What is accounting localization on odoo 17?

Odoo accounting localization makes sure that the program complies with national tax laws, accounting standards, and reporting requirements. Pre-configuring tax structures, fiscal positions, legal statements, and charts of accounts are all part of it. To make this process easier, Odoo offers a variety of fiscal localization packages. Businesses may effectively manage their money while adhering to local rules by utilizing localized Odoo.

Set up a Fiscal localization package for a company.

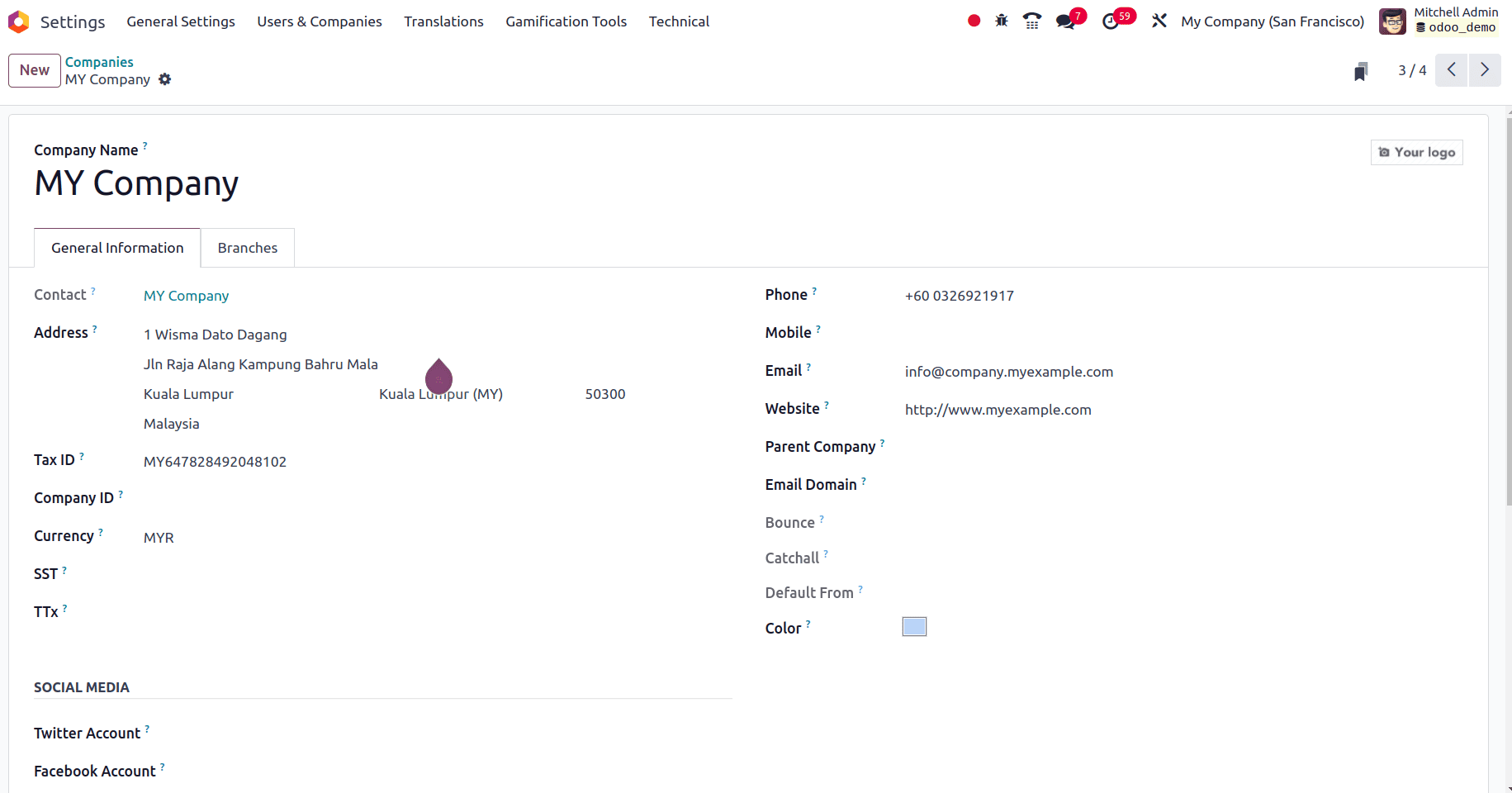

To set up a Fiscal localization for a company, just install the localization packages from Odoo Apps and move to odoo 17 General settings. We just need one company to provide these localization packages, so first we can create a new company. There is a Users and Company menu in the general settings, where you can form a new company. Under that menu, we have the company's sub-menu. Select the Companies submenu and just create a new company from there by clicking the New button. There you will get a form to fill in the whole details of the company like name, address of the company, country to which the company belongs, etc.

We can configure the nation for the business. Here, we have set the country for the company as Malaysia, and so that odoo automatically sets the currency for the company as Malaysian Ringgit (MYR), which is the official currency in Malaysia. At the same time, setting up the details of the company we want to set SST and TTs. SST stands for Sales and Service Tax. It's a consumption tax that Malaysia imposes on the selling of goods and services in Malaysia. TTs stands for Telegraphic transfers, It is a technique for electronically moving money between bank accounts. It's a swift and secure way to move money internationally. For a Malaysian company, a TT would typically involve transferring funds to an overseas account, often in a different currency. TTs are generally faster than other transfer methods. Setting up this company's country-specific localization package is the next stage. Proceed to the Odoo 17 accounting application in order to configure the country-specific localization package.

