Configuring Taxes

Taxes are the liability which a customer should pay to the vendor or the service

provider for the sales that they have conducted, the companies are liable to pay

the same amount to the authorities or the government at the time of tax filings

which happened in specified intervals. Almost all countries operate with a different

form of tax and different percentages which are based on the local governing authorities.

Therefore, an accounting management system should be able to configure custom taxes

for operations which can be done in the Odoo Accounting module.

You can define any form of taxes for sales, purchases, and the services provided

which will be based on the country in which the business operates. This is one of

the localization tools of the Odoo platform which is one of the best features of

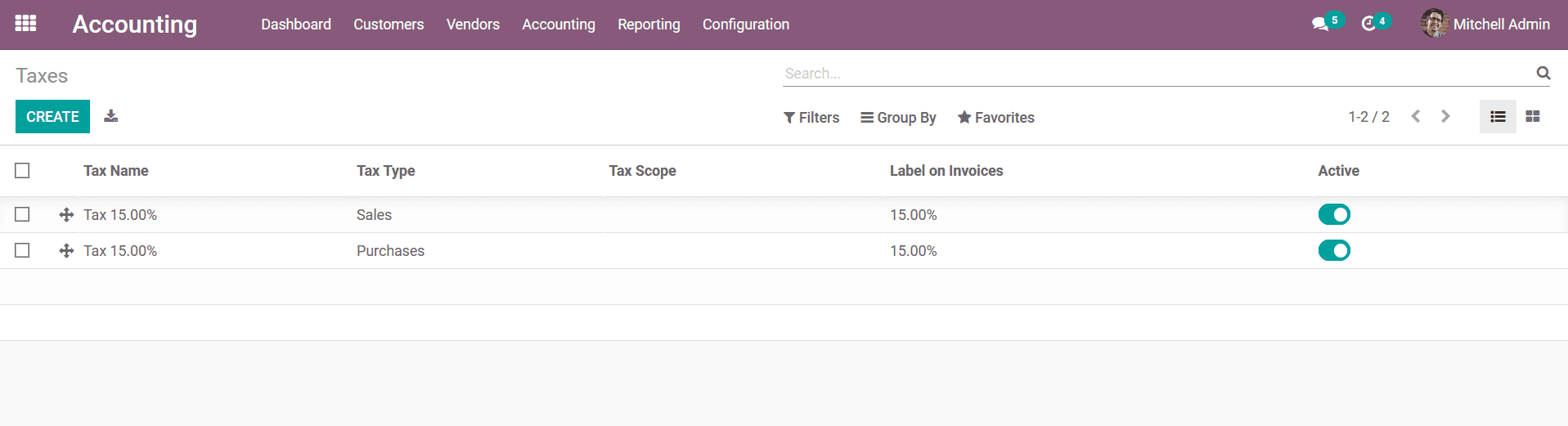

Odoo. You can configure the Taxes for your business operations in the Taxes menu

which is available under the Configuration tab. The following screenshot depicts

the Taxes window where all the Taxes of operations in the company will be defined.

Here, the Tax Name, Tax Type, Tax Scope, and Label of invoices will be defined.

Furthermore, there is an option to Activate and Deactivate the respective tax with

the help of a slider.

With Odoo you can define a Tax computation for the respective taxes which are being

defined. Moreover, the Odoo platform puts forward default Tax Computation such as

Group of Taxes, Fixed, Percentage of Price, and Percentage of Price Tax Included.

The Fixed Tax Computation will be based on the one which is pre-defined. Further,

the Percentage of Price Tax Computation will be based on the fixed percentage which

is set. In the case of Percentage of Price Tax Included the Tax Amount will be included

in the prize amount.

