The Odoo Accounting module is the complete finance and accounting management tool

for any form of business operations equipped with advanced features and operational

capabilities. In the previous chapter, we were discussing the options and tools

available in the Settings menu of the Accounting module. As we are clear on that,

let's now move on to understand the configuration tools as well as the menus available

in the Accounting module in this chapter.

In this chapter, we will be covering the configurational tools available in the

Odoo accounting module such as:

- Accounting configurations

- Payment Options

- Asset Models

- Analytical Accounting

- Configuring Invoicing

- Configuring bank Payments

Each of the options available under these configuration tools will be described

and discussed in detail.

Accounting configurations

The Accounting configuration holds the primary priority of configuration which needs

to be set up before running the financial management operations of the company.

This is because once the aspects of accounting configurations are set up changing

them will be entirely difficult thus affecting the overall operation of the company.

Two of the primary aspects that need to be configured under this tab will be the

Chart of Accounts and Taxes which should be configured at the initial stage of the

business operations to be operational. Let's have an understanding of the configurational

aspects of Accounting one by one in the following sections

Creating Chart of Accounts

The Chart of Accounts is one of the most important parts of financial management

operations in a company, it is considered as the index of all the financial operations

in a company with a complete insight on the general ledger of the company being

defined. Moreover, it will provide the complete and clear cut information of the

financial operations being conducted in terms of the company during a financial

term and well classified based on the categories and ease of recording. In further

terms, it can be said as a bookkeeping tool for the financial operations usable

by accountants, managers as well as the concerned executives of a company as they

can get a full picture of every accounting operation that is being conducted.

Odoo supports double-entry bookkeeping, always ensuring that the records of your

financial operations stay well defined and recorded for future use. One of the initial

aspects of starting your financial management with the Odoo Accounting module is

that you should configure the Chart of Accounts because all the further operations

are defined based on it. You can create custom charts of accounts as per your operational

need helping you to have full control of the management of the financial operations.

You can create a custom Chart of Accounts in the Chart of Accounts menu available

under the Configuration tab of the Accounting module. Here all the Chart of Accounts

derived from the platform will be depicted. Moreover, if you need to obtain a specific

