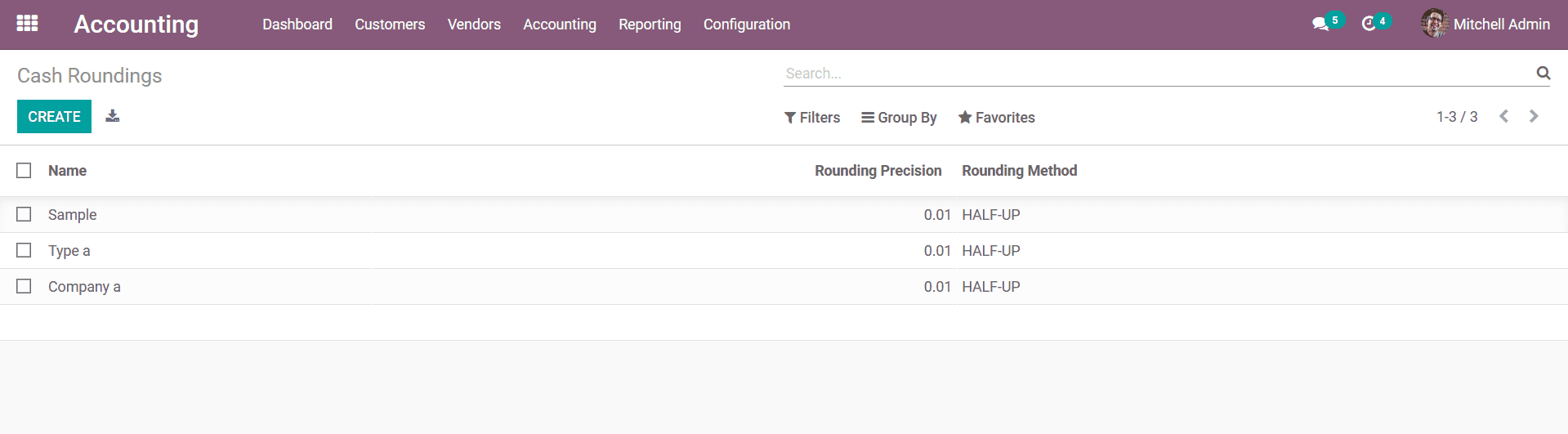

Cash Roundings

In the live environment, the chances of the customer bringing the right amount of

change for the purchase of the products will be the same in the case of the cashier

or the sales counter of the company as they will not be having the right amount

of change to give back to the customer. This is wherein a real-life scenario where

the cash rounding comes into place where the sales invoice amount is done to the

closest common number. The Odoo platform supports this by bringing a systematic

approach to cash routing operations. The Odoo platforms Accounting module has a

Cash Roundings menu available under the Configuration tab of the Accounting module

where the different Cash Rounding operations can be defined. Here, in the menu,

the Cash Roundings Name, Rounding Precision and the Rounding Method will be described.

You will also have Filtering and Group By options available helping you to sort

out and obtain the right Cash Roundings that you have looking for in the menu.

