A payroll tax on employee paychecks enacted by US law in 1935 is referred to as Federal Insurance Contributions Act(FICA). The cash collected through FICA is funded by medicare and social security programs. It is beneficial for working people by contributing a particular amount of paychecks become helpful to their future needs. Several rates are applied for the above taxes for workers based on each company policy. The computation of Federal Insurance taxes is a challenging step for most firms. By running Odoo ERP software, we can quickly manage the salary slip of an employee after mentioning the federal taxes. Odoo 16 Payroll module assists users in configuring federal insurance taxes inside an employee payslip.

This blog depicts the Federal Insurance Contributions Act within a Salary Structure using Odoo 16 Payroll.

We can configure employees' salaries, jobs, contracts, and work entries using the Odoo 16 Payroll module. Management of employees' payslips becomes a more straightforward process within the Payroll application. Lets' examine the process of generation FICA as a salary rule within a salary structure in Odoo 16.

Overview of the Federal Insurance Contributions Act for Employees

United State Congress passed the FICA in 1935 to access social security program contribution funds. Benefits for children, surviving spouses, and retirees can obtain the fund of social security programs. Through this, health and financial benefits are acquired by employees for their later life. We can calculate the federal tax by multiplying the medical care and social security tax percentage with the taxable gross. Based on employees' wage percentage, the computation of taxes become easier.

In 2022, the wage base for social security taxes on earnings is $147000. We can expect a rise in these wages within 2023. The social security tax rate for employees in a company is 6.2%. In contrast, medical care taxes did not have any wage base limit. The total medical care tax needed to pay by the employee is 1.45%. It sometimes reaches up to 2.35% depending on employees' wages.

How to Define FICA as Salary Rules within the Odoo 16 Payroll?