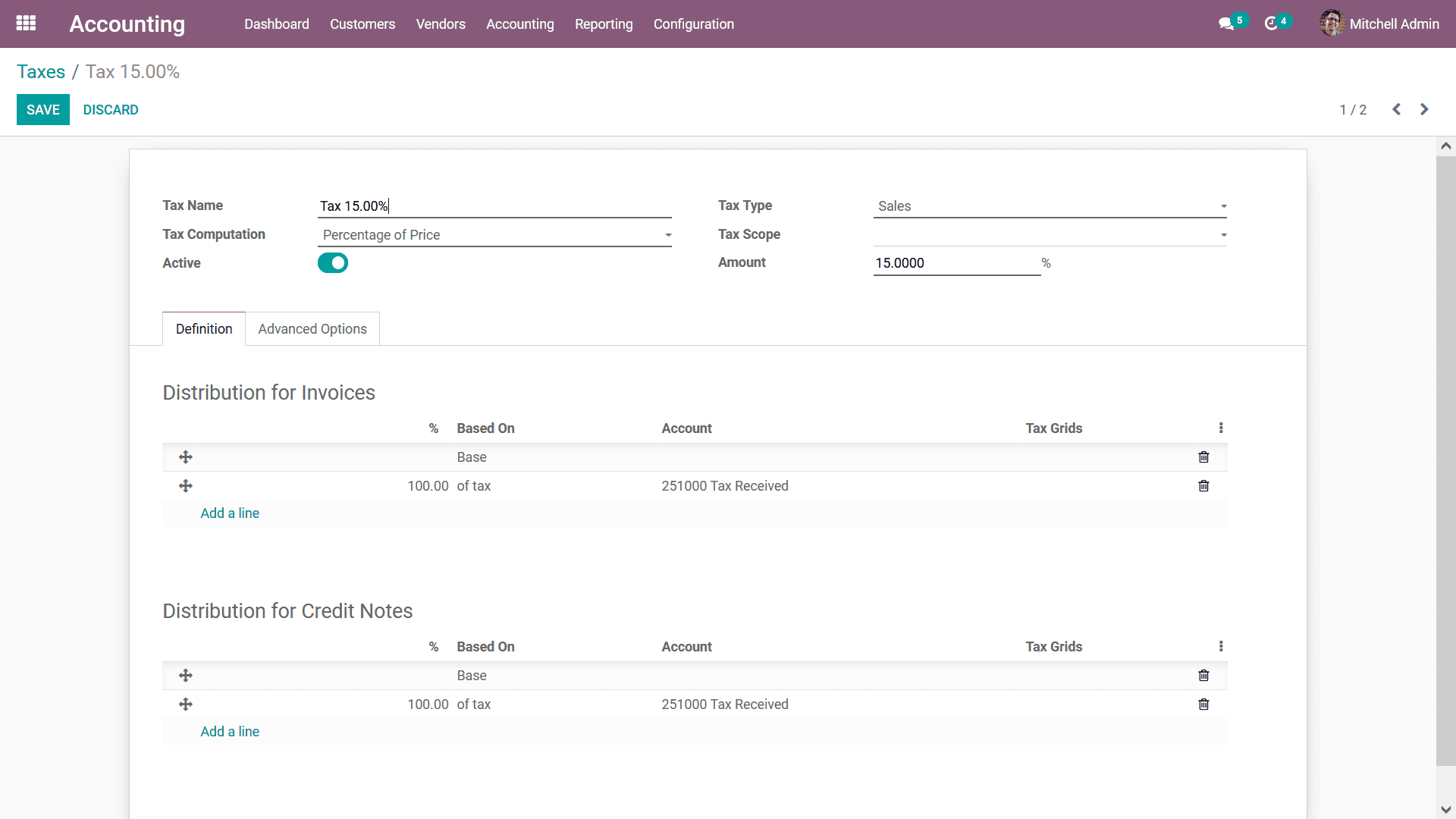

You have the provision to Edit the existing taxes as well as create new ones using

the Create options available. In the Creation or editing window just as depicted

in the following screenshot you will have to provide the Tax Name, Tax Type, Tax

Computation, Tax Scope, Amount in percentage as well as the status of its being

Active or Inactive. Furthermore, the Definition of the tax on the various aspects

of the business operations should also be defined Initially the Distribution of

Invoices should be defined where the Tax definition, Percentage of which it’s Based

On, Account and Tax Grids should be defined. You also have the provision to delete

the existing definition and can add a new one using the Add a line option available.