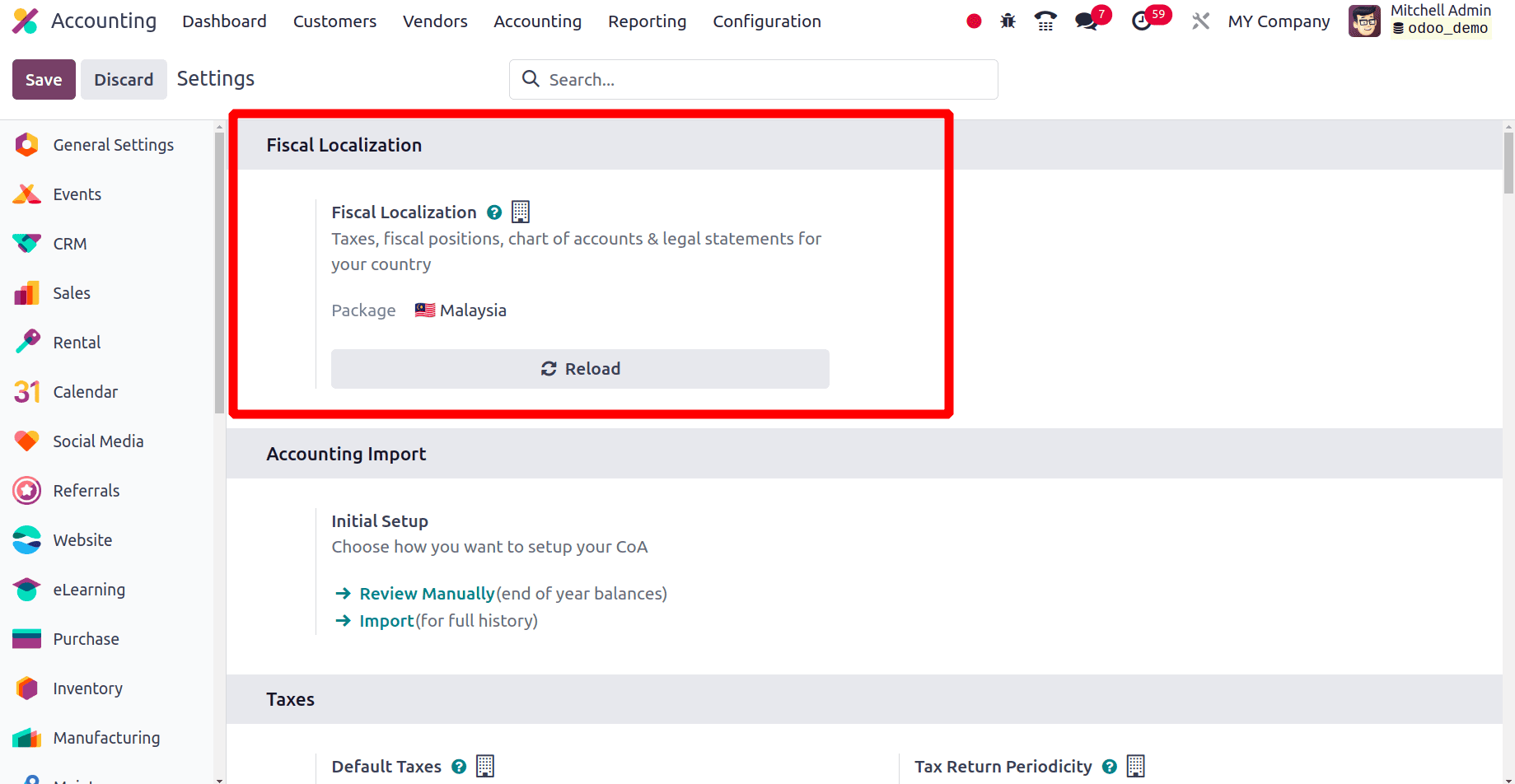

Under the configuration menu, select the Settings sub-menu, and in the Settings, we have the Fiscal Localization section. We can set the localization package for the company here.

Here, you can set the Fiscal localization package as Malaysia and click the save button to save the package for this company. Then let us see the changes happened when the localization package is set as Malaysia

changes happened when the localization package is set as Malaysia

In odoo 17 the main key features of accounting are the Fiscal position for the company, Journals of the company, Charts of Accounts, and the Taxes of the company. Let us begin with all these features.