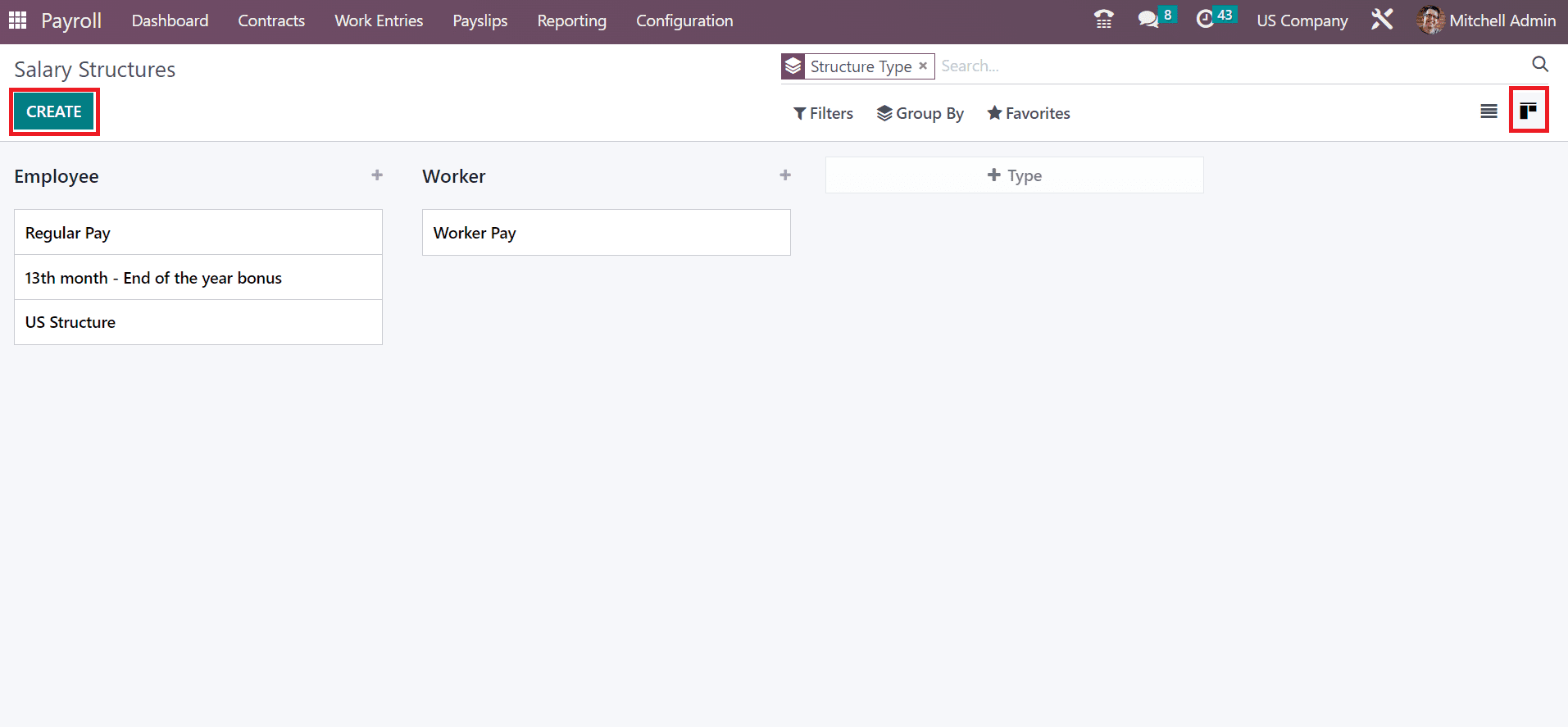

Using the Payroll application of Odoo 16, we can produce salary slips for workers in a company. You must make salary rules in Odoo 16 before creating the payslip. We can develop a structure once choosing the Structures menu in Configuration. In the Kanban view, we can acquire all types of completed structures. Selecting the CREATE icon makes it possible to develop a new one, as depicted in the screenshot below.

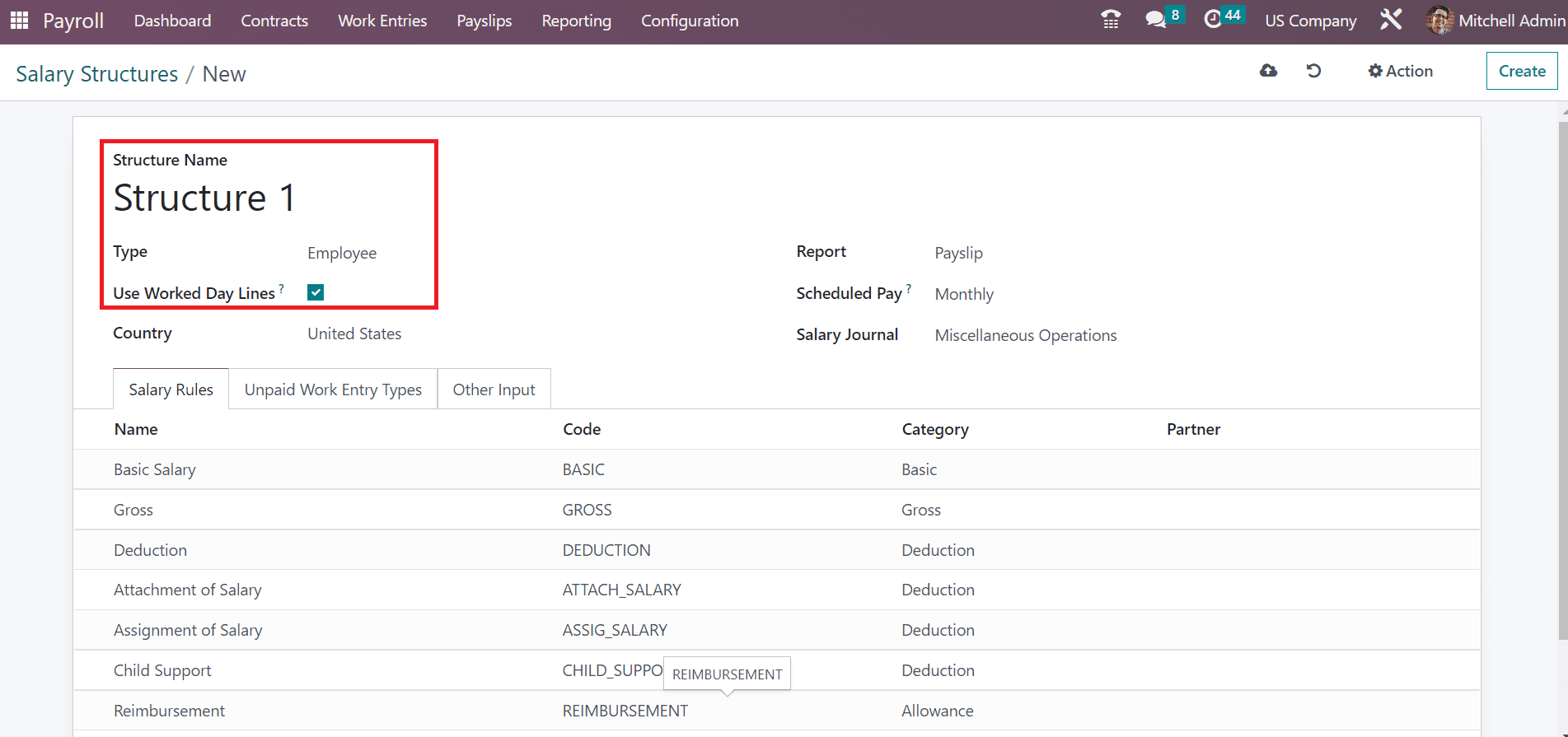

On the open page, you can add Structure 1 as the Structure Name and pick the employee as the Type for your Structure. After activating the Use Worked Day Lines, you can compute working days on payslips, as signified in the screenshot below.

