The Accounting module of the Odoo platform supports the effective management of

the payment as well other financial operations regarding the customer as well as

vendor operations towards the company. With a dedicated menu and tools that are

available in the Odoo Accounting module, both the customer as well as vendor payments

can be managed effectively.

In the last chapter, we were focusing on the configuration aspects of the Accounting

module. All the configuration menus, as well as options available, were defined

in detail. In this chapter, we will be focusing on the financial management aspects

of your company with regard to customer and vendor operations. The following aspects

will be covered in this chapter:

- Accounting module Dashboard

- Customer Finance management with Odoo Accounting module

- Vendor management

All the sub aspects regarding the defined tops will also be defined in this chapter

in detail with proper description and illustrations.

Accounting module Dashboard

Odoo due to the modular aspect of operation has a distinctive Accounting module

where all the financial management operations of the company can be conducted with

dignified menus and options. As the Configuration aspects were described in the

previous chapter let's now move on to understand the face of the Odoo Accounting

module the Dashboard where the users are directed to while entering the Accounting

module. The well-defined Dashboard of the Odoo Accounting module will provide you

with clear-cut information on the various operational aspects.

A descriptive overview of Accounting Module Dashboard

The Dashboard of the Accounting module will provide you with an overview of the

financial operations that are being conducted in the company with the Odoo accounting.

Moreover, with distinctive tabs, you will be provided with an insight into how the

operations are being conducted and what is going on with regard to the financial

aspects of each tab. Initially, when you reach the Dashboard you will be depicted

with Filtered information which is based on the configurations which are set up

during the development of the platform. Moreover, the filtering can be removed based

on your need. In addition, you can create a custom filter option to define your

Dashboard and there are ones that are available by default.

In addition, with the help of the Group by field available in the Dashboard the

information depicted in the menu can be configured based on your operational need.

Furthermore, you will be depicted with an illustrative table on how the configurations

of the Accounting module as well as the further financial management operations

of the company should be conducted. This will provide you information on which all

operations concerning the functioning with the finance management should be configured.

