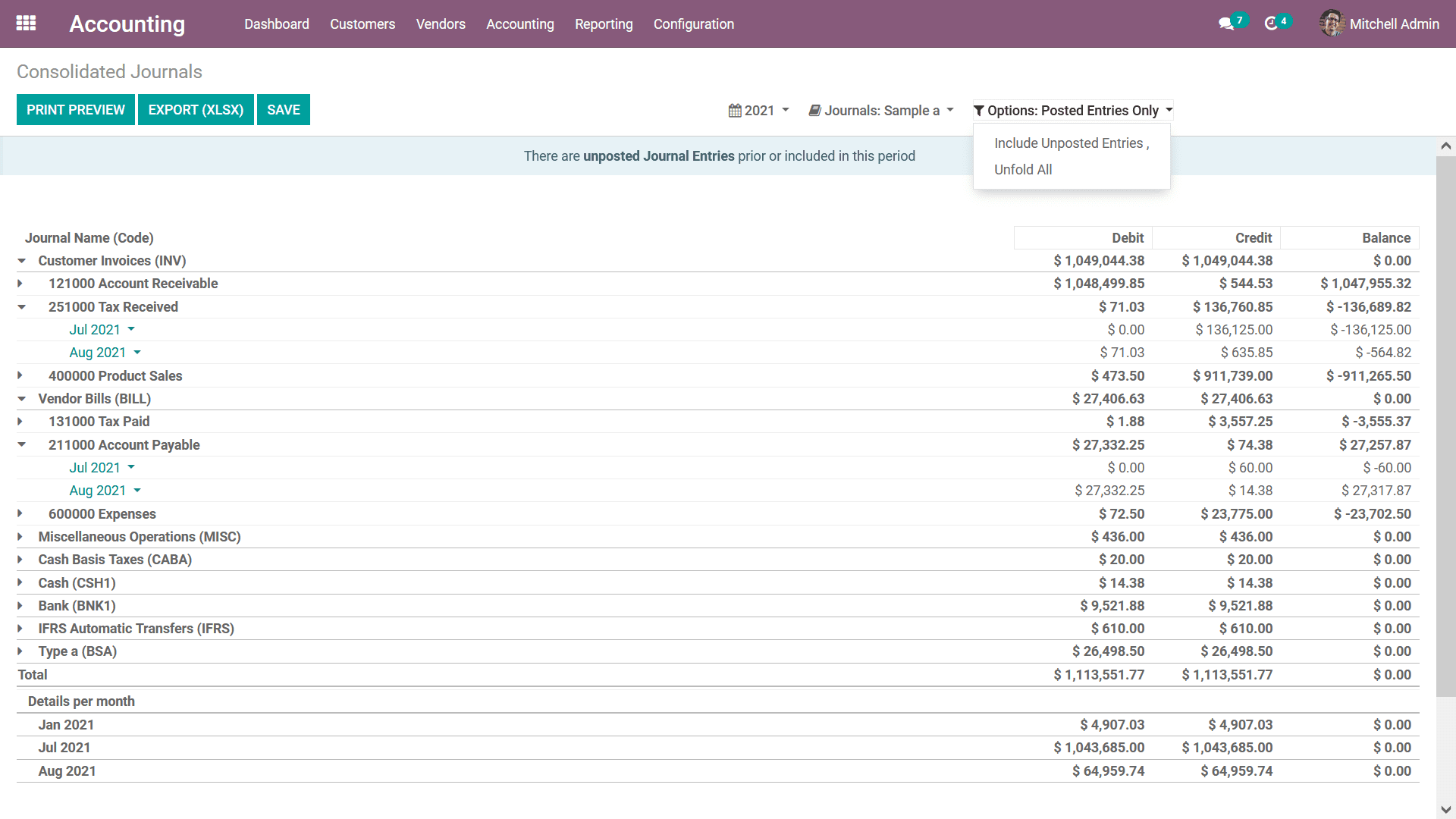

In addition, the filtration can be done with the options tool where the Posted Entries

Only, include unposted Entries, and the Unfold all options available. These filtering

tools and options will ensure that you will have well-defined options to filter

out as well as sort the entries of the Consolidated Journals.