Chart of Account you can use the search bar. Furthermore, there are Filtering as

well as Group By options available in the menu helping you to obtain the desired

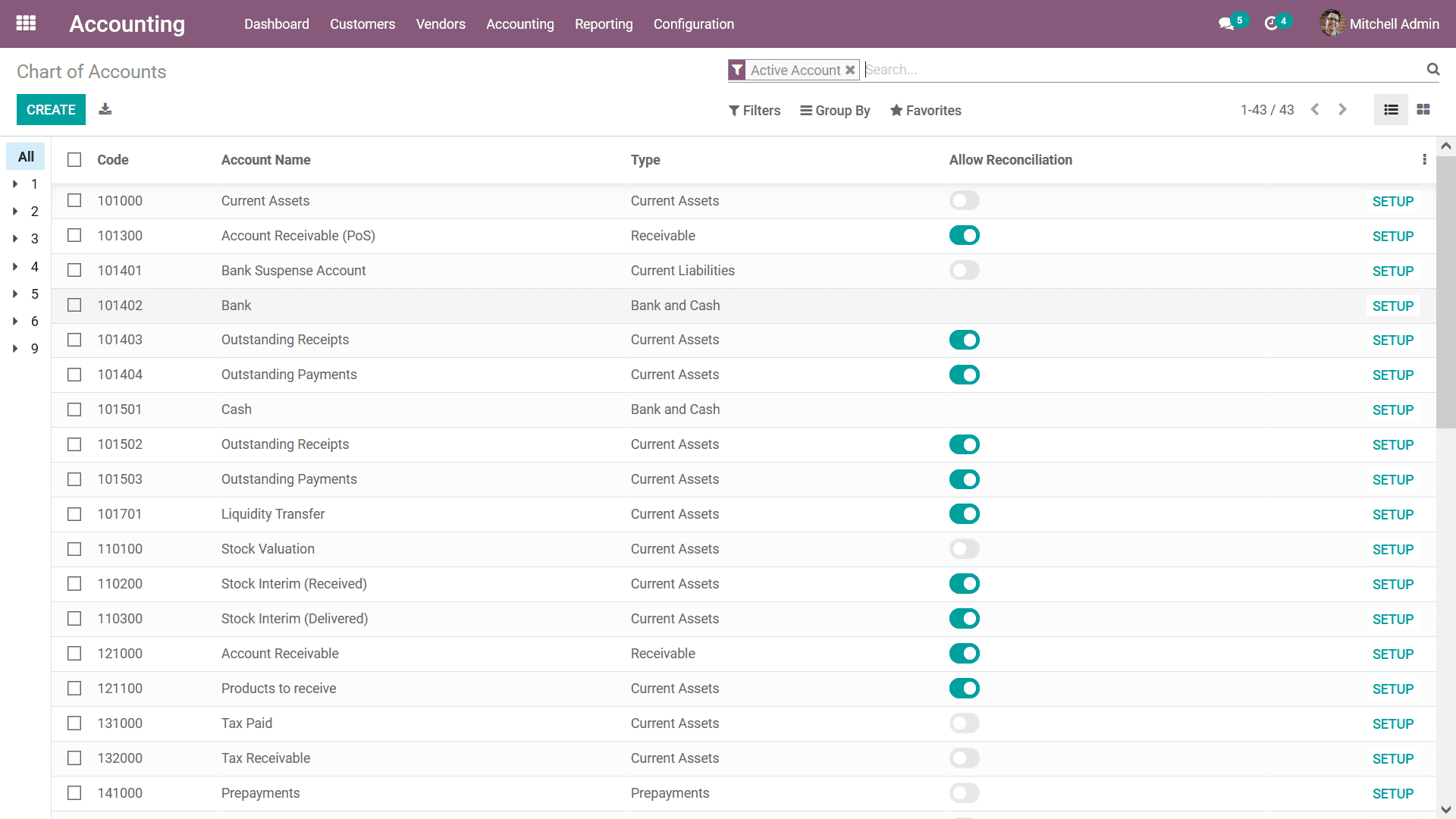

Chart of Account. The following image depicts the Chart of Accounts menu. Here the

Code, Account Name, and Type of the Chart of Accounts will be depicted. There is

also an option available that can be enabled and disabled to configure the Reconciliation

of the respective chart of accounts.

You can choose the Account Type to be the one from the ones which are defined by

default. The Accounting type can be either Asset, Liability, Equity, Profit & Loss,

Expense, or Other. Moreover, there are numerous subtypes of accounts that are available

under all these defined Types of Accounts. Furthermore, the Hierarchy of the Chart

of Account operations of the Odoo platform can be configured during the development

of the platform. Once your business operations are being defined the right experts

of Odoo development will be able to craft and create the hierarchy of operations

for the respective chart of accounts. In the Chart of Accounts menu, the hierarchy

can be viewed by selecting the arrow options that are available on the left side

of the window where the numbers are being depicted. Each of the numbers can be selected

and expanded using the arrow options and you will be able to view the respective

hierarchy of operations.

Additionally, the respective Journal entries with respect to the Chart of Account

can be defined this will provide an insight on the financial operations of the Chart

of Accounts in the company. In addition, the Taxes of operations by default for

the respective Chart of Account can be defined this will ensure that the financial

operations conducted are along with the taxes which have been defined. Moreover,

you can define and select the tax for the respective chart of accounts based on

the region of operation of the company.

To stop the usage of a respective Chart of Account you can select it to be Deprecated

you can enable the respective option in a Chart of Account editing menu. However,

the option will be only visible for the Chart of Accounts which are in operation.

Once you need to stop using and running with a Chart of Account you cannot directly

delete it from operation as it contains the entire and financial data of operations

that were being used and much value in the future. What you can do is stop its operations

in the finance management however you will have the respective entries and data

of the Chart of Account but not in operation. This can be done in Odoo by enabling

the Deprecate options that are available under the respective menu.

To create a new Chart of Accounts you can choose the Create option available which

will bring in a new line for describing the new Chart of Accounts. You can provide

the Code, Account Name, and Type of the Chart of Account along with configuring

the Reconciliation option. In addition, you can make use of the SETUP option available

under each of the Chart of Accounts to move on to the configuration aspects of the