Taxes

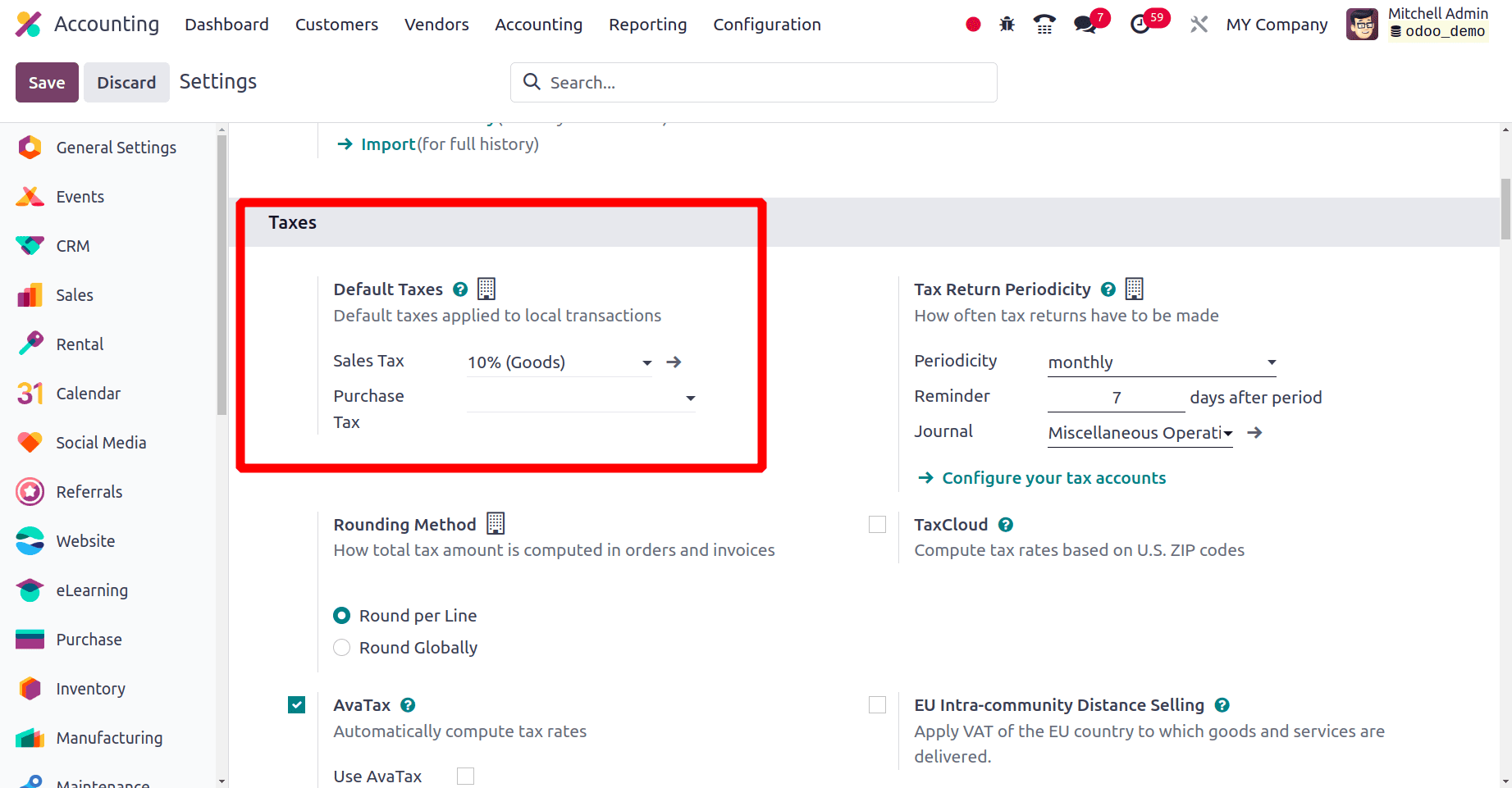

After the localization packages have been saved, Odoo automatically sets the Default taxes for the company. We have the ability to set the default taxes for the company within the Configuration > Settings Taxes section. But here, Odoo automatically sets the default tax for the company when the localization package is set as Malaysia because, for every country, there will be a default tax amount that should be applied.

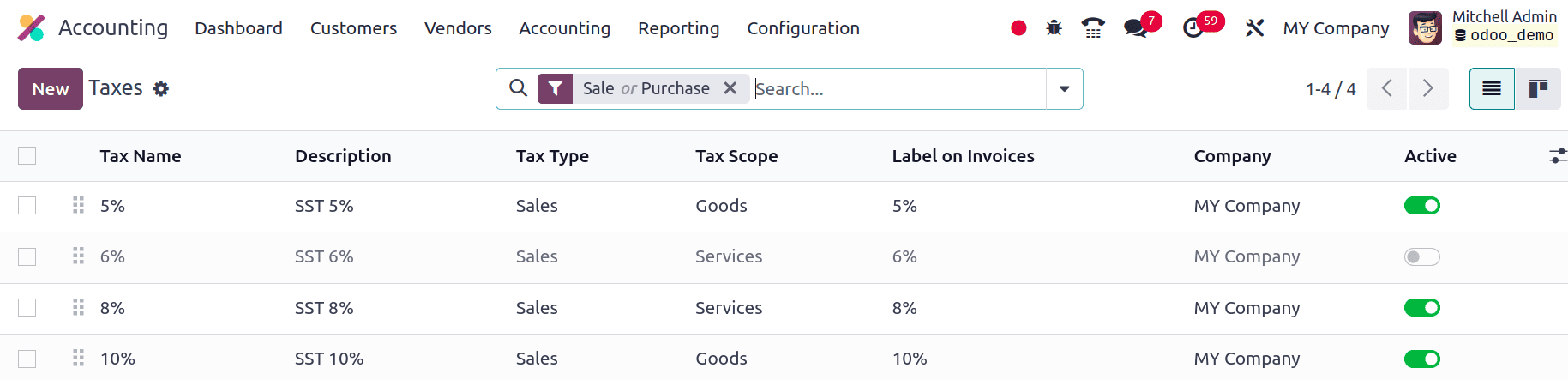

From the above screenshot, we can see that the sales tax for the company is set here by odoo, and we know that there is no general purchase tax in Malaysia as the sales tax. So ,only the Default Sales tax for the company is set here. When you navigate to the Taxes sub-menu under the Configuration menu, you can see a list of all the additional taxes that the Malaysian company can use.

