Deferred Expenses

Just like the Deferred Revenues, the aspect of the operations of the Deferred Expenses

will be similar to it in terms of the fusion will be for a certain period. The Deferred

Expenses can be well associated with the subscription-based products that you have

purchased and will be delivered to you in intervals of time for a long period. An

example can be a cleaning service from a vendor that your company has been subscribed

for the cleaning process will be done daily but the payment is generated monthly

or yearly in advance.

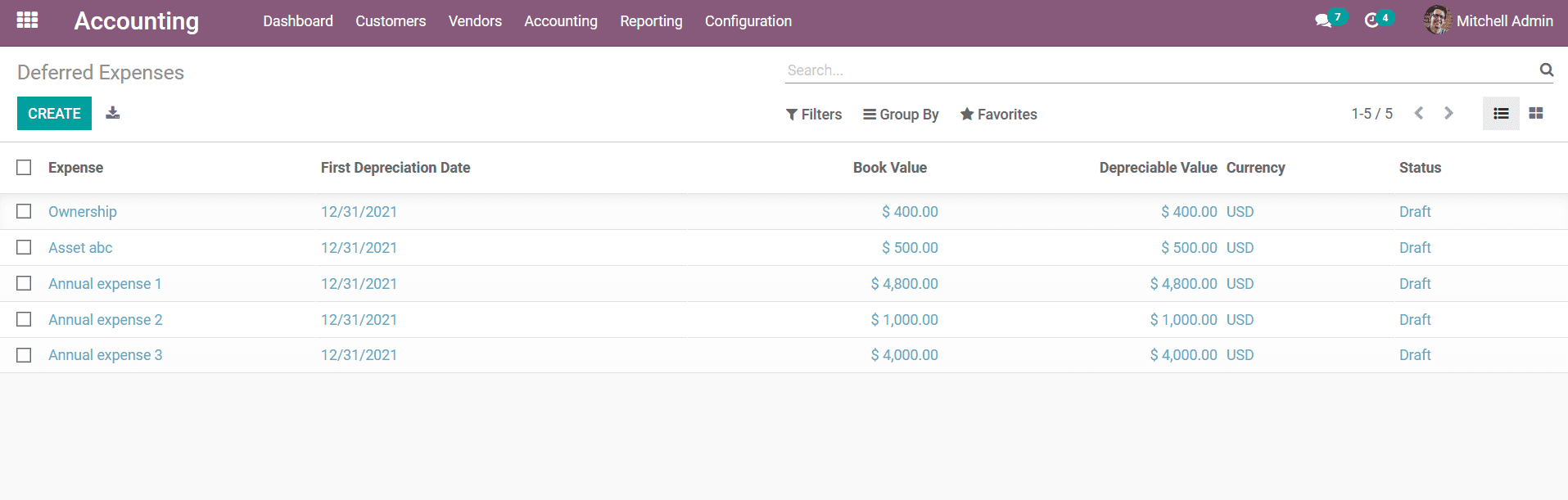

The Odoo platform has a distinctive menu for the management of the Deferred Expenses

just as the Deferred Revenues menu has been defined. The Deferred Expenses menu

can be accessed from the Accounting menu of the Accounting module. Here, all the

Deferred Expenses which have been defined in operations will be depicted which can

be chosen to be edited. Furthermore, you also have the provision to create new Deferred

Expenses by selecting the Create option that is available. There are Filtering as

well as Group by options available as in all other menus of the Odoo platform helping

us to retrieve the respective Deferred Expenses if numerous ones have been defined

based on the need.

