Accounting localization in Odoo 17

In Odoo, accounting localization is the feature set that modifies accounting functions to conform to the unique tax laws, chart of accounts, and financial reporting specifications of a given nation. Through Odoo 17 accounting localization, you ensure that the tax laws, financial reporting specifications, and country-specific chart of accounts are followed in your accounting procedures. By doing this, the chance of mistakes, fines, and legal problems is reduced. Odoo 17 calculates taxes automatically using your nation's tax rates, codes, and laws. This gets rid of repetitive calculations and any mistakes.

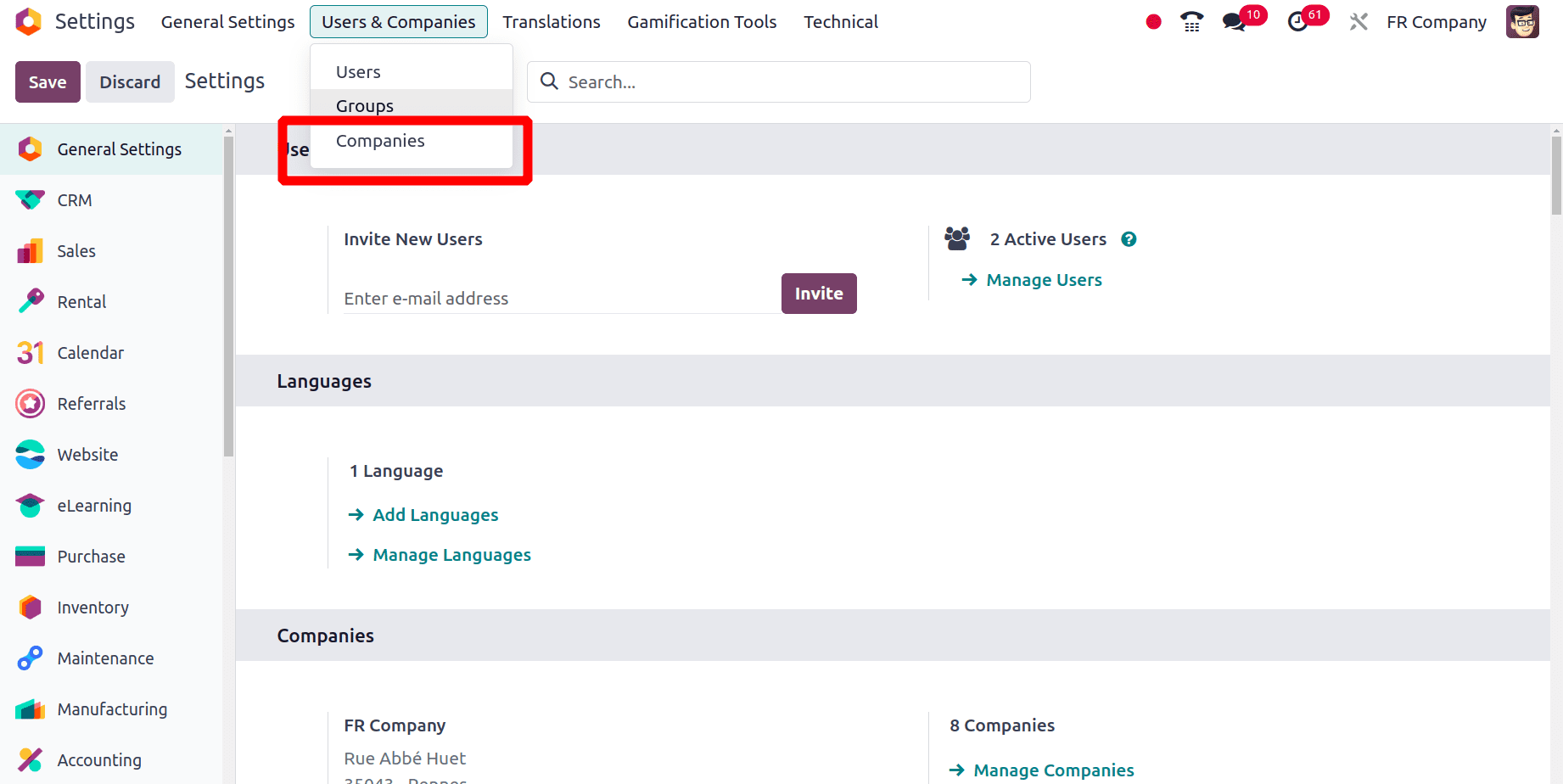

Through this blog, we can go through the accounting localization for a French company in Odoo17. To do that, we first need to set up a France-based company. So to set up that company, move to the General settings of Odoo 17. Under the Users and Companies menu, choose the Companies sub-menu.

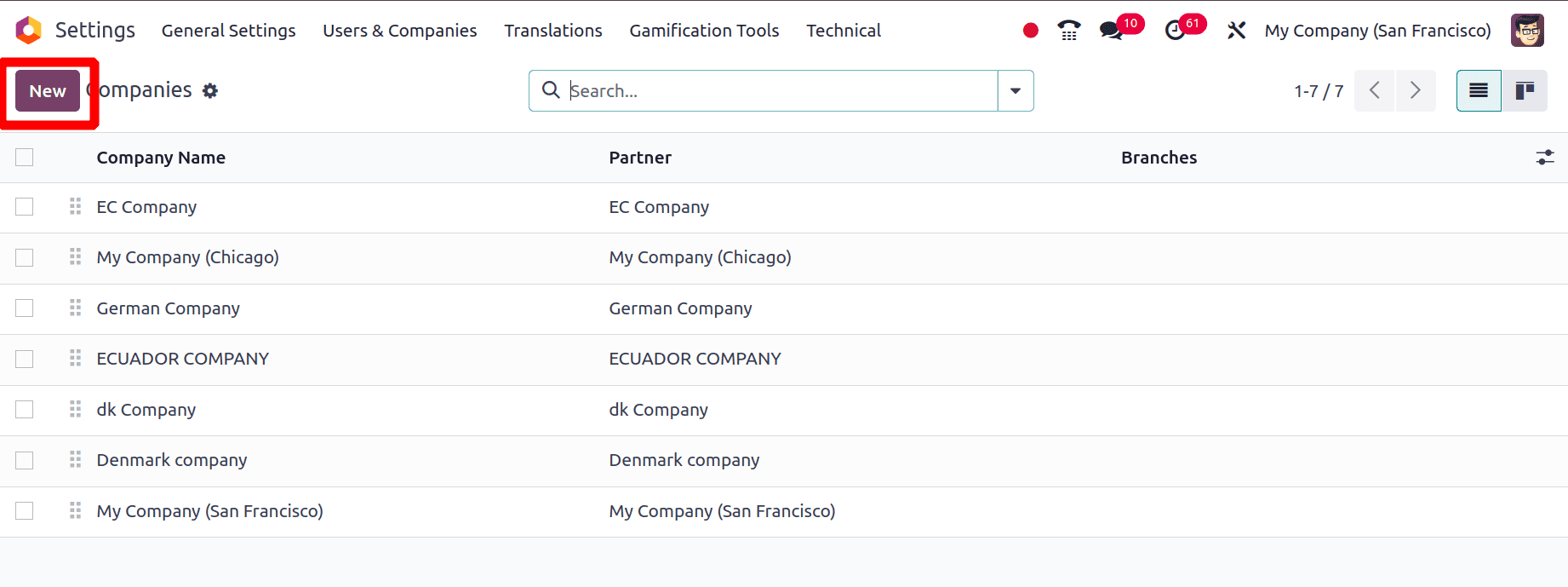

There we can see a list of companies that are already created. From there, we have the option to create a new company by clicking the New button.

