Taxes

Taxes are a very important aspect of a company and the Odoo platform allows you

to create and configure the various taxes for your company operations and the taxes

menu can be accessed under the accounting section available from the configuration

tab of the invoicing module.

Invoicing -> Configuration -> Accounting -> Taxes

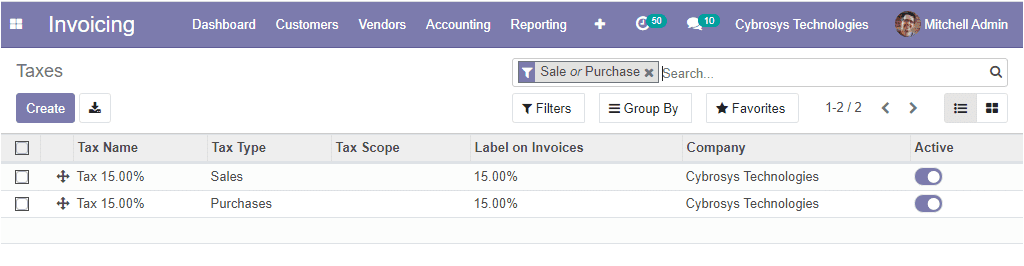

The image of the taxes window is depicted below.

In this taxes window, you can view all the taxes described in the platform along

with the tax name, tax type, label on invoices, and the name of the company.

The Odoo platform supports a wide range of tax types such as Value Added Tax (VAT),

eco-taxes, federal/state/city taxes, retention tax, withholding tax, and many more.

The chart of accounts that you defined is automatically preconfigured with the main

taxes of the country.

Now we can discuss how to define new taxes in the platform.

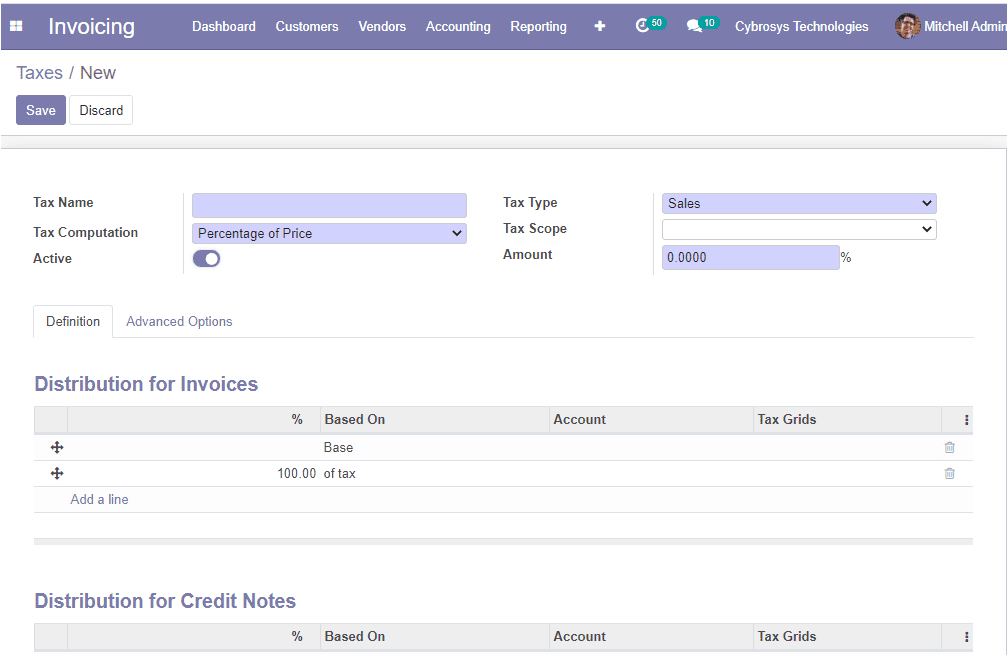

The new taxes can be configured by accessing the creation window available. In the

creation window, you can provide the tax name, allocate tax computation from the

drop-down menu, along with the tax scope, tax type, and amount. The tax scope defines

where the tax is selectable which means with sales, purchase, or none and none means

the tax cant to be used by itself. However, it can still be used in a group. Using

the tax scope option we can restrict the use of taxes to a type of product. There

are four different types of tax computations available under the tax computation

option. Which are the group of taxes, fixed, percentage of the price, percentage

of price tax included. Moreover, you have the option active and you can set active

to false to hide the tax without removing it.

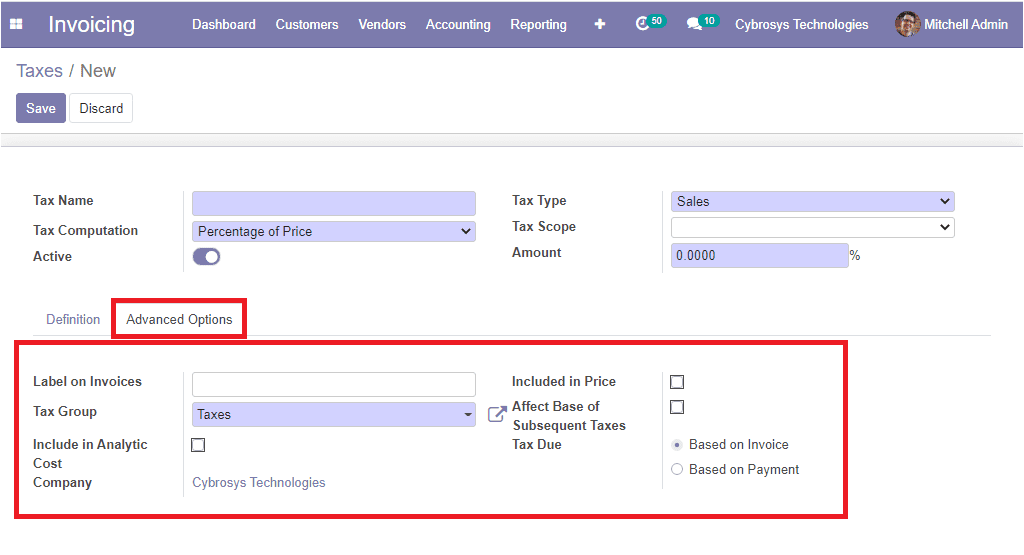

Under the definitions tab, the taxing rule for the distribution of invoices and

credit notes can be configured.

Based on Invoices: the tax is due as soon as the invoice is validated.

Based on Payment: the tax is due as soon as the payment of the

invoice is received.

So far we were discussing the tax configuration in the platform and now let us move

on to the next feature Fiscal positions in the platform.