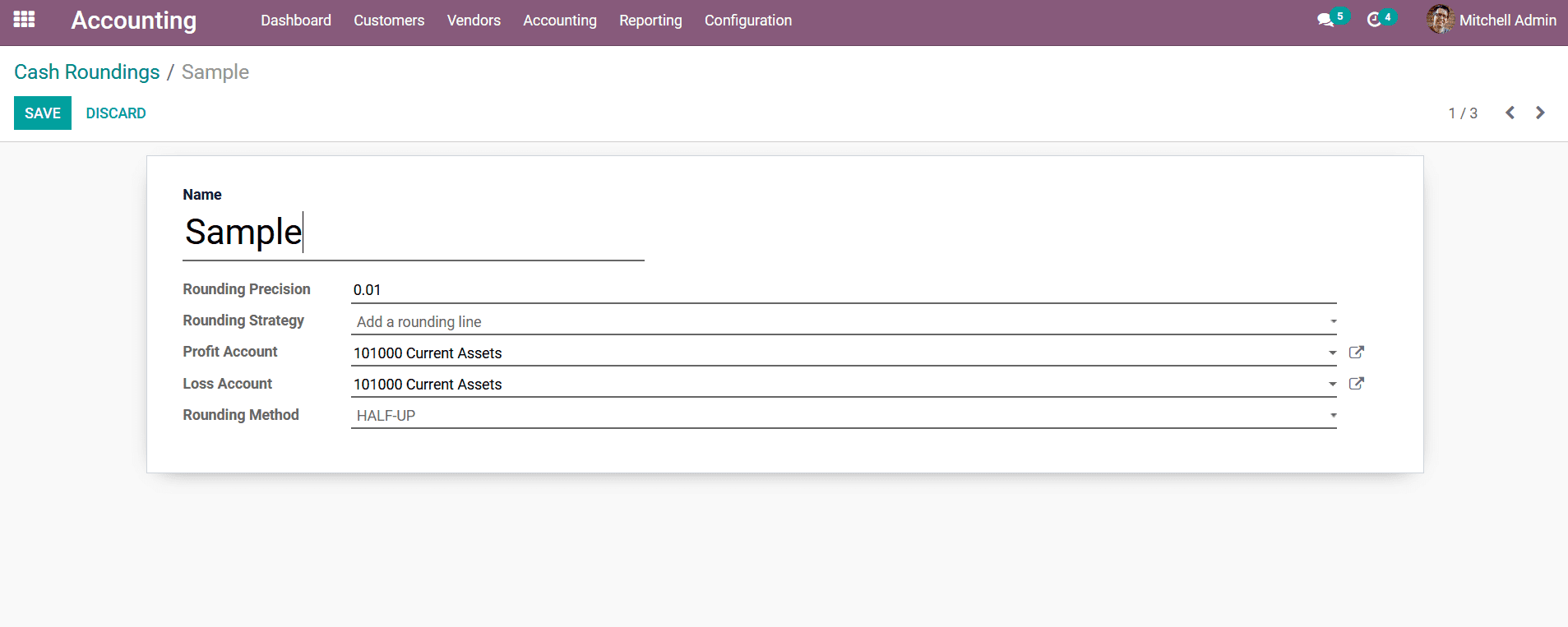

You can edit the Cash Roundings defined by selecting the respective Cash Roundings

that have been defined. To create a new Cash Roundings you can select the Create

Option available which will direct you to the following window where you can define

the Cash Roundings. Initially provide the Name, then provide the Rounding Precision,

select the Rounding Strategy, assign Profit Account, Define Loss Account and select

the Rounding Method from the drop-down menu available.

In Odoo there are three cash rounding methods that can be defined:

- UP: value rounds to plus infinity.

- DOWN: value rounds to lower infinity.

- HALF-UP: If the decimal value is greater than 0.5 it will round up and if the decimal

value is less than 0.5 it will round down.

The Rounding strategy can be round online or on modifying the tax amount. If the

rounding strategy is selected as Add a rounding line and if this rounding is applied

on an order, the rounding will add in a new product line whose value is added with

the subtotal to get the rounded value.

Moreover, we also have to mention the Profit Account and Loss Account in the cash

rounding. So after rounding if the total rounded value tends to a higher infinity

which creates a profit that will be recorded in the Profit Account. If the total

round value tends to a lower infinity which creates a loss that will be recorded

in the Loss Account.

If the rounding strategy is set as Modify tax amount, then the rounding tends to

adjust the tax amount to round the total. Moreover, the Rounding precision influences

the rounding of the computed value.

Once the Cash Rounding is being defined you can save it and will be depicted in

the menu. You also have the provisions to edit the Cash Rounding configuration that

you have defined anytime that you want. As we are clear on the aspects of Cash Rounding

configuration let's now move on to the next section where the Budgetary positions

are being described.