There are mainly two types of accounting practices that are widely adopted across the globe. Everyone is familiar with continental accounting as this is one of the widely used accounting features. Anglo Saxon accounting, on the other hand, is used by a small community.

This blog will describe to you how the Odoo platform will help you manage the continental and Anglo-Saxon accounting operations.

Anglo-Saxon V/s Continental In Odoo

Anglo Saxon is only available in the Enterprise edition of Odoo while the Continental is available in both the Enterprise and Community edition of Odoo (in version 12.0).

Moreover, in Continental Accounting, the expense account is affected at the time of purchase on the other hand, in Anglo Saxon Accounting the expense account is affected at the time of processing a sales order. Let's now look at both Continental and Anglo-Saxon accounting in detail.

Continental Accounting

In accounting, inventory can be validated manually or automatically. Moreover, while doing manually the stock is not affected, therefore it will be manually added/calculated at the end of a month or at the end of a year.

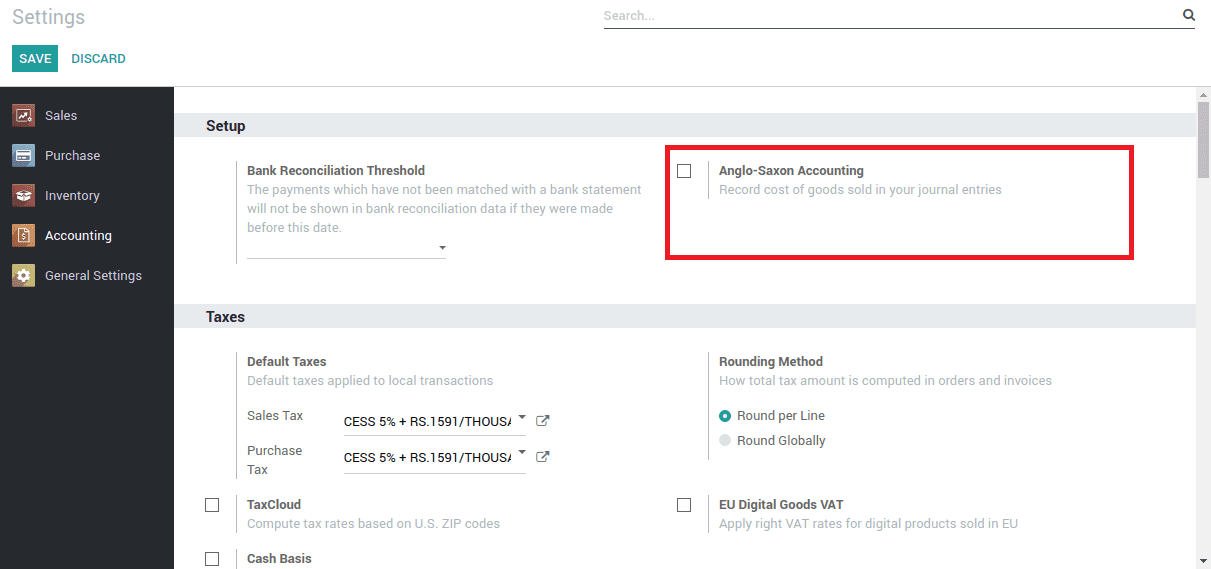

For implementing the continental accounting, go to the settings menu of the accounting module, untick the checkbox (if ticked, by default it will be continental) Anglo-Saxon Accounting, and save changes.

Accounting -> Settings -> Setup

Now let's see how this is applied.

1. Manual inventory valuation

The accounting entries to value the inventory are not posted automatically when a product enters or leaves the company. Moreover, while creating a new customer the payable account is ‘Account payable’ and the receivable account is ‘Account receivable’ for understanding the flow of journal entries as depicted in the following image.

Here the Accounts Payable can be described as the payable account for the vendor, when you purchase a product for a certain amount, the money you have to pay is affected in this account. The following screenshot describes the accounts payable information.

In addition, the accounts receivable over here can be defined as the receivable account of the customer as depicted in the following image. Moreover, when you sell a product for a certain amount, the money you have to receive is affected in this account.

