Businesses operating in different markets face a significant problem when navigating the complexities of financial rules. Businesses gain from an accounting system that is precisely tailored to Venezuelan norms and reporting requirements thanks to Odoo 17's localization within the country. The characteristics of this tailored strategy, which encompass everything from tax reporting to financial statements and compliance with regional accounting standards, are designed to meet the particular requirements of Venezuelan companies. In this blog, we will examine how precise financial reporting, easier tax compliance, and seamless connection with other business activities are just a few of the ways that Odoo 17's Venezuelan accounting localization improves business operations. We will look at important components that are specific to Venezuela, like balance sheets, profit and loss statements, tax administration, and VAT processing.

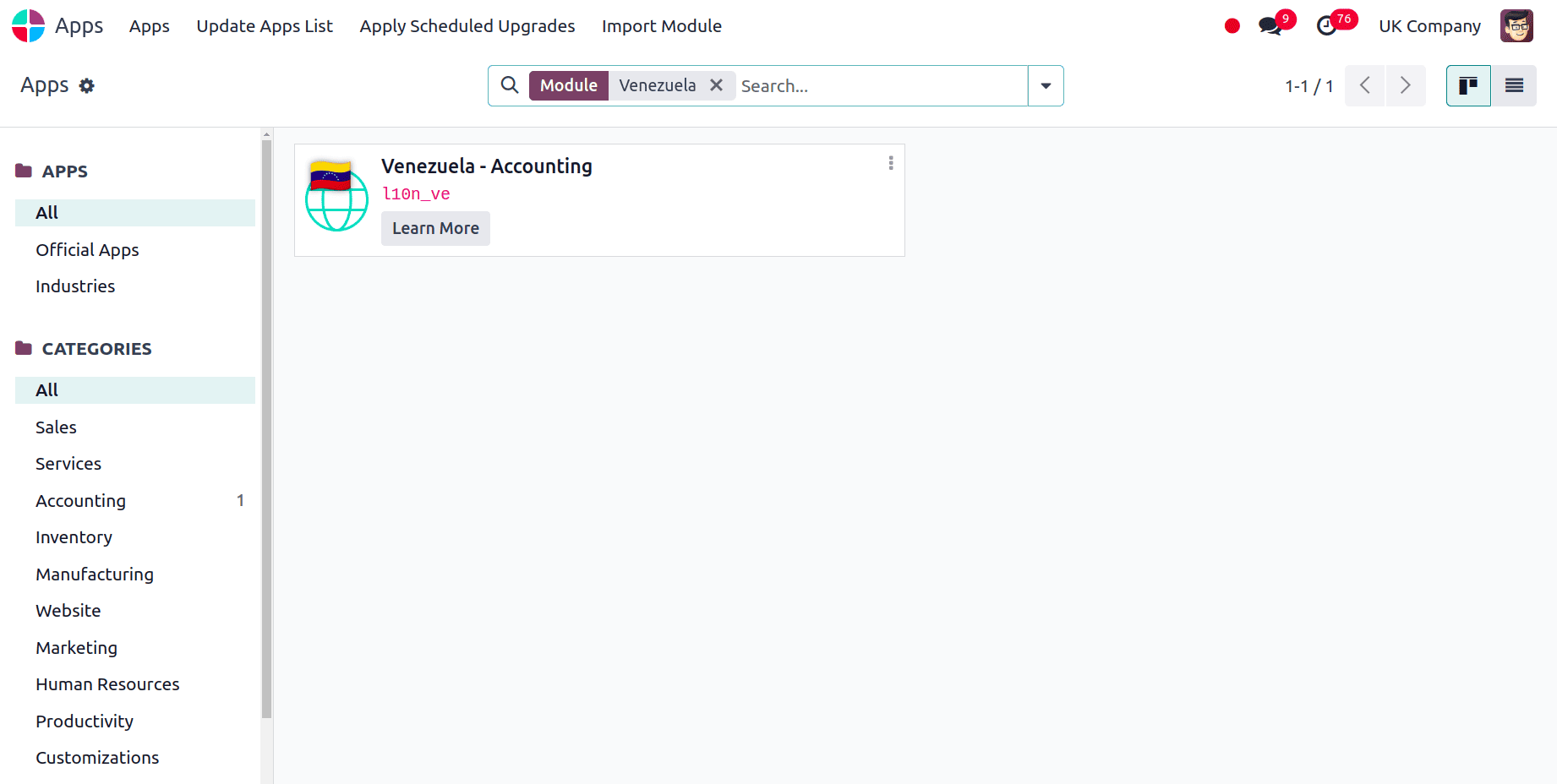

To get the Venezuela Accounting localization, we have to install the required localization modules first. To do this, go to Apps, search for the modules,, and install all the required modules.

