Deferred Expense Models

Another management tool in the Odoo Accounting module is the Deferred Expense Models

which describe the expense aspects of the subscription-based products. As defined

in the section of Deferred Revenue Models where the Deferred Revenue is connected

with the aspects of the payment generated by the customers ahead of the product

being delivered, which is mostly associated with the subscription-based products

that are being defined. Here the Different Expenses will describe the expenses on

the subscription-based products and services which are purchased for the various

vendors.

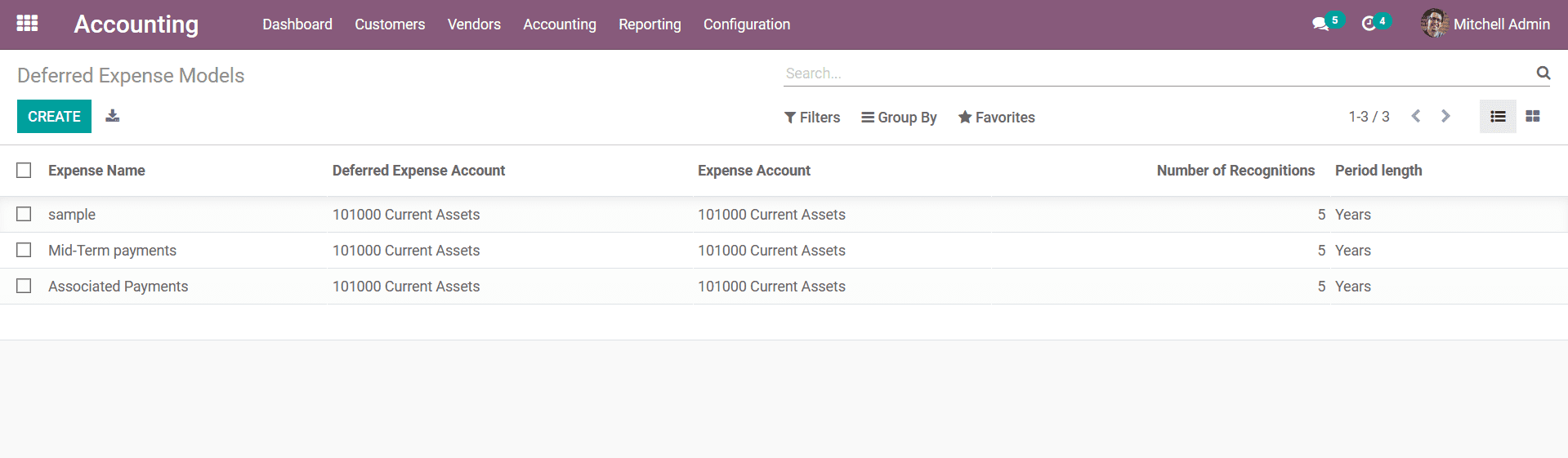

The dedicated Deferred Expense Model menu can be accessed from the Configuration

tab of the Accounting module where all the Deferred Expense Models are being defined.

The Account Type of Deferred Expense Account will be current assets. Even though

the company paid the amount for some services and for the ones which are not obtained

and basically the paid amount creates expense. But as the payment is done for service

and certain of them are yet to be delivered so in that case that deferred expense

will be an asset for the company. And each year the asset will be reduced as the

service is received. This will be recorded in the Asset section of the Balance Sheet.

Here the Expense Name, Deferred Expense Account, Expense Account, the Number of

Recognitions, and Period Length will be defined. You will also have the custom as

well as default filtering and group by tools available.