In the description of each tax, you can see that SST is specified, which means the Sales and Service taxes are specialized for companies from Malaysia. By selecting the New option, you may also create new taxes for this company.

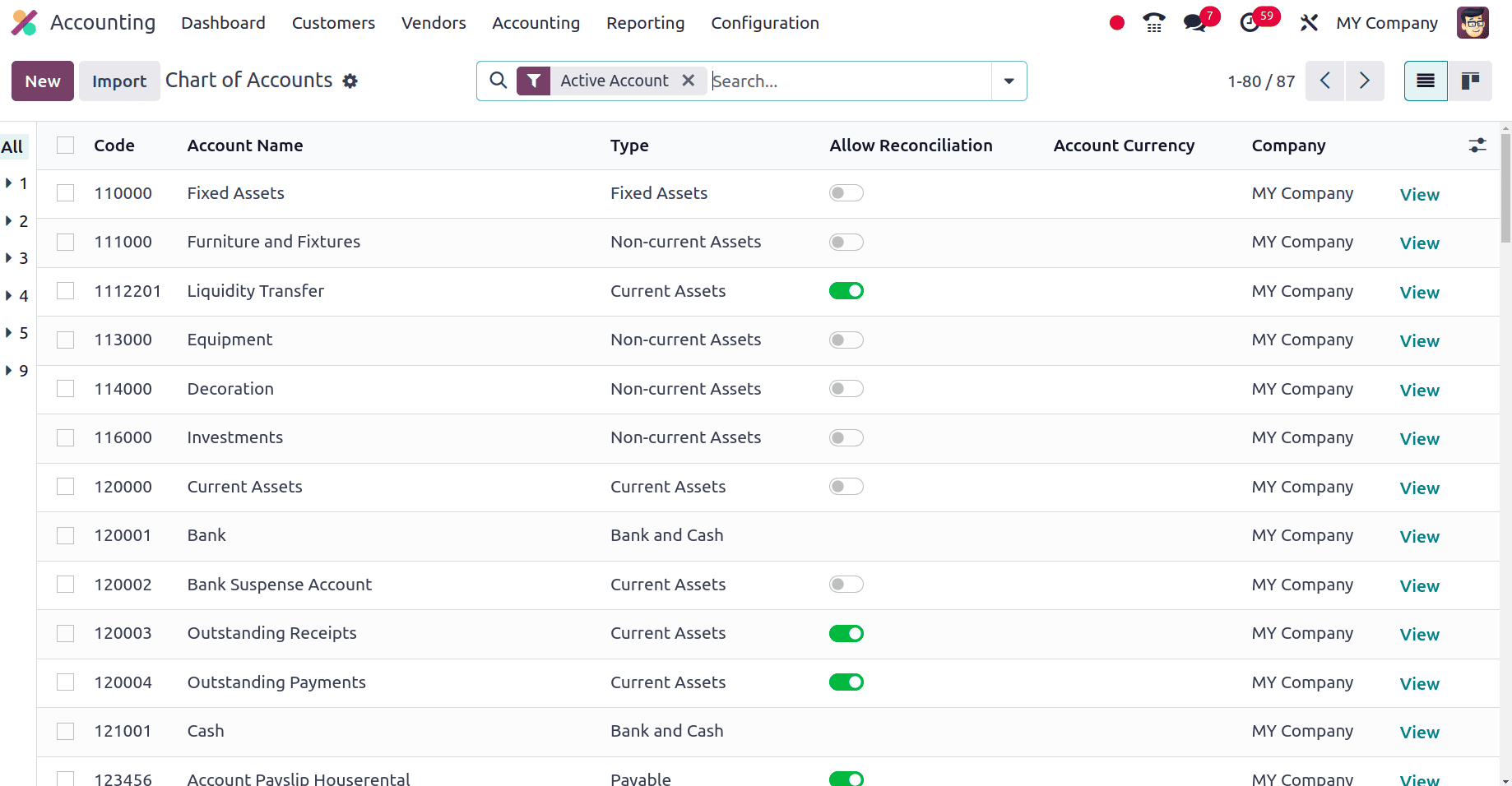

Chart of Accounts

Next is the chart of Accounts of this company. Under the Configuration, we have the Chart of Accounts sub-menu. When we click this Chart of Accounts sub-menu, odoo will provide a list of accounts that are specially configured for the companies from Malaysia.

There are mainly Assets accounts, Liability accounts, and Equity accounts. Fixed Assets, Current assets, investments, etc are included under the assets accounts. The liability accounts contain current liabilities, long-term liabilities, non-current liabilities, and so forth. Paid capital, Share capital, Retained earnings, reserves, etc are included under the Equity accounts.