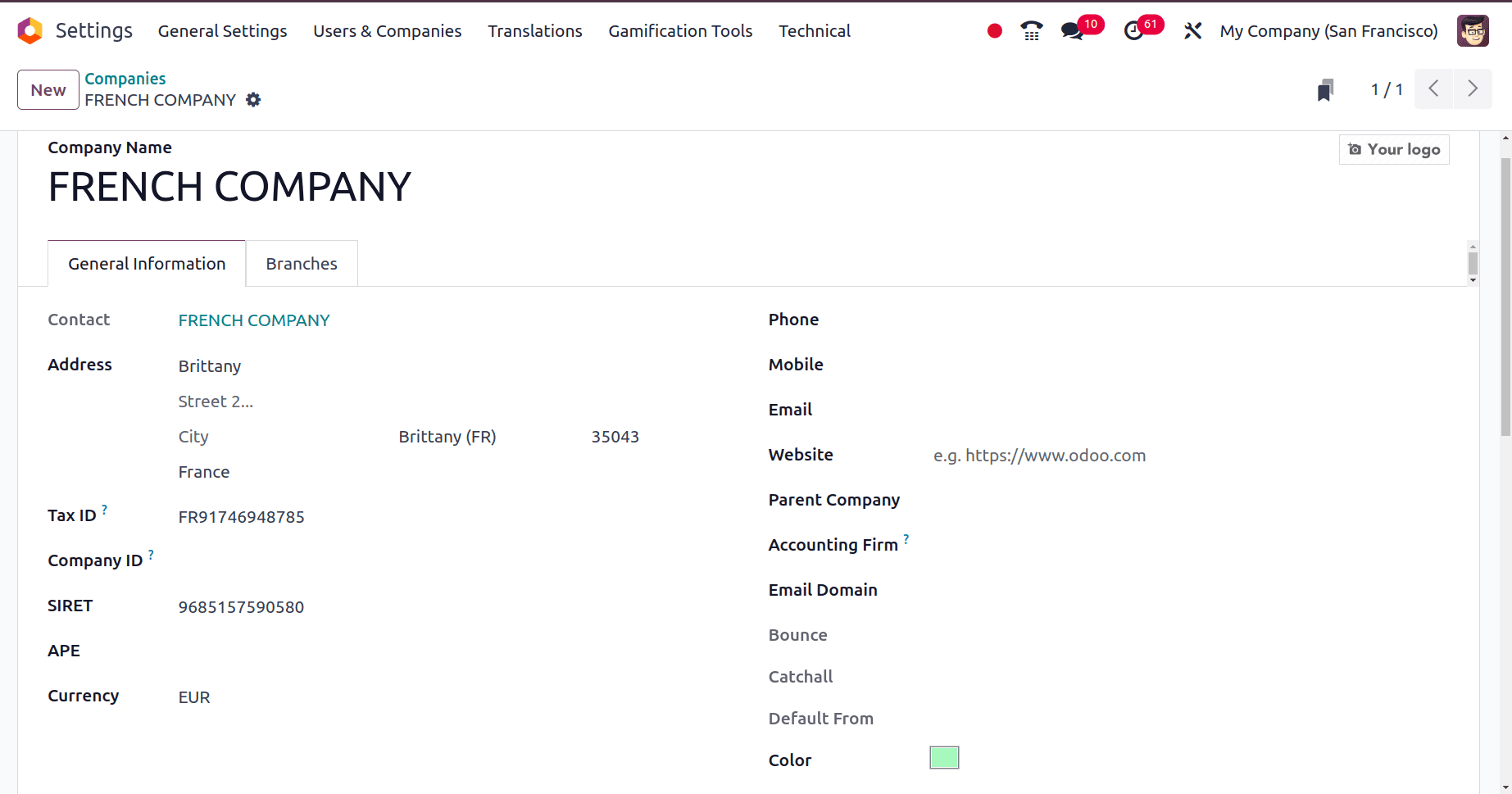

Then we will be directed to a new form where we can provide the details of the company that we are going to create.

In the form, provide the name of the company, the address of the company, the country in which the company belongs, the tax ID, SIRET, APE, etc.

* SIRET is a unique 14-digit code that French firms use to identify themselves. It is essential to French corporate procedures and administration. The SIRET number is frequently utilized in Odoo 17 for partner management, especially when interacting with French businesses.

* APE is a code used in France to identify a company's primary business activity. It's based on the French official classification of economic activities.

We know that the currency used in France is Euro (EUR) and from the above screenshot, we can see that the currency for the company is automatically updated as Euro by Odoo 17.