Now to understand the operations let's create a product with the inventory valuation as ‘Manual’ as depicted in the following image and then select the corresponding accounts for each movement as shown in the image. Furthermore, set a vendor for the product and the price of that product for which the vendor is selling.

Product -> Jio wifi Router -> Product Category

Here is the Income account: When a product is sold, the Revenue will be used to record the transaction based on the sale price, used while validating a customer invoice.

Moreover, in the expense account, as depicted in the following image the expense is accounted for when a vendor bill is processed here, it is set as Purchased Goods.

In addition, while performing a purchase or sales, there are some actions. The following will describe how the accounting entries are posted in those actions.

Action 1: Supplier Invoice validation (While purchasing a product the bill against the order is received)

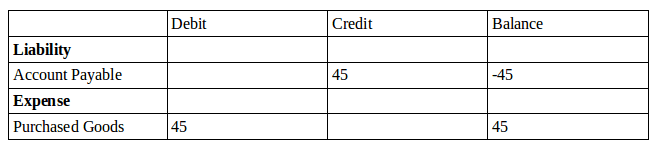

Let me describe here I am purchasing a ’Jio wifi router’ from a vendor and its actual price is 45/-, in this case, I have received the bill first but the product is not received yet. Therefore, the accounts affected will be the Purchased Goods and Account Payable with an entry.

Action 2: Supplier Goods Reception (The ordered product has been received)

In this action, no journal entries are being added.

Action 3: Customer Invoicing (The payment for a corresponding sales order is received)

Now suppose I am selling this product to my customer and I have given the bill for the order. Then while processing it the accounts revenue and account receivable is affected with an entry.

Action 4: Customer Shipping (When the product is delivered) During this action, no entries are being posted.

2. Automatic Inventory Valuation:

An accounting entry is automatically created to value the inventory when a product enters or leaves the company.

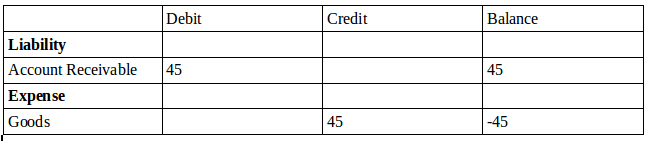

Moreover, the same product is considered with its inventory valuation as ‘Automated’ and selects the corresponding accounts for each movement. Now set a vendor for the product and the price of that product for which the vendor is selling. Now the product’s category is changed as shown in the image.

Product -> Jio wifi Router -> Product Category

Stock Valuation account: When a real-time inventory valuation is enabled on a product, this account inventory will hold the current value of the product.

Now let's consider the following operations to understand how the accounting entries are posted in those actions

Action 1: Supplier Invoice validation (While purchasing a product the bill against the order is received)

I am purchasing a ’Jio wifi router’ from a vendor and its actual price is 45/-, in this case, I have received the bill first, but the product is not received yet. Then the ‘Purchase Expense’ ie, the Expense Account and the account payable is affected.

In addition, the balance sheet is also affected with the same change as depicted in the following screenshot.

Following next, I have done payment against my order and you can see that the ‘Bank’ account is affected.

Now I receive the product and will generate an entry for the ‘Inventory’ ie the stock valuation account and ‘Inventory Variations' as depicted in the following profits and loss statement.

Moreover, the same impact and change can be viewed in the balance sheet as depicted in the following screenshot.

Based on the above-mentioned scenario while receiving a bill from the supplier, the accounting entries will be as shown in the following table:

Action 2: Supplier Goods Reception (The ordered product has been received)

I am purchasing a ’Jio wifi router’ from a vendor and its actual price is 45/-, but before paying the amount, the product is received. Then the stock valuation account ie,’ Inventory’, and the stock input account ie, ‘Inventory variations’ is affected with corresponding entries.

Similarly, the changes can also be viewed in the balance sheet of the platform as displayed in the following image.

Furthermore, while receiving the bill against the purchase, then the Accounts payable and Purchase expense are affected by the purchase order as depicted in the following profit and loss report screenshot.

In addition, the similar effect can be seen in the balance sheet of the platform as shown in the following image.

In addition, after the payment is provided to the vendor for the corresponding purchase order, then it is affected in the Bank account as shown in the following image.