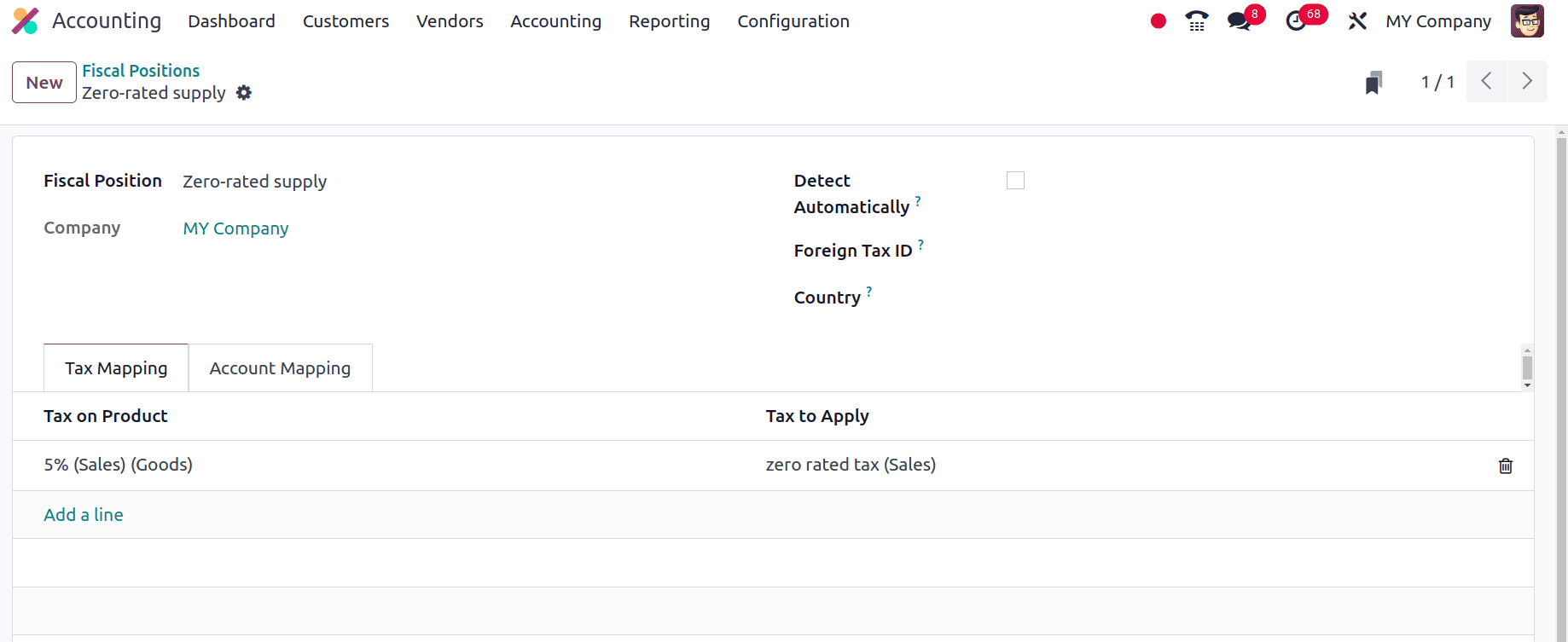

Fiscal position

Odoo 17, fiscal position is a useful feature that lets you modify taxes and accounts for a transaction according to a number of parameters, including location, product, and customer. This guarantees correct financial reporting and adherence to tax laws. Under the Configuration menu, you have a Fiscal position sub-menu. On clicking the fiscal position ,we can see all the Ffiscalpositions wthatare already configured for the company from Malaysia.

You can configure a new fiscal position for the company by clicking the New button. There, you have the option to map the Taxes and the Accounts of this company. Let's create a new Fiscal position for the company. First, click the New button and you will obtain a form to fill in the features of the new Fiscal position.

Here they are mapping the tax on products to a zero-rated tax so that any product with a 5% sales tax will be mapped to zero-rated taxes. We can also able to map two accounts similarly.

* Tax Mapping: In Odoo, tax mapping is the process of specifying, based on a number of factors, which taxes and accounts ought to be used for a given transaction.

* Account Mapping: Account mapping in Odoo refers to the process of assigning specific general ledger (GL) accounts to different types of transactions or business operations. This is essential for producing accurate financial reports and keeping correct financial records.