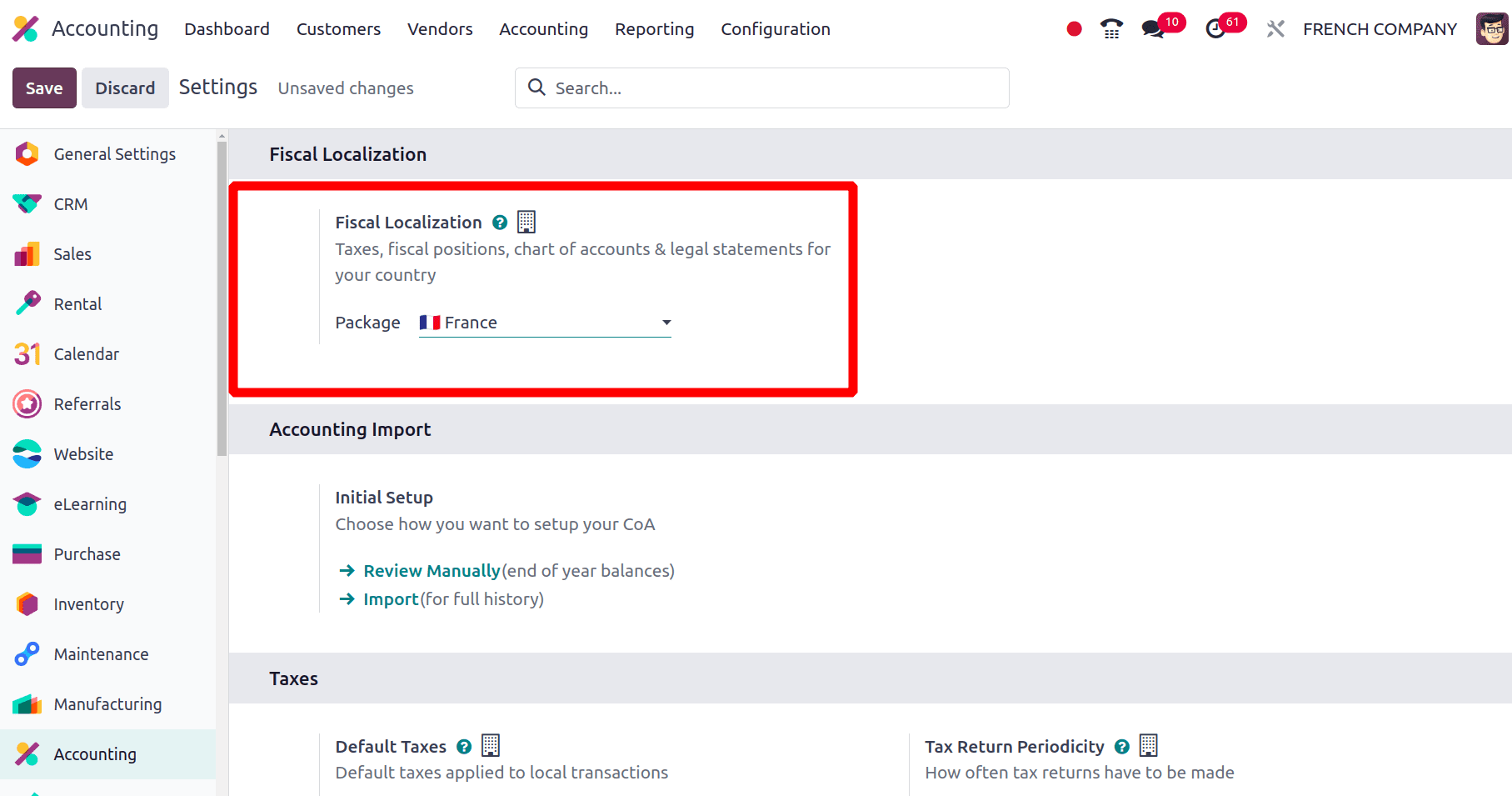

The next step is to set up the company's localization package. Move to the Accounting module of Odoo 17 to set the package. In Configuration > Settings of Odoo 17, under the Fiscal localization section, we can configure the package as France and click the Save button to save it.

Changes formed on setting the France localization package in Odoo 17

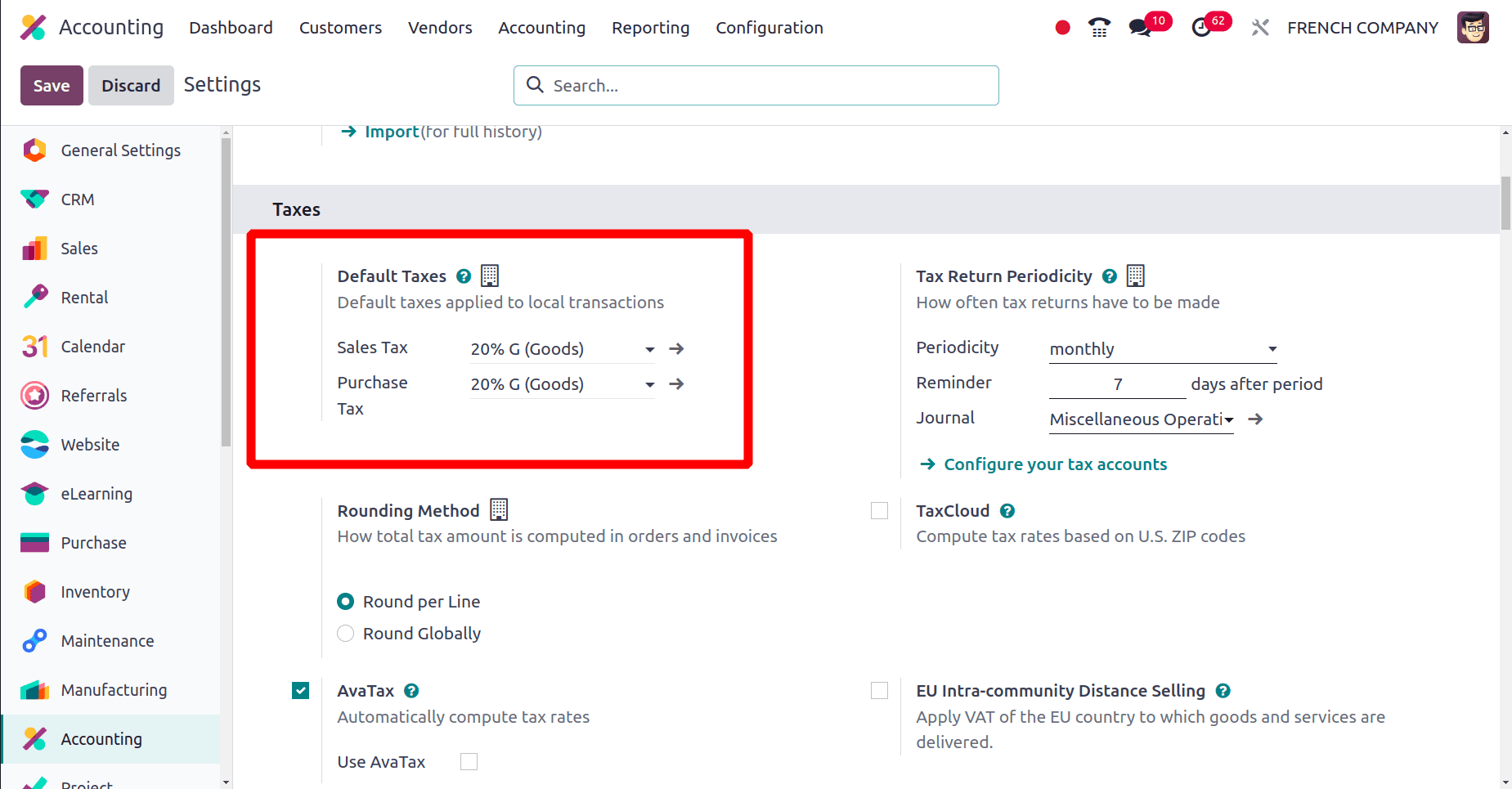

Move to the Taxes section under the Configuration Settings, and there we can see a default taxes field. Default Sales Tax and the Default Purchase Taxes are provided there.

The default Sales tax and the Default Purchase Tax used by all the companies in France are 20% G (Goods). From the above screenshot, we can see that the sales and purchase taxes are set as 20% G (Goods), and this is configured by Odoo 17 automatically when the localization package is saved as France.

