Invoicing

Cash Rounding Methods

Cash rounding is possible when the base unit of an account is smaller than the most reduced denomination category of the currency. The amount that needs to be paid is adjusted to the closest variety of cash unit accessible, through exchanges paid in different ways such as cheques, credit cards, are not adjusted.

Cash rounding is an important aspect of any type of business. This business process enables the vendor to round off the cost of any request while instalment is made. Odoo not only supports cash rounding but also helps you to round the total amount of a bill to the nearest

This helps the vendor to create a more close and rounded figured bill.

For enabling this feature what you want to do is to go to settings and enable the cash rounding option from settings.

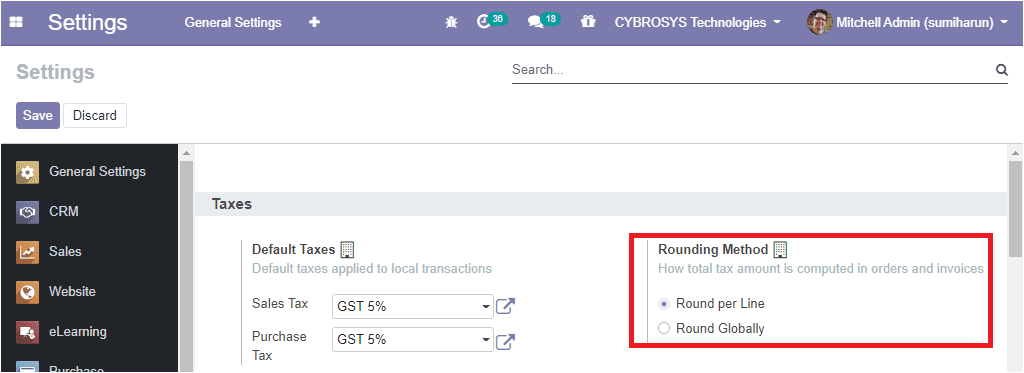

Go to Invoicing -> Configuration -> Settings -> Taxes -> Rounding method. The image of the window is given below.

This platform provides two methods for cash rounding.

1. Round per Line: The round per line method can be used when the price is tax included and this method will help to calculate the sum of line subtotals as equal to the total with taxes.