The Consolidated Journals reporting window will ensure that the viewer will have

a complete understanding of the various financial entries and its allocated aspects

of the Accounting operations of the company to be defined effectively. Let's now

move on to the next reporting tool in the Odoo Accounting module the Tax Reports

in the next section of this chapter.

Tax Report

Taxes and their operations in business which are functioning in all parts of the

world are inevitable aspects. Therefore, the business tends to keep a close eye

on the operations of these taxes in the financial operations of the company as the

authorities trick every nation for the records in regards to the taxes and its payment

to be done at the right time and right accordance. The Odoo Accounting module has

a dedicated Tax Management window which is well defined in chapter 3 of this book

and under section 3.1.2 Configuring Taxes. You can have a look at the respective

past of the book to have an understanding of how the tax management operations are

conducted for a business in Odoo.

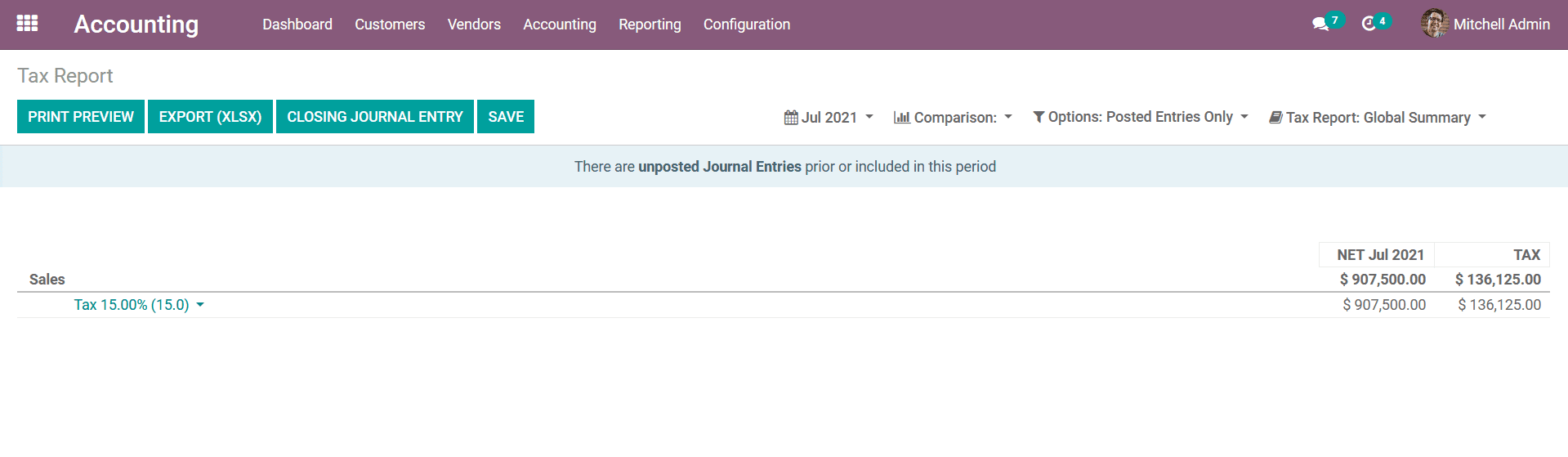

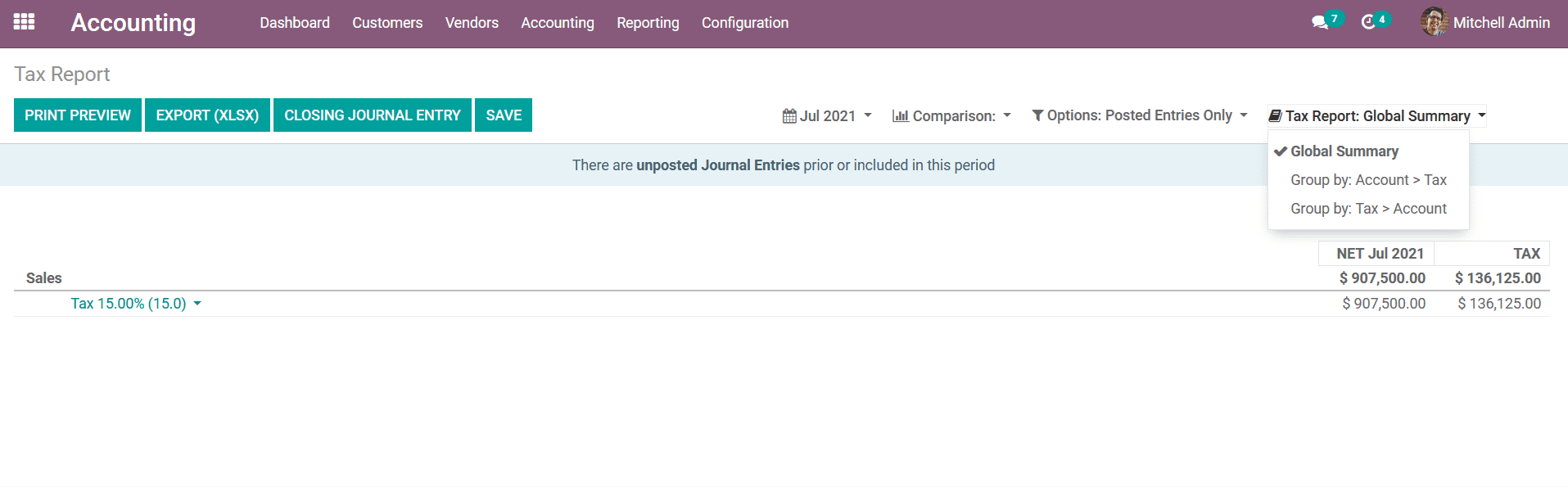

In regards to the reporting aspects on the taxes involved in the financial operations

