Credit Note Management on the Customer Invoices

You might have an insight on the aspects of credit note operations that will help

you to refund the invoices amounts in the last section. As the chances of having

to define the credit note operations are high in a real-time business environment

the Odoo has a dedicated menu that supports the management of all the credit note

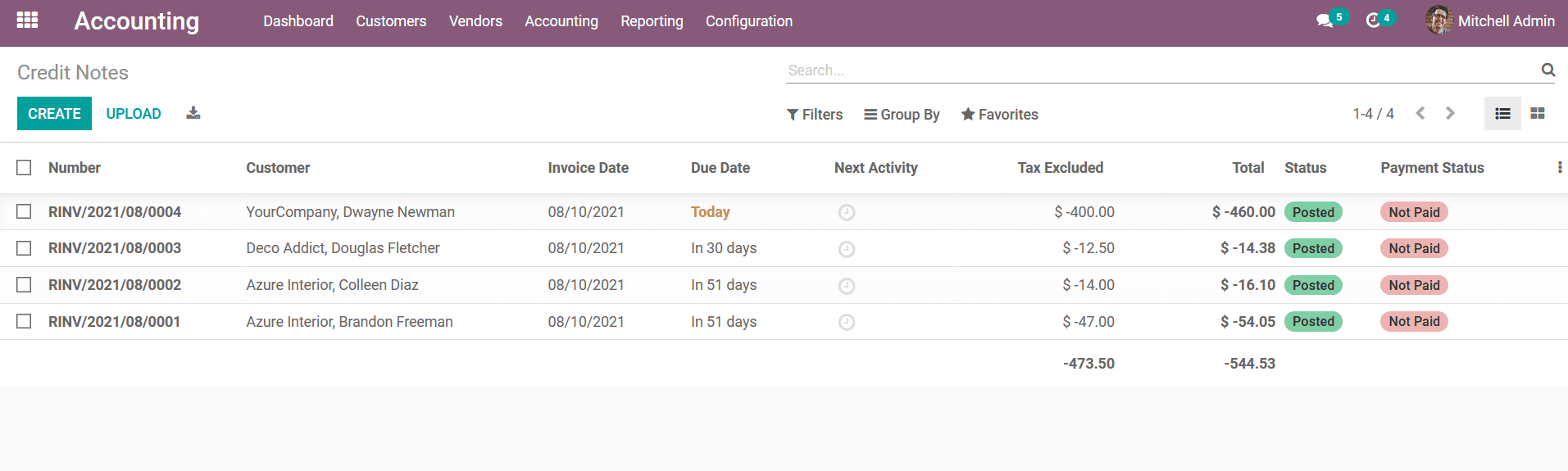

operations. In the Credit Notes menu which can be accessed through the Customer

tab, all the Credit Notes will be defined with the Number, Customer details, Invoice

Date, Due Date, Next Scheduled activity, Tax Excluded, Total, Status, and the Payment

Status will be described. There are also default as well as custom Filter and Group

by options that can be defined to retrieve the required Credit Notes from the menu.