The same can be done in the Distribution of Credit notes of the Taxes based on the

operational requirement.

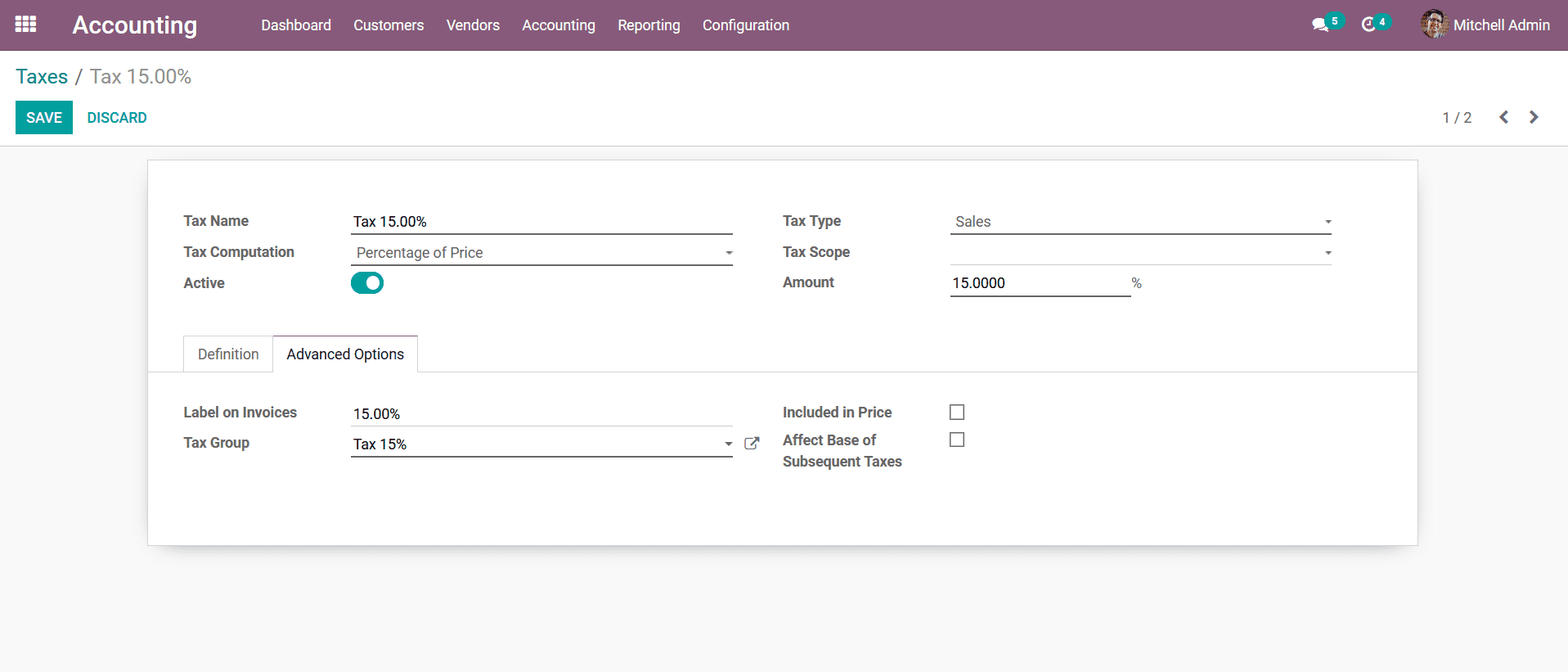

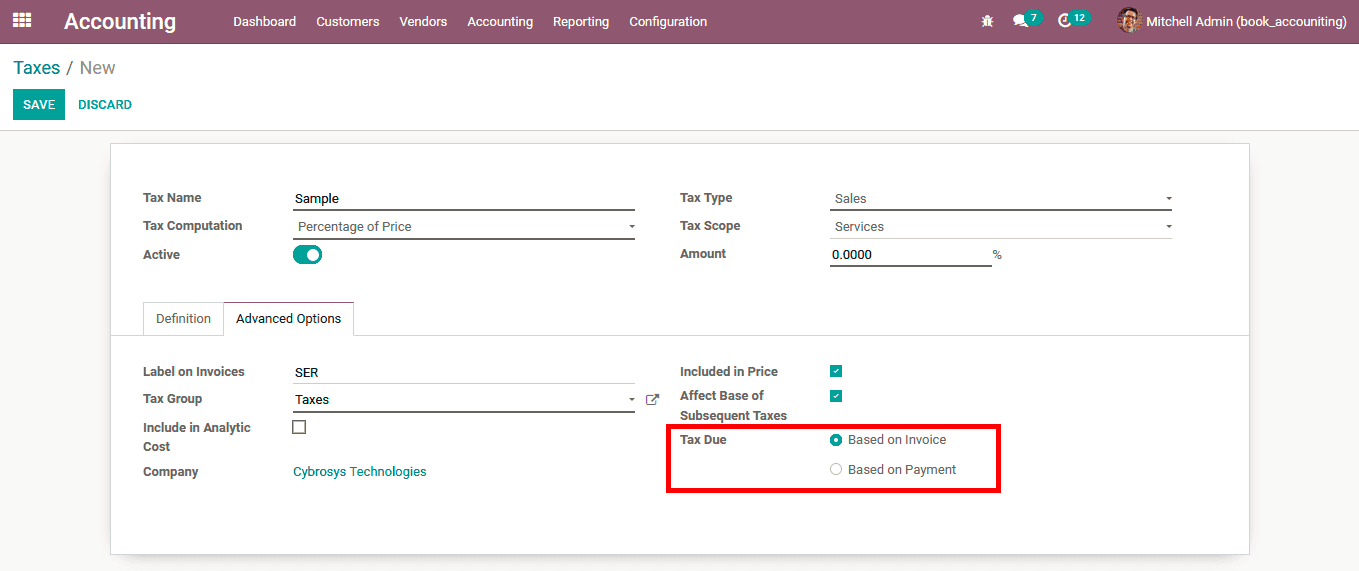

Furthermore, there are other Advanced Options available in the configuration window

such as the Label on Invoices and the Tax group of the defined tax. You also can

configure the Tax to be Included in Price and Affect Base of Subsequent Taxes upon

enabling and disabling the respective option. Once the configuration is all done

you should save the page for it to be operational. The Configuration window of the

taxes for the Advanced Options is depicted in the following screenshot.

These are all the aspects regarding the Tax Configuration, once they are being configured

you will be able to use them in the operations of the various aspects of your business.

All the sales tax as well as the purchase taxes along with other service taxes can

be defined here which will apply to all the products as well as services unless

a distinctive tax of operations is defined under the respective product or service.