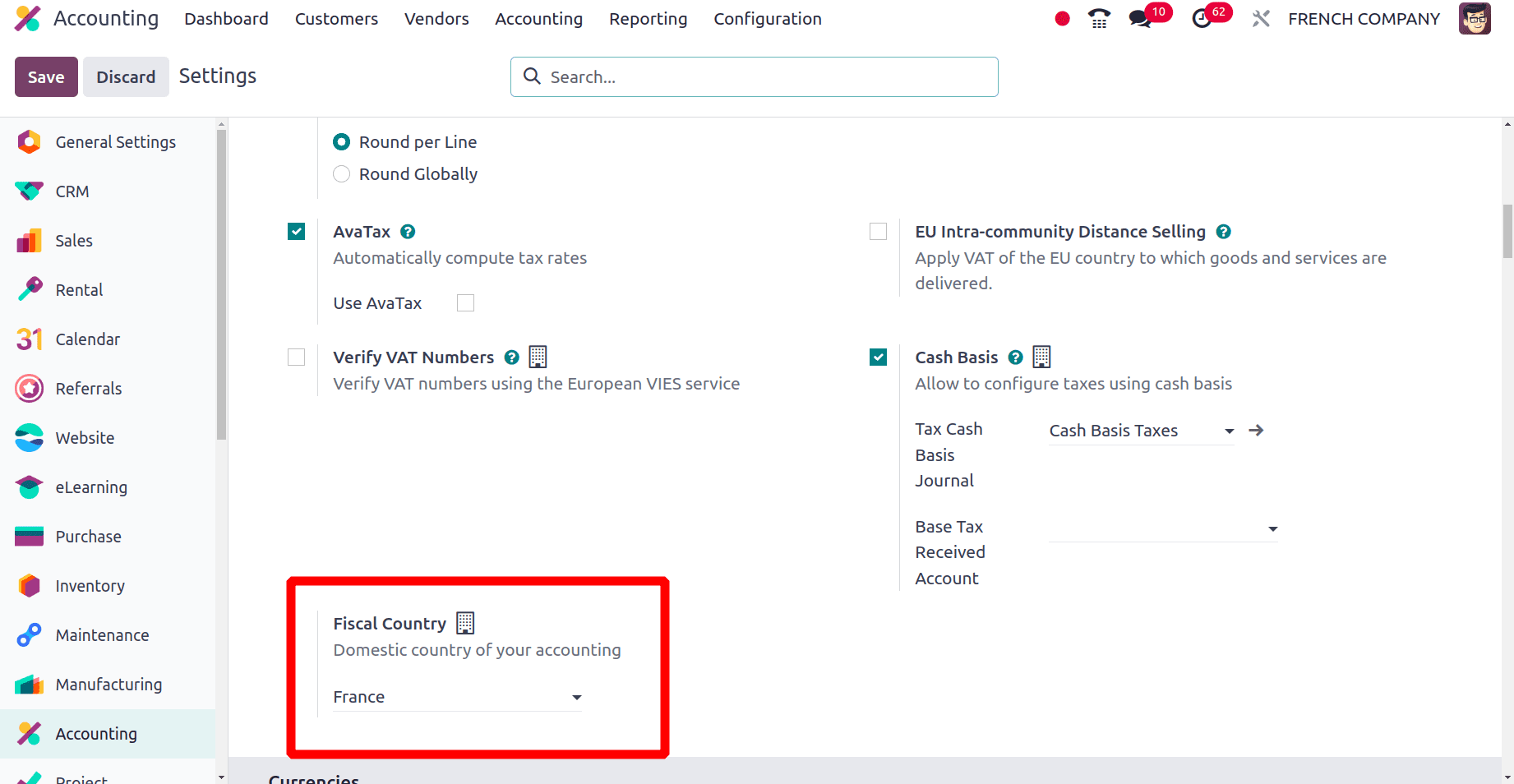

Under the taxes section of the Configuration settings, there is a Fiscal Country field. Fiscal country refers to the country where a business has its tax registration.

Odoo 17 automatically sets the Fiscal Country as France when the package for the company is set as France. Then move to the currencies section in the Configuration Settings.

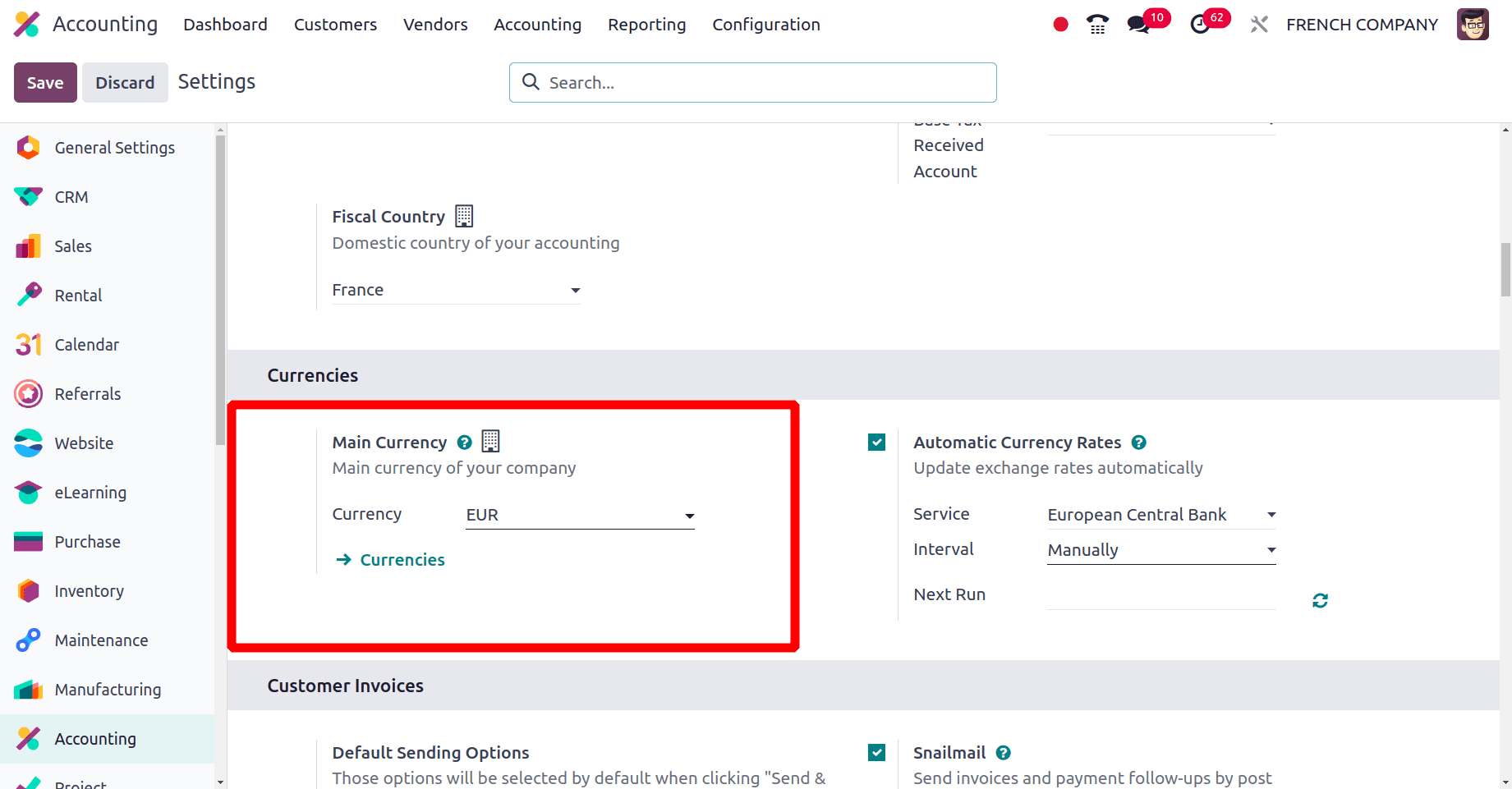

There we can configure the Main Currency for the company, but Odoo 17 spontaneously sets the main currency of the company as the Euro when the France localization package is saved.