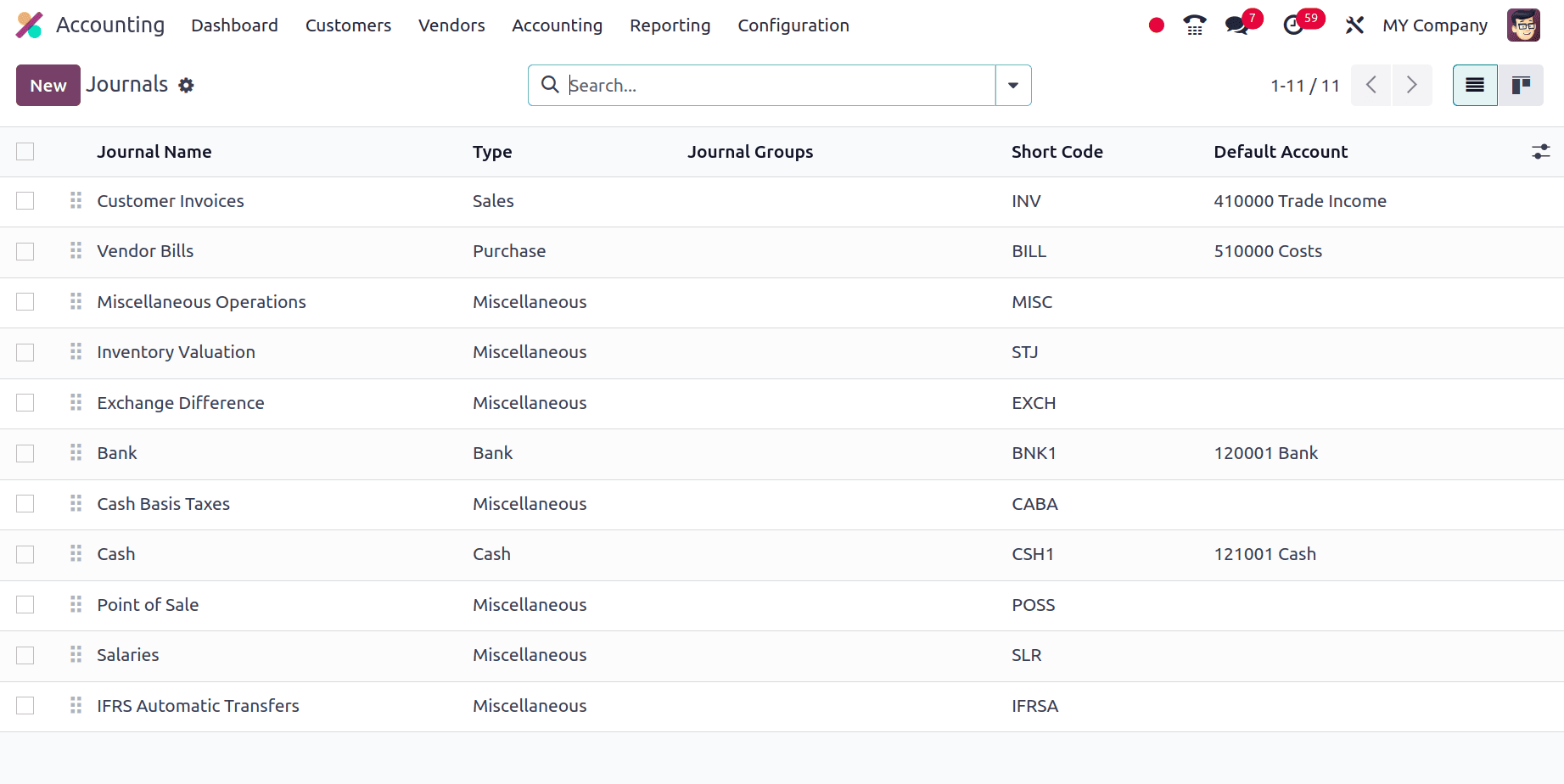

Journals

In Odoo 17, journals serve as virtual ledgers where you can keep track of all of your financial activities. They act as your accounting system's skeleton. Under the Configuration menu, we have a Journals sub-menu. When we choose the journals submenu all the journals that are already created will be visible there.

There are mainly five types of journals Cash, Bank, Sale, Purchase, and Miscellaneous.

* A cash journal in Odoo is used to record all cash-based transactions within your business. This includes both cash inflows (receipts) and outflows (payments).

* Bank journals in Odoo are specifically designed to record all transactions related to your bank accounts which include deposits, withdrawals, Bank transfers, etc.

* In Odoo, a special ledger called the Purchase Journal is used to keep track of all transactions pertaining to vendor purchases. It acts as a central repository for monitoring and controlling the liabilities of your business.

* In Odoo, a special ledger called the Purchase Journal is used to keep track of all transactions pertaining to vendor purchases. It acts as a central repository for monitoring and controlling the liabilities of your business.

* The Miscellaneous Journal in Odoo is a versatile tool used for recording financial transactions that don't fit into the standard categories of sales, purchases, cash, or bank journals.