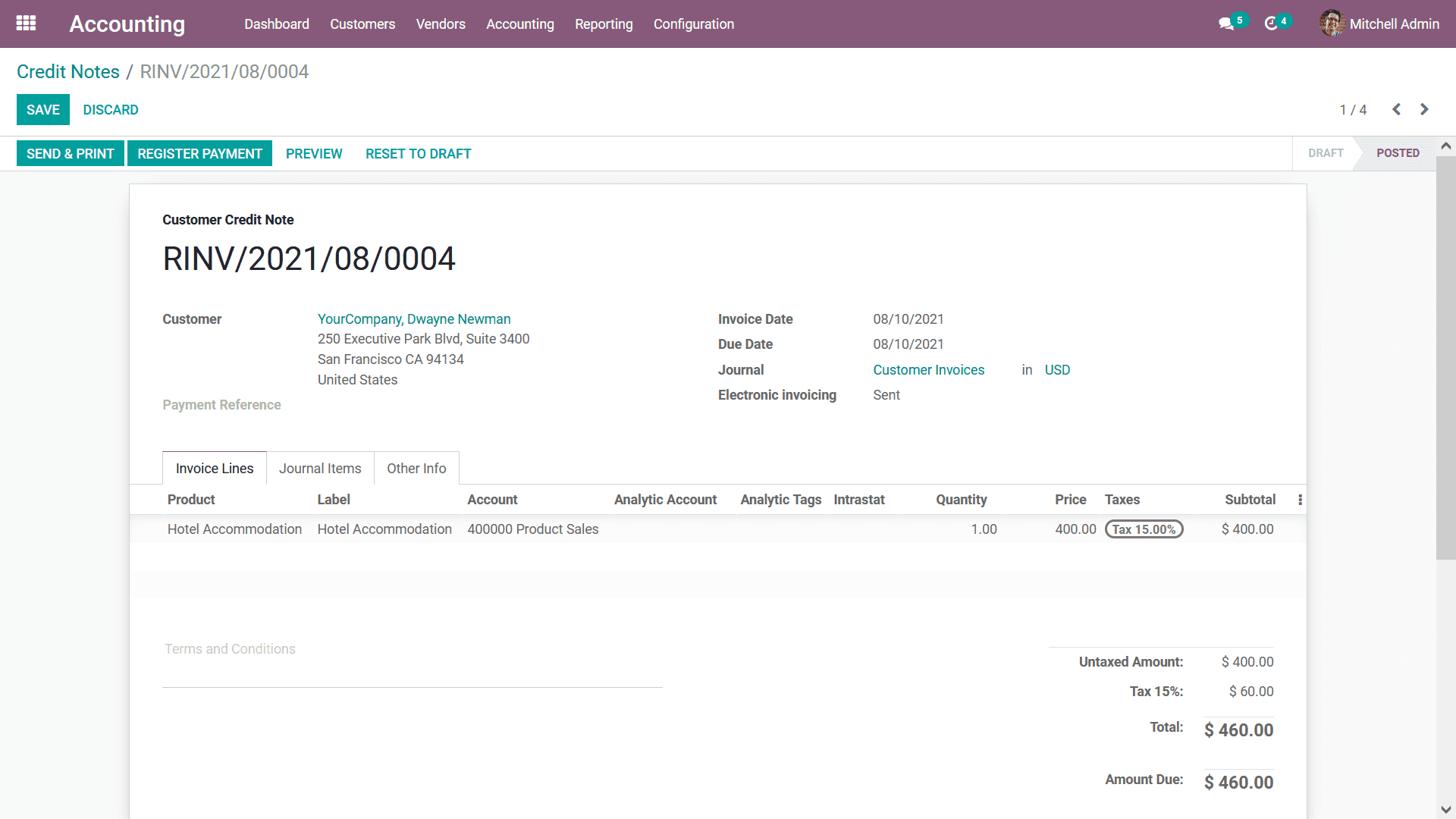

You will also have the provision to edit the Credit Notes as well as create new

ones by selecting the Create option. In the Creation menu, the Credit Note number

will be defined and you can see that the number starts with the RINV label which

indicates the reverse invoice operation. Whereas the invoice number will be defined

as INV at the beginning of the number. The Customer details along with the Payment

Reference details can be defined. Furthermore, the Invoice Date, Due Date, Journal,

and Electronic Invoicing details will be depicted concerning the Credit Note.

Additionally, the Invoice Lines can be defined by selecting the Add a line option.

Moreover, you can add a section to the invoice by selecting the Add a section option

along with there is a provision to add a note by selecting the Add an available

note option.

