Deferred Revenue Models

The next type of Management tool that is available in the Odoo platforms is the

Deferred Revenue Models which will indicate the payments received by the company

at first before the products are even delivered or manufactured. The Deferred Revenue

is mainly associated with the Subscription-based products of the company where the

subscription amount is paid in advance before the products are completely delivered

for a month or year of the fixed period. For example, the Subscription charge for

a Magazine or newspaper is provided in advance for the month and the payments made

in such a manner will fall under the Deferred Revenue.

Odoo Accounting has a separate window to define the Deferred Revenues of the company

and the Deferred Revenue Models under the configuration tab. The operational account

type of the Deferred Accounts will be of Current Liability. In the operations of

the business the company will be rendering service to the customer and the payment

will be received for the service which is not being provided and the payment has

been received in advance then the Deferred Revenue will fall under a liability for

the company in Odoo. Furthermore, when the services are being rendered during each

year to the customers for the advanced payment they the lability is reduced until

the next advance is received. All the service rendering as pecs as well as the reduction

of the liabilities of the Deferred Revenue will be clearly recorded in the Balance

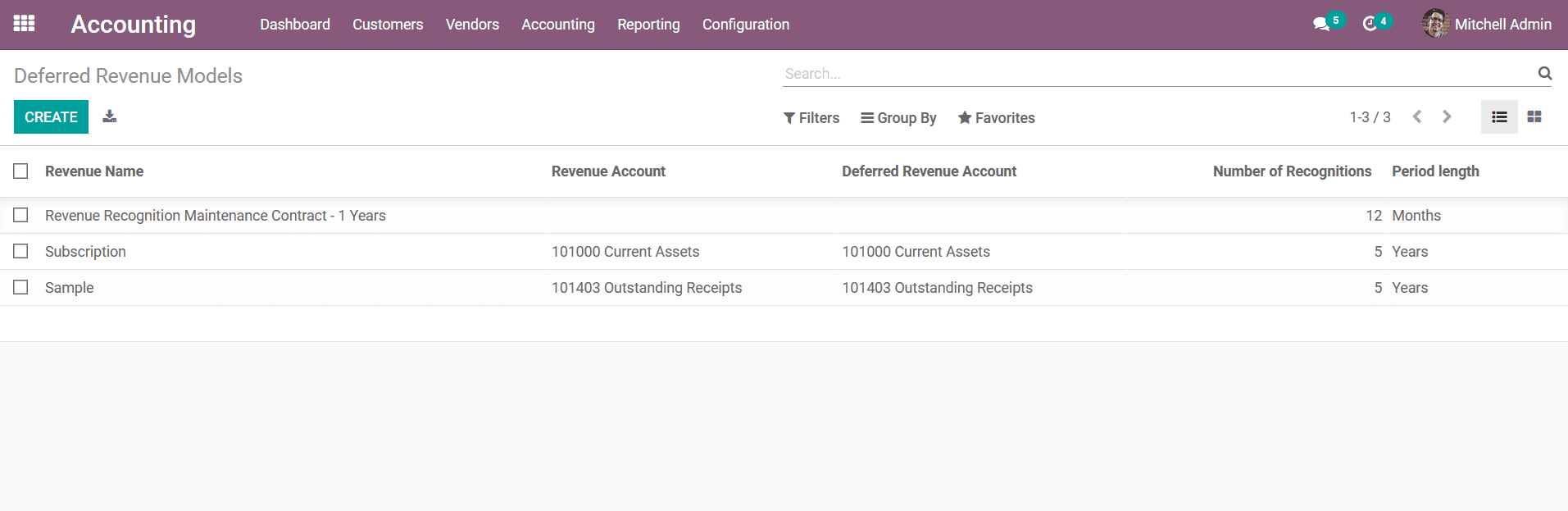

Sheet of the platform. Here all the Deferred Revenue Models will be depicted just

as shown in the following screenshot. Here the Revenue Name, Revenue Account, Deferred

Revenue Account, Number of Recognitions, and Period length will be described. As

in all other menus of the Odoo platform, there are also filtering as well as Group

by options available helping you to sort out the required Deferred Revenue Models.