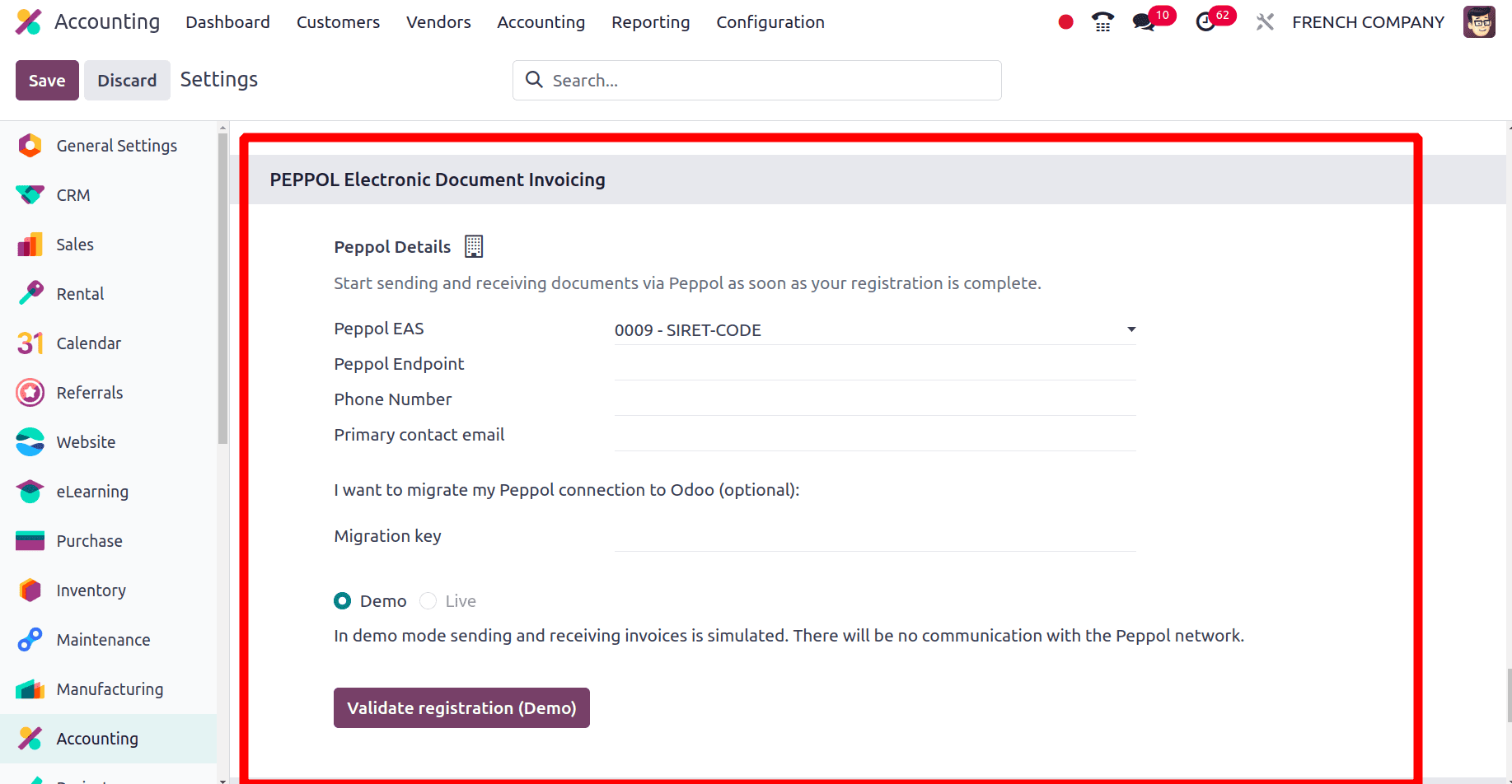

An extra section PEPPOL Electronic Document Invoicing is added to the Configuration settings in which PEPPOL is an international system and protocol that makes it easier to send and receive electronic business documents securely and uniformly between countries. PEPPOL, which was first created as an EU standard, has expanded to include a greater number of nations, making it an invaluable resource for companies of all sizes trying to expedite electronic invoicing.

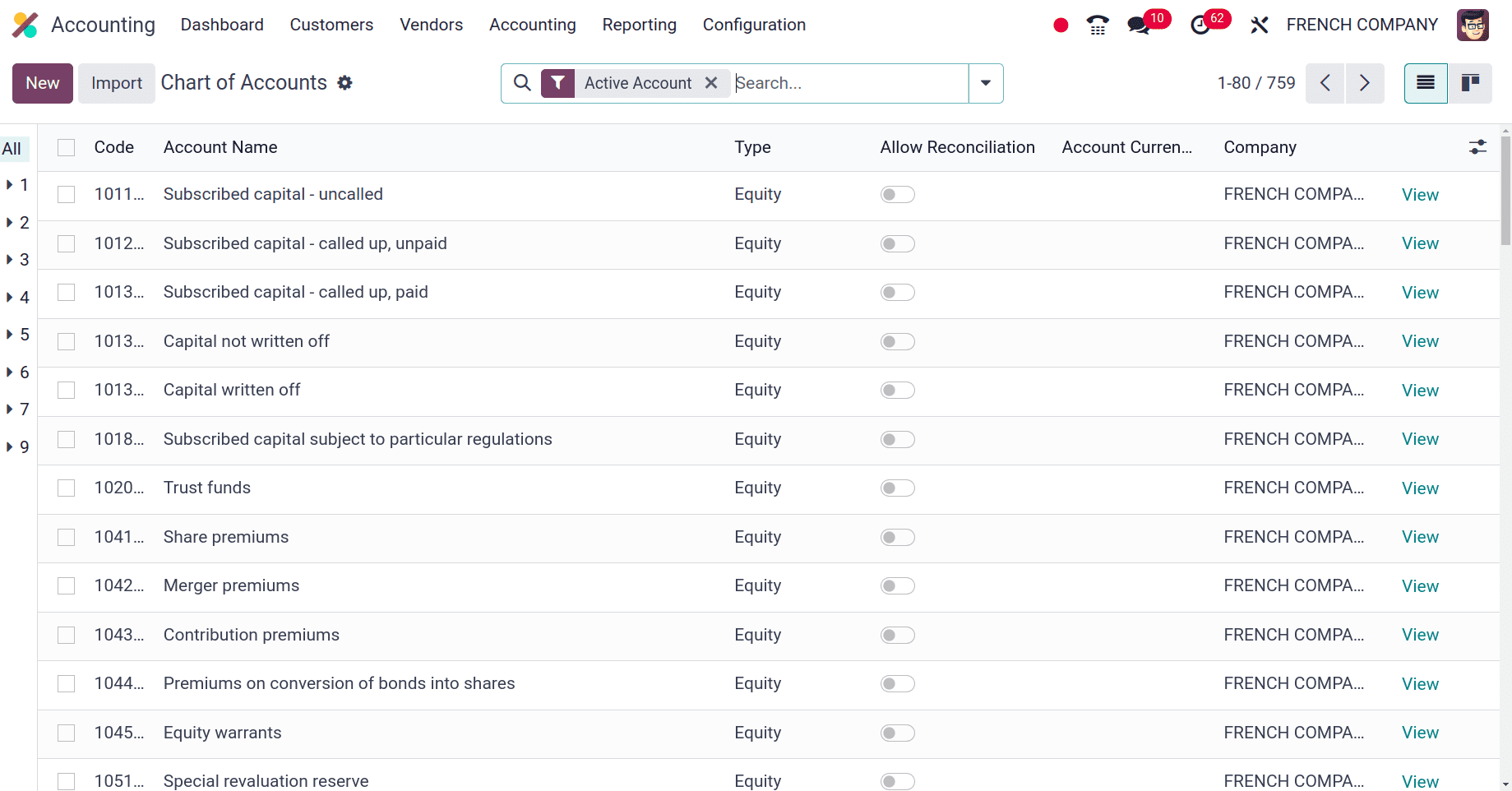

The next is the Chart of Accounts of the companies in France. Each country uses its own specific accounts for its different specific business needs, and it may vary from country to country. The different accounts used by the companies in France are shown in the screenshot below.

