Accounting

You will get the Accounting menu in the Invoicing module in the Odoo Community edition

only after activating the corresponding option from the General Settings just like we

detailed earlier in this chapter. The Accounting menu includes various accounting

options and we will discuss all those options here.

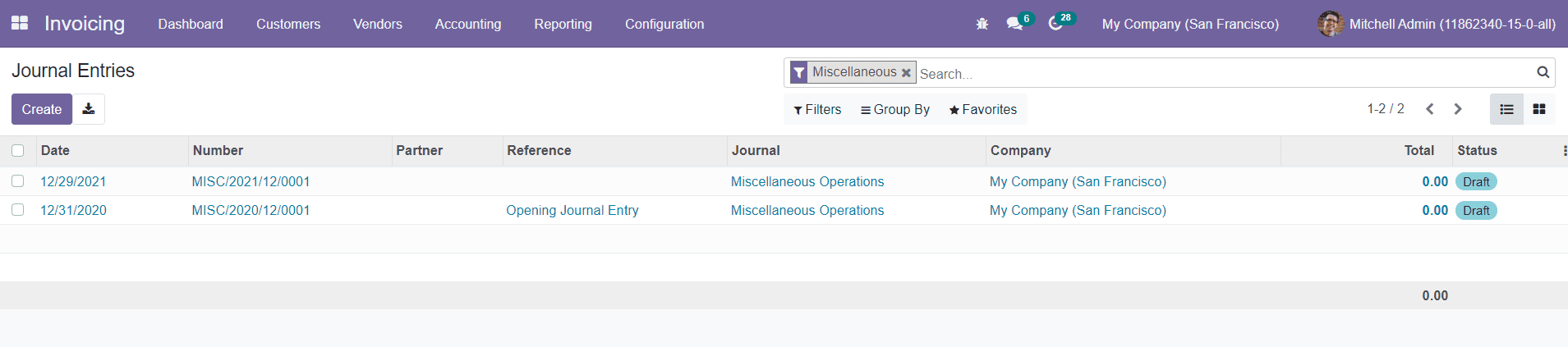

Journal Entries

Odoo records all financial transactions and documents related to various business

activities in the form of journal entries. You can create and manage journal entries of

business transactions in the Journal Entries option available in the Accounting tab.

This window will show all created journal entries for miscellaneous operations.

You will get the details of the Date, Number, Partner, Reference, Journal, Company, Total

Amount, and Status of each journal entry from the List view of the window. Using the

Create button, you can easily create a new journal entry.

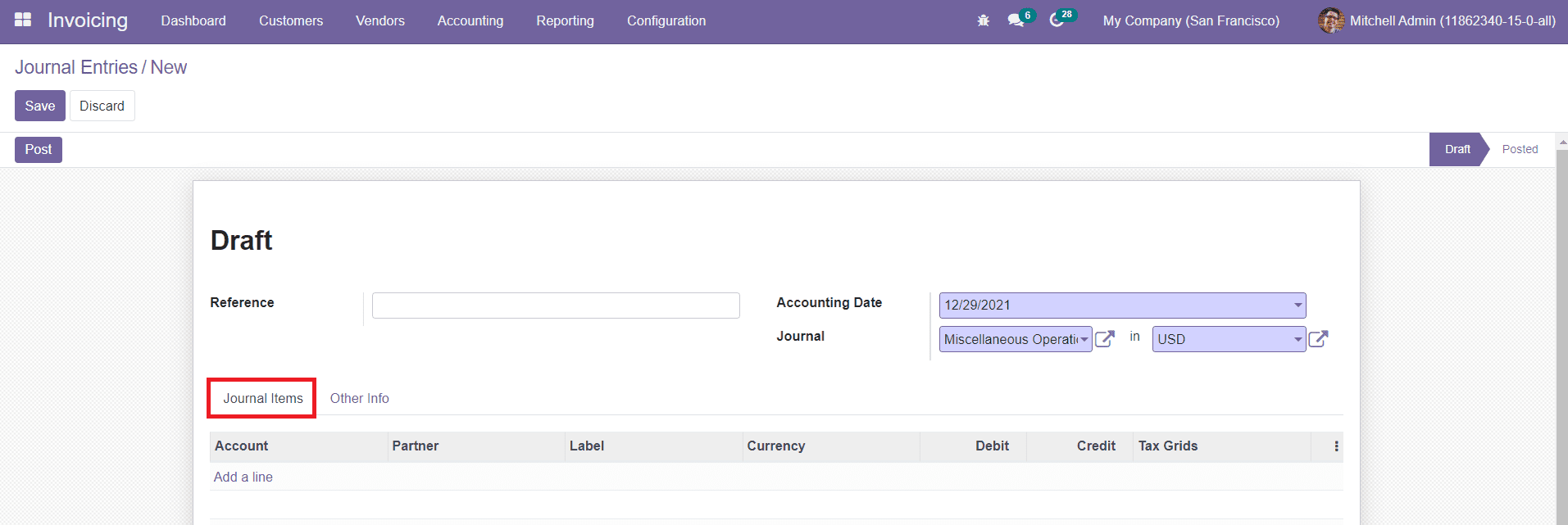

Mention the Reference of the journal entry in the given field. The Accounting Date and

Journal to which this journal entry belongs can be seen in the corresponding fields.