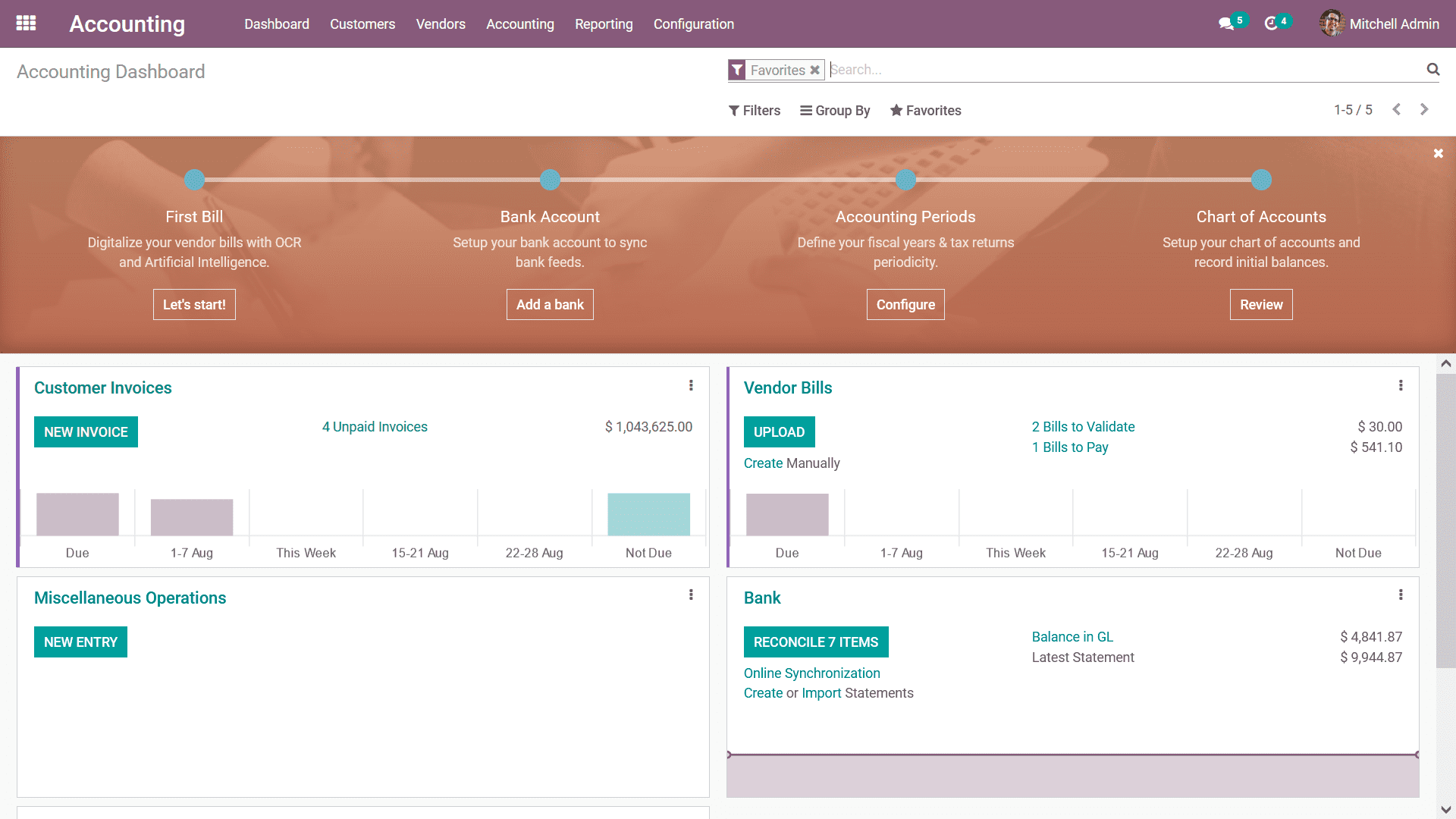

The following image depicts the Dashboard of the Accounting module with the configuration

description window.

From the overview itself, you can define the First bill for vendors can be drafted

by clicking on it. Let’s Start option that will direct you to a Vendor Bill Creation

window and you can right away create the Vendor Bills based on the functional needs.

Furthermore, you can configure a Bank Account for the operation of the company by

clicking on Add a Bank which will lead to the same interface of creating a bank

account for the company. Further, then you can set the Accounting Period and Tax

Return Periodicity for different periods like quarterly, annually, and based on

the need by clicking on the configure button under Accounting Periods.

Additionally, all the Charts of Accounts of the currently installed localization

can be seen from the Review button. Moreover, if required more Chart of Accounts

can be created/imported as per requirement. Furthermore, the Review button under

the Chart of Accounts will provide the users with the capability to add the opening

balance. In addition, the Credit/Debit Amount on each account can be added and the

changes can be Saved for the operation of the platform. The corresponding Journal

Entry will be generated for Opening Balance in Journal Entries. If there is any

difference in Debit and Credit amounts, Odoo will automatically add that difference

amount to ‘999999 Undistributed Profits/Losses' for automatic balancing.