* Subscribed capital - uncalled is used to describe the part of a company's capital that has been authorized by its shareholders but has not yet been subject to payment demands.

* Capital not written off refers to accounts that, after losses or payments, represent a company's equity or shareholders' cash that has yet to be diminished or exhausted.

* Share premiums represent the difference between a share's par value and its issuing price.

* Revaluation reserve accounts are used to record the difference between the current value of an asset and its carrying amount (historical cost minus accumulated depreciation).

These are some of the accounts used by the companies and their usage. The next are the taxes that businesses in France can use to meet their needs.

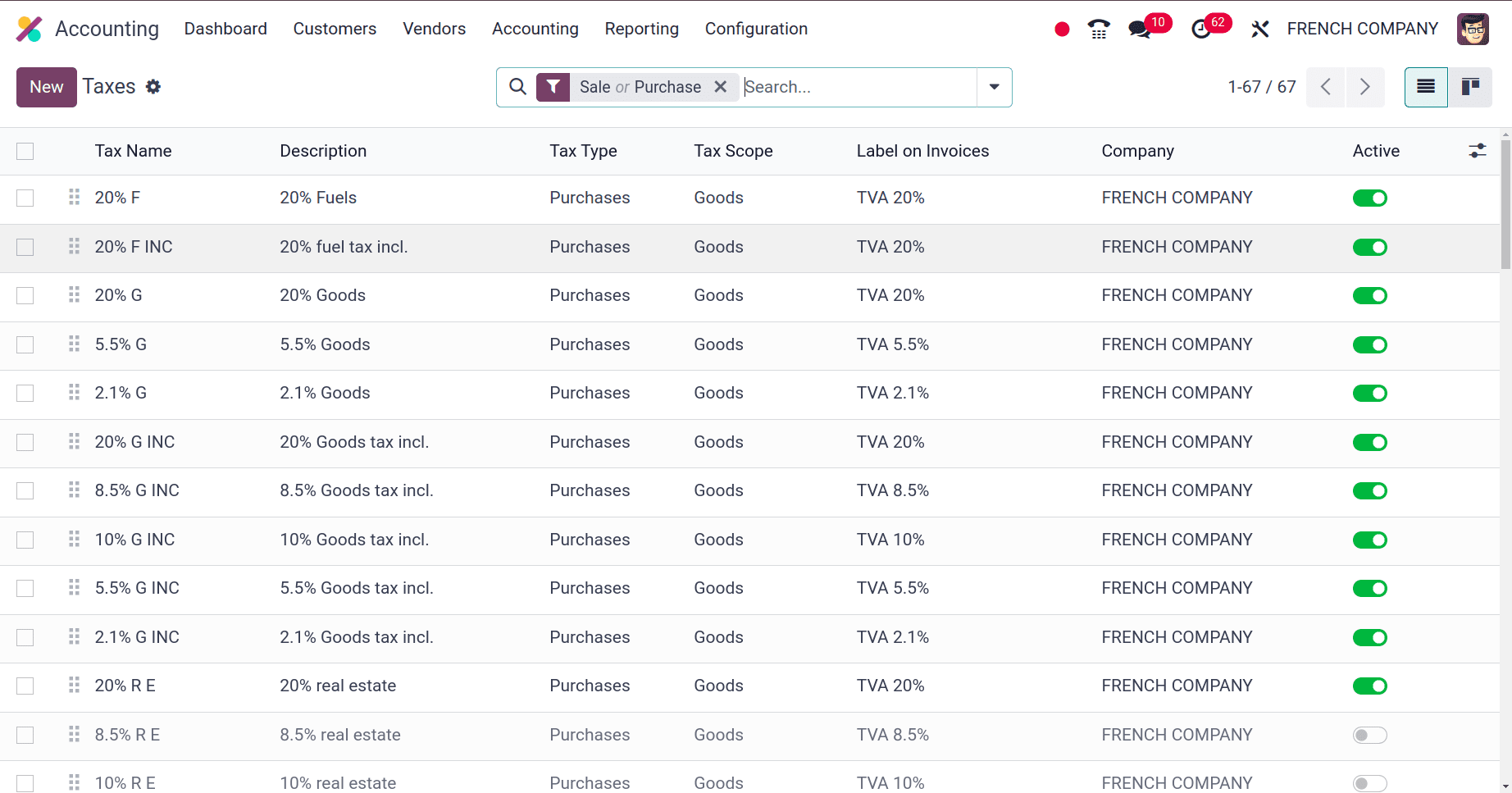

In the list, there will be different sales taxes and purchase taxes, and the companies can use these taxes for different needs.

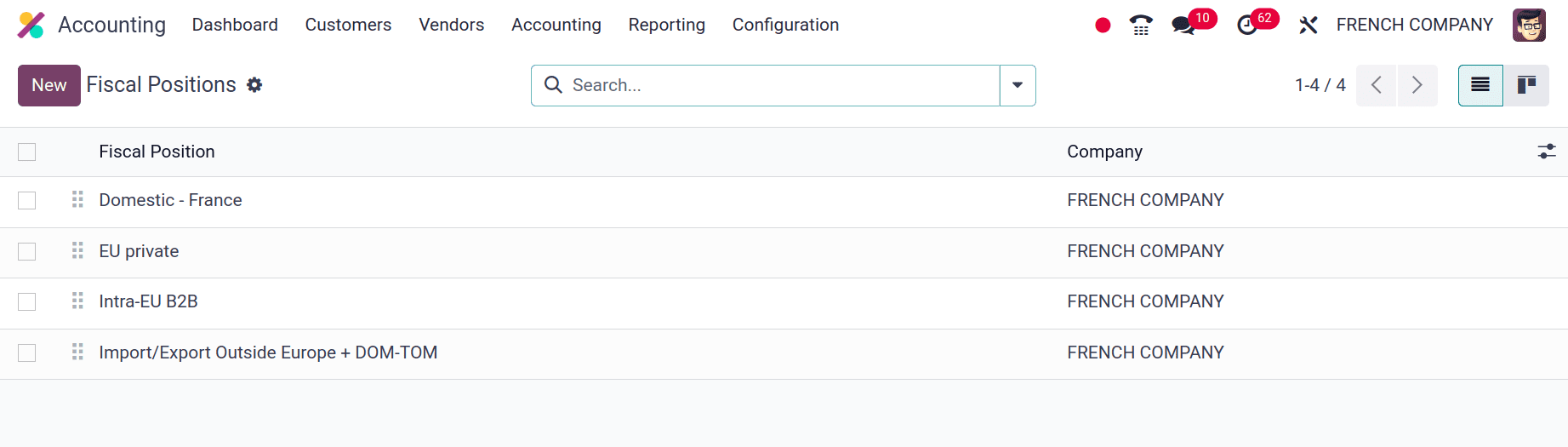

These are the fiscal positions used by the companies in France to map their taxes or accounts from one to another.