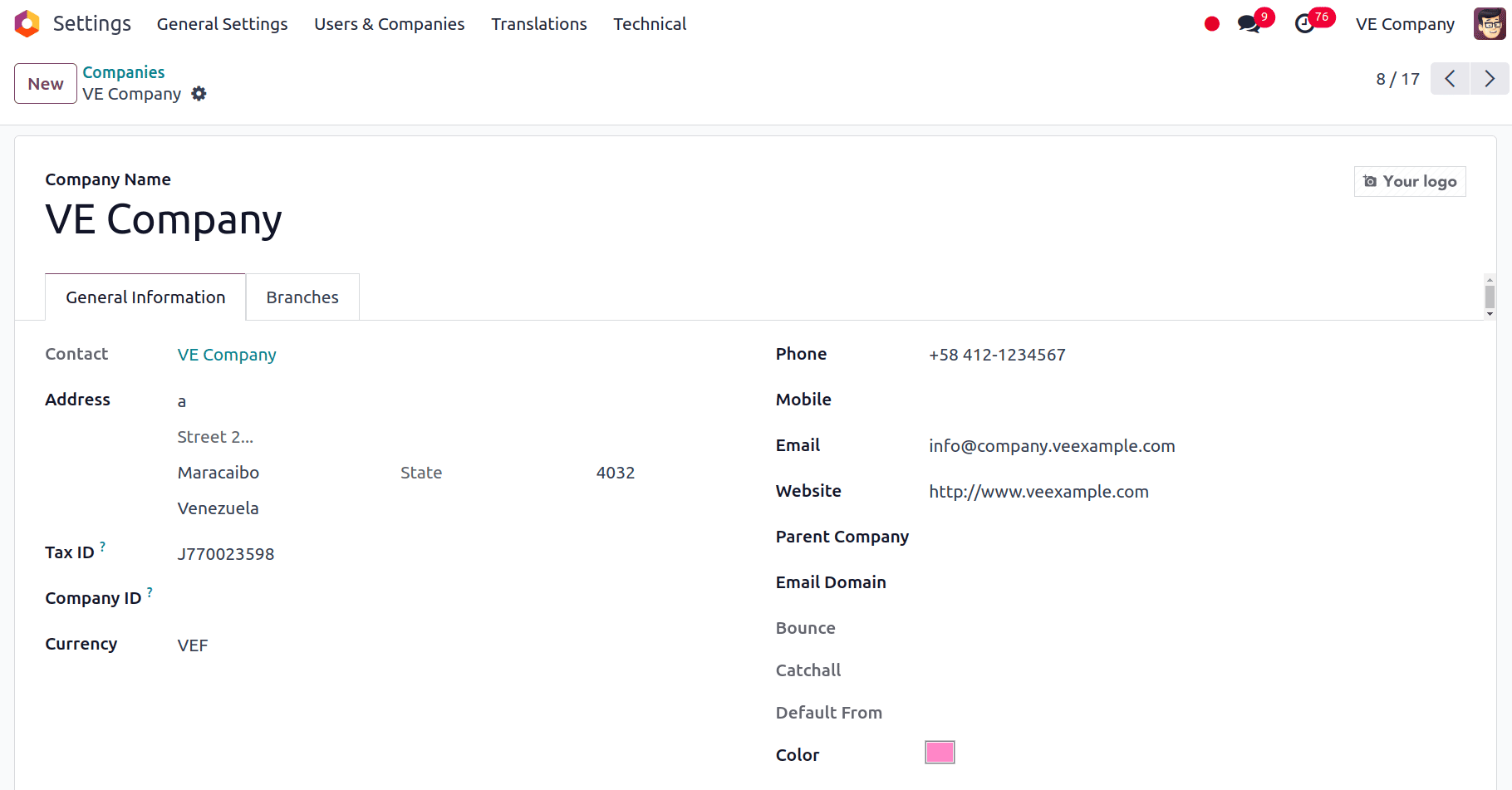

After the installation of the modules, we can now make sure that the company configuration is correct. Navigate to Settings > Users and Companies > Companies to accomplish that. We can either click on the New button to start a new company or choose the firm from the list of companies that displays for which we want to examine the specifications.