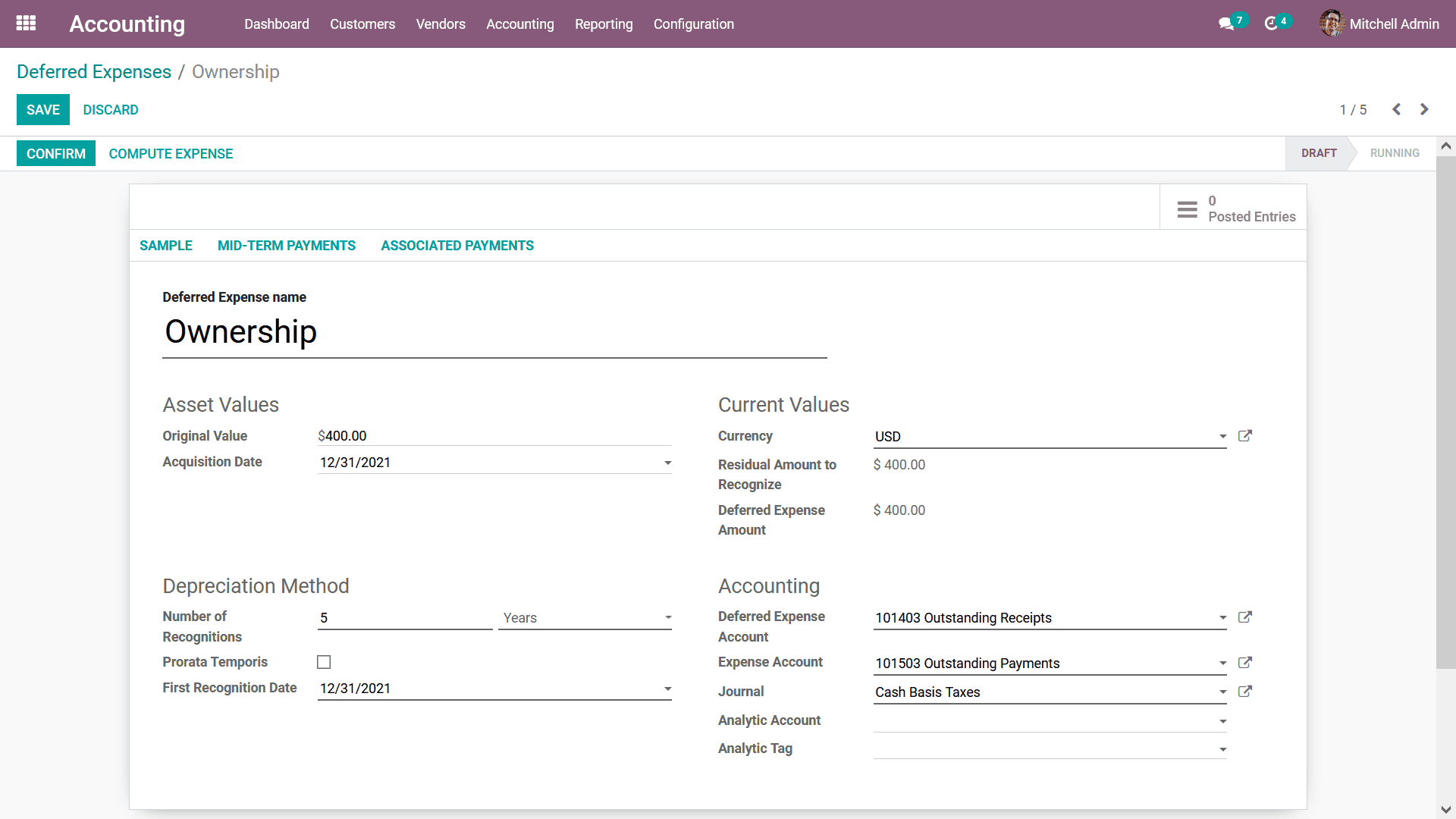

Upon selecting to create a new Deferred Expenses by defining the Create option that

is available you will be depicted with the window as shown in the following screenshot.

Here you need to initially define the Deferred Expenses Name and further configure

the Asset value details of it such as the Original Value and the Acquisition Date

should be defined. Further the Current Values configuration of the Deferred Expenses

such as the Currency, Residual Amount to Recognize, and the Deferred Expenses Amount

can be defined.

Additionally, the Depreciation Method configurational aspects of the Deferred Expenses

such as the Number of Recognitions and the duration of the Depreciation should be

defined. There is an option to enable the Prorata Temporis which will allow you

to define the Date for the Depreciation from which it should be conducted. The First

Recognition Date can also be defined for the operations. Furthermore, the Accounting

aspect such as the Deferred Expenses Account, Expense Account Journal, Analytic

Account, and the Analytic Tag can be defined by selecting it from the drop-down

menu where all the defined Accounts will be listed out.