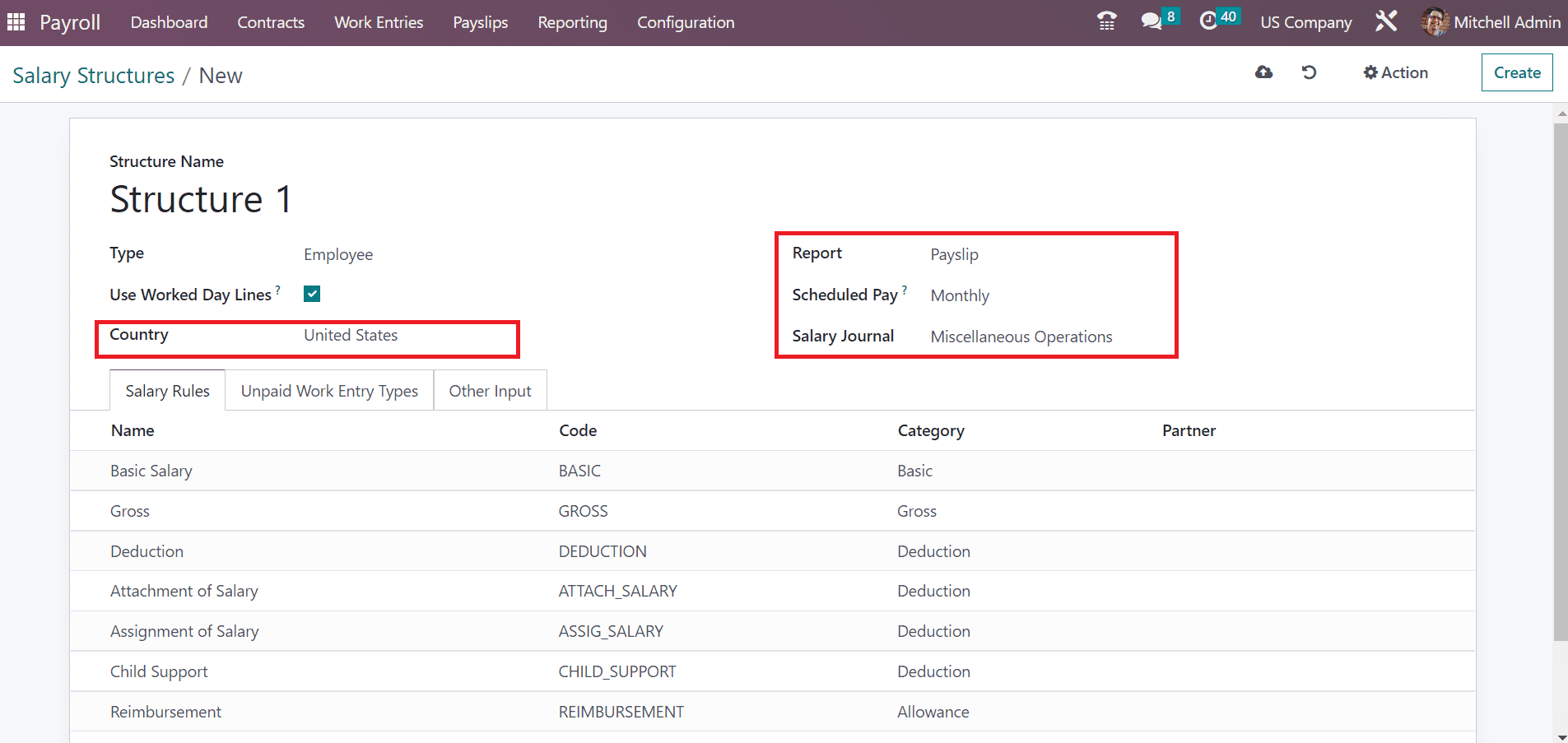

Next, you can add the United States in the Country field and enter Payslip as Report. Specify wage payment frequency as Monthly in the Scheduled Pay field. Also, choose Miscellaneous Operations within the Salary Journal option, as depicted in the screenshot below.