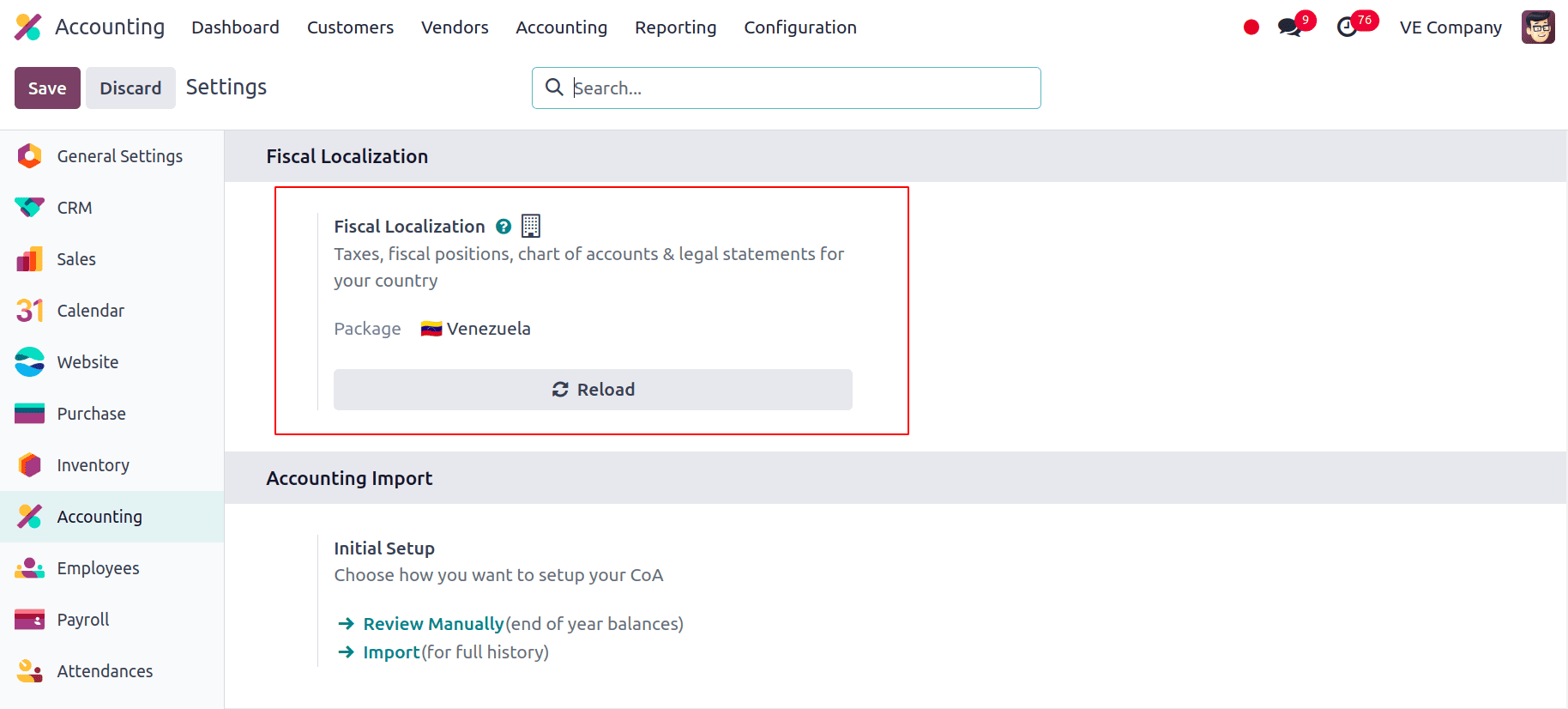

We can observe that the Accounting Module's configuration settings will have Venezuela selected as the Fiscal Localisation following the localization's installation.