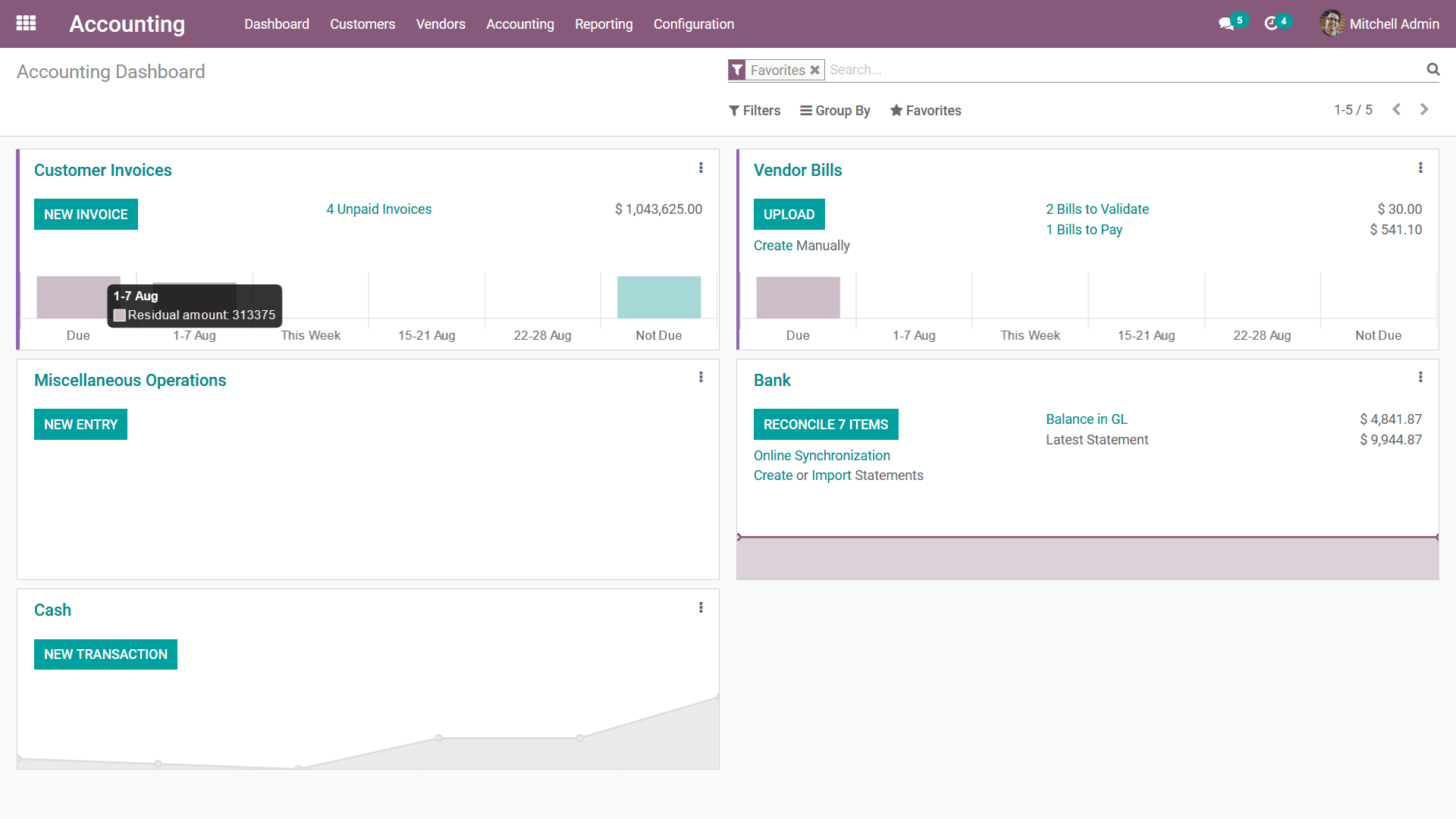

The depicted window can be closed as the need and you will be depicted with the

Dashboard as shown in the following image. The various tabs such as Customer Invoices,

Vendor Bills, Miscellaneous Operations, Bank details, the Cash information, and

many more will be depicted based on the Favorites of the Dashboard being defined

in operation. Moreover, all the Journals which are created and operations will be

available in the Dashboard. Furthermore, you can add the ones which are used frequently

based on your requirement to the Favorites. This will be helpful for filtering the

Journals based on the need. An informative chart on the operations concerning the

functioning on each tab will be depicted as shown in the following screenshot. Upon

hovering your mouse pointer on the charts you will be depicted with the distinctive

information on each based on the definition on the chart.