Under the Journal Items tab, you can mention the Account, Partner, Label, Currency,

Debit, Credit, and Tax Grids details.

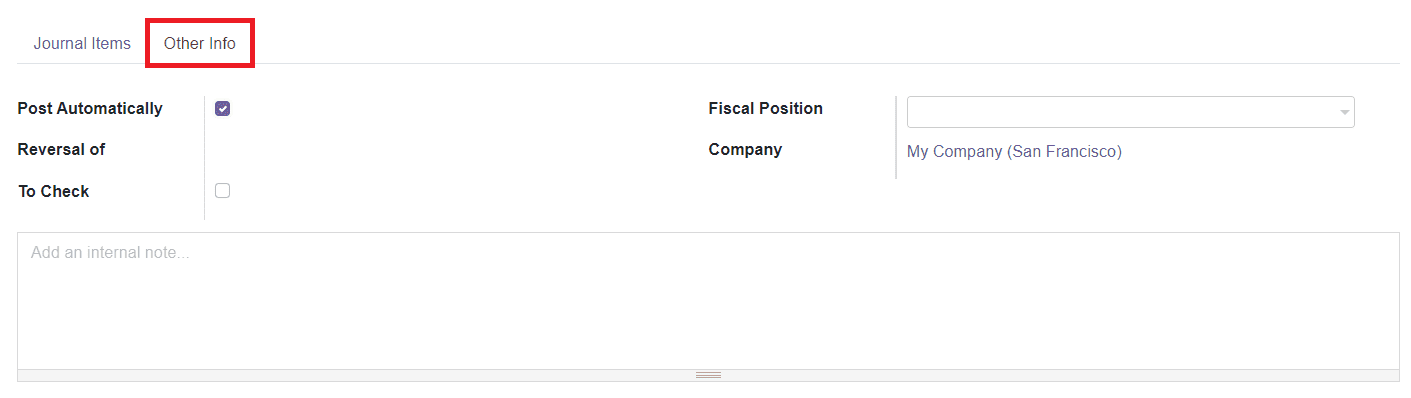

In the Other Information tab, you can activate the Post Automatically option to post the

entry automatically on the specified date. By activating the To Check option, you can

recheck the information added in the journal entry. Mention the Fiscal Position and

Company in the respective fields. Fiscal Positions are used to adapt taxes and accounts

for particular customers or sales orders/invoices. You are allowed to add an internal

note regarding this particular journal entry in the given field. After adding all

details, click the Save button.