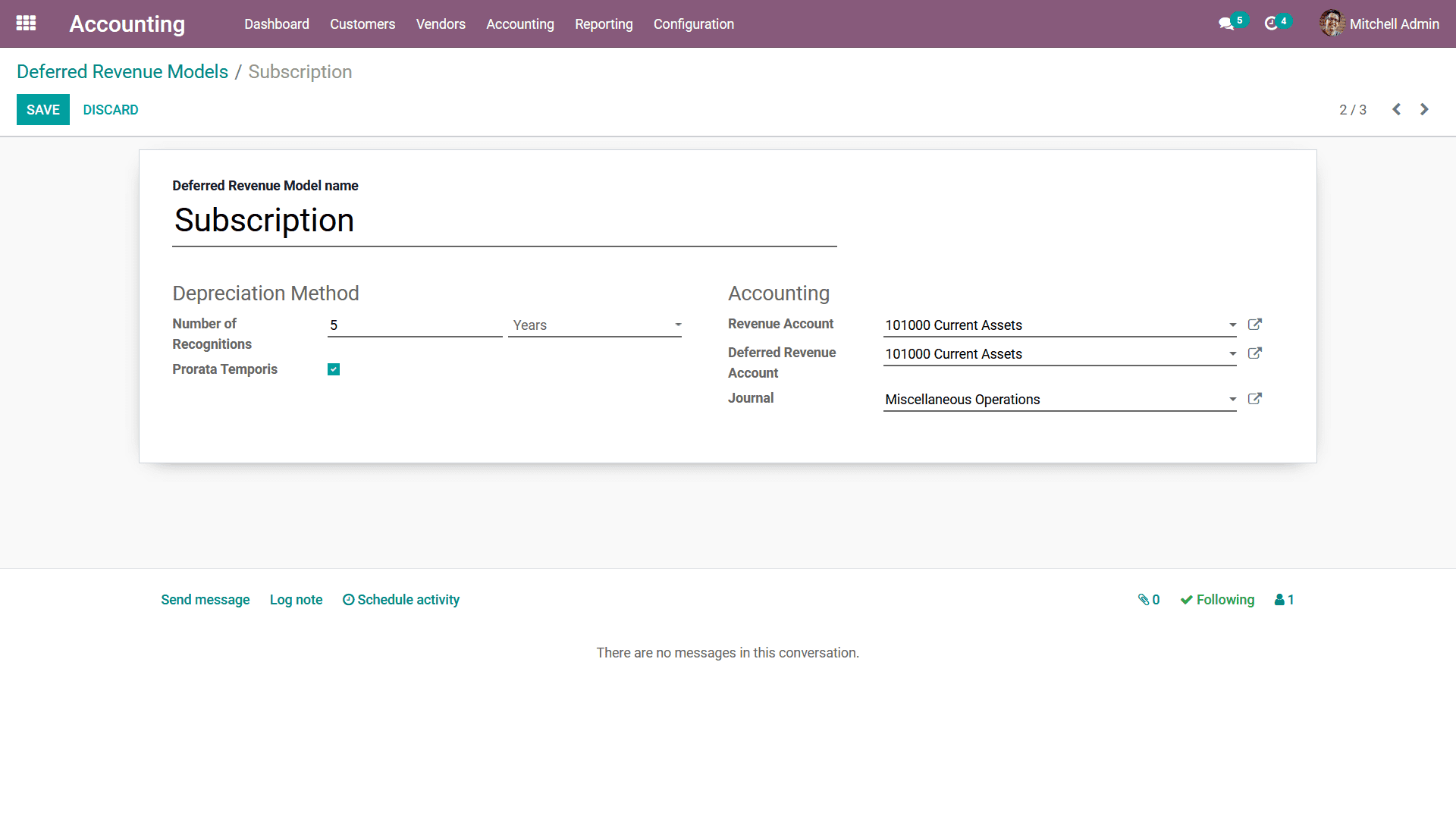

You can create a new Deferred Revenue Model by selecting the Create option available

which will depict you with the window as depicted in the following screenshot. Here

the Name of the Deferred Revenue Model should be initially provided. Furthermore,

the Depreciation Method options such as the Number of Recognitions in terms of Months

or Years should be provided. If you want the Depreciation to start from the day,

the Deferred Revenue Model is being defined you can enable the Prorata Temporis

option available.

Furthermore, there are also Accounting configuration options available under the

Deferred Revenue Models where the Revenue Account, Deferred Revenue Account, and

the Journal can be selected from the drop-down menu options available. There are

also configuration options to add Followers to the respective Deferred Revenue Model

and the number of followers will be depicted. Additionally, you can add an attachment

to the model by selecting the attachment option available. In addition, you can

also Schedule activities using the help of a calendar and send messages to the followers

using the Send message option available.

All the Log entries on the respective Deferred Revenue Model will be depicted in

the menu and there is provision to add a Log note. As we are clear on the Deferred

Revenue Models management menu of the Odoo Accounting let's now move on to the next

section where the Products categories option is being defined.