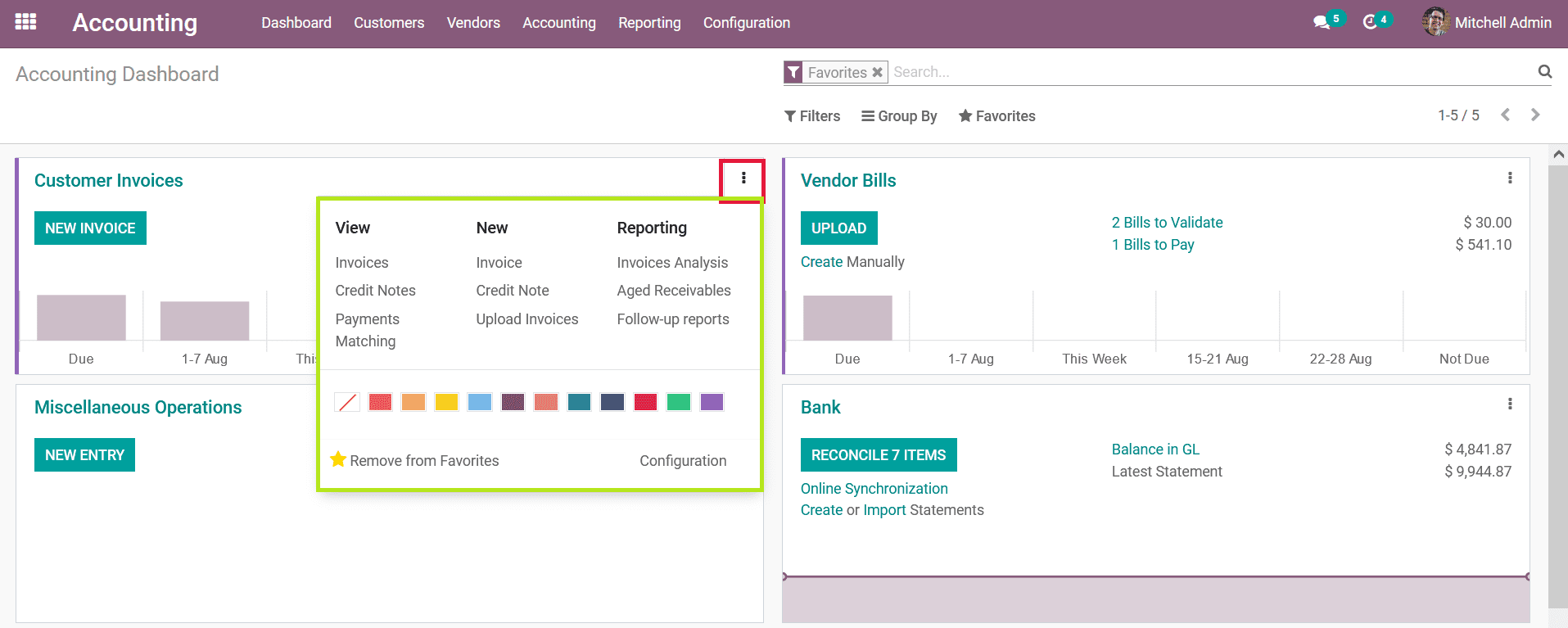

There are also options to directly move to the respective menus of each of the tabs

that have been defined. In addition, there are distinctive configuration options

available under each of the tabs that have been defined based on the operational

aspect of each. The color configurations options help you to define the various

color coordination for each tab helping you to classify them distinctively if numerous

tabs are present.

There are also options available to Remove from Favourites helping the respective

tab to be removed from the Dashboard of the Accounting module. In addition, for

each Journal, the respective documents such as Invoices/Bills, Credit/Debit notes

can be viewed, created a new doc, and reports on the docs of each Journal can be

taken from the Overview. Furthermore, there is a Configuration option which upon

selecting will take you to the configuration menu of the respective tab. Each of

the tabs will have a different configuration setting and in general, you will have