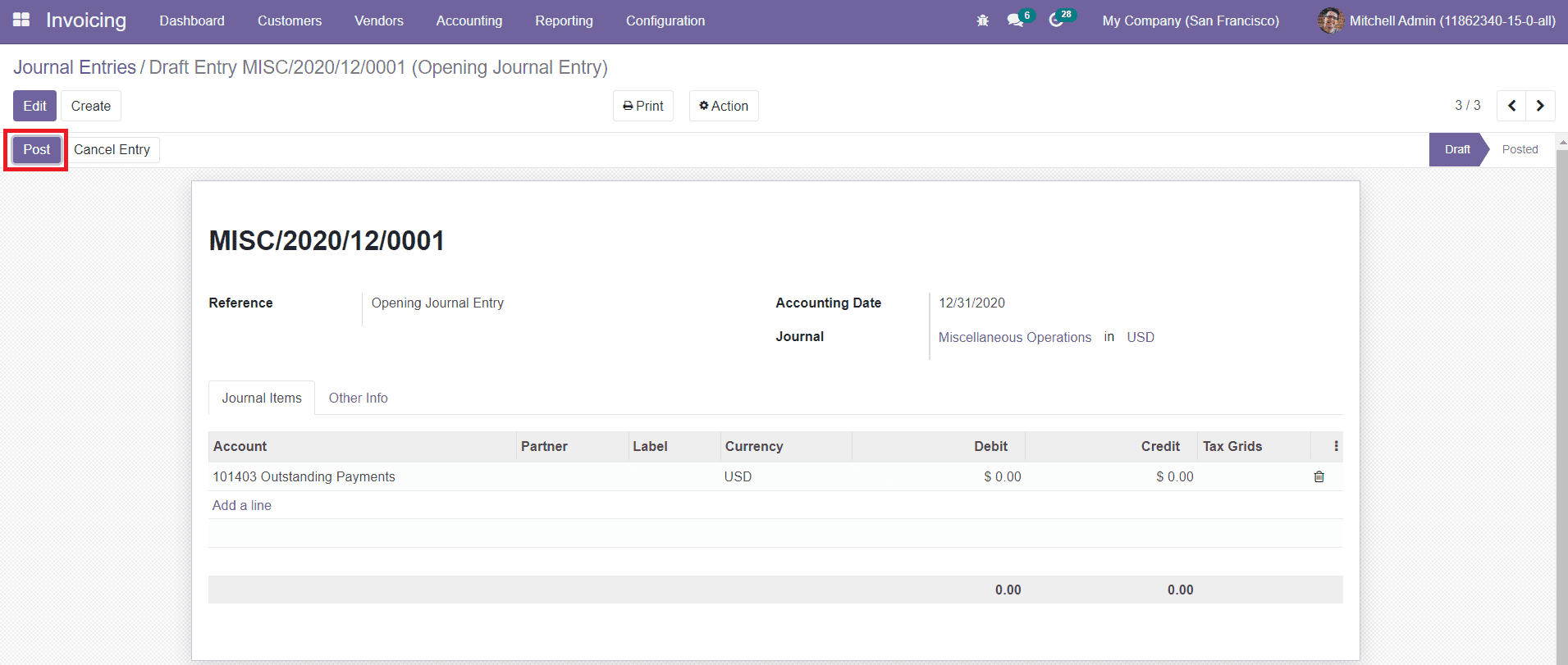

The new journal entry can be posted by clicking on the Post button.

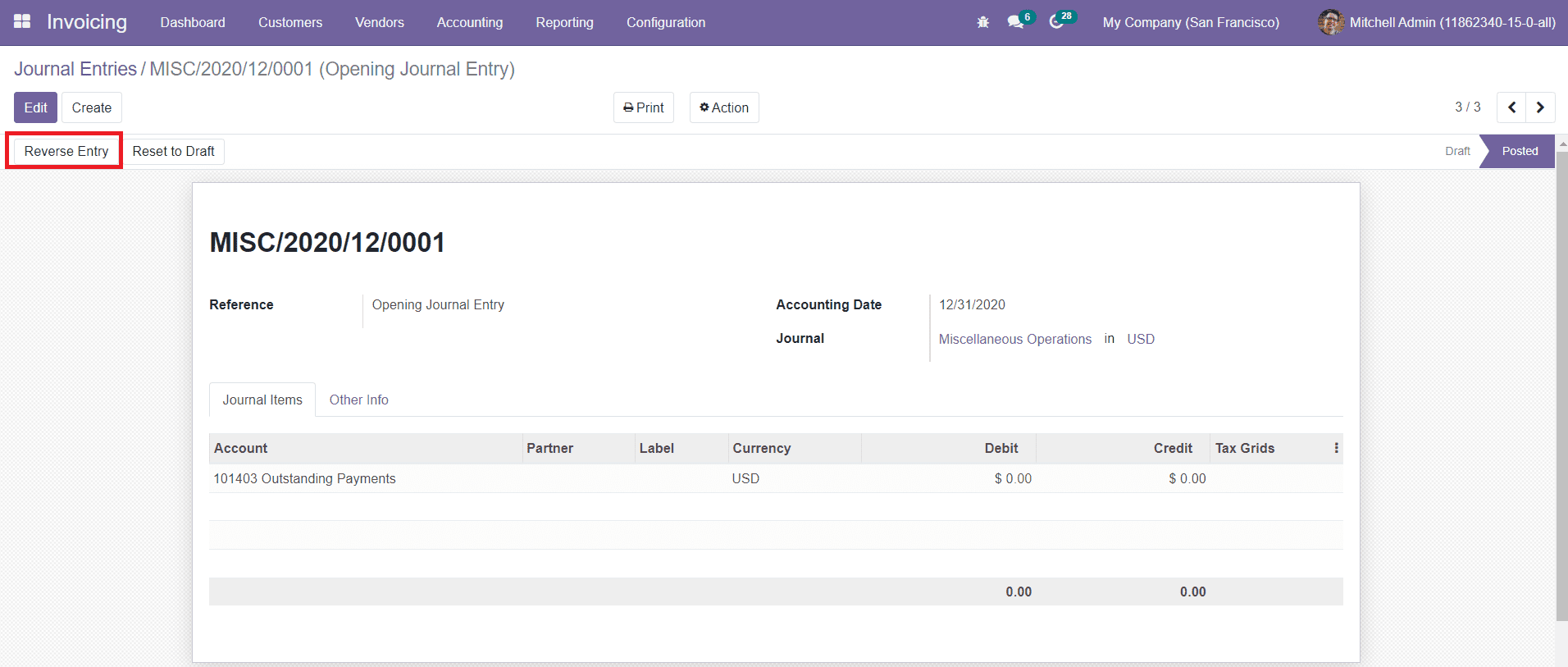

If you want to reverse the journal entry to a new accounting period, you can click on the

Reverse Entry button.

