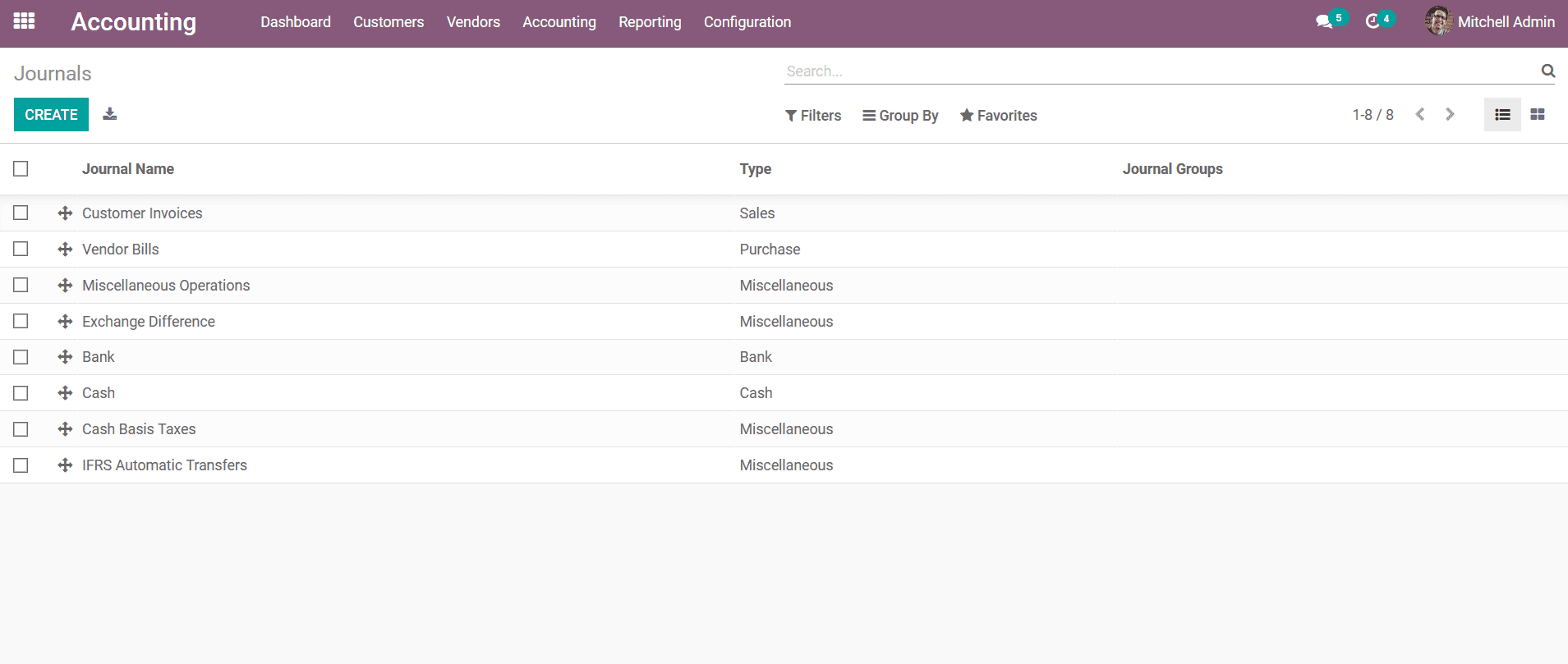

Defining Journals

Journals are one of the vital aspects of accounting operations in any company as

they will define the distinctive operations as categorizing and the financial operation

is based on it. Every business all around the world will maintain a journal entry

of the financial operations conducted both credits as well as density which will

be done in favor of the company. Moreover, the Journals are defined based on the

operations of the business and a Journal record is maintained to define the operations

in it which in earlier days were one in pen and paper and has been digitized now

with the impact of digitalization. The Odoo Accounting module supports the aspects

of creation and management of Custom Journals as per the need with the help of a

dedicated Journal management menu where all the Journals are defined as depicted

in the following image. Here, the Journal Name, Journal Type, and the Journal Group

of the respective Journals are being defined. You will also have Filters, Group

By, and Favorites options available helping you to retrieve the required journal

from the long list of Journals that are being described. Moreover, in Odoo you can

define the Journal Types based on the default ones which have been defined in the

platform, and in Odoo it’s a must that you choose a Journal type for a respective

