Fiscal Position

The fiscal position is generally considered as a beneficial accounting feature available in the Odoo Invoicing module. This will help to fix the tax according to the tax policy of a particular country. This feature will assist you in mapping taxes and accounts with relative tax and account on the basis of countries or a group of countries.

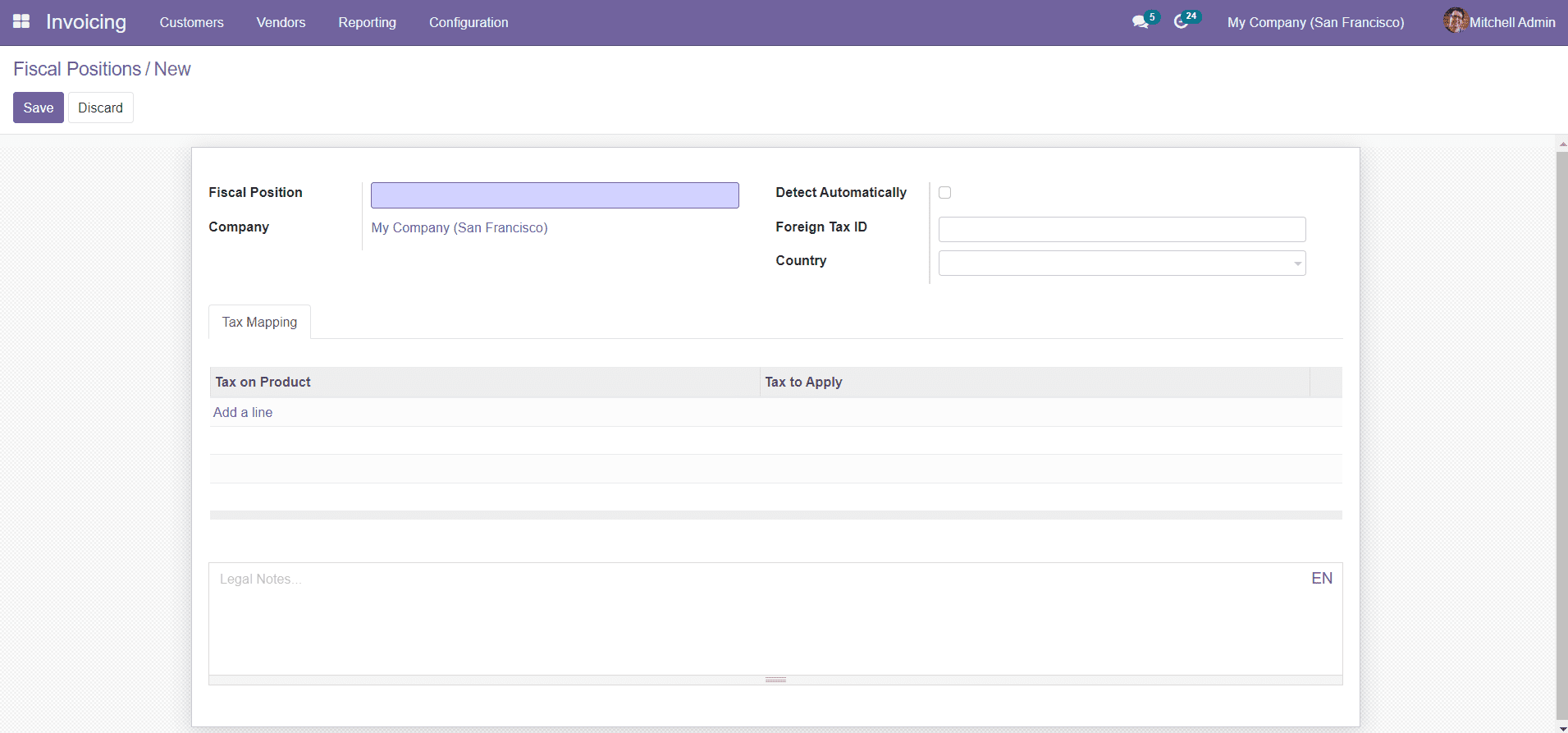

You will get access to the platform to define various Fiscal Positions from the Configuration menu of the Odoo Invoicing module. When you enter the platform, you will get the list of all available fiscal positions in the Invoicing module. Using the ‘Create’ button, you can easily create a new fiscal position.

In the new fiscal position creation window, you can mention the Fiscal Position, Company, Foreign Tax ID, and Country. You can also enable the field Detect Automatically in the same window. Foreign Tax ID is the tax ID of your company in the region mapped by this fiscal position.

Under the Tax Mapping tab, you can add Tax on Product and Tax to Apply details using the ‘Add a Line’ option. These details will help you to map taxes. You will also get an additional field to add Legal Notes which will later appear on invoices.

Let’s discuss the payment acquirers in the Invoicing module in the following session.