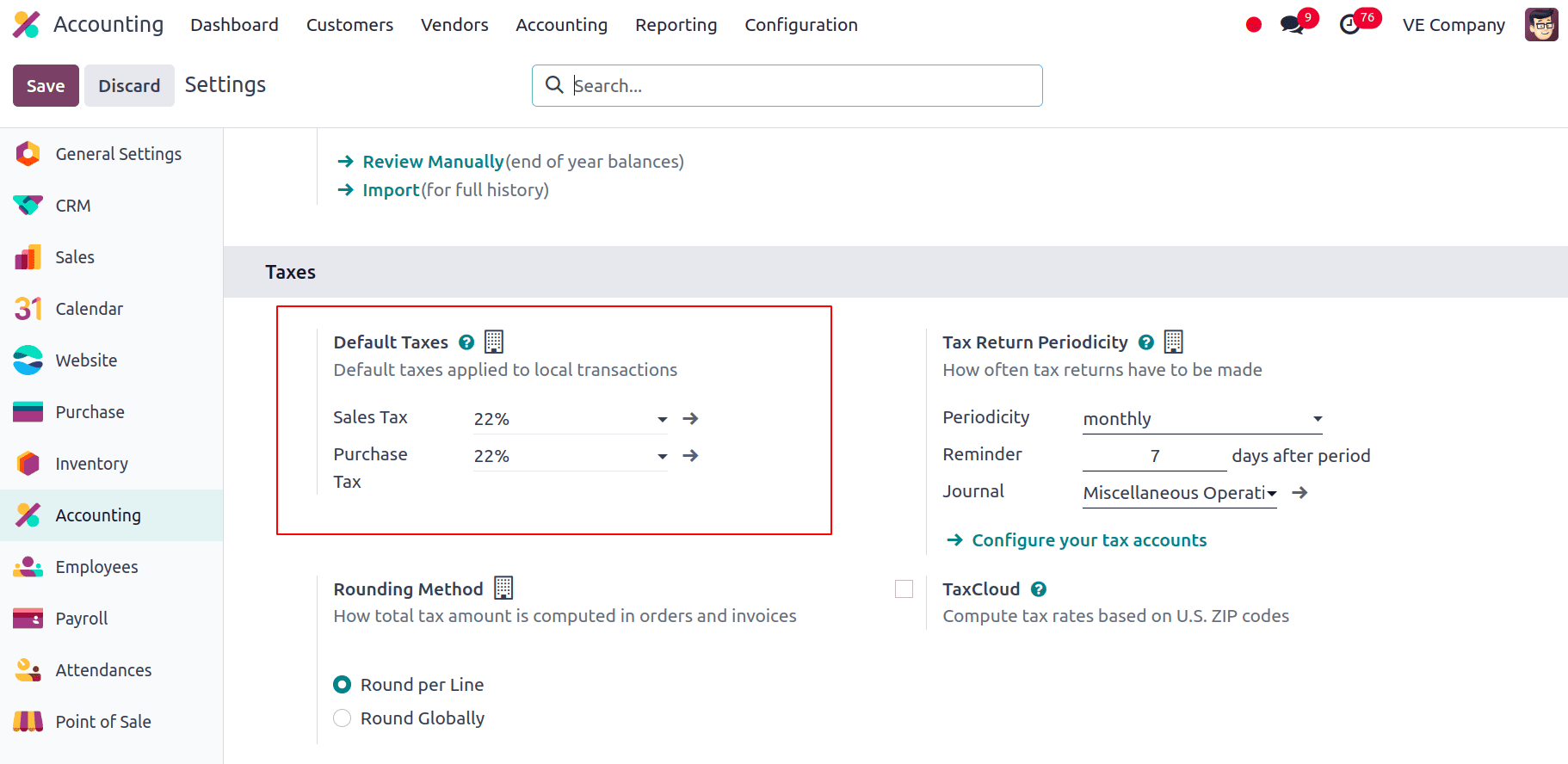

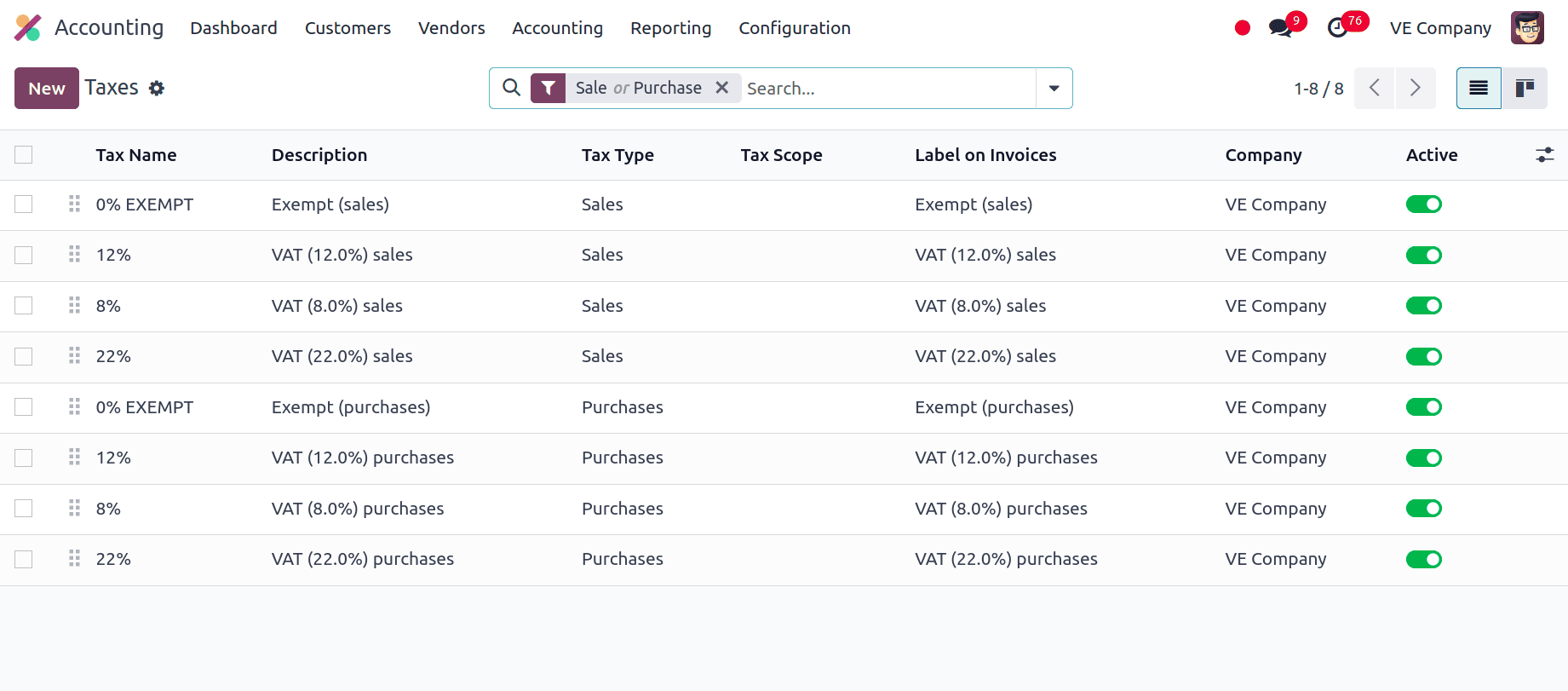

Also, the default taxes that can be configured in the settings so that all the transactions automatically take that tax will be pre-defined with localization. Here, it will be set according to Venezuela standards, which is 22% Sales and Purchase Tax.