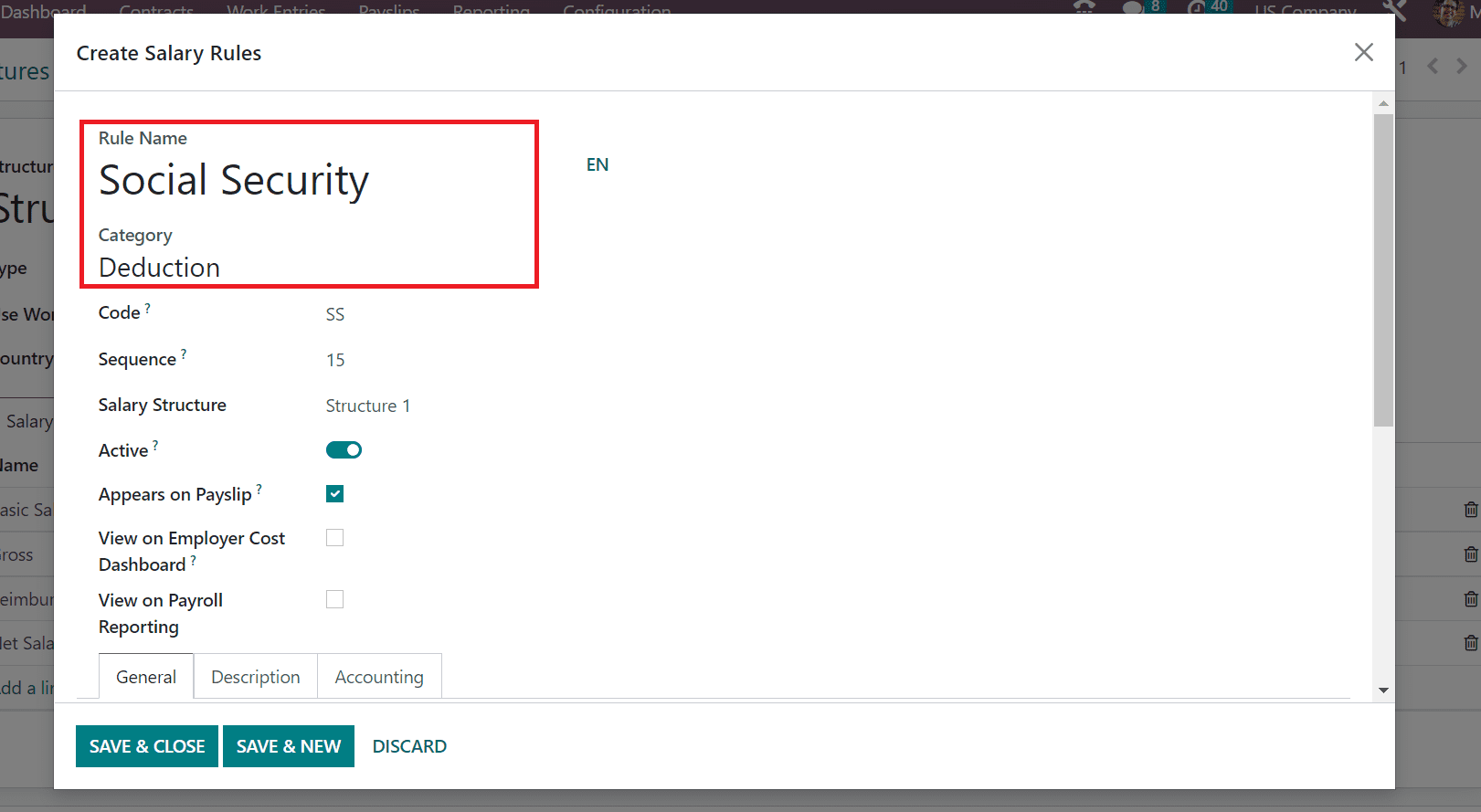

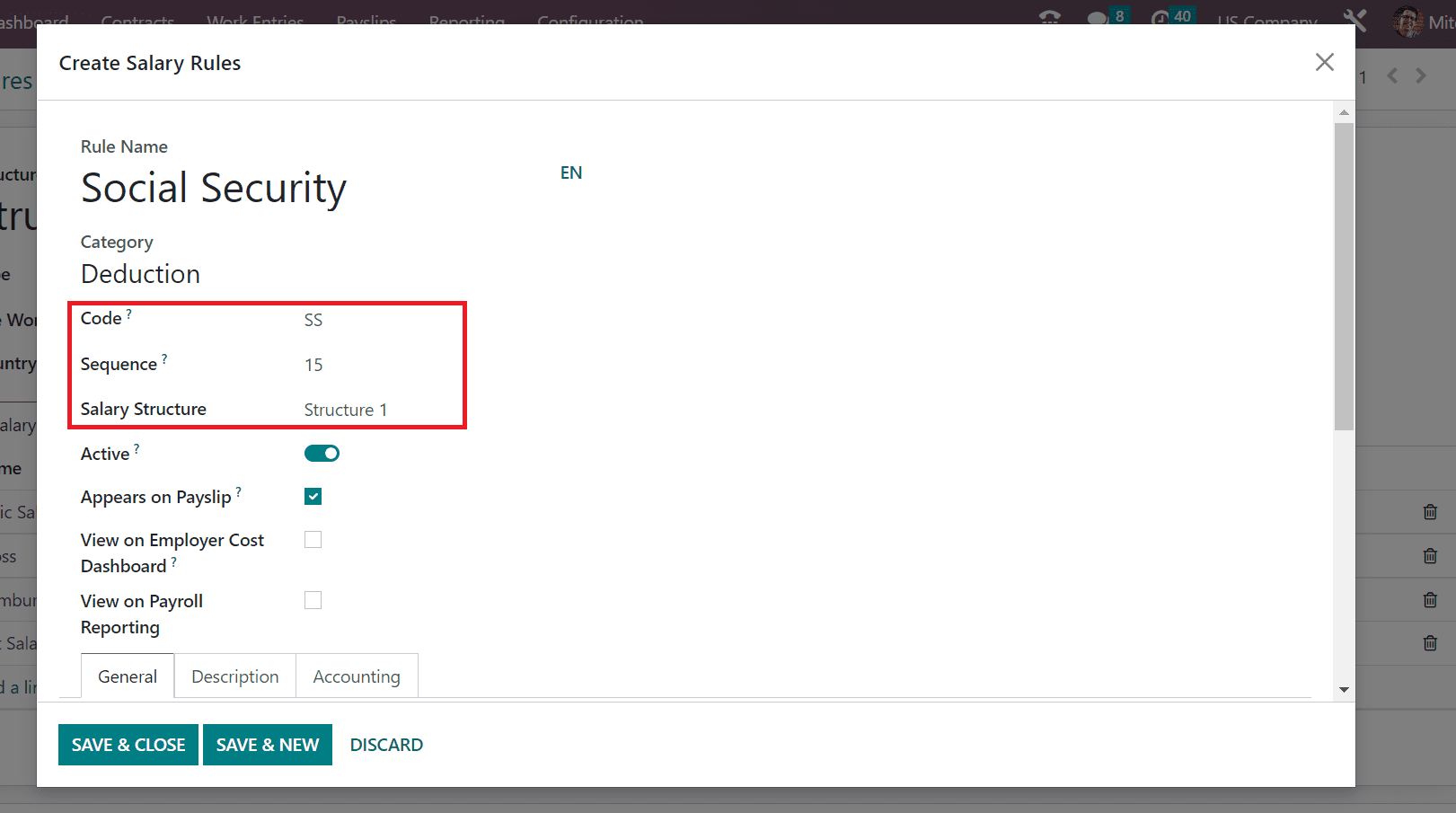

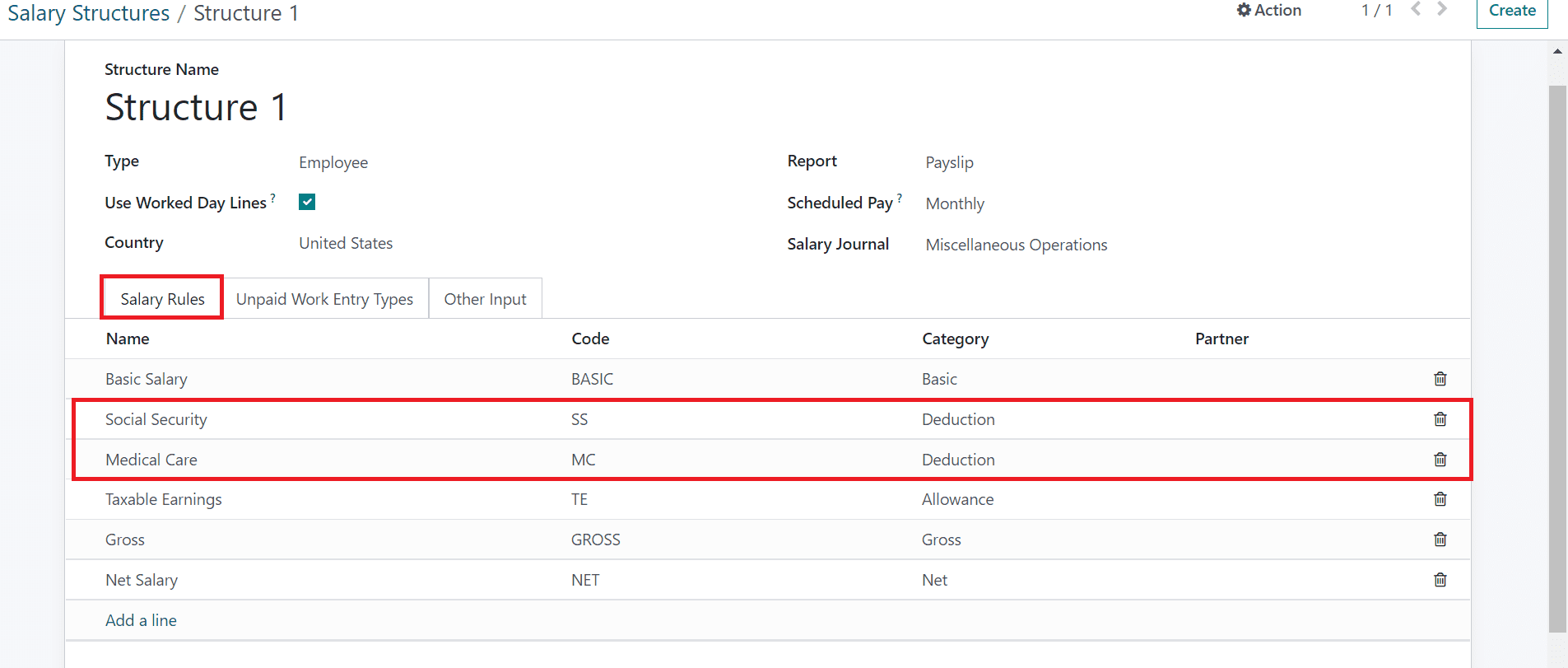

Next, we can add federal tax for medical care and social security as the salary rule for your Structure. By clicking on the Add a line option, it is easy to mention each salary rule. Users can apply the Rule Name as Social Security and Deduction as Category for your rule in the Create Salary Rules window, as mentioned in the screenshot below.

You can add a code for your salary rule Social Security as SS. Afterward, enter a sequence number as 15 in the Sequence option and choose Structure 1 from the Salary Structure field.

