Deferred Revenues

The use of the term Deferred Revenues describes the aspects of the revenues obtained

to the company in advance even before the products or the services are being delivered

to a customer. This advanced usage of revenue management in the accounting operations

of the company will aid in the effectiveness in the aspects of the subscription-based

products and services. This is because a subscription-based product or service,

for example, newspaper, milk delivery, or a magazine is paid upfront for the month

or a certain period.

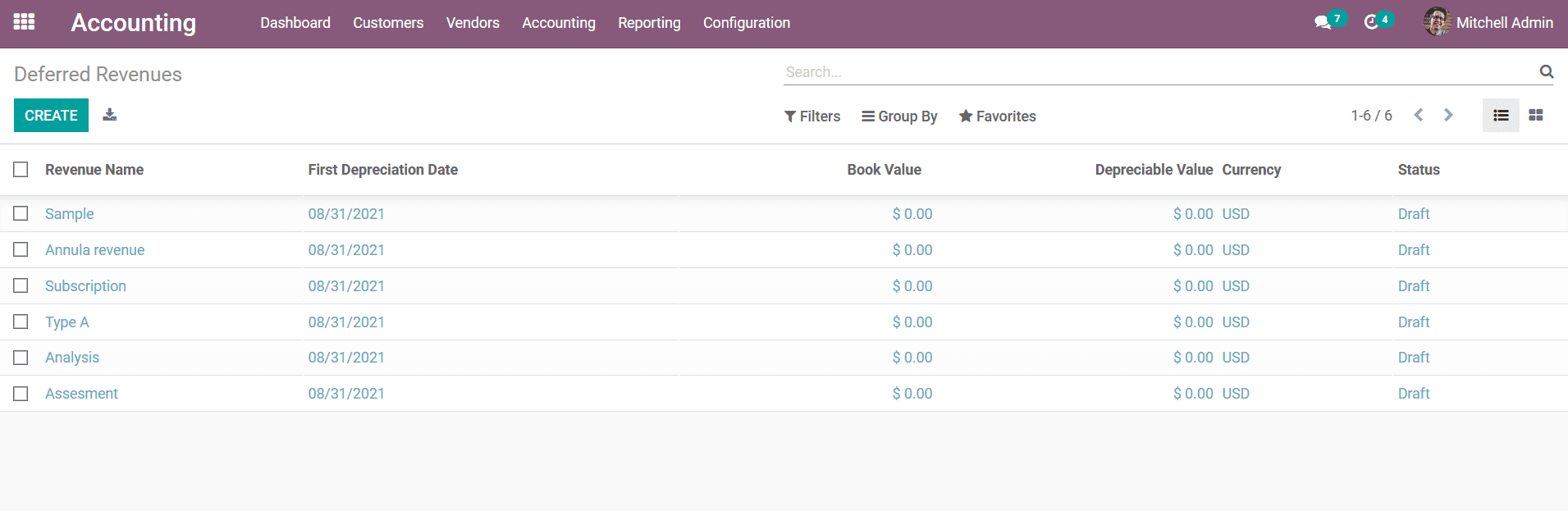

In Odoo Accounting management aspects there is a distinctive menu that will help

with the management of the Deferred Revenues in the company. This feature will help

you to run the financial aspects of the subscription-based products in an advanced

system rather than keeping them on old journals as well as ledgers. The Deferred

Revenues menu can be accessed from the Accounting tab of the Odoo Accounting module.

The menu will depict all the Deferred Revenues which have been defined with the

Revenue Name, First Depreciation Date, Book Value, Depreciable Value, Company as

well as the Status of the respective Deferred Revenue. There are Filtering as well

as Group by options available as in all other menus of the Odoo platform helping

us to retrieve the respective Deferred Revenue based on the need. The menu can be

viewed in the form of a List view as well as the Dashboard view.