Journal which is being defined. Here, you can select a Journal as one of the following

types: Sales, Purchase, Cash, Bank, and Miscellaneous. The Sales Journal is used

to define all the Sales operations entries of an organization likewise the Purchase

journal defines all the purchase operations of the company. Similarly, the Cash

Journal will define all the cash operations entries with respect to the functioning

of the company. Moreover, the same is in the case of Bank Journal where all the

Bank based transactions are being entered.

However, in the case of the Miscellaneous Journal, all the entries which do not

fall into the other journal are being defined over here. The Journal entries such

as Inventory Adjustment, Exchange Record, Salary Slip details, and many more.

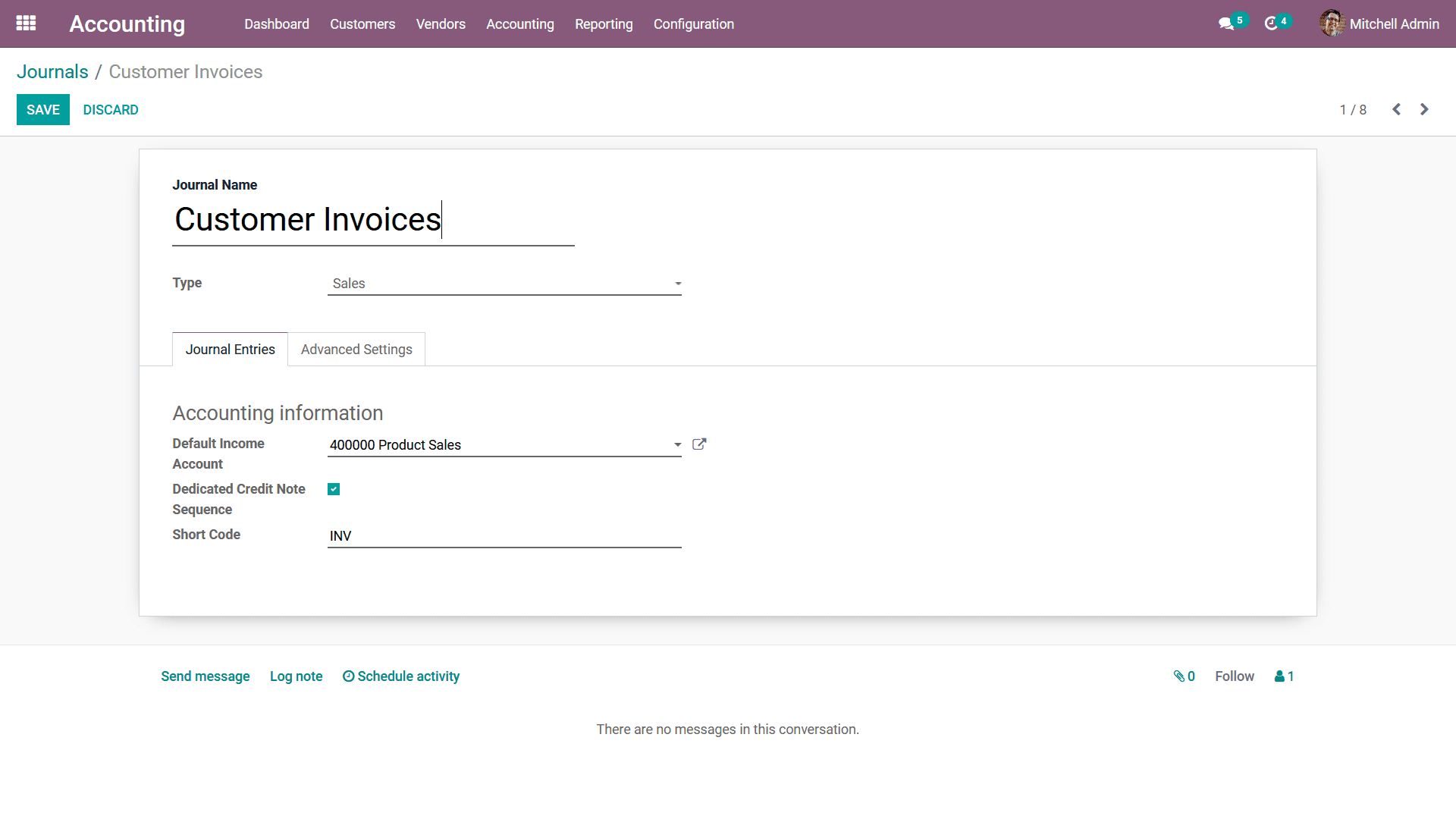

You can create a new Journal by selecting the Create option available which will

direct you towards the window as depicted in the following screenshot. Here, the

Journal Name, and Type can be defined. Under the Journal Entries menu, the Accounting

Information such as the Default Income Account as well as the Short Code can be

defined by creating new or selecting it from the drop-down menu available. Moreover,

you can enable or disable the Dedicated Credit Note Sequence which will configure

whether the Invoices, as well as the Credit notes which are being described in the

operations, require the same sequence on the number or not. The Short Code for the

journal entries can be defined here which will ensure that the invoice and the credit

note entries start with the respective code provided. Here the Short Code is described

as INV and then when the invoices are generated it will start with the term INV

and further with the sequence number. Additionally, there is an option to Send Messages

as well as describe a Log Note to the followers of the respective Journal. These

followers are the other users of your Odoo platform who are the employees working

in your company. The Log Note will help to register the changes done by the employees

and describe it along with the date and time.

Furthermore, you can schedule an activity with the followers or an external person,

or a party to discuss the various aspects of the respective Journal. The scheduling

can be done with the help of a calendar helping you to schedule the activities which

do not coincide with other activities and company operations with the same date

and time. In addition, there is an Advanced Settings menu available in the Journal

description menu.