Furthermore, based on the above-mentioned scenario while receiving a product the accounting entries will be as shown in the following table.

Action 3: Customer Invoice.

Now suppose am selling this product to my customer and I have given the bill for the order. Then while processing it, the ‘Goods’ ie, income and the ’Account Receivable’ account is affected with an entry.

In addition, similar implications can be seen in the balance sheet also as depicted in the following image.

Now when the customer has paid the amount for the corresponding order then ‘Bank’ is affected with the payment as depicted in the following screenshot of the balance sheet.

Now I have delivered the product, it will generate an entry for the ‘Inventory’ i.e. the stock valuation account and ‘Inventory variations’ as depicted in the balance sheet image below.

Additionally, similar auto-generated modifications can be seen in the profit and loss statement reports as depicted in the following image.

Furthermore, based on the above-mentioned scenario while invoicing the accounting entries it will be as the data depicted in the following table.

Let's now move on to understand the action: Customer Shipping.

Action 4: Customer Shipping.

I am selling this product to my customer and I have delivered him the product. Now the ‘Inventory Variation’ and the Stock valuation account ie, ‘Inventory’ is being affected with the order.

Moreover, the changes in the balance sheet are as depicted in the following image.

Now when I have given the bill regarding the order then the Accounts receivable and the ‘Goods ‘income account is affected as depicted in the following image.

Additionally, the balance sheet also faces similar changes as that of the profit and loss reports as depicted in the following image.

Then when the customer pays for the corresponding bill it is affected in the Bank account as depicted in the following balance sheet screenshot.

In addition, based on the above-mentioned scenario while shipping a product the accounting entries will be as per the following table.

Anglo-Saxon Accounting

For differentiating both the accounting features here, I am considering the same scenario as mentioned in the continental accounting section, let's see how it is being implemented. Set the accounting configuration as Anglo-Saxon accounting. Accounting module -> ‘Setup’ -> tick the ‘Anglo-Saxon accounting’ -> save. The following image depicts the accounting module setting window. Anglo-Saxon accounting. Accounting module -> ‘Setup’ -> tick the ‘Anglo-Saxon accounting’ -> save.

In accounting, inventory can be validated Manually or Automatically. While doing manually, the stock is not affected. So it will be manually added at the end of a month or year. Now let's see how it is applied. While implementing,

1. Manual inventory valuation

Set the Products Property accounts as shown for implementing Anglo Saxon with a manual inventory valuation. Products -> Category

In addition, the Price Difference account is used to value the price difference between the purchase price and accounting cost of a product, and the menu is depicted in the following image.

Moreover, the Stock Input account is used If you are doing real-time inventory, all incoming stock moves will be posted in this account, ie Goods received not Purchased as depicted in the following image.

Furthermore, the Stock Output account is used when a sales order is confirmed the product is delivered but not invoiced then it is affected as a Goods issued not invoiced as depicted in the following image.

Additionally, the Income account is used when a product is sold, the Goods will be used to record the transaction based on the sale price, used while validating a customer invoice.

Furthermore, the Expense account when a vendor bill is processed, in Anglo-Saxon with perpetual inventory valuation in which case the expense is recognized at customer invoice validation and set as Cost of Goods Sold.

As you have an understanding on the various accounts being used in Anglo-Saxon accounting now let's consider the following operations and understand how the accounting entries are posted in those actions.

Action 1: Supplier Invoice validation (While purchasing a product the bill against the order is received)

I am purchasing a ’Jio wifi router’ from a vendor and its actual price is 45/-, in this case, I have received the bill first but the product is not received yet. Then the accounts affected will be the Cost of Goods Sold and Account Payable with an entry as depicted in the following table.

Now as you are clear on the Action 1: Supplier Invoice validation, let's move on to understanding Action 2: Supplier Goods Reception.

Action 2: Supplier Goods Reception (The ordered product has been received)

In this action, no journal entries are being added. Therefore, let's move on to understand Action 3: Customer Invoicing.

Action 3: Customer Invoicing (The payment for a corresponding sales order is received)

Now suppose I am selling this product to my customer and I have given the bill for the order. Then while processing it, the accounts Goods and Account Receivable are affected with an entry as depicted in the following table.