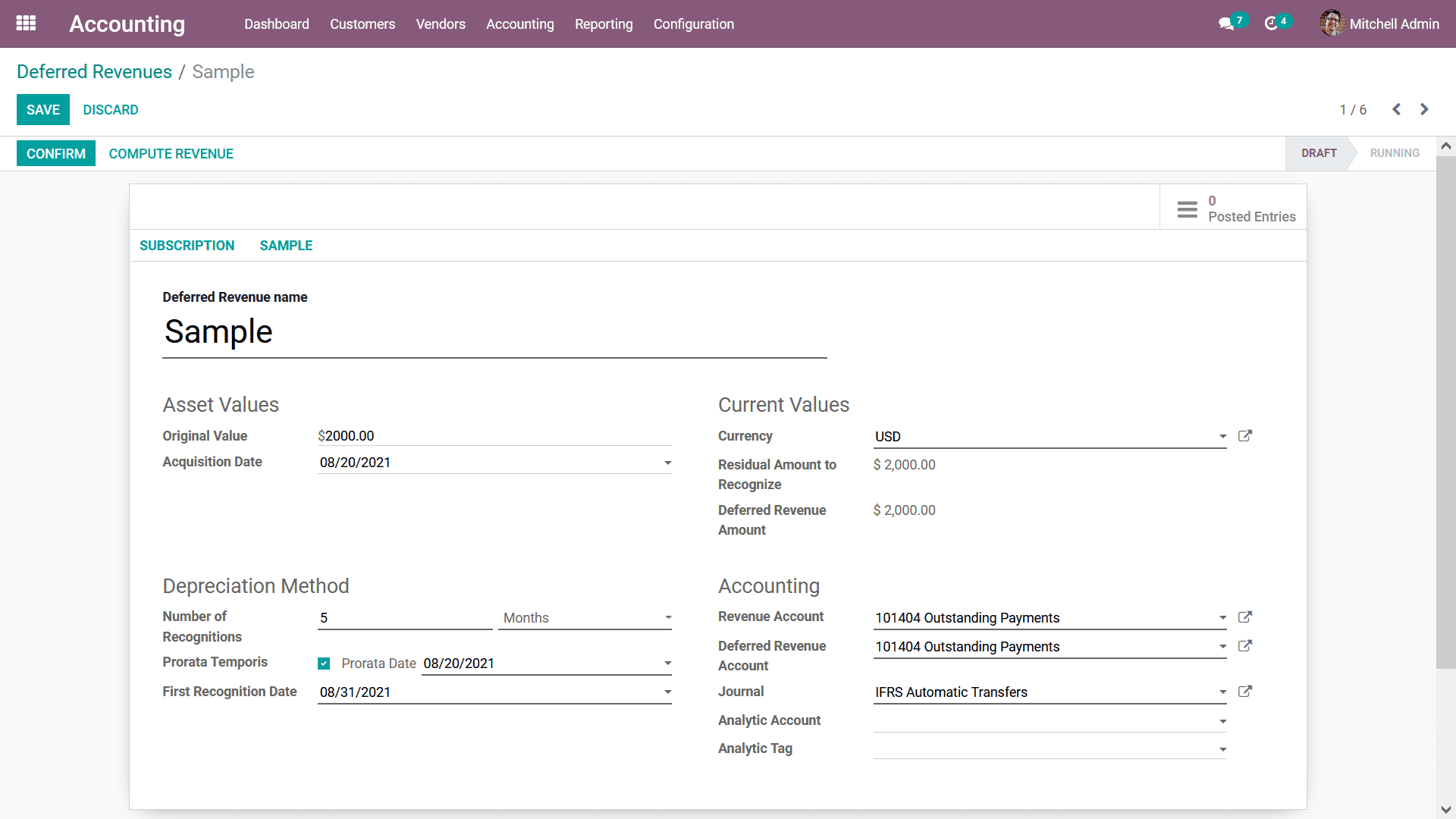

To create new Deferred Revenues, you can select the Create option that is available

which will depict you with the creative menu as shown in the following screenshot.