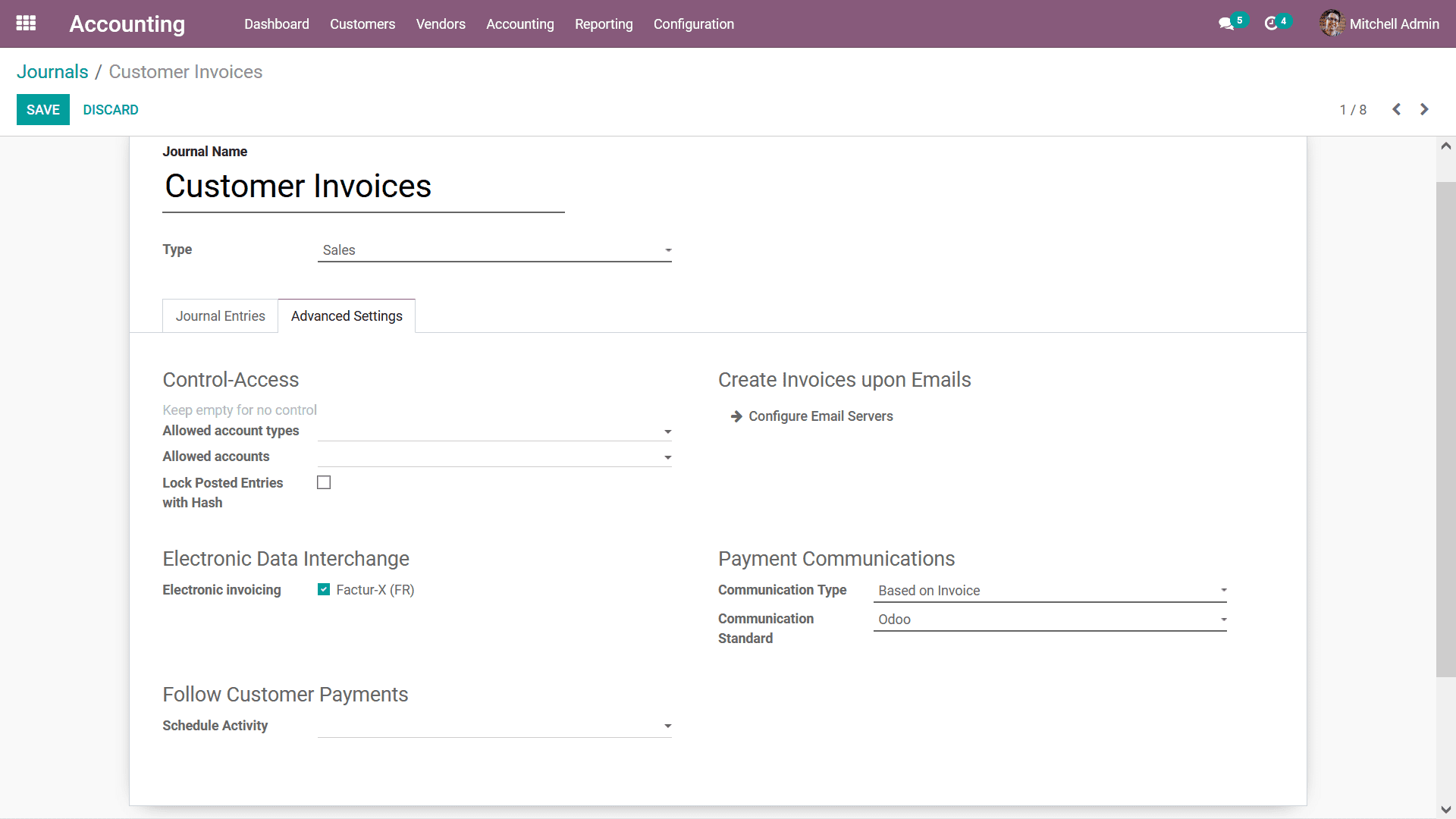

Under the Advanced Settings the Control Access details such as the Allowed Account

Types, and the Allowed Accounts can be defined or can be selected from the drop-down

menu. You can also enable the option Lock Posted Entries with Hash helping you to

lock the entries to the respective Journal with a hashtag to it. This will ensure

that an Invoice created under the respective Journal cannot be Reset to Draft or

modified in any form once it's posted. You can also configure the option Create

Invoices upon Emails where you have the directly to the menu where you can Configure

Email Servers which will ensure that once an email is being received under the respective

server domain an invoice will be created. Here the Customer invoices will be created

in the respective journal which is being defined which will be a helpful feature

for the business operations to implement the automated invoice generation upon the

order revival form the customers.

Additionally, the Electronic Data Interchange configuration of the Electronic Invoicing

the Factor-X(FR) can be enabled or disabled. Moreover, the Payment Communication

configuration option, the Communication Type, and the Communication Standard can

be defined. This will be helpful in the operations of the customer invoice payment

where a communication reference will be available. The same reference can be used

by the customer while generating the payment for the invoice. The Follow Customer

Payment option Schedule Activity can be defined by selecting the activity from the

drop-down menu.