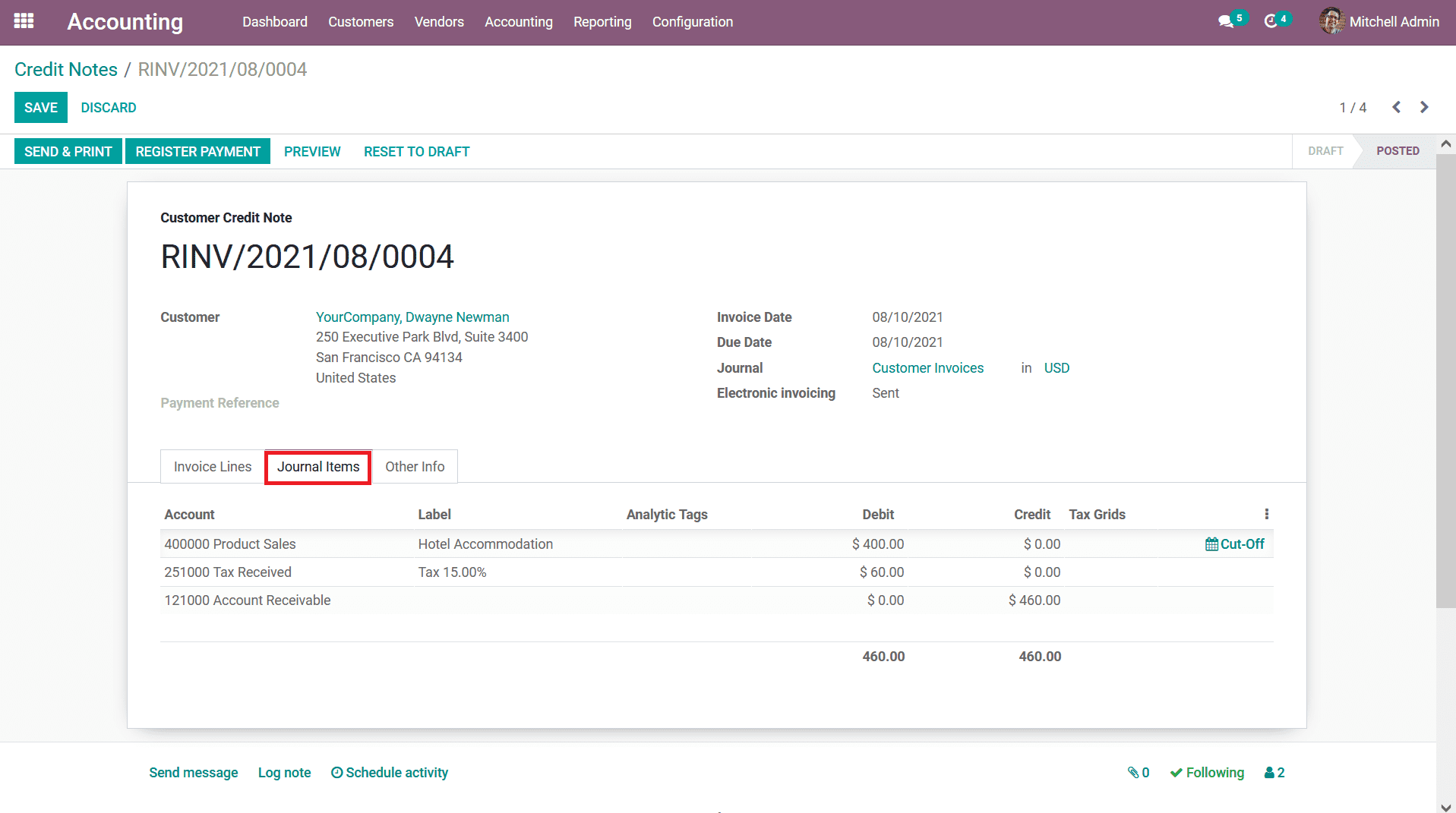

In the Journal Items the Account details along with the Label, Analytic Tags, Debit,

Credit as well as the Tax Grid details will be defined. Once we add the product

to the reverse invoice itself, the Journals items tab will be filled with the accounts

affected. During this process, Income Account and Tax Account are debited and the

Account Receivable is credited. This means while reversing Invoice the income is

decreasing and thus it is debited and account receivable is of nature 'Asset' decreases

thus credited.