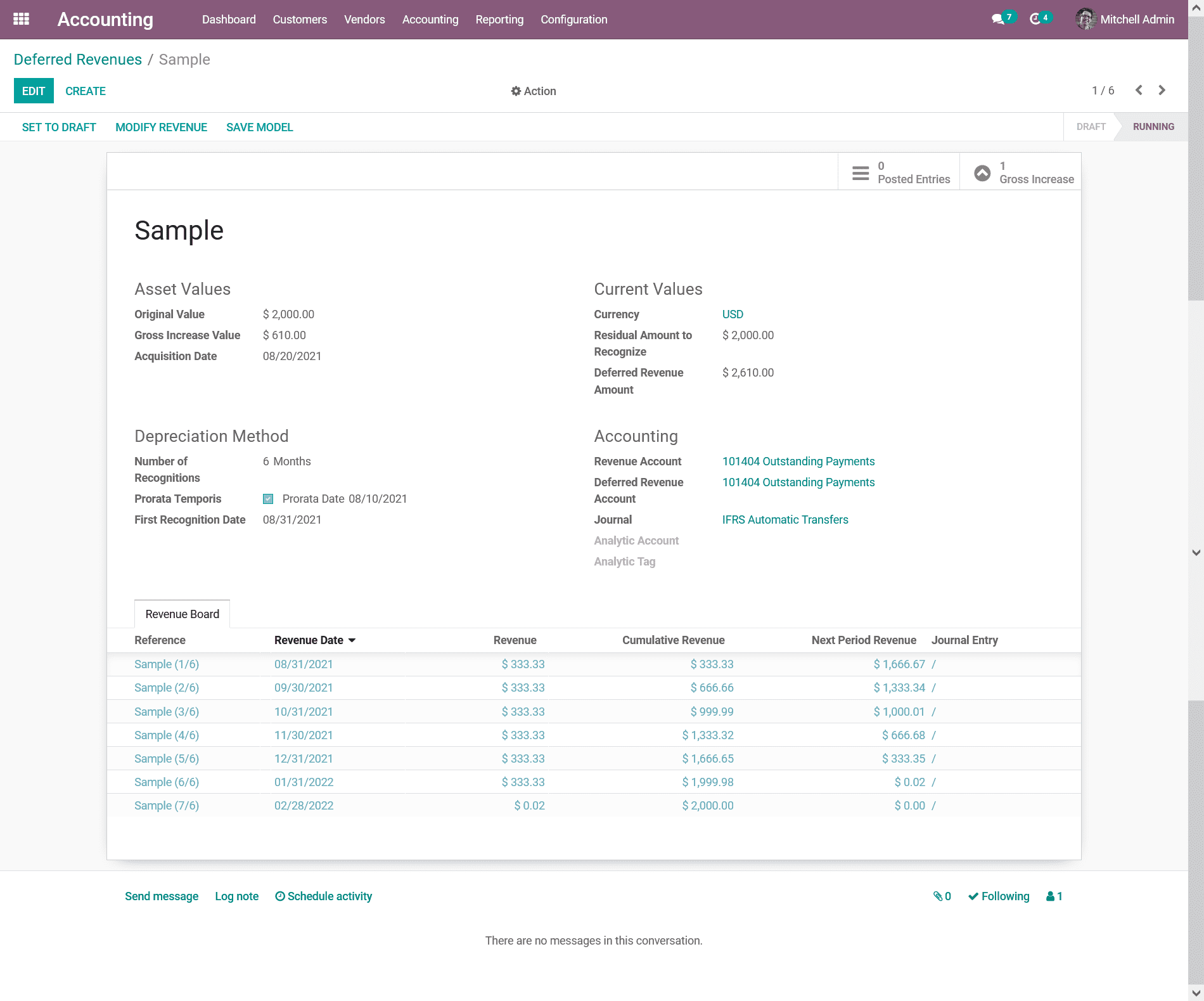

Here, the Deferred Revenue Name can be defined. Further then the Asset Values details

such as the Original Value, and the Acquisition Date can be defined. The Current

Values aspects such as the Currency, Residual Amount to Recognize, and the Deferred

Revenue amounts can be defined.

Additionally, there is a distinctive tab where the Depreciation Method can be defined

here, the Number of Recognitions and whether the Depreciation Criteria of the respective

Deferred Revenue is based on months or years can be defined. Furthermore, the Accounting

aspects such as the Revenue Account which is used to record the Revenue, Deferred

Revenue Account, Journal details, Analytical Account as well as the Analytic Tag

can be defined by selecting them from the drop-down menu available. Moreover, the

Deferred Revenue Account is the account to recognize the deferred income whose account

type is the Current Liabilities. Since the service has not been completely delivered

for the customer when an income is gained from it, which will actually act as a

liability for the company.