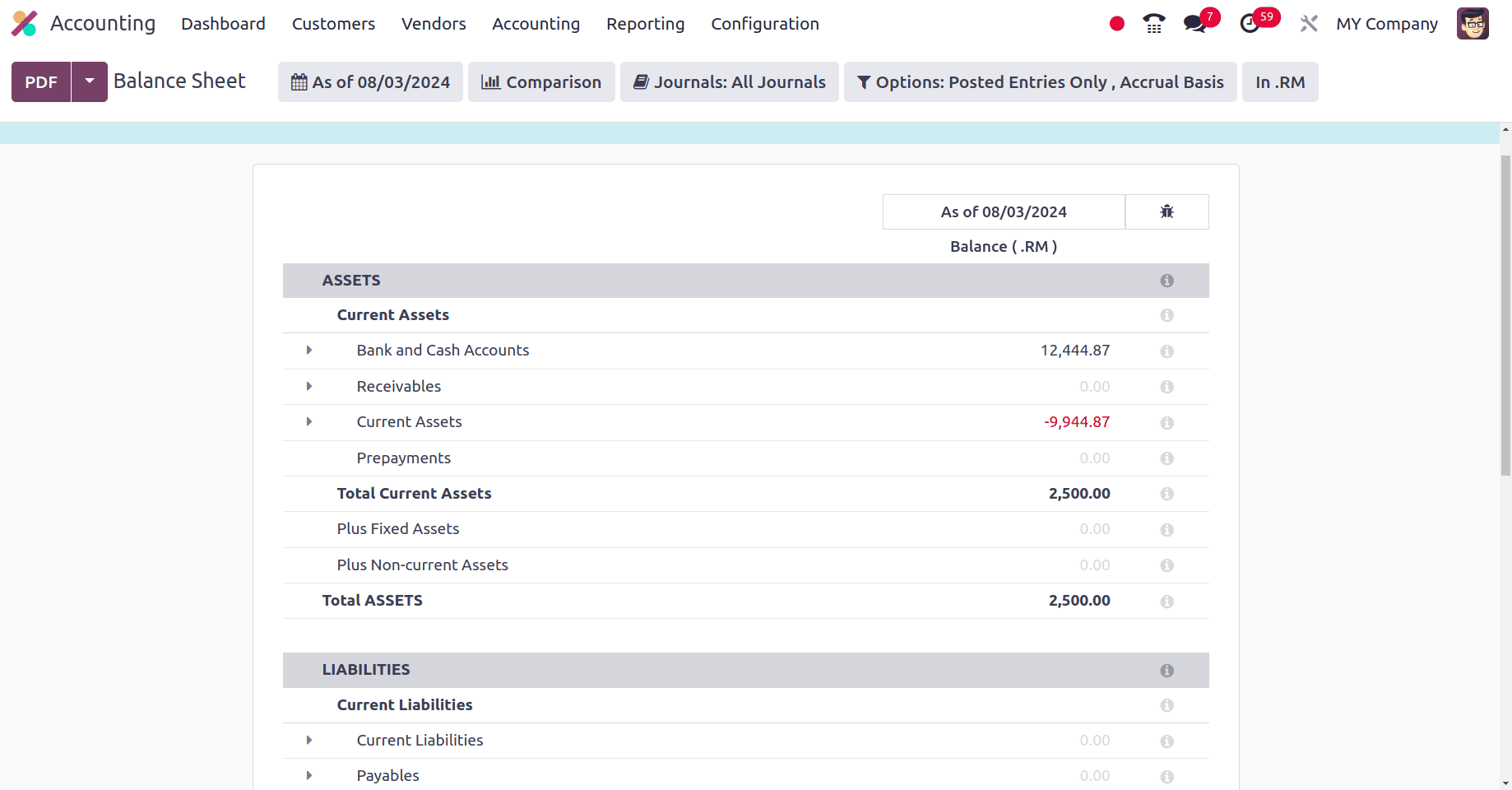

The company's balance sheet is available under the Reporting menu. In Odoo, the balance sheet is a key financial statement that shows the financial health of a business at a particular moment in time. It enumerates the business's equity, liabilities, and assets. The balance sheet sub-menu is located under the Reporting menu. Select the balance sheet to acquire the company's balance sheet.

In the balance sheet, the company's assets, liability, and equity are specified. At the top of the balance sheet, you can see that the currency used is also specified. Current assets, Rreceivables Pprepayments Pixed assets, eetc.,are included in the current assets. You will get the reports of current liability, payables, noncurrent liabilities, etc, from the liability section of the balance sheet. Under the Equity section of the report, you will get the unallocated earnings, current-year earnings, retained earnings, etc.