of the companies functioning with Odoo, there is a dedicated Tax Report menu accessible

from the Reporting tab of the Odoo Accounting module. Here the operations of all

the financial aspects in respect to the Taxes defined will be depicted along with

the operation, the Net value of money, and the Tax amount as shown in the following

screenshot. In addition, there is a Print Preview option available which will provide

a preview of the Consolidated Journals report. Furthermore, you can choose the Export(XSLX)

option to export the Consolidated Journals in the XLSX report. You can choose the

Save option for the Consolidated Journals report to be saved after the Filtration

Group by another configuration aspect.

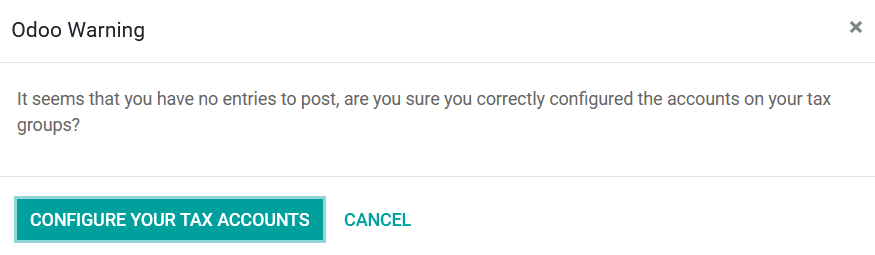

You will also have a Closing Journal Entry option that is available which can be

chosen for the Journal Entries in regards to the Tax operations to be closed to

be submitted. Upon choosing the option you will be depicted with the pop-up window

as depicted in the following screenshot. The message will be an Odoo Warning which

is auto depicted based on the configuration done in the Odoo platform. Here if you

want to go ahead with it you can choose the Configure Your Tax Accounts option or

else the Cancel option can be chosen.