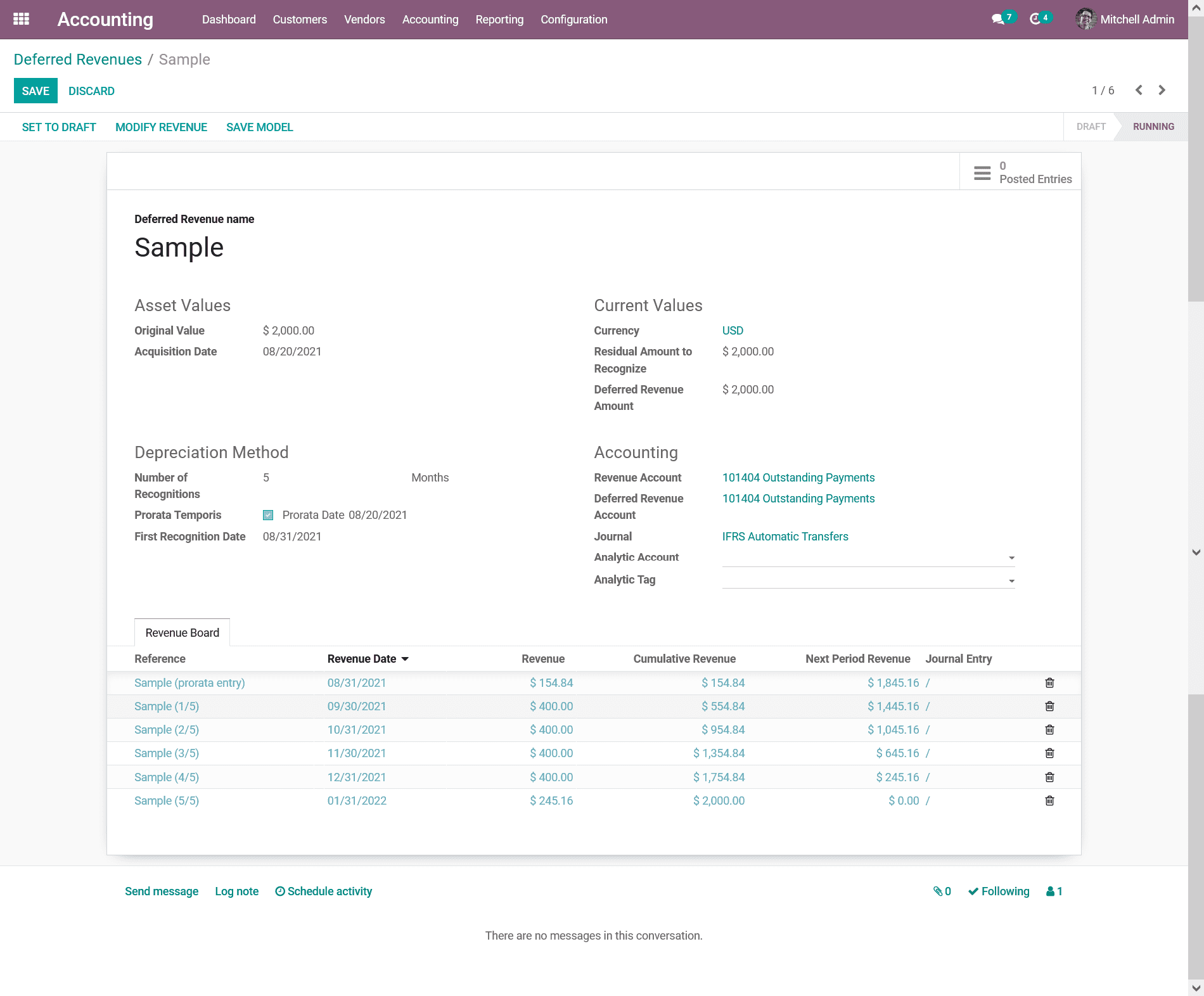

Once all the aspects of the Deferred Revenue are being defined next you have to

Save the menu and Confirm the Deferred Revenues by selecting the Confirm option

which will allow the respective Revenue to be operational. As the Deferred Revenues

is operational the Revenue Board will be depicted where the Reference, Revenue Date,

Revenue, Cumulative Revenue, Next Period Revenue, and the Journal details will be

described which will be auto-calculated and defined based on the contrarians of

the Deferred Revenue being defined.