Where the Deferred Expense Account is the account used to recognize the Deferred

Expense whose account type should be Current Assets. Since the company has paid

the amount in advance for the service and even though it is an expense for the company

and has not gained the complete service, for future it will be treated as a current

asset. Furthermore, the Expense account is the account to record the expense and

a miscellaneous type journal can be used to record the Deferred Expense.

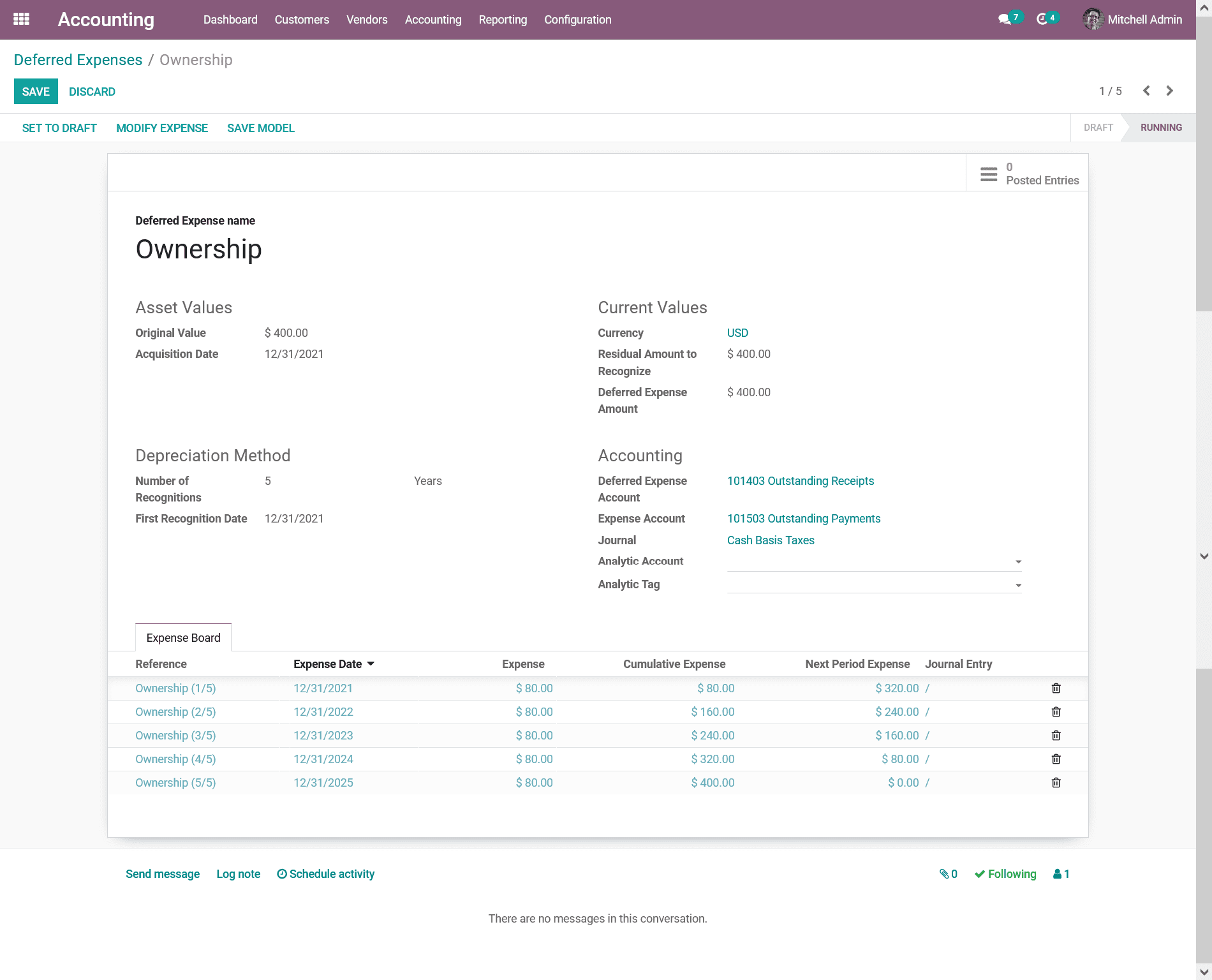

Once the aspects of the respective Deferred Expenses are configured you can Save

the window and Confirm the Deferred Expenses operation by selecting the respective

options. Further, you can select the Compute Expense options available in the respective

menu and a new Expense Board will be depicted as shown in the following screenshot.