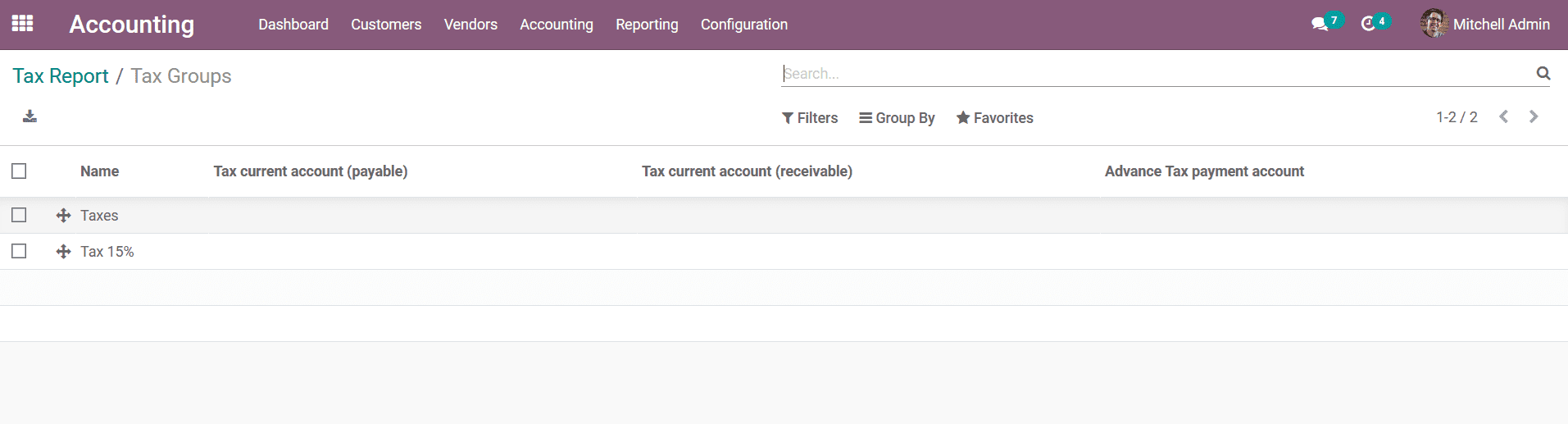

Upon choosing to Configure Your Tax Accounts you will be depicted with the TaxGroups

window as depicted in the following screenshot. Here all the Tax groups of operations

will be depicted and you can read the 3.1.2 Configuring Taxes section of Chapter

3 to have a detailed understanding of the Tax Configuration.

Furthermore, you will have Filtering and Group by options available just as depicted

in the following screenshot in the Tax Report menu. You can read the previous sections

to have an understanding of the common tools such as the Period based Filtering,

Comparison filter, and the Options filter available in the reporting menus. In addition,

there are Tax Report Grouping tools available where you can configure it as Global

Summary, Group by Account> Tax, and Group by Tax > Account.

The Tax Reporting menu of the Odoo platform will provide an overview of the Tax

operations in regards to the Financial and Accounting functions of the company.

Let's now move on to the next section where the Intrastat Reporting tool has been

defined.