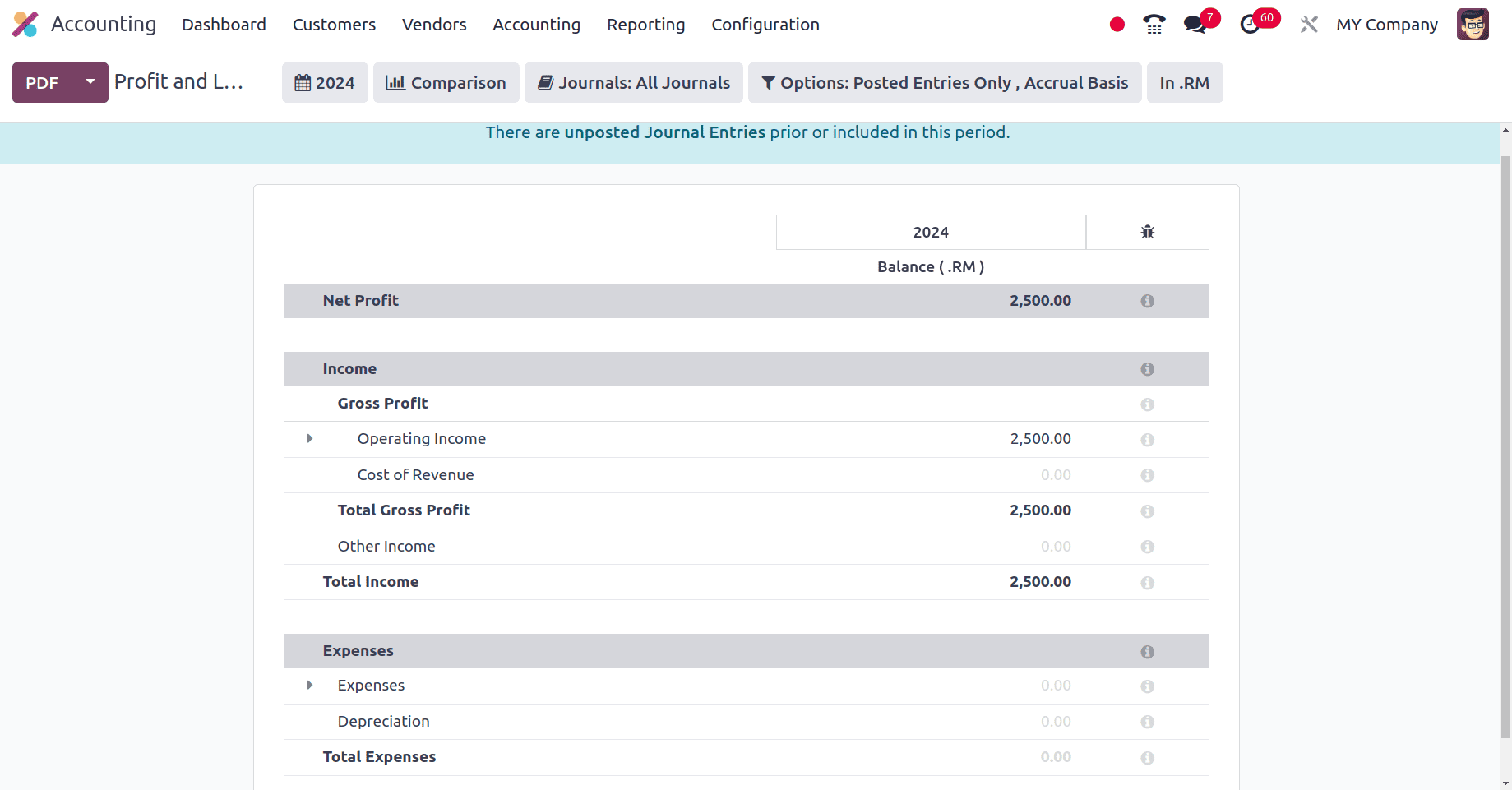

The company's profit and loss report comes next. We have the profit and loss submenu under the reporting menu. The Odoo profit and loss report offers a thorough summary of the financial performance of your business over a given time frame. It outlines your revenues, expenses, and the resulting profit or loss.

The company's revenue and expenses are listed in the profit and loss report. The profit and loss report's income section includes operating income, cost of revenue, other incomes, etc., while the expense portion includes expenses like depreciation.

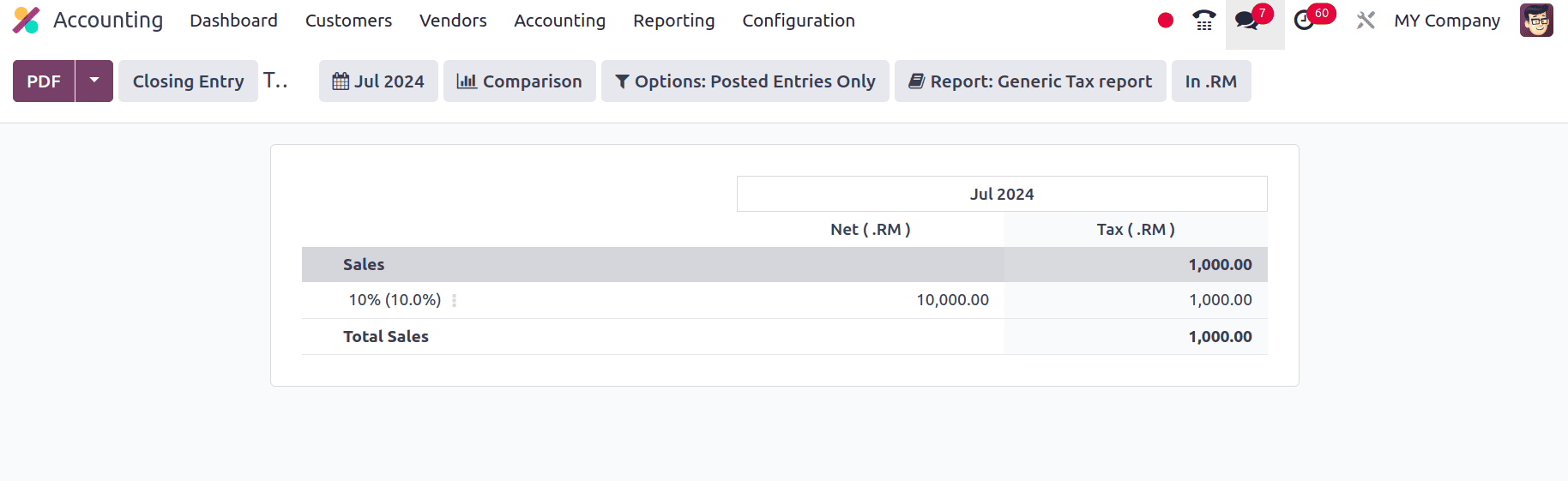

The company's tax report is available under the reporting menu. Sales tax reports, purchase tax reports, and all other tax reports of the company are shown in the tax report of the company.

Odoo's tax reporting capabilities Ensure precise tax computations based on defined tax rates, exemptions, and rules. Facilitates compliance with complex tax laws for organizations by automating computations and producing required reports. Reduces manual effort and errors associated with tax calculations and reporting.

Businesses navigating the complex accounting landscape of Malaysia can benefit from Odoo's reliable and effective localization. With capabilities customized to local company practices, financial reporting requirements, and tax laws in Malaysia, Odoo helps organizations increase compliance, streamline financial processes, and make well-informed decisions.

To read more about An Overview of Accounting Localization for Singapore in Odoo 17, refer to our blog An Overview of Accounting Localization for Singapore in Odoo 17.