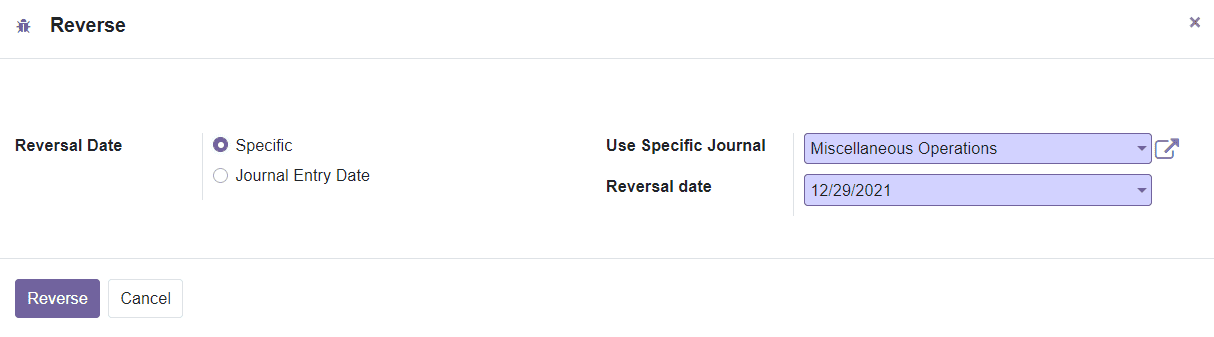

You will get a pop-up window where you can set the Reversal Date on a specific date or

journal entry date.

After mentioning the journal and reversal date, you can click on the Reverse button.

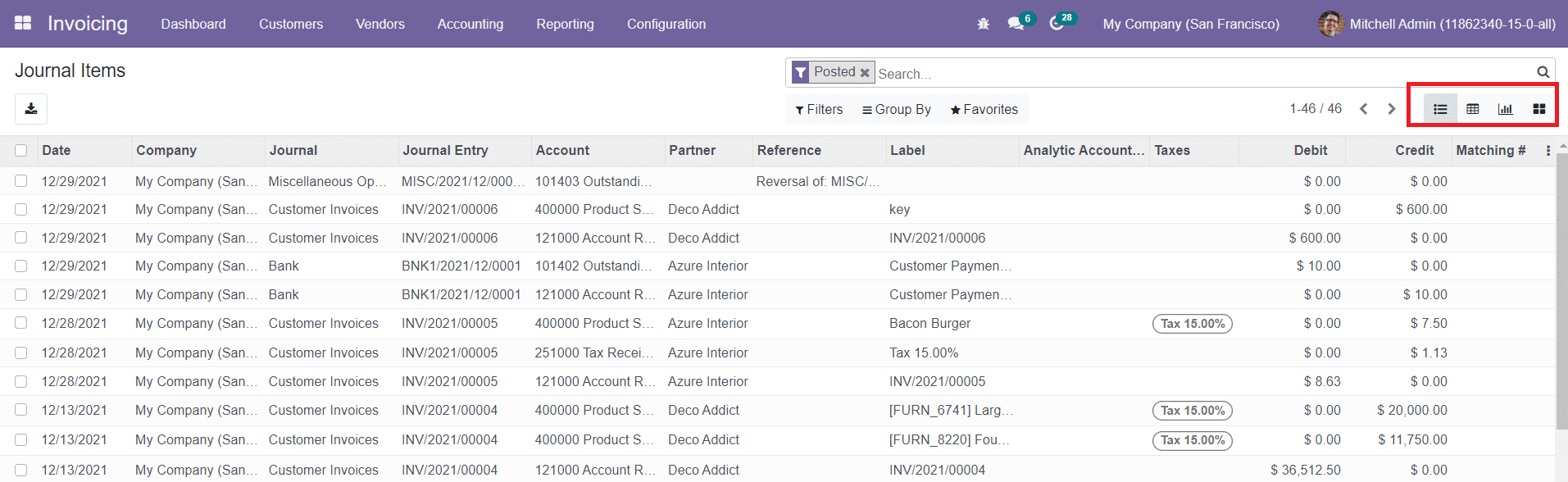

The Journal Items option in the Accounting tab will record the details of all journal

items configured in various journal entries.

This platform can be altered into List, Kanban, Pivot, and Graphical views. The list view

will show the Date, Company, Journal, Journal Entry, Account, Partner, Reference, Label,

Analytical Account, Taxes, Debit, and Credit details.

Journals

In journals, you can record all your transactions in chronological order. You will get

five types of journals such as Sales, Purchases, Bank, Cash, and Miscellaneous in Odoo.

The record of all these types of journals created in Odoo can be seen under the Journal

option in the Accounting menu.