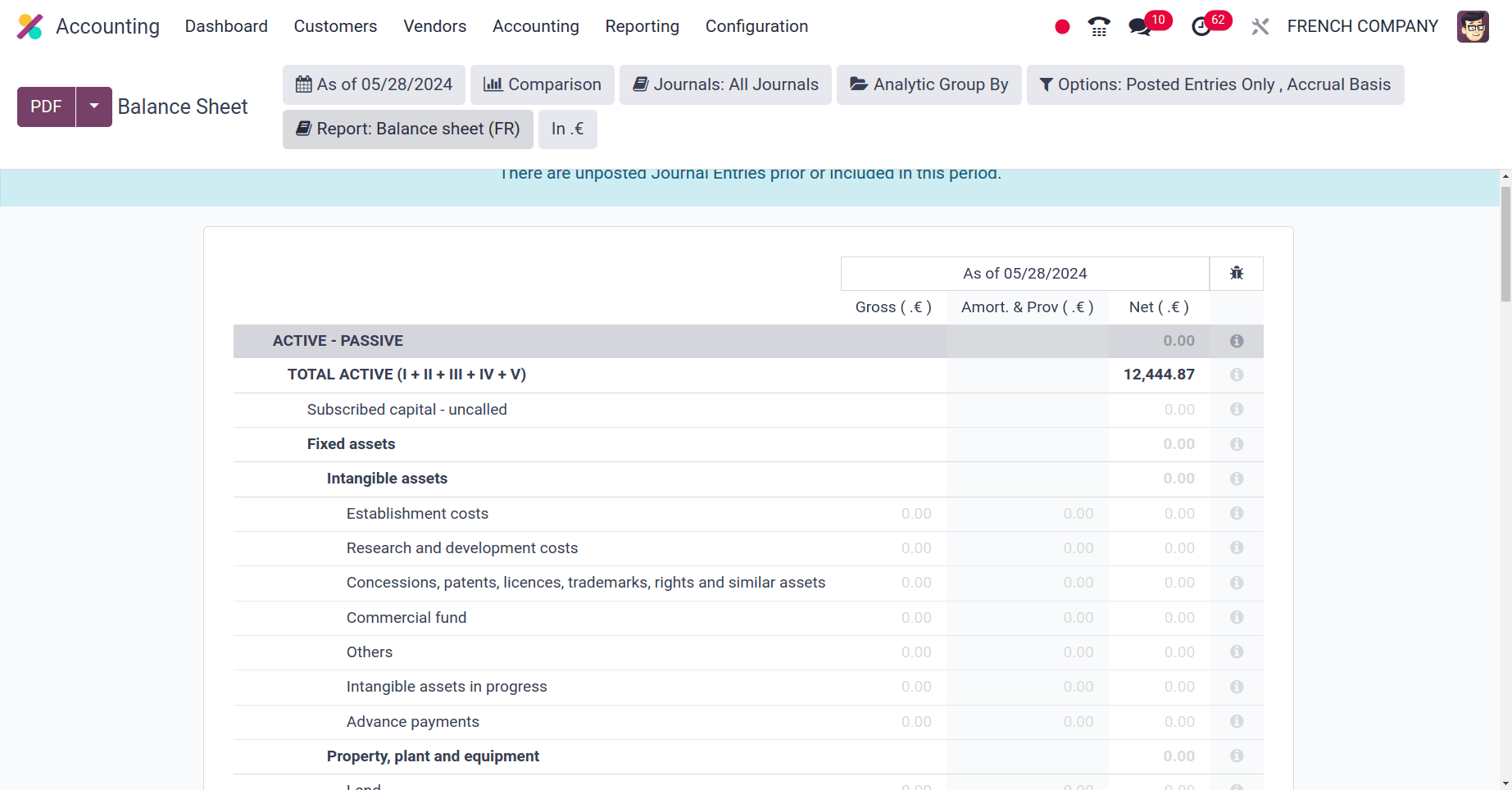

A balance sheet in Odoo is a financial statement showing the state of your company's finances as of a particular date. It provides an overview of your company's assets, liabilities, and equity, highlighting what it owns (assets), owes (liabilities), and the difference that represents the owners' claim (equity).

The balance sheet of the companies in France includes Intangible assets, Property, Plant and equipment, Financial assets, Marketable Securities, etc.