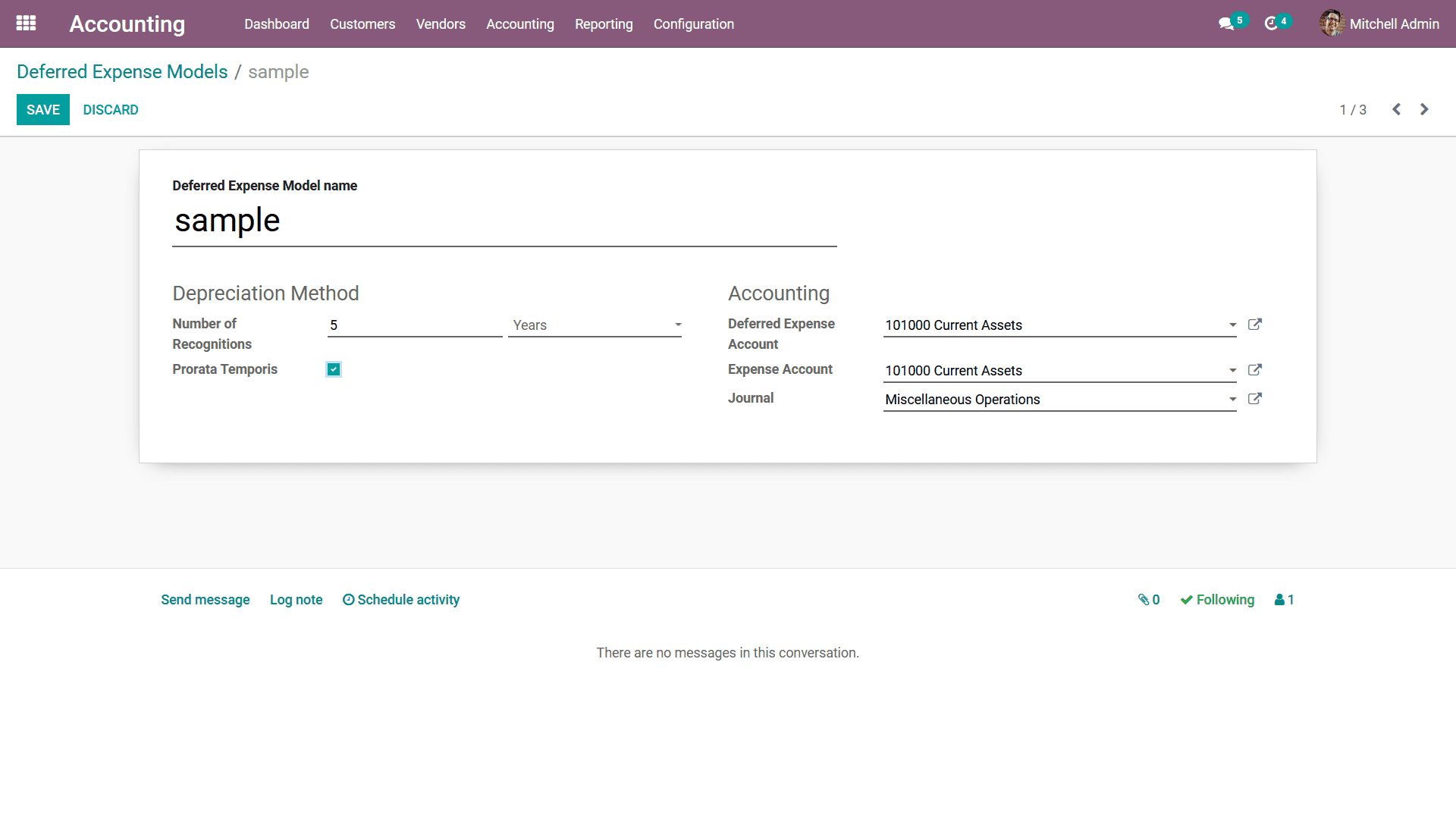

To create a new Deferred Expense Model, you can select the Create button which will

take you to the Deferred Expense Model creation window as depicted in the following

screenshot. In the creation window, the model Name can be provided and under the

Depreciation Method tab, the Number of Recognitions in years or months can be described.

Upon enabling the Prorata Temporis the Depreciation will start from the day the

Deferred Expense Model is being defined. The Accounting details of the Deferred

Expense Model such as the Deferred Expense Account, the Expense Account as well

as the Journal can be described.

The number of followers of the Deferred Expense Model will be described in the creation

window and you can add followers as well as attachments to the documents related

to it. In case you want to schedule an activity with the followers of the respective

Deferred Expense Model which can be based on a calendar that is being defined. There

is a provision to Send messages and define the Log note for the Deferred Expense

Model furthermore, all the Log entries concerning the model will be depicted over

here. As we are clear on the Deferred Expense Models of the Odoo Accounting module

let's now move on to the next section where the Cash Roundings configurations are

described.