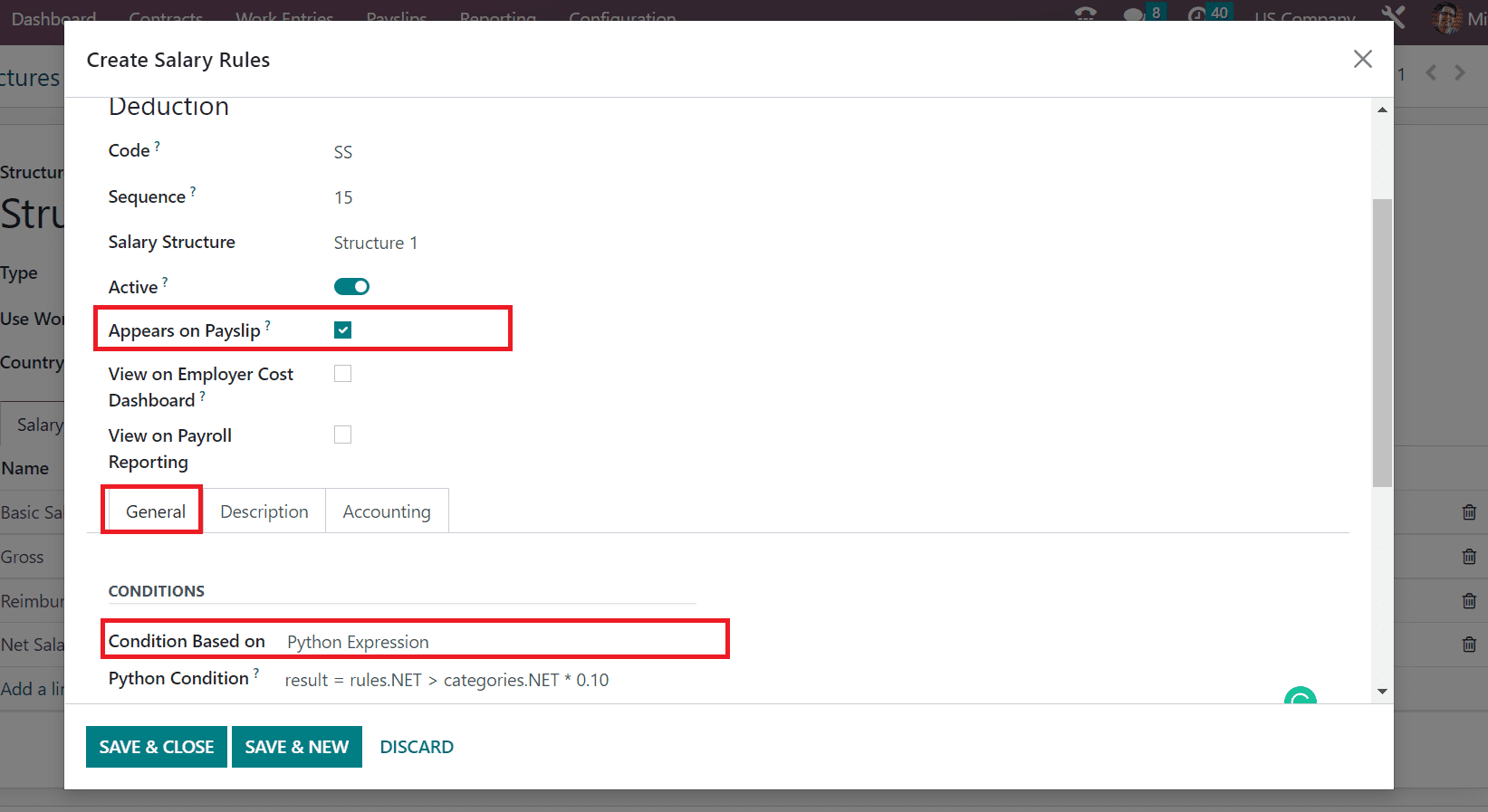

Enable the Appears on Payslip option to view the salary rule on a payslip. Inside the General tab, we can enter your rule's various calculation methods and conditions.