Here all the aspects of the respective Deferred Expenses such as the Reference,

Expense Date, Expense, Cumulative Expense, Next Period Expense, and the Journal

Entry details will be described. Once it is confirmed you can find the Draft Journal

Entries in the smart tab the Posted Entries which can be posted manually to respective

accounts or posted automatically on the accounting date if the Post Automatically

checkbox is checked.

So each period the expense and deferred expense are added to the profit and loss

report and balance sheet respectively. There will also be provided to delete the

respective Expense Board lines by selecting the available Delete option.

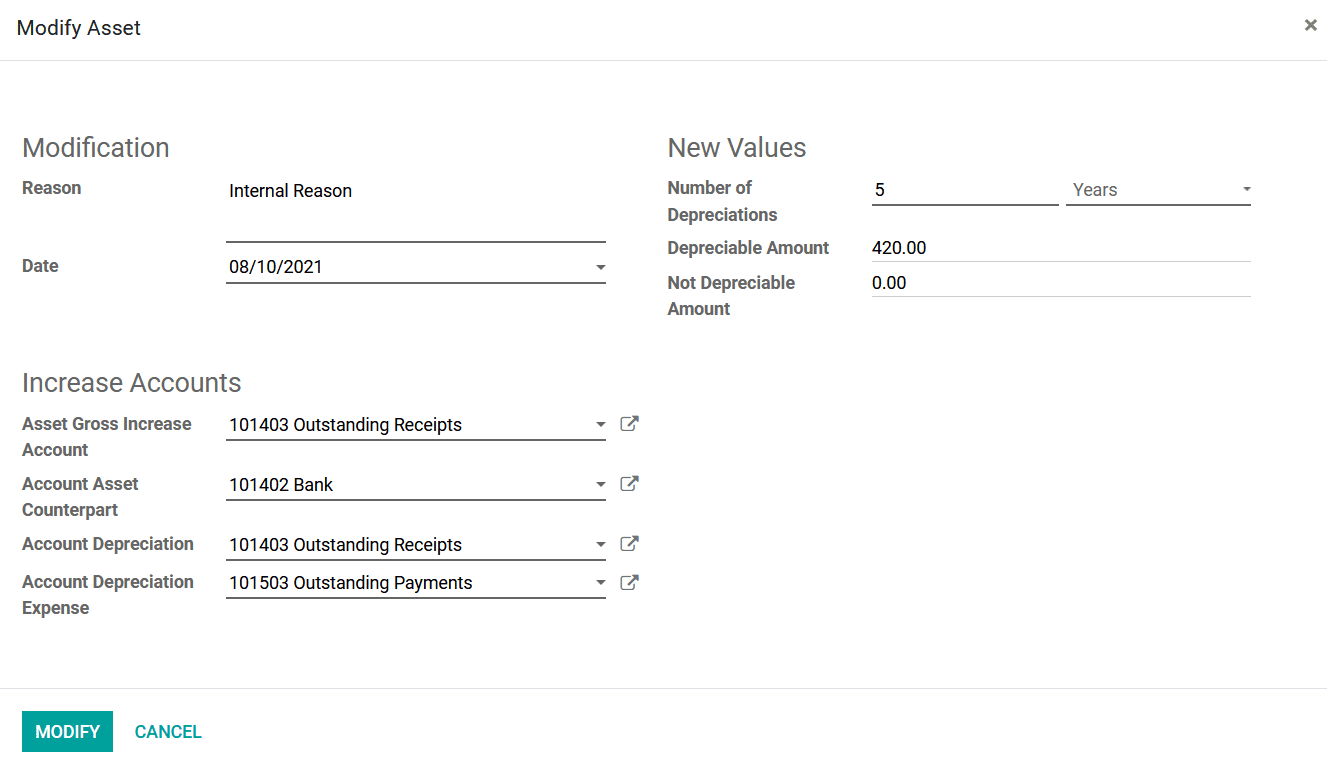

To Modify the Asset information, you can select the Modify Expense option that is

available in the menu which will depict you with a pop-up window as shown in the

following screenshot. Here you need to define the various Modifications aspects

such as the Reason and the Date of the modification to be done. Further, the New

Values which should be inherited by the respective Deferred Expenses can be defined

by describing the Number of Depreciation and the interval in Months, Days, or Years.