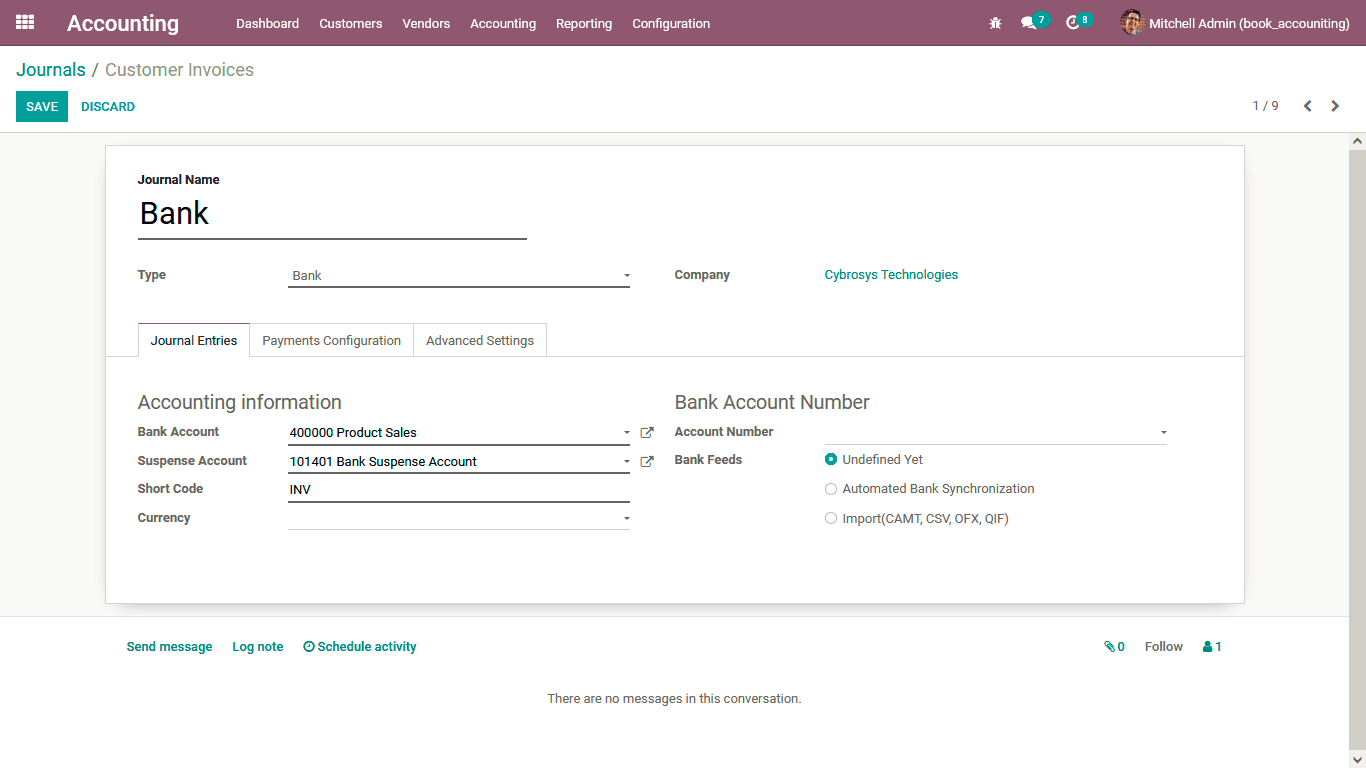

The Journal creation and configuration of the Sales, Purchase, and Miscellaneous

types of Journals are the same in Odoo. As we have described the operation of the

Sales Journal type, let's now move on to understand the configuration aspect of

the Bank Journal which is configured in a different way than the Sales, Purchase,

and Miscellaneous Journal types.