Intrastat Report

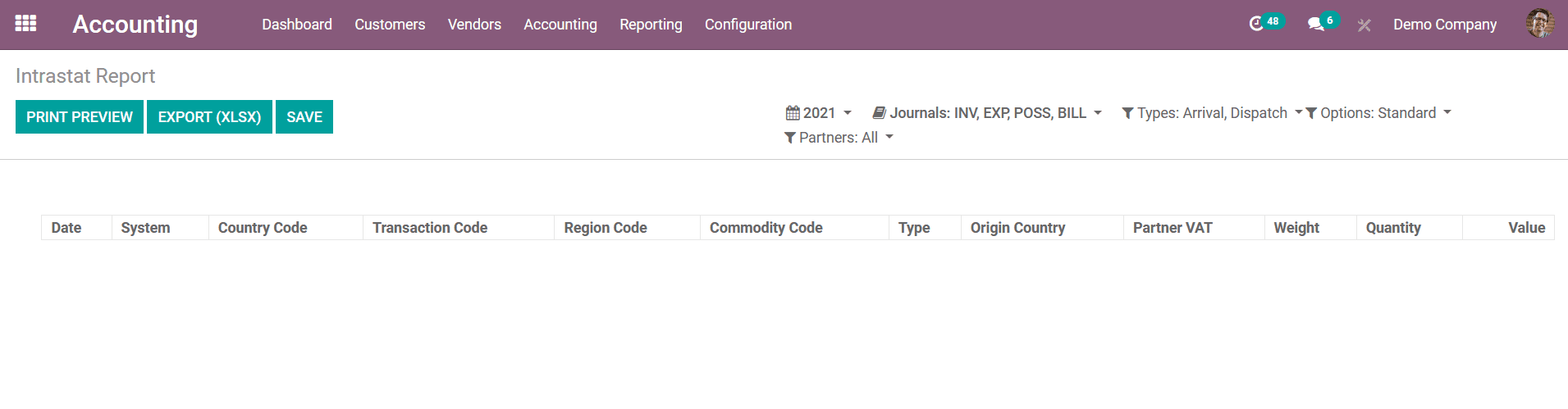

The Intrastat Report in Odoo is one of the advanced forms of reporting menu available

in the Accounting module of the platform. The Intrastat report is a form of reporting

tool which enables the European Union as well as the governments to track the trades

and business in a statistical way. The Intrastat Report menu can be accessed from

the Reporting tab of the Odoo Accounting module. Here all the aspects of the Intrastat

Reporting in respect to the company operations will be displayed. Furthermore, there

are dedicated Filtering as well as Group by tools that are available in the menu

which will help with the sorting out aspects.

There are filtering tools in respect to the fiscal periods of operations, Journals

which have been defined, Types of Journal Entries and there are Filtrations based

on the Option as well as the company in which Business is conducted either as Partners,

Vendor or Customers which will be aiding to the filtration aspect of the Intrastat

Reports in the Odoo platform.

You can refer to the Reporting aspects which have been defined in the previous sections

to have a clearer understanding in regards to the filtration aspects of the entries

which have been defined in the report. Let's now move on to the next section where

the EC Sales List reporting menu of the Odoo platform will be defined.

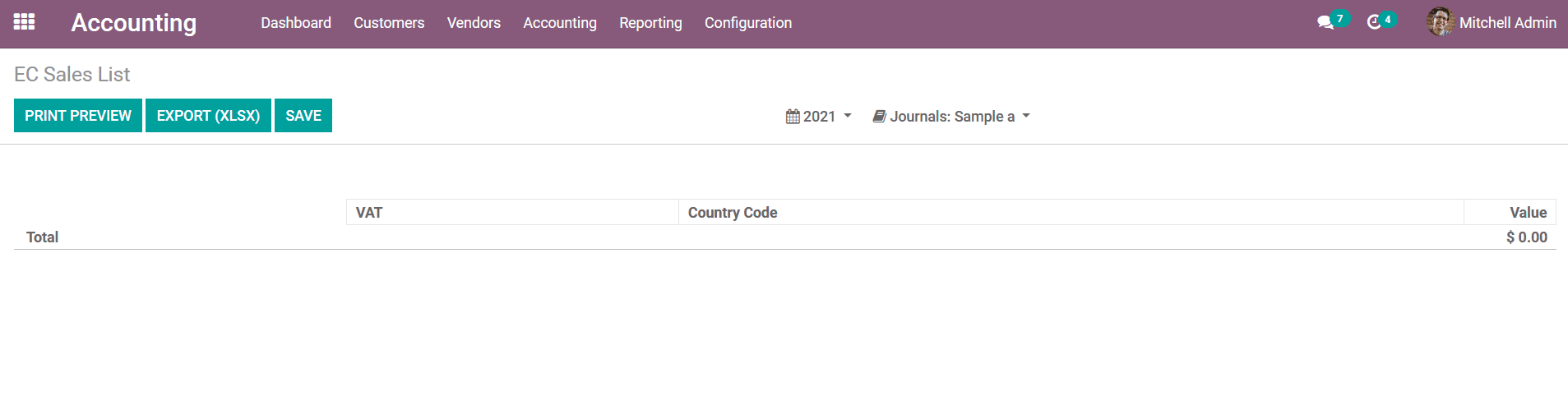

EC Sales List

Another form of reporting tool in Odoo is the EC Sales List reporting which will

provide you a complete insight on the aspect of the financial operations of the

company. The EC Sales List reporting is one of the tools which is to be sent to

Her Majesty's Revenue and Customs of the UK government based on the sales of goods

and services to other businesses in the European Union by VAT registered businesses

across the UK. The EC Sales List Reporting can be accessed from the Reporting tab

of the Odoo Accounting module. Here all the entries in regards to the EC Sales List

will be defined.