The Depreciation Board will have the calculated value for each year based on the

original value and the Number of Recognitions. Once the Prorata Temporis is enabled

and while calculating the Depreciation Board, it will recognize the first depreciation

entry with the start from the Asset Creation Date/ Purchase Date instead of the

start of Fiscal Year.

Once it is confirmed you can find the draft journal entries in the smart tab Posted

Entries which can be posted manually to respective accounts or will be posted automatically

on the accounting date as if the Post Automatically option is checked. Therefore,

in each period the Income and Deferred Revenue are added to the Profit and Loss

Report and Balance Sheet respectively. You will also have the provision to delete

any of the Revenue Board details or lines of the respective Deferred Revenue.

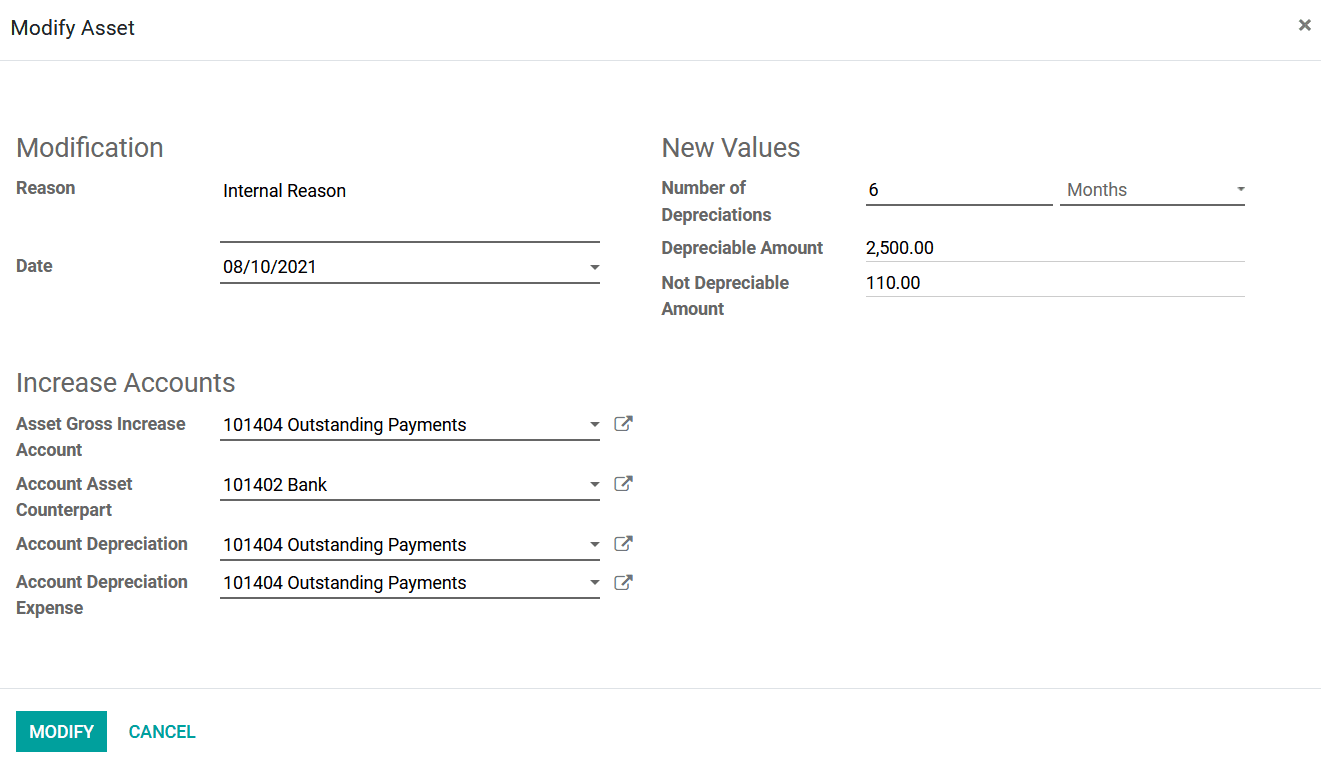

In case you need to Modify the aspects of the Deferred Revenues there will also

be a Modify Revenue option that will be available in the above-described menu. Upon