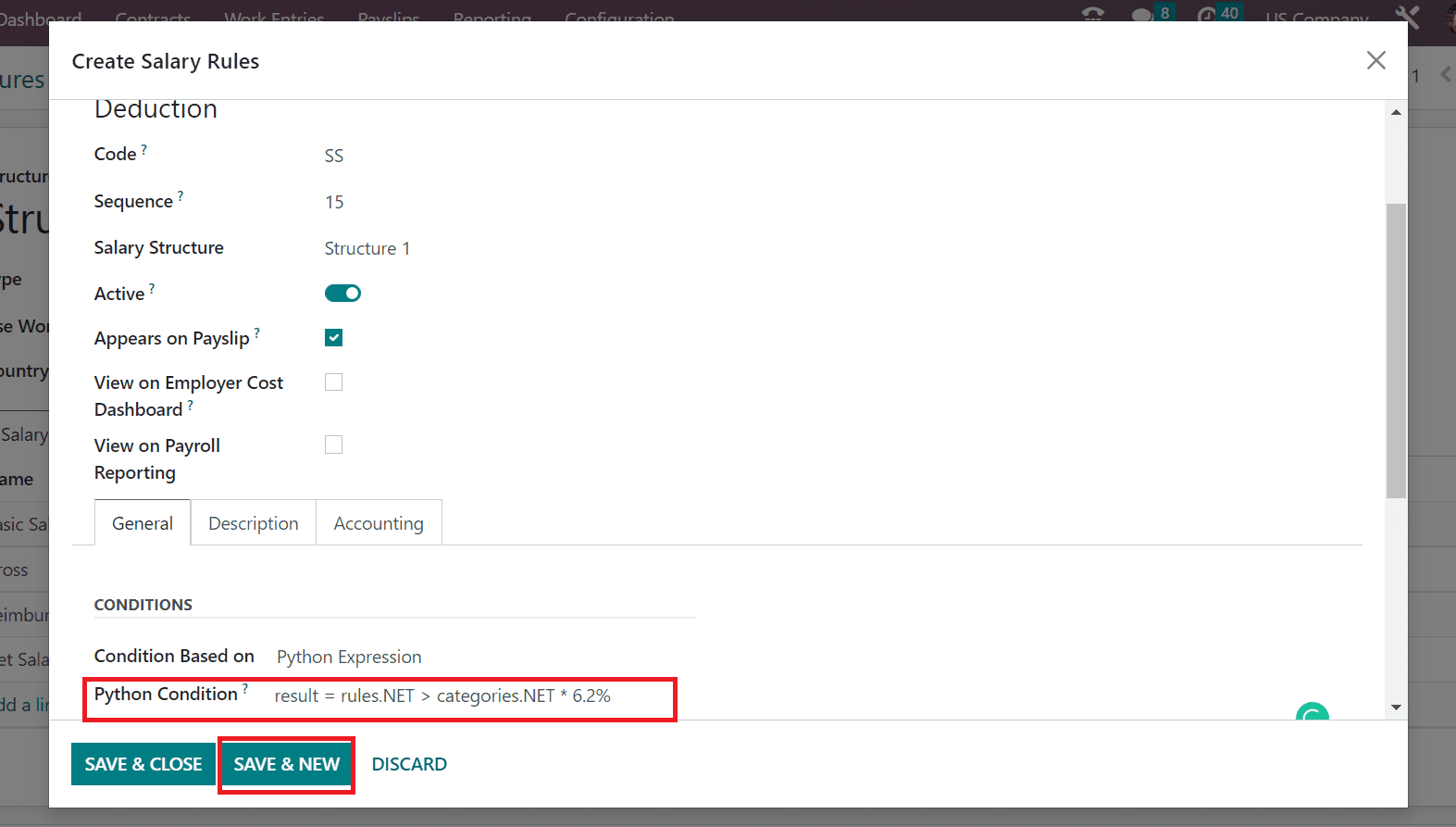

You can set the condition as per Python Expression below the CONDITIONS section. Later, enter your python