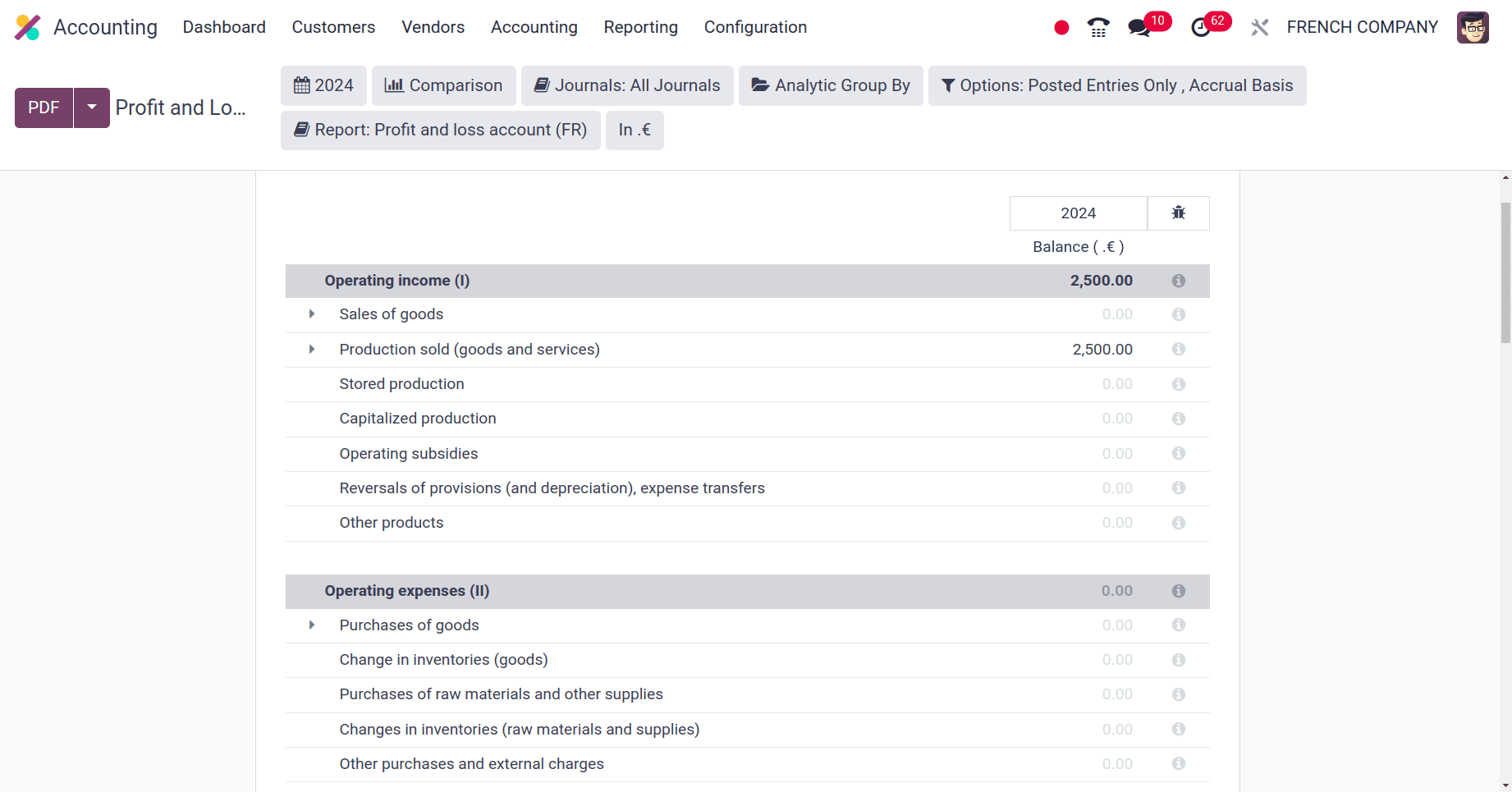

The profit and loss report in Odoo shows the complete profits and losses earned by the companies over a specific period of time. This report mainly shows the financial year.

The profit and loss report of the companies in France includes Operating Income, Operating Expenses, Share of Profit on Joint operations, Financial Income, Financial Charges, etc.

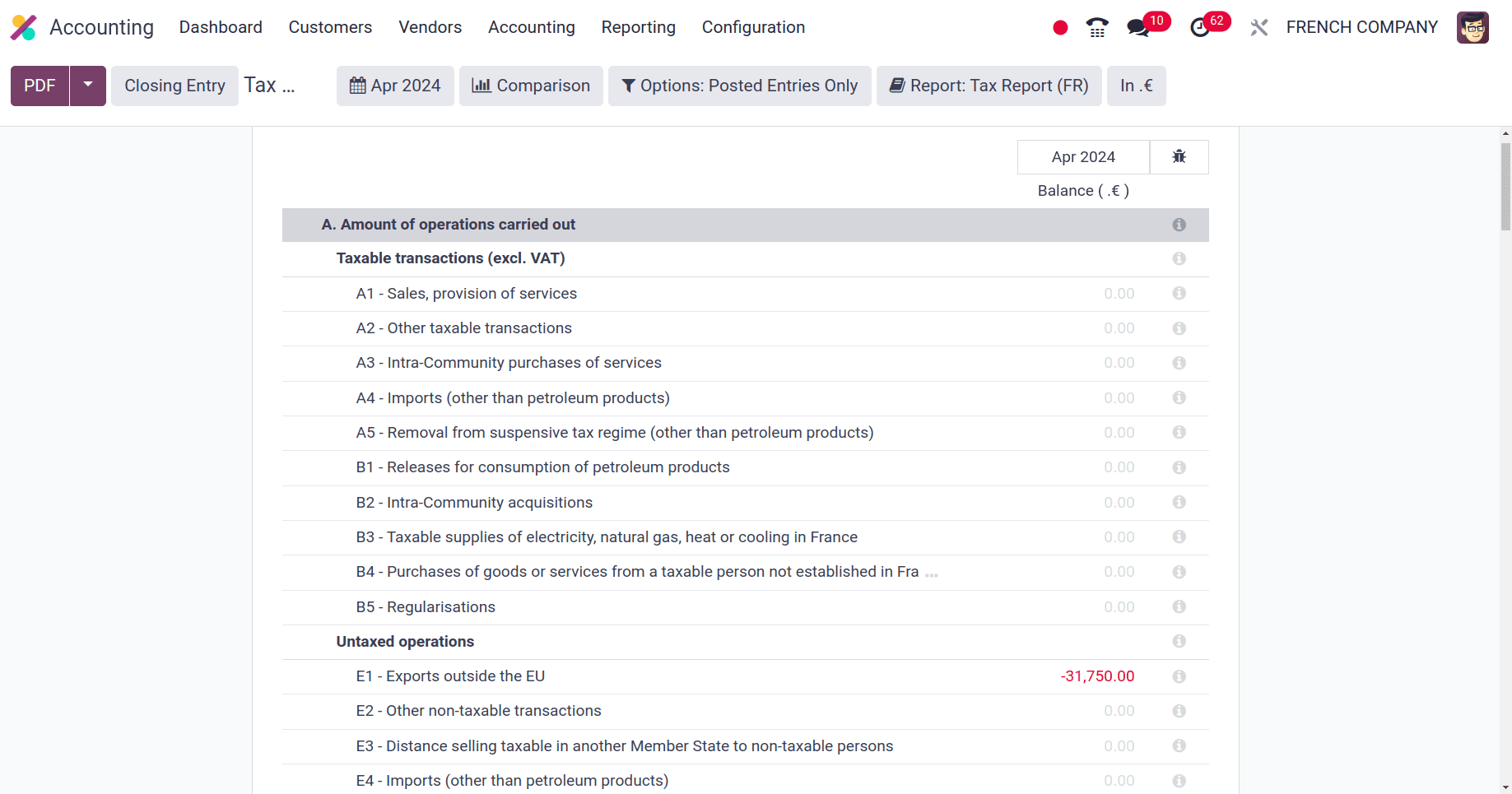

The Tax report of a company in Odoo is a recorded account of the tax data for your business for a given time period. It assists you in scheduling payments, calculating your tax liabilities, and maybe filing for a tax return.

Taxes reported by different companies from different countries may vary. The tax report used to represent the data by the companies from France includes Taxable Transactions (excl. VAT), Untaxed Operations, Settlement of VAT to be paid, etc.

EDI (Electronic data interchange) Export is an extra feature for French accounting localization that refers to the standard formatted electronic exchange of business papers between an organization and its suppliers or consumers. It's a commonly employed technique that increases productivity and streamlines corporate procedures and the EDI tax reports are available under the Reporting menu of the Accounting application.

To summarise, the incorporation of accounting localization into Odoo 17 provides enterprises with a comprehensive approach to managing finances in various markets and locations. Businesses may easily modify their accounting procedures to conform to local laws, currencies, and reporting requirements thanks to Odoo's adaptable and customizable platform. Businesses may simplify their financial processes and guarantee compliance with local regulations by utilizing Odoo's powerful capabilities, which include tax customization, multi-currency support, and localized reporting templates. In the end, Odoo helps businesses efficiently and accurately handle the challenges of worldwide accounting, opening the door for long-term expansion and success abroad.

To read more about An Overview of Accounting Localization for Denmark in Odoo 17, refer to our blog An Overview of Accounting Localization for Denmark in Odoo 17.