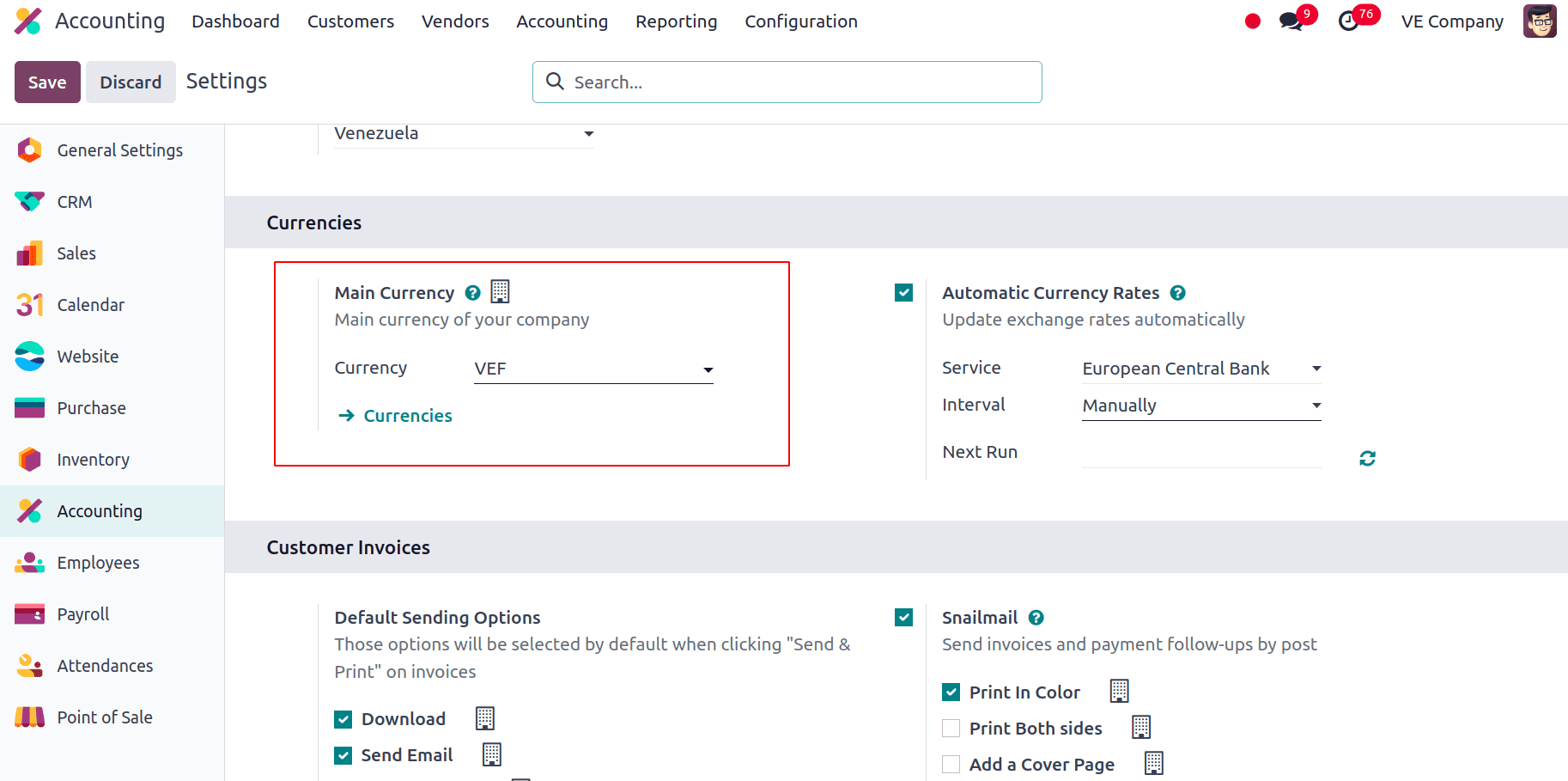

The main currency will be configured to Venezuela’s official currency, which is Venezuelan bolívar (VEF), so that all the transactions use this currency by default.