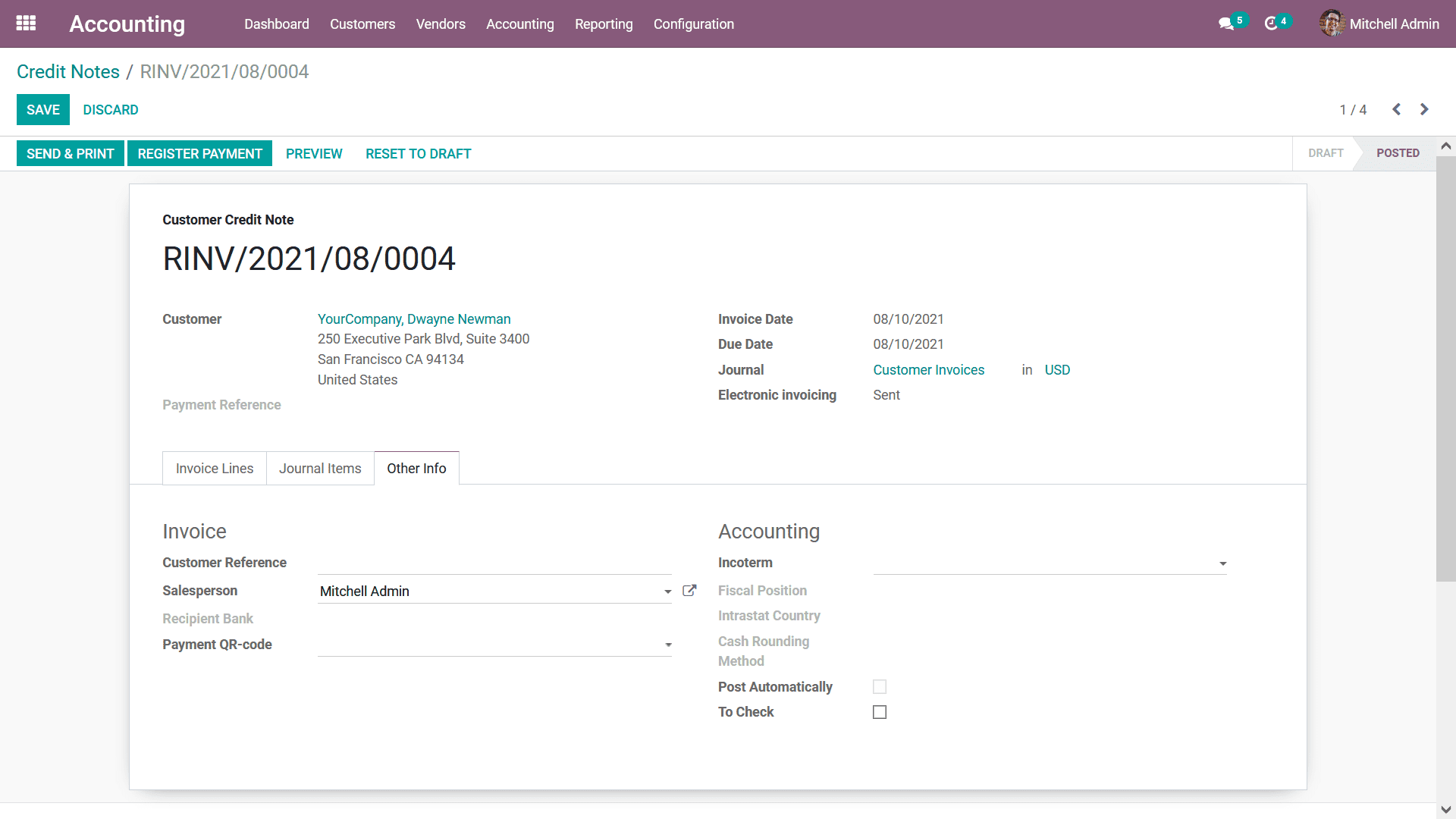

In the Other Info tab, the Invoice, as well as Accounting details, can be defined.