selecting the Modify Revenue option you will be depicted with the popup window as

depicted in the following screenshot where you can define the Modifications aspects

of the respective Deferred Revenue. Initially, the Reason for the Modification and

the Date of the Modifications to happen can be defined. Further, the New Values

for the Deferred Revenue can be configured by defining the Number of Depreciations

and the duration of it to take place in Months or Years. Further, the Depreciable

Amount can be defined along with the Non-Depreciable Amount details.

Additionally, the increased Accounts details such as the Asset Gross Increase Account,

Account Asset Counterpart, Account Depreciation, and the Account Depreciation Expense

can be defined by selecting the respective account from the drop-down menu which

has been defined. Once all these aspects have been configured the next step will

be to select the Modify option available which will do the modifications of the

Deferred Revenues as per the defined terms.

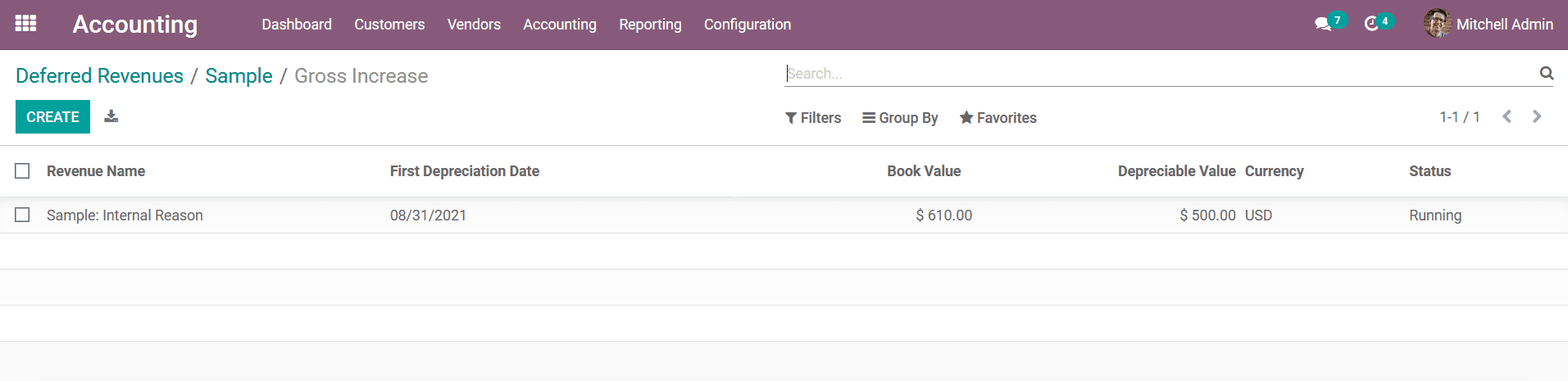

Once you get back to the respective Deferred Revenue you can see that the Modifications

done concerning the Revenue have been described and there will be a new smart option

available in the dashboard to view the Gross Increase.

Upon selecting to view the Gross Increase you will be directed to the window as

shown in the following screenshot. Here, the description on the Gross Increase details

will be defined where the Revenue Name, First Depreciation Date, Book Value, Depreciation

Value, Currency details, and the Status will be described. There are Filtering as

well as Group by options available as in all other menus of the Odoo platform helping

us to retrieve the respective Gross Increase if numerous ones have been defined

based on the need.

Automating the Deferred Revenue and Deferred Revenue Models are the other aspects

which should be considered in regards to the Deferred Revenue operation you can

refer to section 3.3.2, to have a clear understanding of them. The management menu

for the Deferred Revenue will help you to define the subscription product's financial

management efficiently. As we have a clear understanding of the aspects of the Deferred

Revenue let's now move on to the next section where the Deferred Expenses are being

defined.