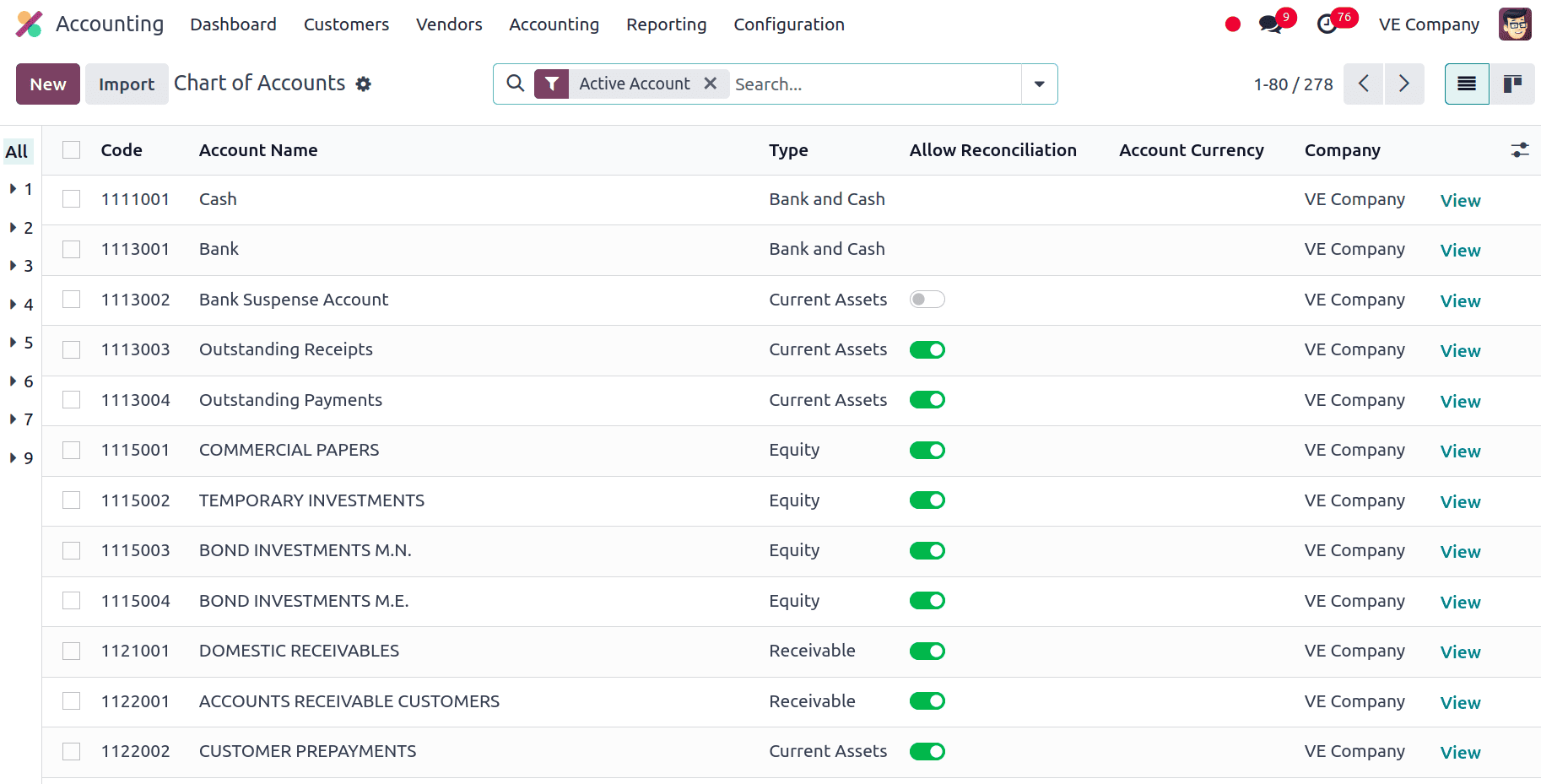

Next, we can look at the chart of accounts that are defined for this localization. Any accounting system's cornerstone is the Chart of Accounts, which offers a standardized framework for classifying financial transactions. The Chart of Accounts in Odoo is a crucial component for effective financial management since it is made to be flexible and compliant with a range of accounting standards. Odoo's Chart of Accounts is set up to mirror the Venezuelan accounting system with the installation of the modules. Classifications such as assets, liabilities, equity, income, and expenses are included, along with account types and codes that adhere to regional standards. The framework enables thorough reporting and tracking in accordance with Venezuelan regulations.

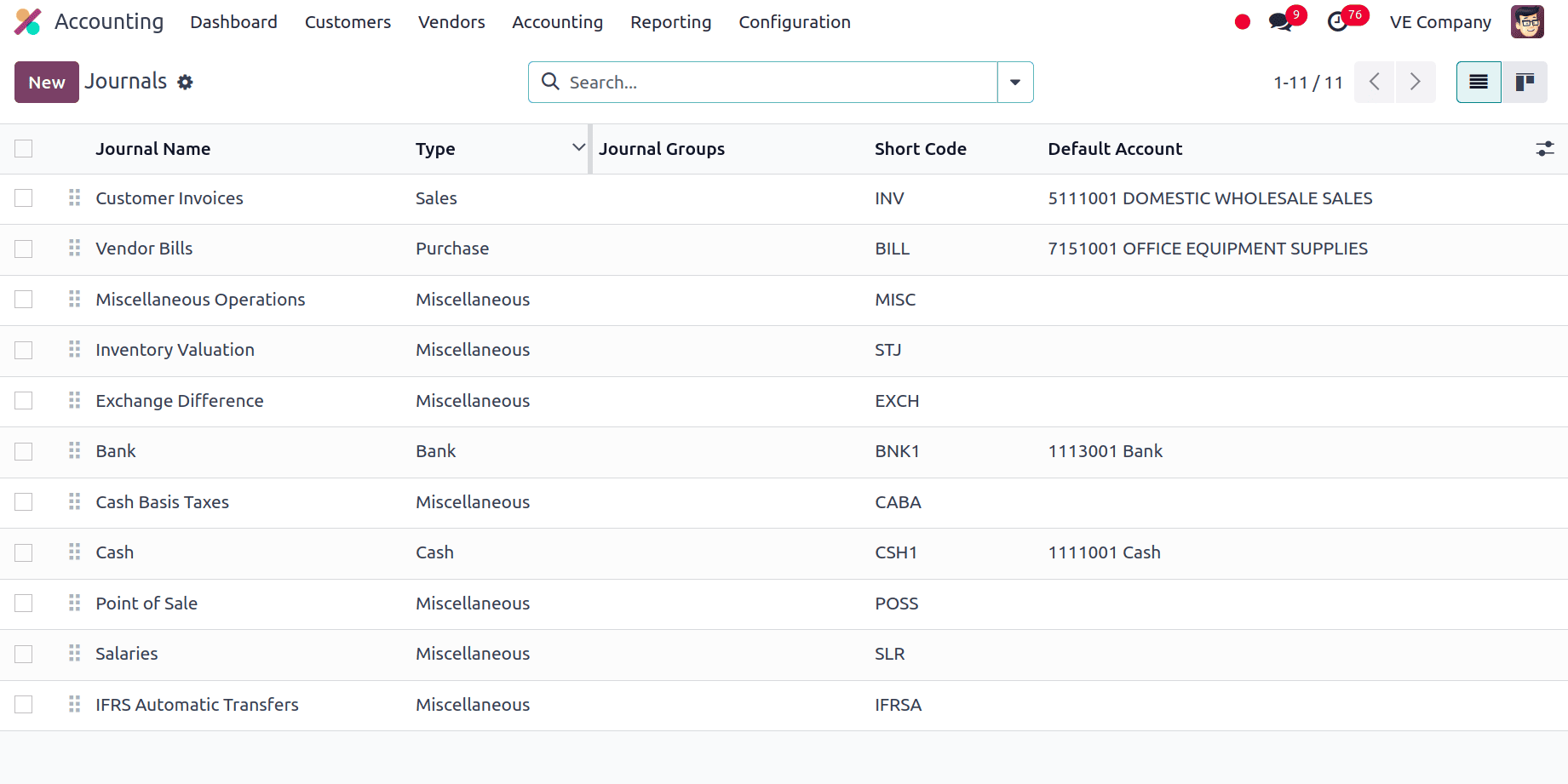

Journals are necessary in Odoo to precisely and methodically record financial transactions. Localized for Venezuela, these journals are designed to comply with regional accounting norms and procedures, guaranteeing adherence to national financial standards and boosting the effectiveness of financial administration. The localization of Odoo for Venezuela makes sure that the journals abide by regional accounting laws and norms. This involves following the General Accounting Plan (PGC) of Venezuela and the tax regulations set forth by the National Superintendency of Securities (SNV) and the tax authority of Venezuela.