The Invoice details such as the Customer Reference, Salesperson details, Recipient

Bank, and the Payment QR- code can be defined. The Accounting details such as the

Incoterms, Fiscal Position, Intrastat Country, Cash rounding Method, Post Automatically

and To Check can be defined based on the need.

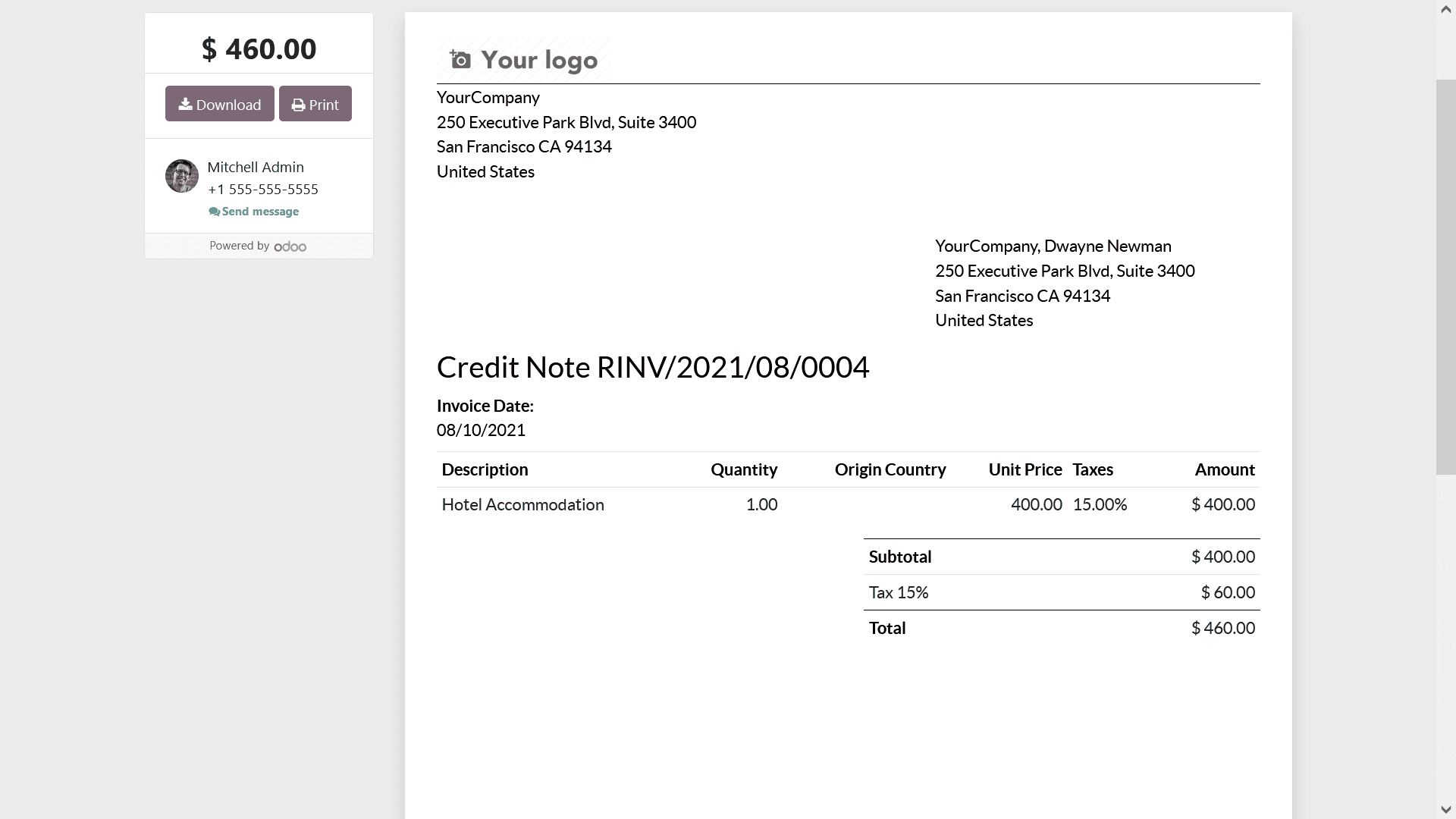

A reverse invoice should be sent back to the customer, the preview of the reverse

invoice for the Credit Note can be viewed by selecting the Preview option available

in the respective Credit Note menu. The following screenshots depict the reverse

invoice which is being defined to be sent to the customer. Here all the information

will be defined just as it has been provided in the Credit note which has been provided

by you.

If the descriptions on the Credit Notes are correct they can be sent to the customer