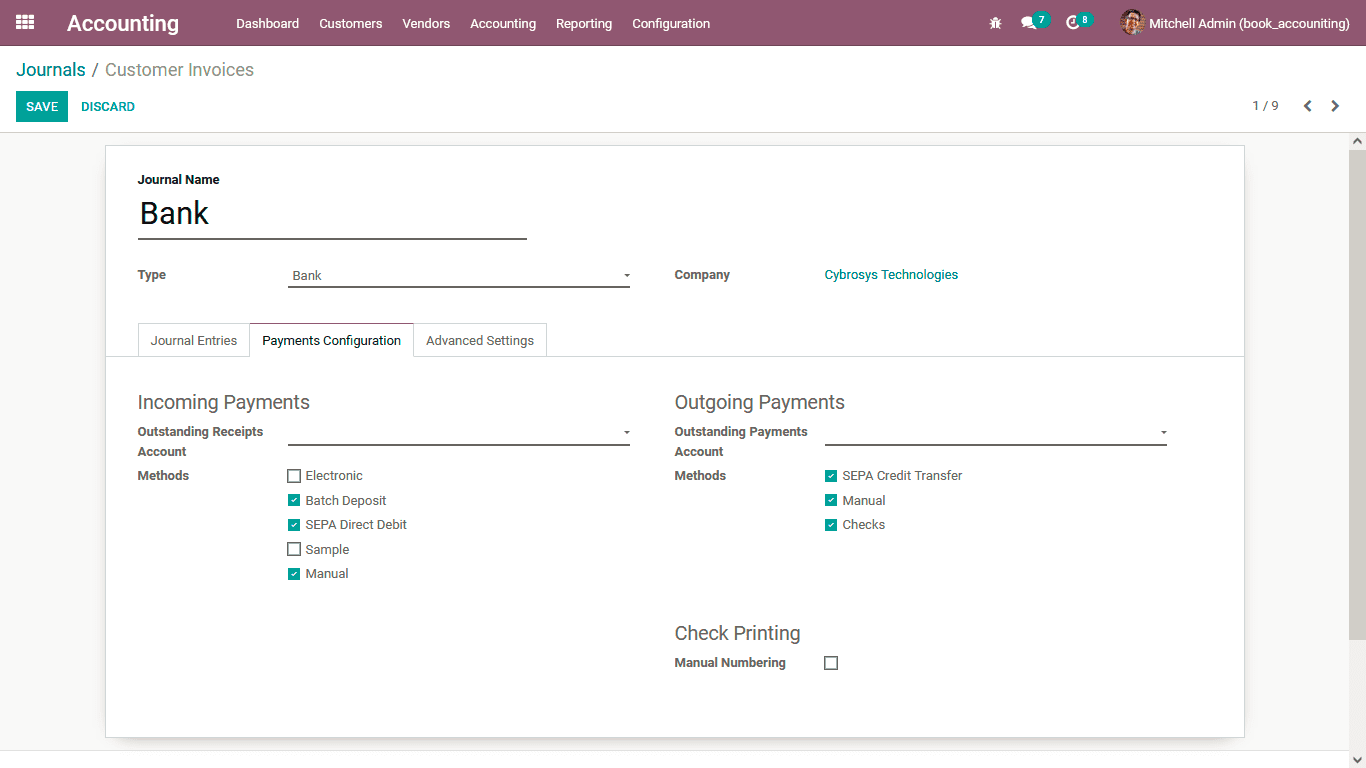

If the Journal Type is chosen as Bank you will need to define the Journal Entries

aspects such as the Accounting Information and the Bank Account Number details.

Under the Account Information the Bank Account, the Suspense Account, Shortcode,

and the Currency Details can be defined. The Suspense Account is used until the

Bank Account is reconciled to the payments, here the Suspense Account acts as a

temporary holding up until reconciliation of the bank statement transactions for

the respective journal operation. Further, under the Bank Account Number, the Account

Number and the Bank Feeds can be selected as Undefined Yet, Automated Bank Synchronization

or as Import (CAMT, CSV, OFZ, QIF) should be selected. Upon choosing the Import

option the details can be imported from the dashboard. Furthermore, if the Automated

Bank Synchronization is enabled the Odoo platform will fetch the Invoice payment

details directly from the bank servers, and in the dashboard, you will obtain the

review on the synchronized operations moreover, there will be an online synchronization

option available.

Furthermore, the Payment Configuration details such as the Incoming as well as the

Outgoing Payment details can be defined. Under the Incoming Payments, the Outstanding

Receipts Account can be chosen from the drop-down list. Furthermore, the Methods

such as Electronic, Batch Deposit, SEPA Direct Debit, Manual, and the ones which

have been defined can be enabled. Under the Outgoing Payments, the Outstanding Payment

Account can be selected from the drop-down menu. The Methods can be SEPA Credit

Transfer, Manual, or Checks. Moreover, the Check Printing option the Manual Numbering

can be enabled based on the need.

The operations of the Outstanding Account operations are as follows; once the customer

generates the payment for the invoice it would never directly be credited to the

bank account rather it will be defined in the Outstanding Receipts Account which

can be defined here. Once the Bank statement, as well as the payment, is being reconciled

either automatically or manually then only the payment will be credited to the Bank

account of the company. Similarly, in the case of purchase payment, the amount for

the vendor bill will be initially generated from the Accounts payable and will be

moved to the Outstanding Payments Account further then when the bank statement reconciliation

occurs with respect to the vendor bill bank will be credited. Further during Reconciliation,

the respective transaction will be Reconciled with the outstanding payment entries

instead of the Payable Account.