2. Round Globally: This method is used when the tax is included but it adjusts on the total tax amount.

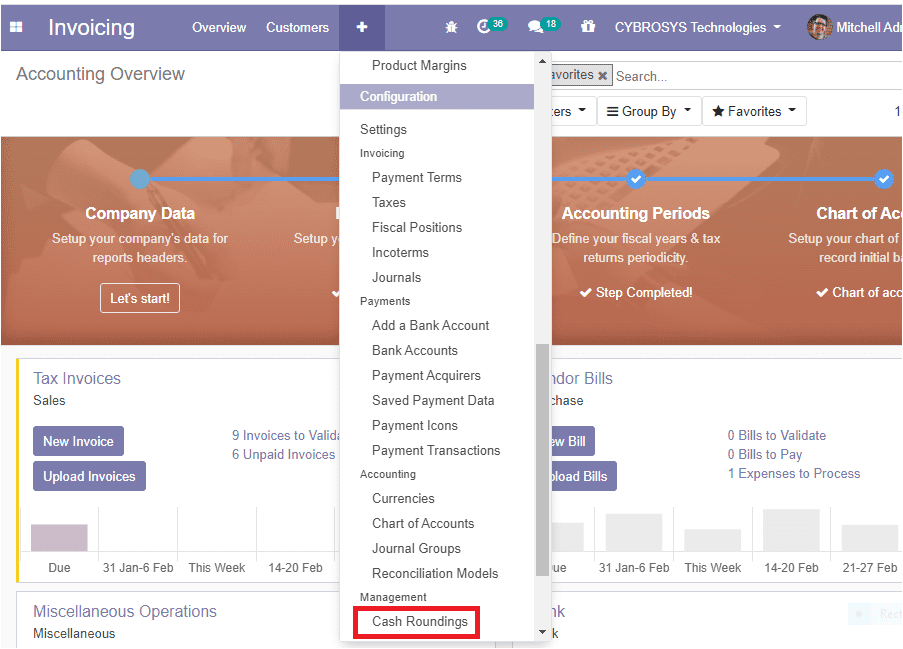

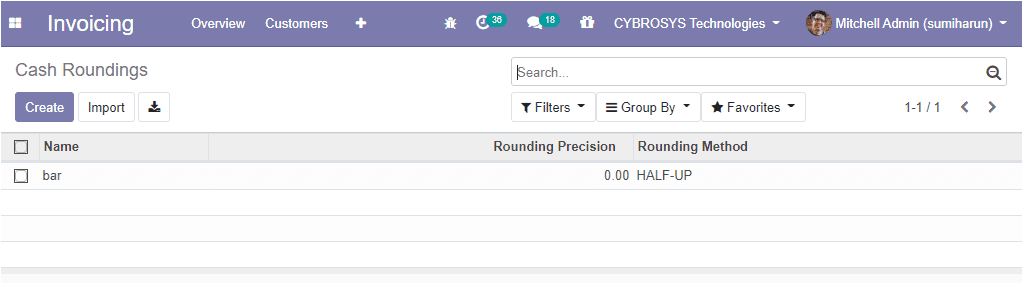

Now you can create cash rounding through Invoicing -> Configuration -> Management -> Cash rounding.

Then you will be depicted with a new window as shown below and in this window you can see all the cash rounding’s described in the platform and you have the provision to create a new one by selecting the create button.

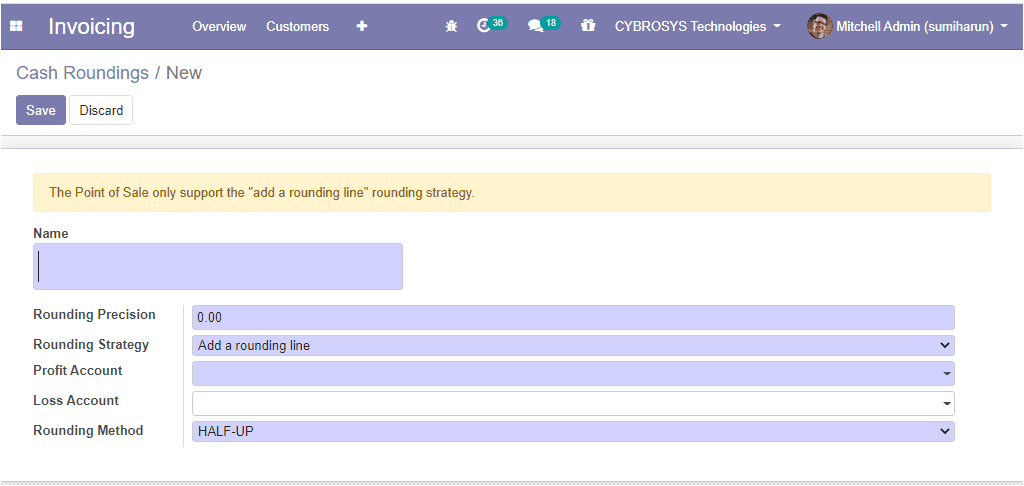

If you are selecting the create button, you will be depicted with a new creation window as shown below and using this window you can create a new cash rounding method in Odoo.

In this window, you can provide a name for cash rounding’s and can describe the rounding precision which is the numeric value describing the number of digits expressing the particular value both left and right of the decimal. The rounding precision will also affect the rounding of the computed value. The next field that you need to describe is the rounding strategy. Here we can specify which way will be used to round the invoice amount to the rounding precision. In this field, you have two options. Add a rounding line and modify the tax amount. In the add a rounding line method, you can add the rounding in a new line, and in the case of the modify the tax amount, you can add the rounding to the highest tax amount. Then allocate the account and the rounding method, using this method you can define to which precise value it is rounding, which can be either up, down, or half-up.

This is all about the cash rounding aspects in this module and now let us discuss the multi-currencies in the platform.