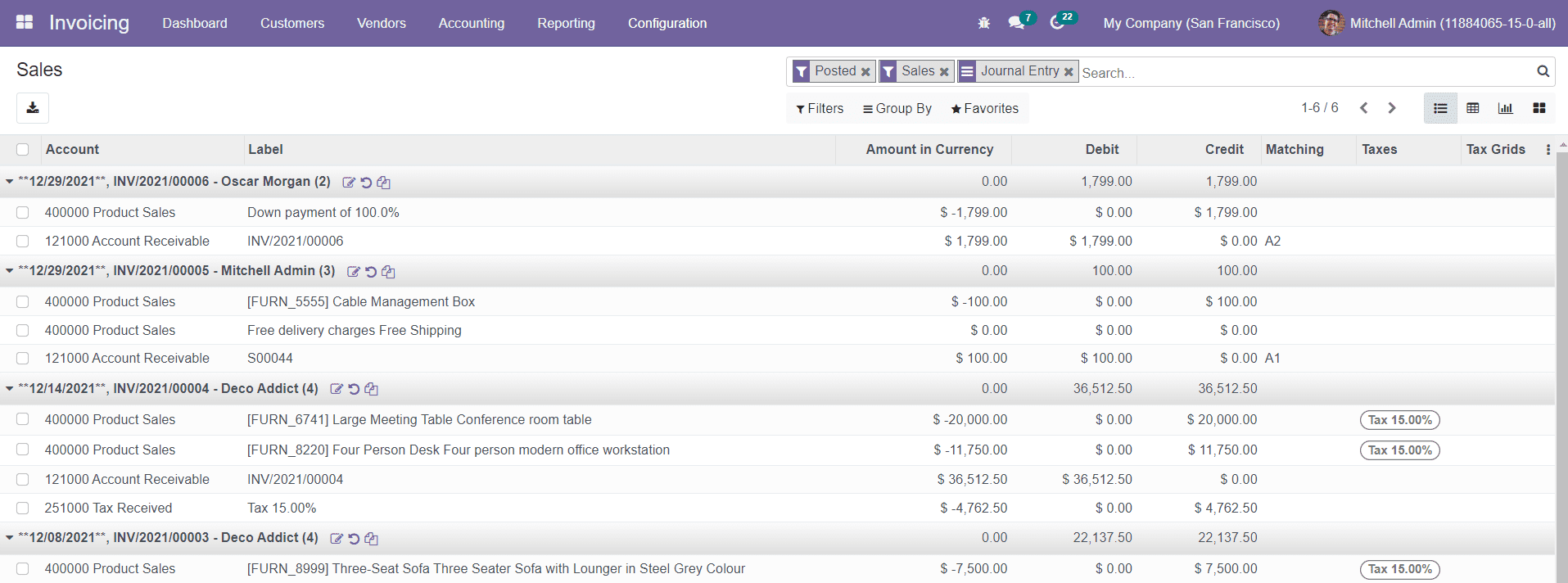

Sales

The sales journals can be used to post all recorded customer invoices in Odoo. You can

see such recorded sales journals in the Sales option available under the Journal tab in

the Accounting menu.

You will get List, Pivot, Kanban, and Graphical views on this platform. The List view

shows the Account, Label, Amount in Currency, Debit, Credit, Tax Grids, and Taxes

details of each sales journal.

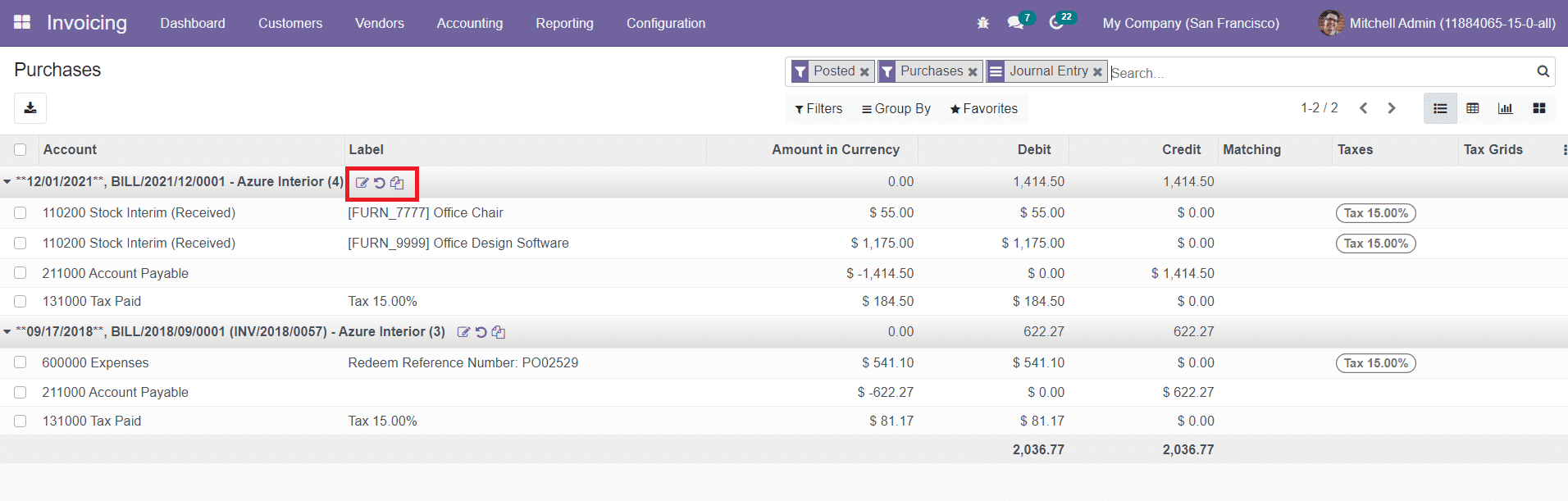

Purchases

Purchase journals will keep a record of all received vendor bills. The Purchase option in

the Accounting tab will show the list of all purchase journals posted in Odoo.