The Advanced settings configuration is similar to that of the Sales, Purchase, and

the Miscellaneous accounts, and the respective account operations details can be

configured for the Cash as well as Bank Journals based on the operational needs.

In this manner, you will be able to define and edit the Journals where the Journal

entries will be defined for the finance management operations. As we are clear on

the aspects of defining Journals and managing them, let's now move on to understanding

the Journal Groups which will help classify the Journals which are being defined

in the next section.

Group your journals

Classification is a vital aspect in the operations of a business where you can group

various aspects of the business operation, helping you to divide the entire operation

into miniature tasks. In the Odoo platform, you have defined multiple Journals for

the running of the finance operations of accounting in your company. There are chances

that you will mix up the Journals and their entries. Therefore, the Odoo platform

has a special feature to Group the Journals. This advanced feature will help in

the classification aspects of the journals that have been created.

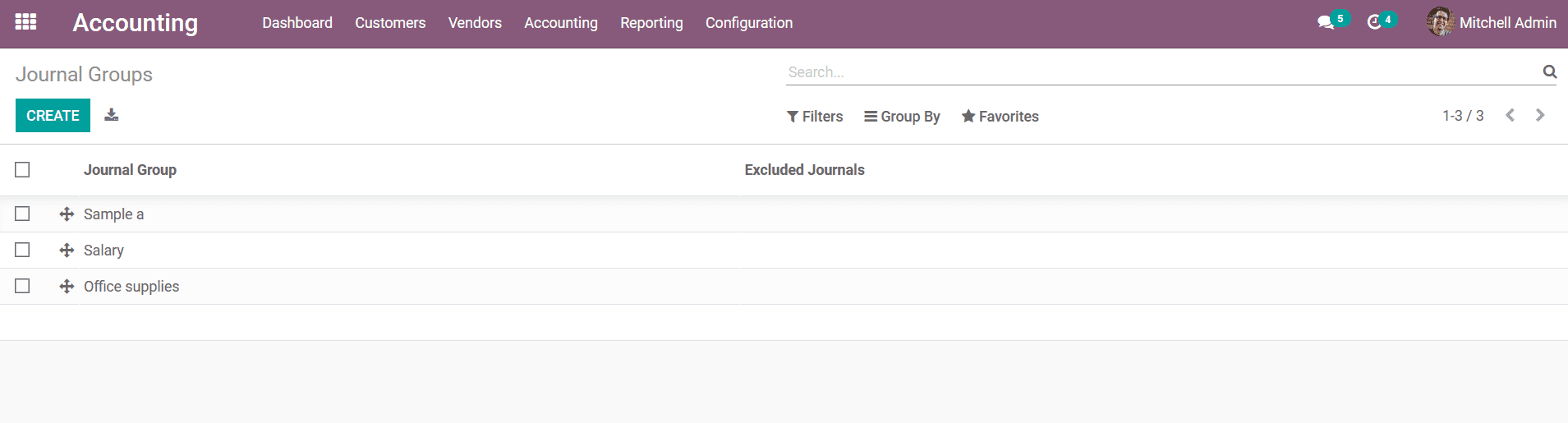

You can access the Journal Groups menu from the Configuration tab of the Accounting

module where all the Journal Groups that have been described will be depicted. You

can also create new Journal Groups by using the Create option available. Once you

select to create a new line will appear in the listed out menu and you can provide

the Journal Group name and allocate the Excluded Journals. In the menu, you will

also have default as well as customizable Group By and Filtering options helping

you to sort out the required Journal Groups.