via post or email. The Credit Notes as well the reverse payment can be generated

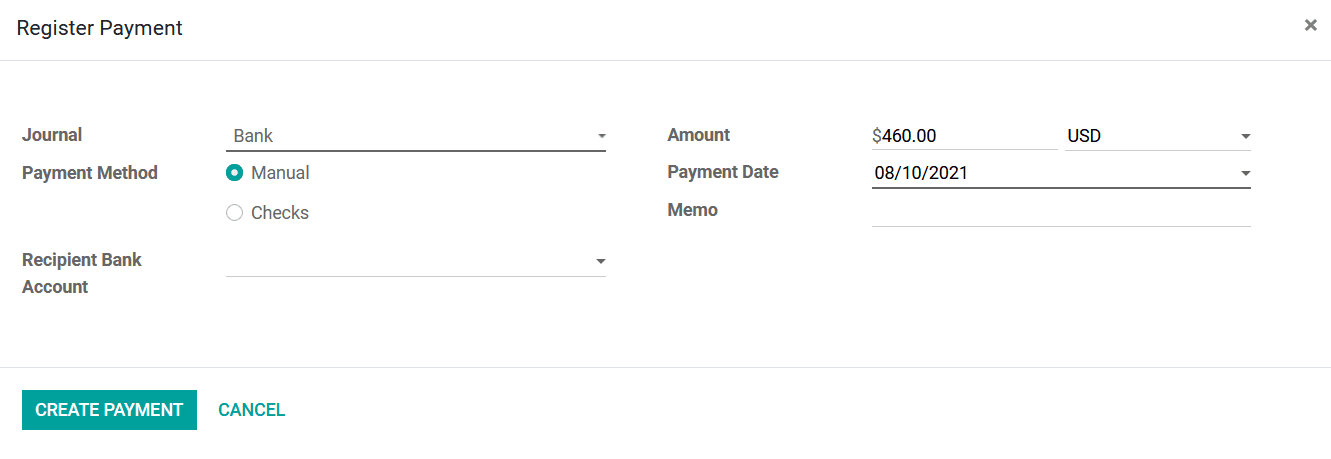

towards the customer. Once the payment has been generated you should Register Payment

towards the customer payments in the respective journals of the financial operations

in the respective platform. Upon selecting the Register Payment option, you will

be depicted with the following pop-up window where the payment register details

can be defined. The aspects such as Journals, Payment Method which can be selected

as Manual or Checks. The Recipient Bank Account details can also be provided. Furthermore,

the Amount and the currency in which the payment should be provided as well as the

Payment Date and the Memo can also be defined. Once the details are being described

you can select the Create Payment option that is available.