Taxes are an essential part of financial management in Odoo, allowing companies to effectively manage tax compliance, reporting, and computations. Odoo's tax functions are tailored to match the unique requirements of Venezuelan tax rules when localized for the country, guaranteeing that businesses may accurately handle their tax responsibilities in compliance with local laws. Odoo's localization for Venezuela guarantees that tax reporting and computations comply with local tax legislation, including Value Added Tax (VAT) and other applicable taxes as specified by Venezuelan tax authorities. Businesses can avoid fines and keep accurate financial records by complying with this regulation. Configuring VAT rates according to Venezuelan regulations is possible with Odoo. Depending on the type of transaction, users can set up alternative VAT rates (such as standard, reduced, or exempt).

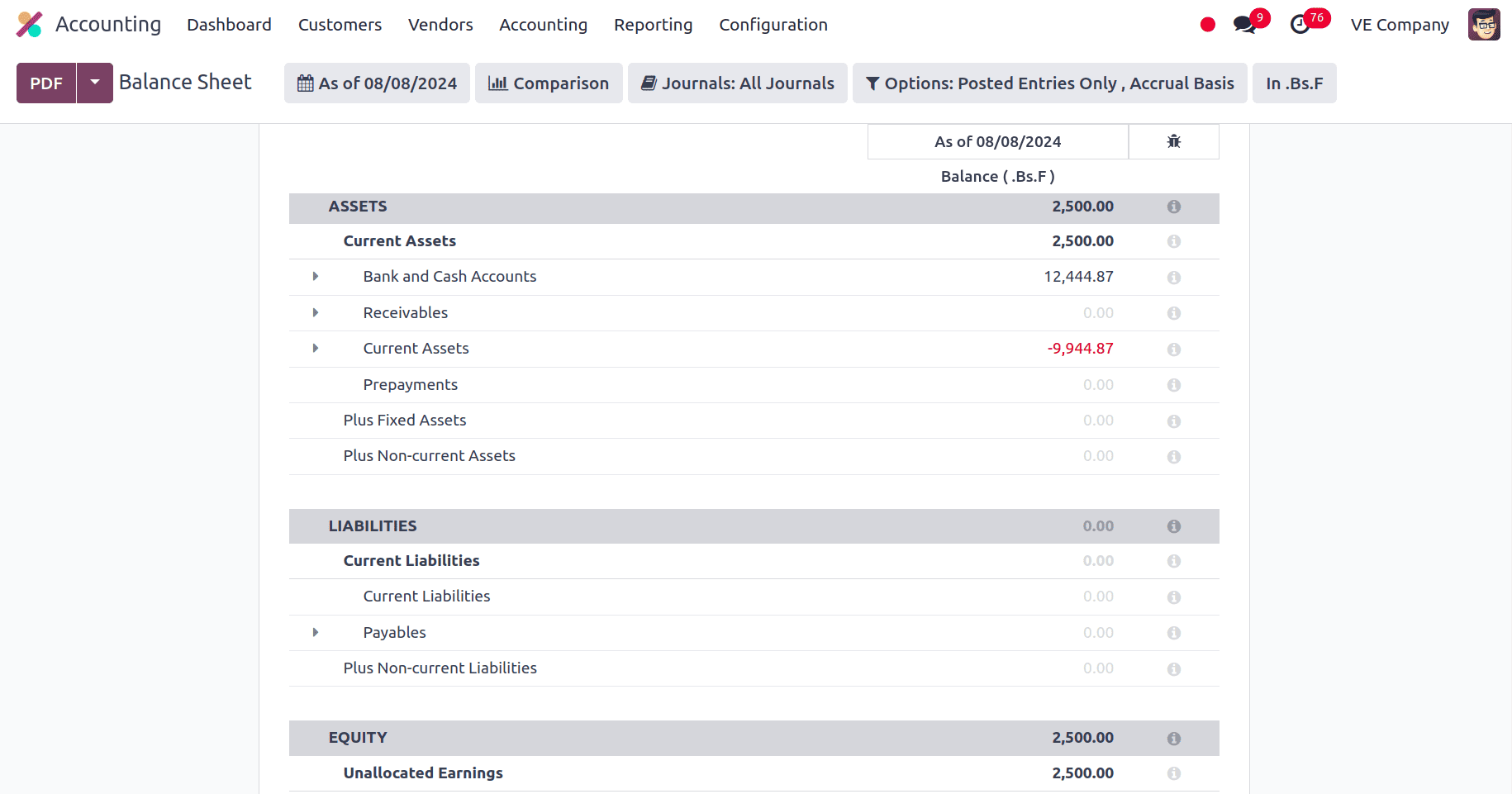

The Balance Sheet, one of the most fundamental financial documents, provides an outline of the financial situation of a business at a particular moment in time. For businesses operating in Venezuela, Odoo’s localization ensures that the Balance Sheet adheres to Venezuelan accounting standards and regulations, providing accurate and compliant financial reporting.

A business's receipts, expenses, and earnings for a specific period are summarised in the Profit and Loss Report, which is an essential financial document. Odoo's localization guarantees that the Profit and Loss Report complies with Venezuelan accounting requirements and offers precise financial data for companies doing business there.