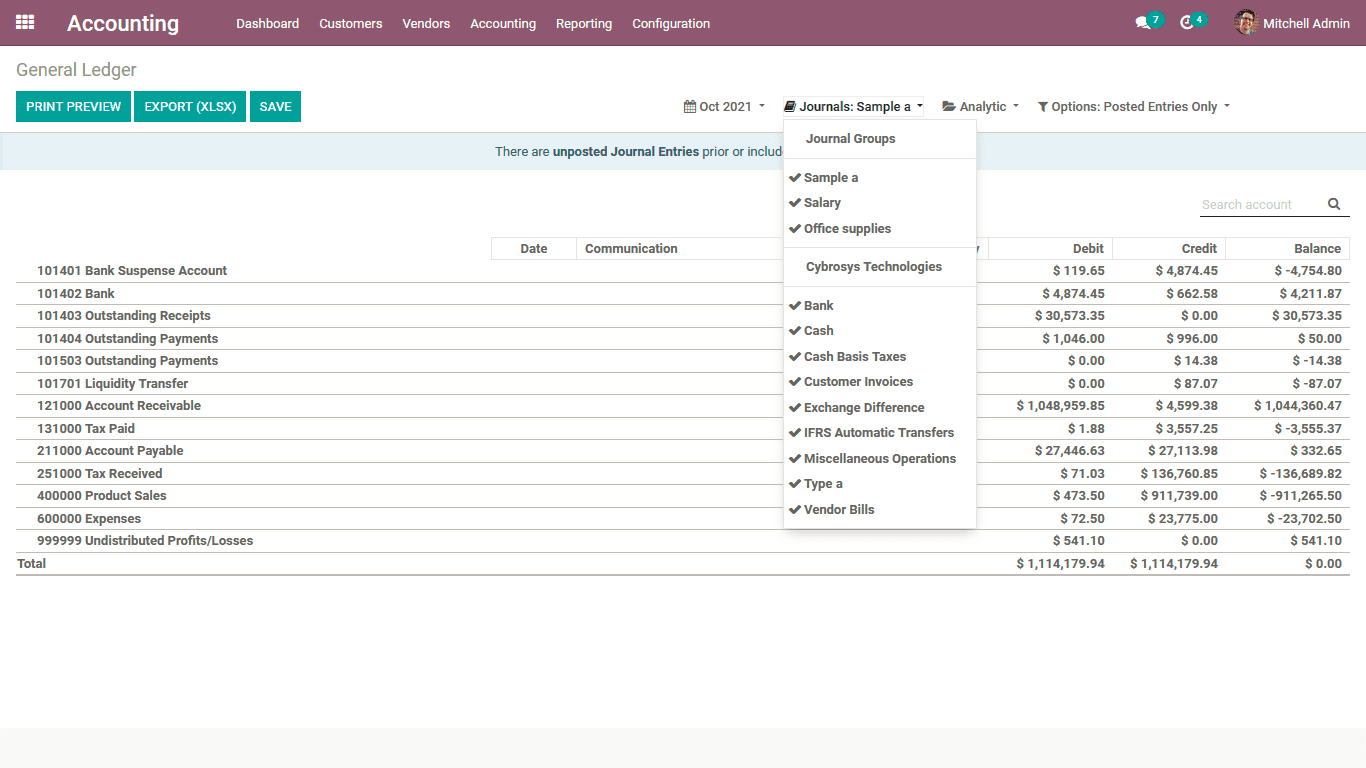

The Journal Grouping functionality that is available in the Odoo Accounting module

will be a useful feature helping you with the Filtering as well as Group by aspects

of the various operations of the Journal and its financial operations. In Odoo reporting

as well as report generation are some of the advanced features which the platform

puts forward. Moreover, in any of the Accounting based reporting functionality in

Odoo, you will obtain a filtering tool where the Journals Types can be used as a

filtering aspect helping with the effective operation.

The Chart of Account Types can be also be selected for the respective one while

defining it, this will be beneficial for the filtration aspects of the accounting

information with respect to the Chart of Account Types which are being defined.

The Journal Group functionality will help the finance department of your company

to run the Journal management operations with ease. As we are clear on the aspects

of Journal Groups let's now move on to understand the Currency Management aspects

of the Odoo Accounting module in the next section.