Now you might have understood Action 3: Customer Invoicing let's move onto understanding Action 4: Customer Shipping

Action 4: Customer Shipping (When the product is delivered) During this action no entries are being posted.

That's the end of the manual aspects of inventory valuation therefore, let's move onto the next section where the automatic inventory valuation is described.

2. Automatic Inventory Valuation:

In this condition, change the product category to ‘Automated’ as depicted in the following image.

Now let's look at certain action operations.

Action 1: Supplier Invoice validation (While purchasing a product the bill against the order is received)

A Request for Quotation (RFQ) is used when you plan to purchase some products and you would like to receive a quote for those products. I am purchasing a ’Jio wifi router’ from a vendor and its actual price is 45/-, but the bill for the order is received first.

In the Purchases -> Create Request for quotation -> add Products as depicted in the following screenshot.

Then ‘Goods received not purchased’ (This account has been set for the input account and hasn't changed it.) i.e. here the Stock Input account and the ‘Accounts Payable’ accounts are affected with an entry for the corresponding order as depicted in the following image.

In addition, while paying the amount against the bill the ‘Bank’ account is affected. Now while receiving the products, an entry for the ‘Inventory’ ( ie the stock valuation account) is affected as shown the following image.

Furthermore, based on the above-mentioned scenario while receiving a bill the accounting entries will be as depicted in the following table.

As we are clear on Action 1: Supplier Invoice validation let's move on to understanding Action 2: Supplier Goods Reception.

Action 2: Supplier Goods Reception.

Now I am purchasing a ’Jio wifi router’ from a vendor but the product is received first before paying the amount. Then the Stock valuation account i.e.,’ Inventory’, and the Stock input account i.e. here ‘Goods received not purchased’ is affected with corresponding entries as depicted in the following image.

Additionally, when the supplier gives the bill, then the Accounts payable is affected by the corresponding purchase order as depicted in the following image.

After receiving the bill and doing the payment it is affected in the Bank account too as depicted in the following screenshot.

Furthermore, based on the above-mentioned scenario while receiving a product the accounting entries will be as depicted in the following table

As we are clear on the Action 2: Supplier Goods Reception let's move on to understanding Action 3: Anglo-Saxon based on Price Difference.

Action 3: Anglo-Saxon based on Price Difference.

Here, I am purchasing a ’Jio wifi router’ from a vendor but the product is received first before paying the amount.

Additionally, the actual price of the product is 45/- and here the price of the product is changed in the bill received from the supplier as 55/-. Therefore, the difference in the price of the product is added to the ‘Price Difference’ account as depicted in the following image.

In addition, this is reflected in the profit and loss report as it is the summary of income and expense, in which the price difference is calculated as the difference of the actual cost of the product and the cost of product while billing as shown in the following screenshot.

As we are clear on Action 3: Anglo-Saxon based on Price Difference let's move on to understanding Action 4: Customer Shipping.

Action 4: Customer Shipping

I am selling the same product to my customer and I have delivered the product before receiving the payment. Now the Stock output account ie, ‘Goods Issued Not Invoiced’ and the Stock valuation account ie, ‘Inventory’ is being affected with the order as depicted in the following screenshot.

Now I have given the bill against the order then the Accounts receivable is affected as in the below image.

In addition, while receiving the payment, it is affected in the Bank account as in the following screenshot.

Based on this scenario while shipping a product the accounting entries may look like this.

As we are clear on Action 4: Customer Shipping let's move on to understanding Action 5: Customer Invoice.

Action 5: Customer Invoice.

I am selling the same product to my customer and I have sent an invoice for the order. Then the ‘Goods issued not invoiced’ ie, the stock output account and the ‘Accounts Receivable’ accounts are affected with an entry.

If the customer paid the corresponding amount then the payment is affected in the ‘Bank’ account. As the Anglo-Saxon will take the cost when a sales invoice is created, the income and expense accounts are affected i.e., ‘Goods’ & ‘Cost of Goods Sold’ as in the following screenshot.

In addition, based on the above-mentioned scenario while invoicing, the accounting entries will be as depicted in the following image.

To know more about Odoo Accounting, the Best Accounting Software. Watch the video below to know more about the features of Odoo Accounting