Cash Basis Tax Configuration

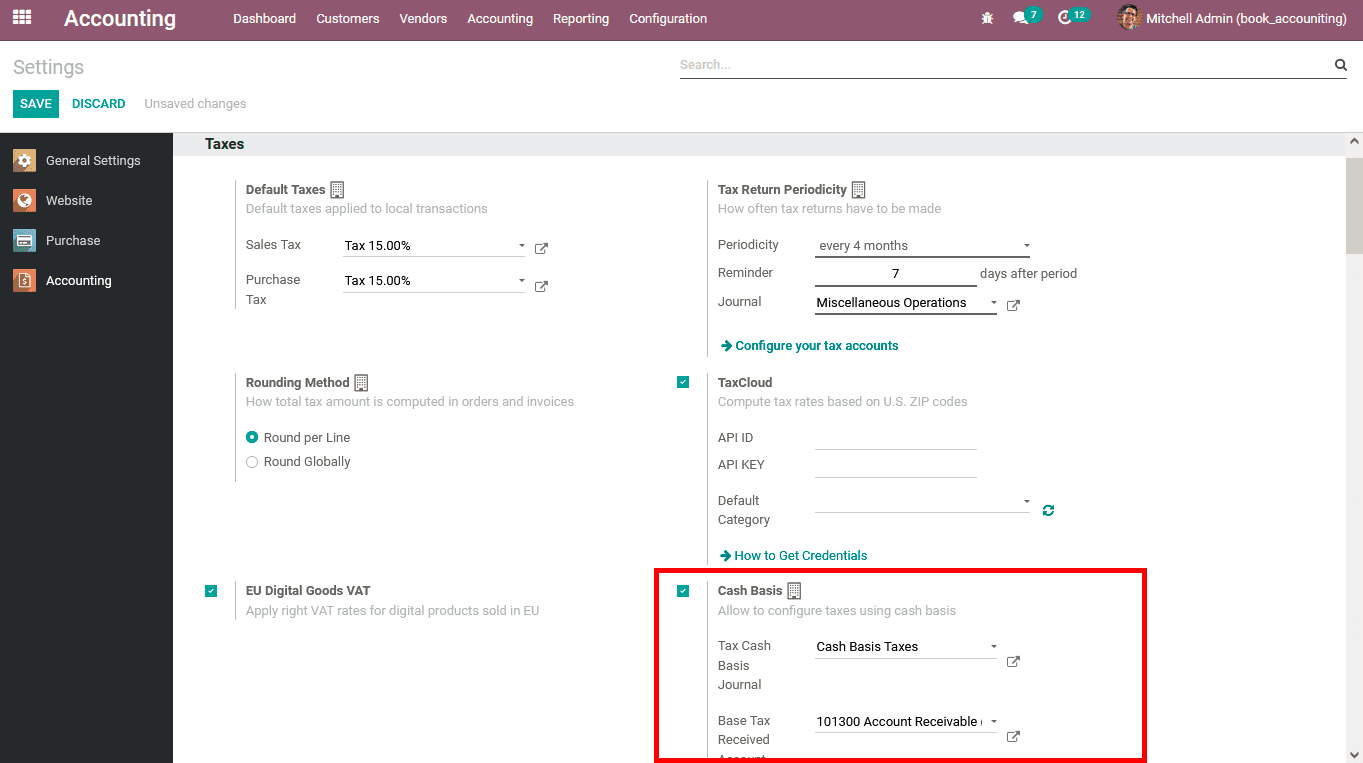

The Cash Basis Tax configuration is another aspect while functioning with cash operations

in a company. The operations of Cash Basis in Odoo are configured in the way that

they are due when the payment is done and not at the time of the product or service

delivery and the validations of the invoice. For the Cash Basis Taxation to be functioning

in Odoo you need to initially enable the Cash Basis option that is available in

the Settings menu of the Odoo Accounting module under the Taxes tab. Here the Tax

Cash Basis Journal and the Base Tax Received Account should be defined.

Further when you configure your Taxes in the Taxes window under the Advanced Options

tab the Tax Due can be defined as either Based on Invoice or as Based on Payment.

This will provide an extra nudge with the Tax configuration and management of the

financial aspects of the company abiding by the rules of the State of the region

of their operation.

Once the Cash Basis Tax is configured initially the tax on the product or the service

will be credited to the Temporary Tax Account and upon reconciliation, the respective

amount will be credited to the Tax Received Account. As we are clear on the aspects

of the configuration of taxes let's now move on to understand the aspect of Defining

Journals in the next section.