Further, the Depreciable amount, as well as the Non-Depreciable Amount, should be

defined.

Additionally, the Increase Account details such as the Asset Gross Increase Account,

Account Asset Counterpart, Account Depreciation, and the Account Depreciation Expenses

can be defined by selecting it from the drop-down menu available in each of the

options. As all the aspects have been defined next you can select the modify option

for the respective modifications to be applied to the Deferred Expenses.

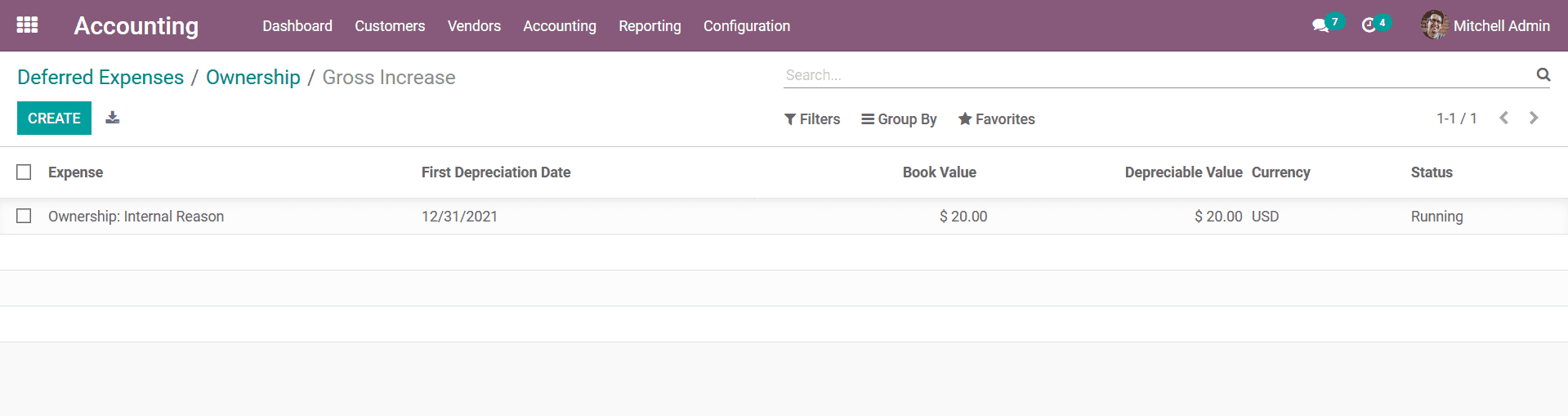

Moreover, you can view the details of the Gross Income for the respective Deferred

Expenses by selecting the Gross Income icon from the menu which has been defined.

Here all the Gross Income related to the respective Deferred Expenses will be depicted

along with the Expense details, First Depreciation Date, Book Value, Depreciable

Value, Currency, and the Status of the operation. There are Filtering as well as

Group by options available by default and the new ones can be customized to sort

out the Gross income of the respective Deferred Expenses which has been defined.

The Deferred Expenses management menu available in the Odoo Accounting module will

support the operations of the purchase of the subscription-based products and services

and manage the financial aspect of its to be run effectively. Moreover, the Deferred

Expense Automation and the Deferred Expense Model play a crucial role in the operation

of the Deferred Expenses management which you can refer to in section 3.3.4 for

a clear understanding. As we are clear on the Deferred Expenses and the further

Accounting Management tools in the Odoo Accounting Module, let's move on to the

next section where the aspects of Accounting Management Actions in the Odoo Accounting

module will be described.