The sections of the profit and loss report in Odoo are standard and mandated by Venezuelan accounting standards. A company's assets are its resources that are anticipated to generate future financial gains. Assets are handled and classified in Odoo to give a clear picture of the resources available to a business. In Odoo, current assets include:

* Bank and Cash Equivalents: This encompasses bank balances, petty cash, and short-term investments.

* Current Assets: Assets classified as current assets are those that are expected to be used up or converted into cash within a year.

* Accounts Receivable: Outstanding invoices from customers are tracked in the Accounts Receivable module, ensuring timely collection.

A company's liabilities are debts to other parties that eventually need to be paid off. Odoo categorizes liabilities to ensure they are managed and reported correctly.

* Current Liabilities: These are debts that have a one-year payoff deadline. Features of Odoo for current liabilities include :

1. Short-Term Loans: Odoo allows businesses to track short-term borrowings and their repayment schedules.

2. Accounts Payable: To guarantee on-time settlements, the Accounts Payable module assists in tracking and managing supplier payments.

3. Accrued Expenses: Odoo allows you to record costs that have been incurred but not yet paid, such as electricity or accrued salaries.

The amount of equity in a corporation that remains after deducting liabilities is its assets. It reflects the ownership value and is crucial for understanding a company’s financial health. In Odoo, equity management includes:

* Retained Earnings: Profits reinvested into the business rather than distributed as dividends are monitored and updated in the financial reports.

* Reserves: Odoo allows for the creation and management of reserves set aside for specific purposes, such as legal or contingency reserves.

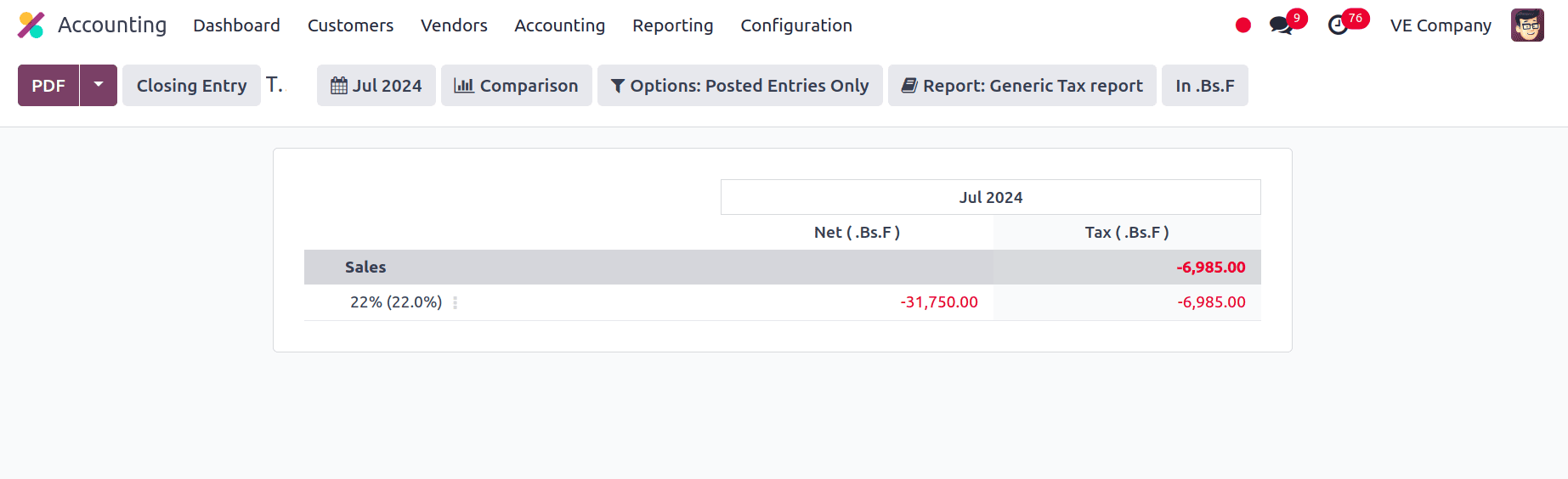

Tax Report

The Tax Report function in Odoo is a crucial tool for effectively managing and adhering to tax laws for organizations. In addition to guaranteeing proper reporting to tax authorities, this report provides a full perspective of a company's tax responsibilities by consolidating tax-related data. Value Added Tax (VAT), sales tax, and other municipal taxes are among the tax kinds that Odoo supports. To give a clear view of a company's tax responsibilities, the Tax Report compiles information from various tax categories. By gathering tax information from every transaction, the Tax Report helps prepare tax returns. It makes it easier to prepare accurate and timely tax submissions by providing a clear summary of tax responsibilities.

We have seen that Odoo's accounting localization for Venezuela provides companies doing business there with a thorough and customized solution. Through feature alignment with Venezuelan accounting standards and regulatory regulations, Odoo guarantees that businesses can effectively manage their financial processes while adhering to local laws. The Venezuelan localization of Odoo comes with a comprehensive Balance Sheet and Profit and Loss Report that follow local accounting standards, a well-organized Chart of Accounts, customized Journals, and particular Taxes. Businesses may more easily negotiate the intricacies of Venezuelan financial regulations thanks to this localized strategy, which makes tax reporting, asset management, and financial statement preparation simpler.

To read more about An Overview of Accounting Localization for Mexico in Odoo 17, refer to our blog An Overview of Accounting Localization for Mexico in Odoo 17.