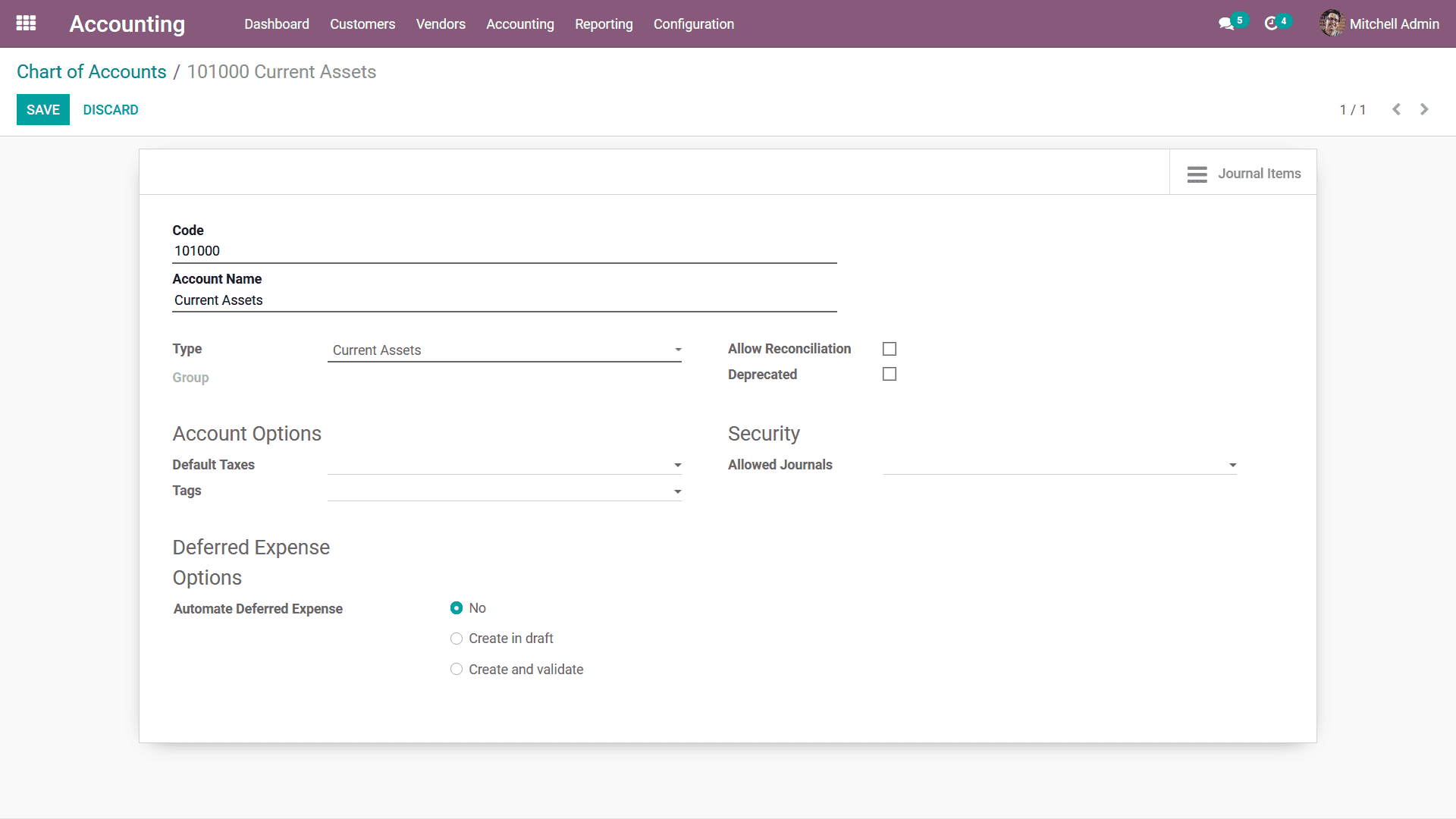

respective Chart of Account. The following image depicts the configuration window

of a Chart of Account. Here all the information such as the Code, Account Name,

Type, and Group of the Chart of Account will be described just as depicted in the

previous menu of all the Chart of Accounts. Furthermore, there are options to enable

or disable the Reconciliation as well as the Deprecation of the Chart of Accounts.

The Accounting Options available in the configuration of the Chart of Accounts allow

you to define the Default Taxes, and the Tags allocated which can be selected from

the drop-down menu. In the Security tab, the Allowed Journal for the respective

Chart of Account can be specified from the dropdown menu. Additionally, the Deferred

Expense Options of Automated Deferred Expense can be set as No, Create in the draft,

and Create and validate. To view the Journal Items concerning the Chart of Accounts

you can select the Journal Items menu available in the right corner of the respective

Chart of Accounts menu as shown in the following image.

You can create an N number of Chart of Accounts. based on the requirement of the

company operations which will be helpful for you to define the accounting operations

of every finance management. Let's now move on to understand the aspects of Configuring

Taxes on the company operations based on the region.