On each purchase journal, you will get icons to Edit, Reverse, and Duplicate the

respective journal.

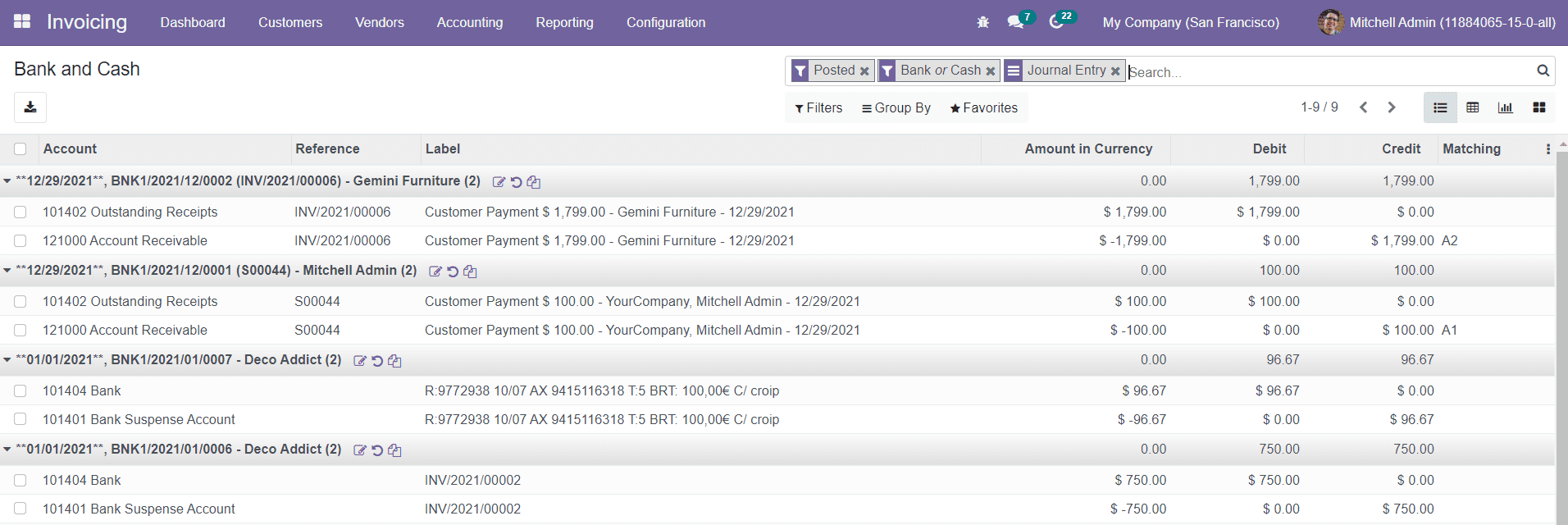

Bank and Cash

The cash journals can be used to keep a track of the daily cash transactions and received

customer payments. The bank journals will help you to post all bank statements. This

will also be used to track customer payments, vendor payments, and all other

transactions done by using your associated bank account.

This record of all posted bank and cash journals can be found under the Bank and Cash

option available in the Accounting menu.

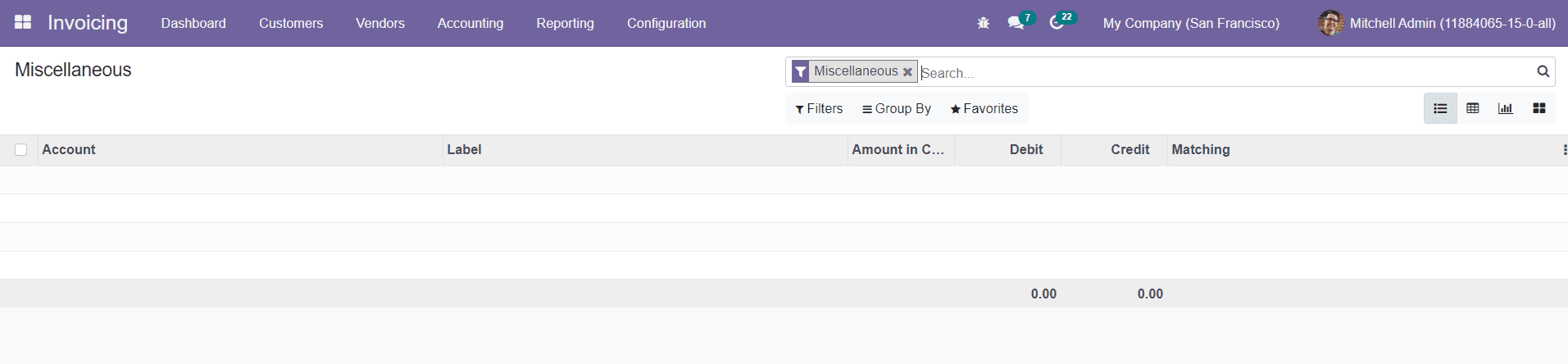

Miscellaneous

Last but not the least, the Miscellaneous journal will help you to record all other

transactions that don’t fit into the Sales, Purchase, Cash, and Bank journals.