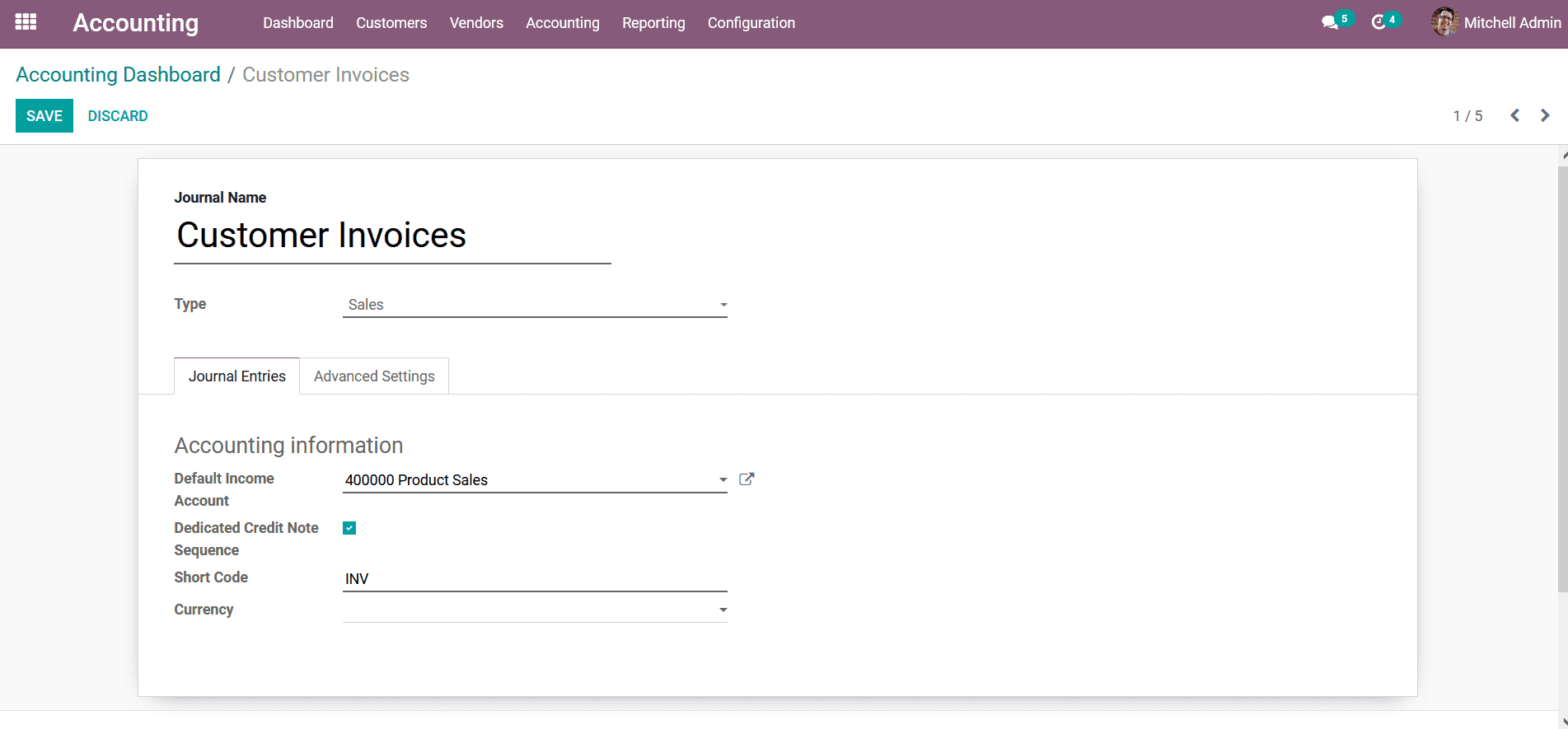

to define the Journal Entries of the respective tab being defined. For example,

here the Customer Invoices tab is selected and the following screenshot depicts

the Configuration menu of it. Here you will get information on the respective Journal

such as the Type of the Journal. Further, the Journal Entries configuration details

such as the Default Income Account, Dedicated Credit Note Sequence, Short Code,

and the Currency details. You will have the provision to modify all the prescribed

details of the Journal by selecting the Edit option that is available in the Configuration

window.