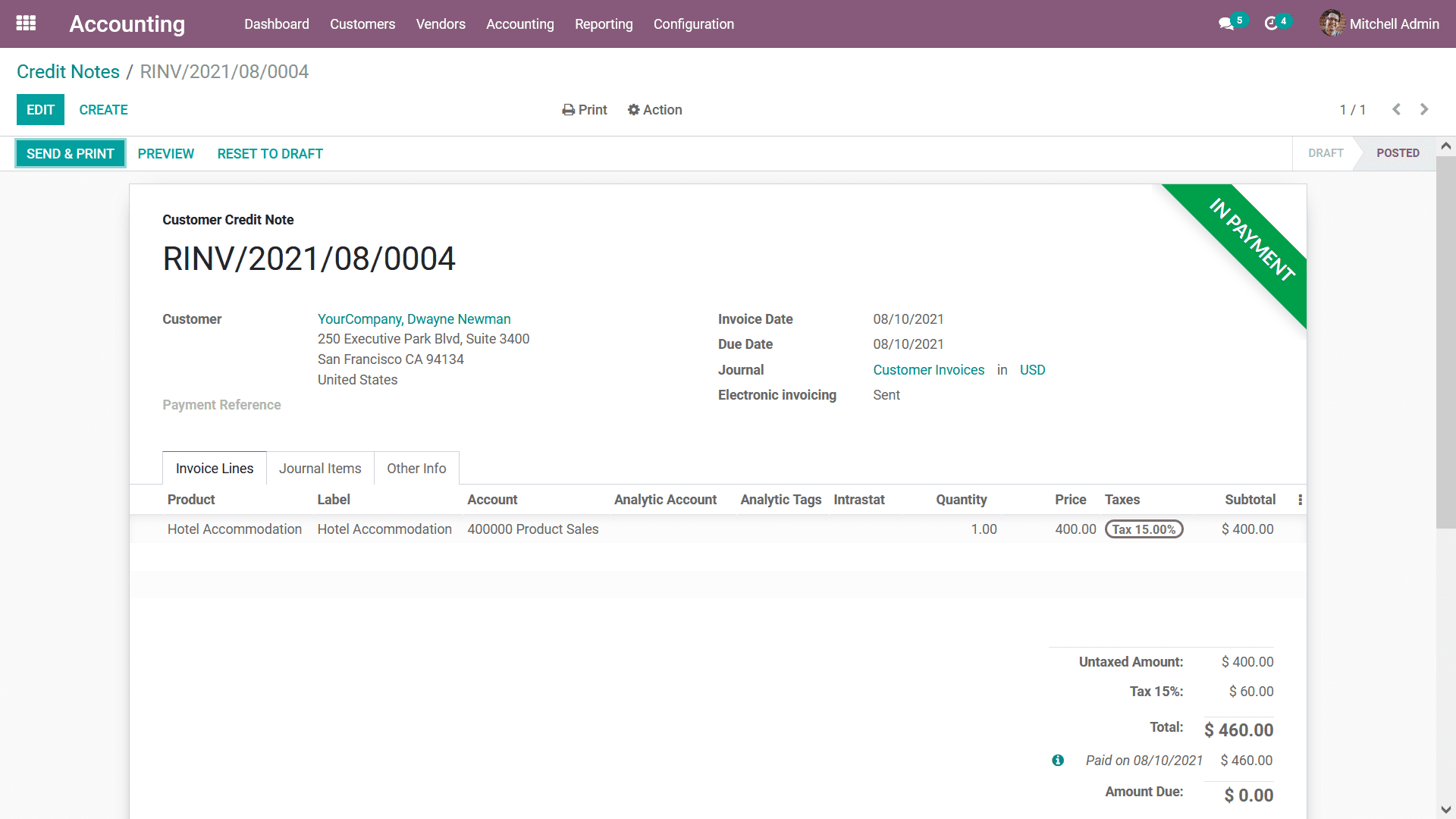

Once the Payment is registered the respective Credit Note will depict the indication

of payment with a label as In Payment if the payment is yet to be approved or is

being done. In case the payment is completed the label will depict it as Paid.

As of now you will be having and undressing the Credit Notes operations and how

it functions and the management aspects regarding it. In the next section, we will

be discussing the aspect of Customer Receipts management in the Odoo Accounting

module.