In the Miscellaneous platform available under the Accounting tab, Odoo will show the

record of transactions posted in the miscellaneous journal.

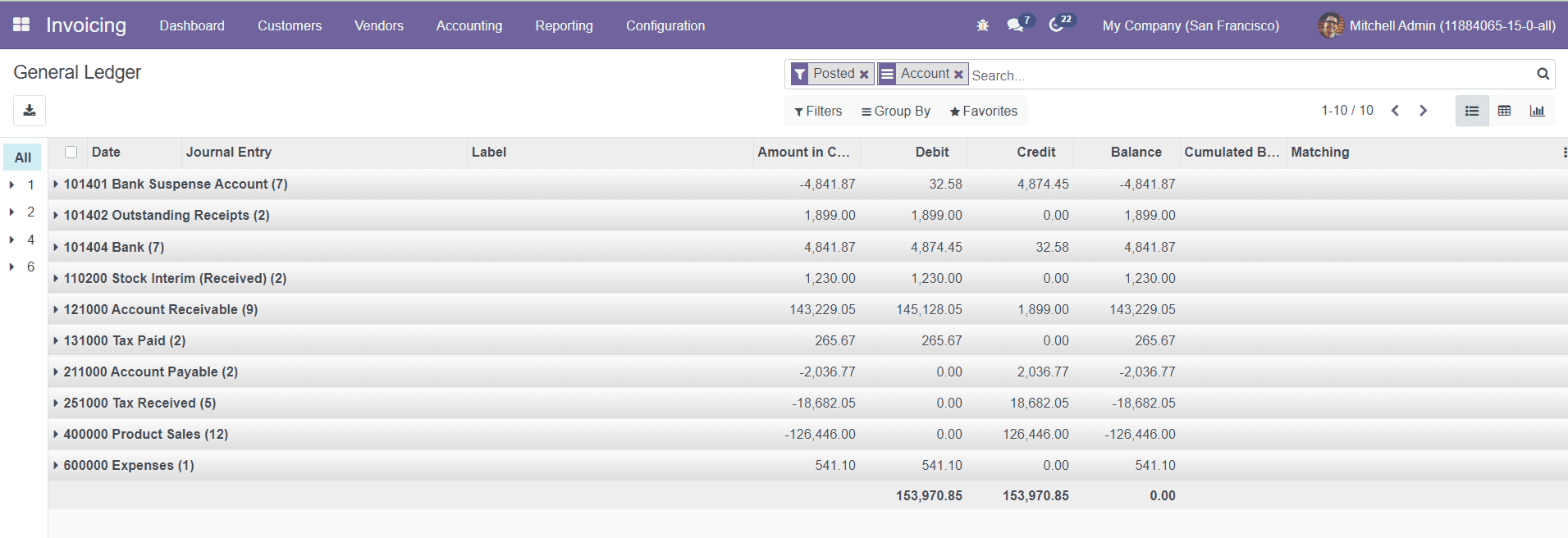

Ledgers

General Ledger

In Odoo, you can maintain ledgers for the accounting operations that will help you to

understand every financial transaction done in your company. You can use these ledgers

to generate financial statements for various business operations. General ledgers will

show all transactions in an account for a particular accounting period. You will get the

records of all general ledgers in the General Ledger option available under the

Accounting menu.

You can alter the window into List, Pivot, and Graphical views. The list view of this

platform shows the Date, Journal Entry, Label, Amount in Currency, Debit, Credit,

Balance, and Cumulated Balance of each ledger.