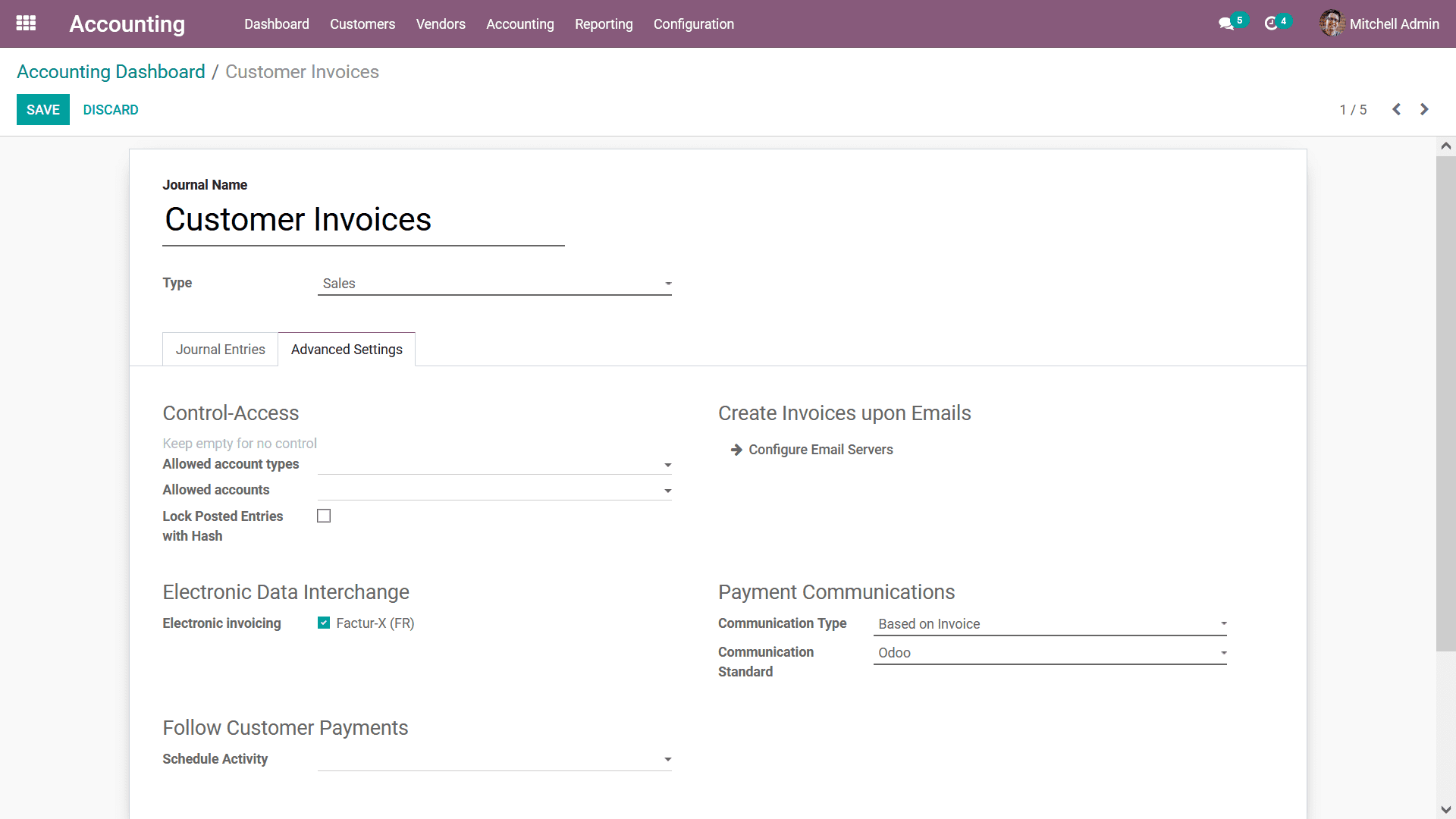

Additionally, the Advanced Settings concerning the defined Journal can also be configured

where the menu options such as Control Access details such as Allowed Account Types,

Allowed Accounts can be modified and you can enable or disable the Lock Posted Entries

with Hash. Moreover, the Configure Email Servers option will help you to modify

the Email Servers from which the Accounting emails will be received. The Electronic

Data Interchange option the Electronic Invoicing by Factor-X(FR) can be enabled

or disabled for the respective Journal.

Furthermore, the Payment Communications options can be modified such as the Communication

Type, as well as the Communication Standard options. In order to Follow Customer

Payment, the Scheduled activity can be defined based on the follow-up activity and

can be modified based on the need.

How Opening Balance is added?

The Opening Balance for the company operations should be added to illustrate the

funds that are available in the respective accounts of operations. The aspects of

Opening Balance will provide an insight into the funds that are available in the

company operating at the initial stages of functioning of the company. Let's now

move on to understand the steps by which the Opening Balance for the company can

be defined in Odoo:

Step 1: Opening balance can be added by mentioning the debit or

credit amount in respective ledgers.

Step 2: While saving a draft, Journal Entry is created in the Accounting

menu > Journal Entries with reference as 'Opening Journal Entry'.

Step 3: If any account is missed, they can be added by editing

a draft Journal Entry.

Step 4: The difference between Credit & Debit value is automatically

taken to '999999 Undistributed Profits/Losses Account which is provided by Odoo

for automatic balancing.

Step 5: Further, Edit the accounting date on which the Opening

Balance to be affected in Account Ledgers are defined.

Step 6: Once it is posted the Balance Sheet is updated with those

values.

Step 7: f we want to add a certain Credit/Debit amount to some

Account Ledgers that have been missed while entering the Opening Journal. They can

be added further by manual Journal Entry.

The thing that has to be noted is that while posting, add the correct Accounting

Date, it should be the same on which the entry is recorded in the balance sheet.

The Odoo Accounting module Dashboard is advanced and provides you a clear picture

of the operations that were ongoing in regards to the accounting management of the

company. As you have a complete understanding of it lets now move on to the next

section where the customer finance management aspect is being described concerning

the Odoo Accounting module.