You will have Filtering as well as Group by tools that are available helping you

to sort out the entries based on the fiscal years and the Journals which have been

defined. You can refer to the reporting menus which have been defined in the previous

sections. Furthermore, there are Print Preview options as well as Export(XLSX) options

that are available in the EC Sales List menu which will be helpful in the operations

of the financial management aspects of the company.

As you are clear on the EC Sales List reporting management menu of the Odoo platform

let's now move on to the next section where the Journal Audits will be defined.

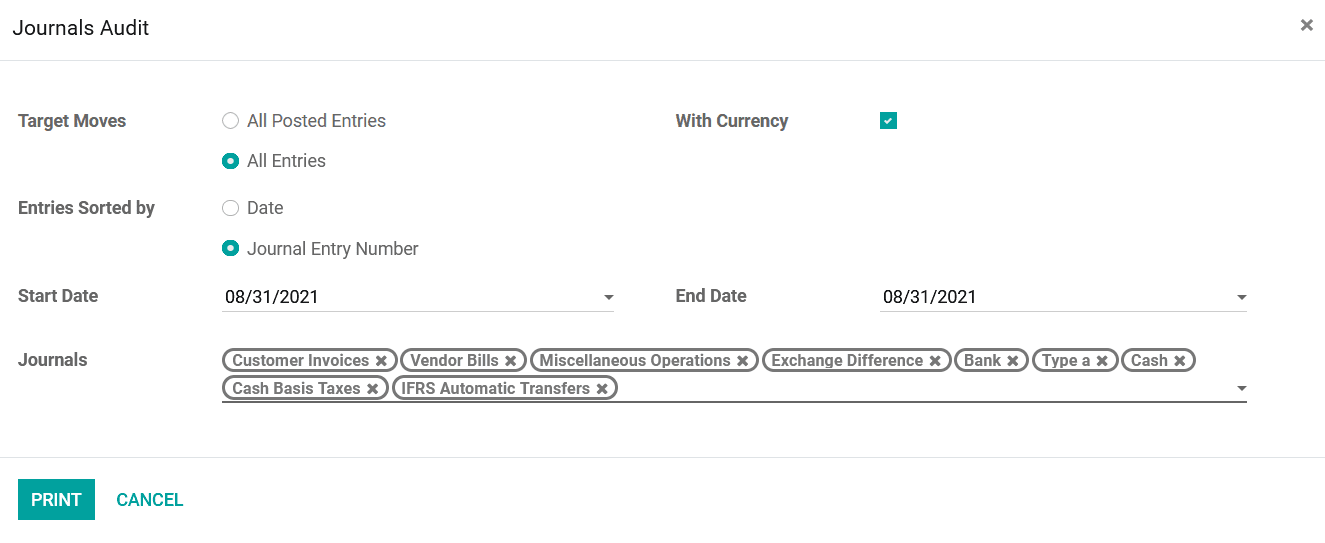

Journal Audits

Auditing operations on the Journals and their entries can be a much-needed tool

in the business operations of the companies. Financial Audits in regards to the

accounting operations of the company are conducted based on the Fiscal years which

have been defined. The Odoo platform has a definite Journal Audits running tool

that is available which can be accessed from the Reporting tab of the Odoo Accounting

module. Upon selecting the Journal Audits options in the menu you will be depicted

with a pop-up window as defined in the following screenshot. Here you can configure

the aspects such as Target Moves as All Posted Entries or All Entries. Further,

the Entries Sorted by options can be configured as Date or Journal Entry Number.

In addition, the Start Date, as well as the End Date of operation of the Audit,

can be defined. The Journals can be added to be Audited from the list of them defined

in the drop-down menu available. Additionally, the with Currency options can be

enabled to run the Auditing operations in regards to the currencies defined.

Once the configuration aspect in regards to the Auditing operations is configured

you can select the Print option that is available for the Journal Audits report

to be printed for the external as well other accounting uses. As you are clear on

the Journal Audits let's now move on to the next section where the various Management-based

Reporting tools will be described.