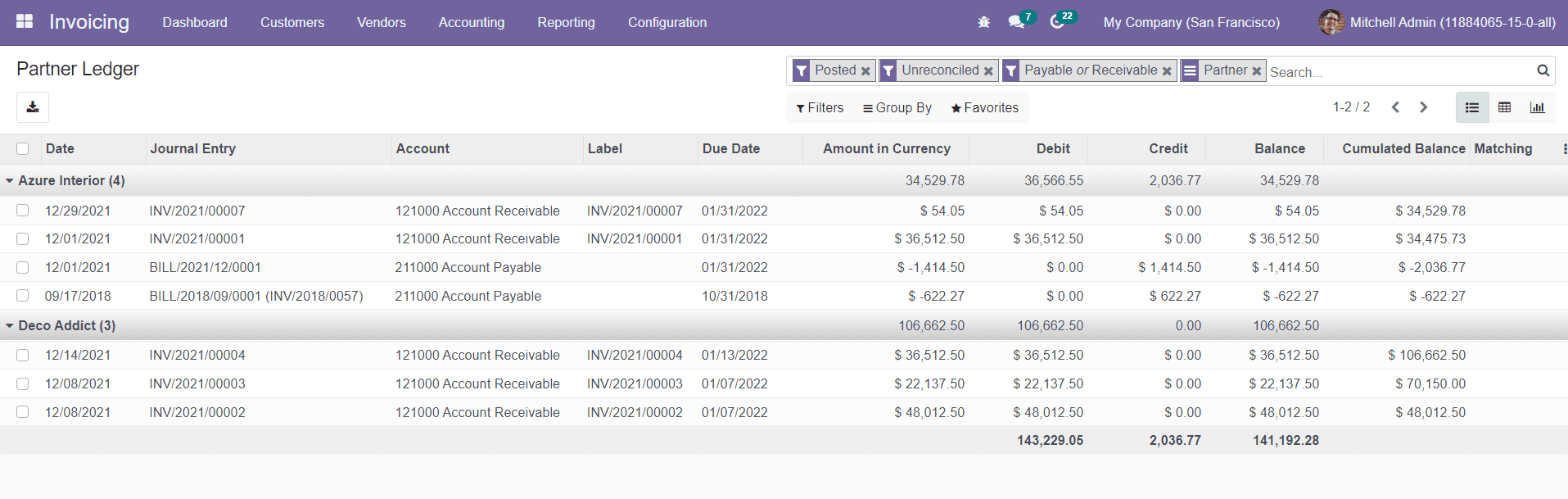

Partner Ledger

You can maintain separate partner ledgers in Odoo to record the financial transactions of

partners. It is easy to track and manage ledgers associated with parters using the

Partner Legger platform available under the Accounting menu.

The list view of this platform will show the details about the Date, Journal Entry,

Account, Label, Due Date, Amount in Currency, Debit, Credit, Balance, and Cumulated

Balance. You are allowed to use the default as well as customizable Filters and Group By

options as searching and categorizing tools.

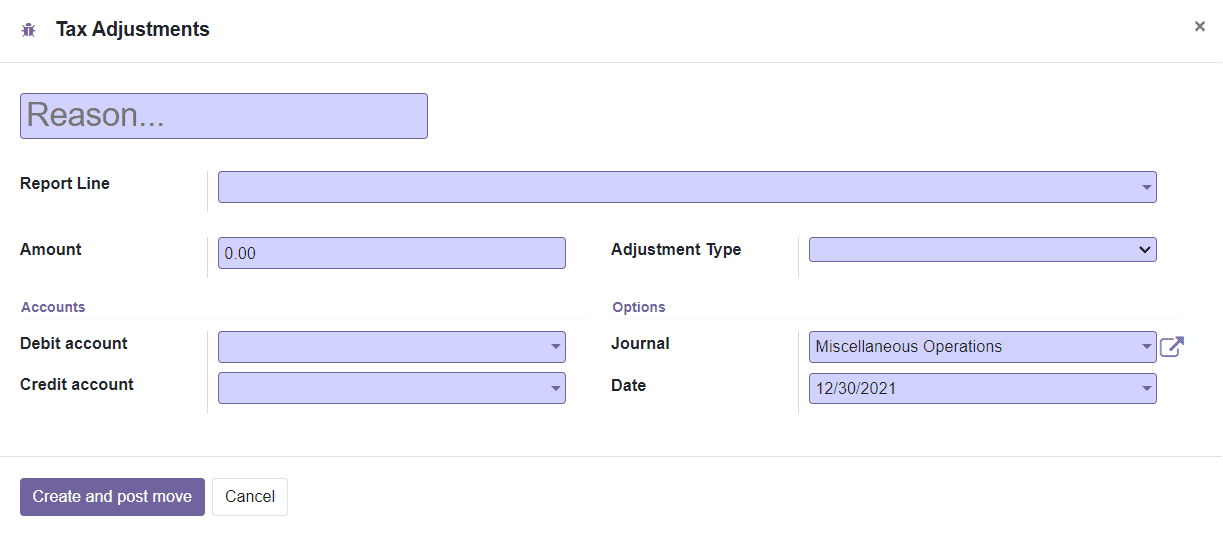

Tax Adjustments

The Tax Adjustment option available in the Accounting menu can be used to adjust the

payable taxes to arrive at the correct tax liability. When you select this option, you

will get a pop-up window.

Here, you can mention the reason for tax adjustment, Report Line, Amount, and Adjustment

Type in the corresponding fields. You can apply the adjustment on debit journal items or

credit journal items which can be defined in the Adjustment Types. In the Accounts tab,

mention the Debit Account, Credit Account, Journal, and Date of tac adjustment. After

completing all fields, you can click on the Create and Post Move button.