condition for the rule, including the social security tax percentage as specified in the screenshot below.

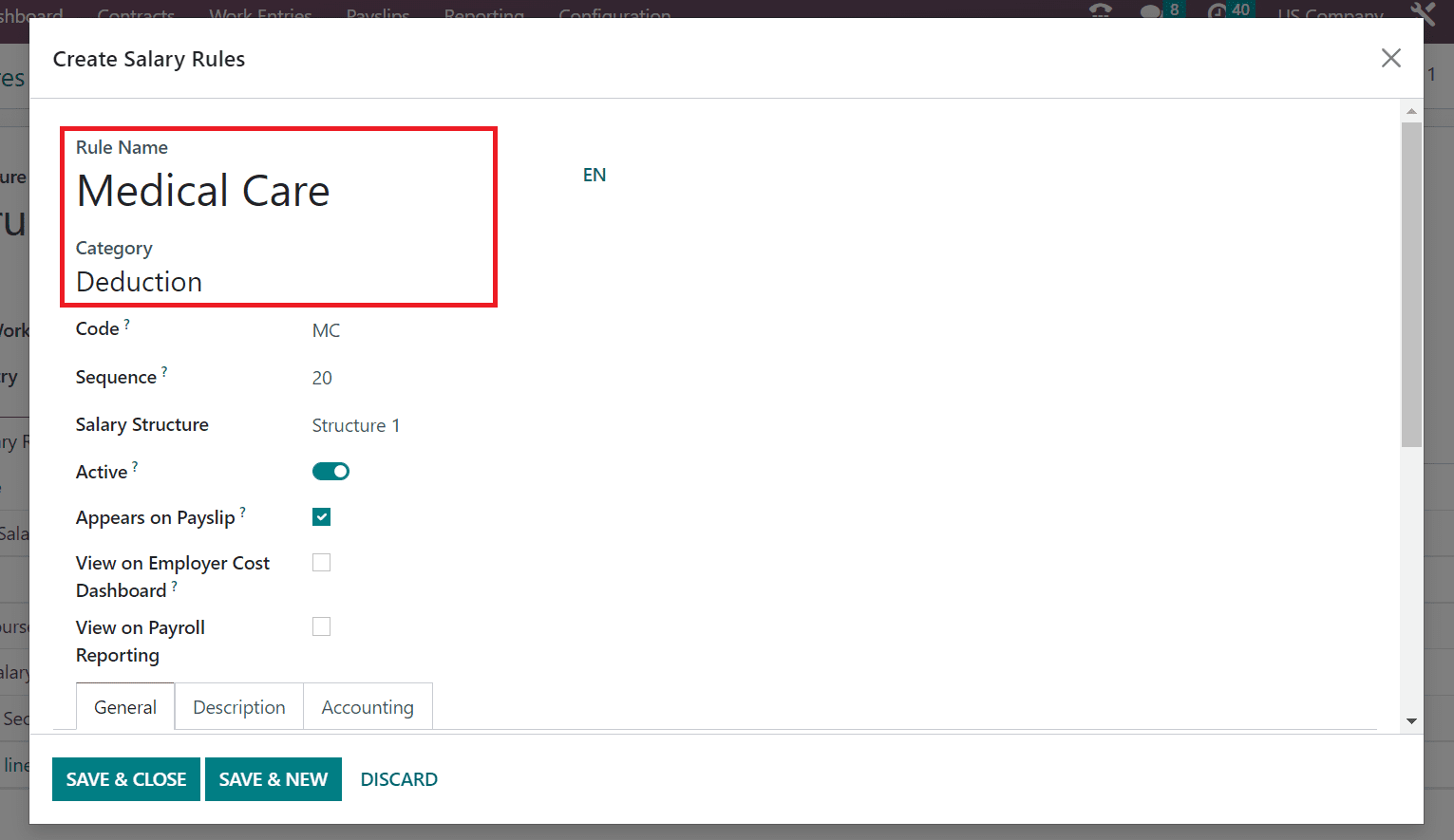

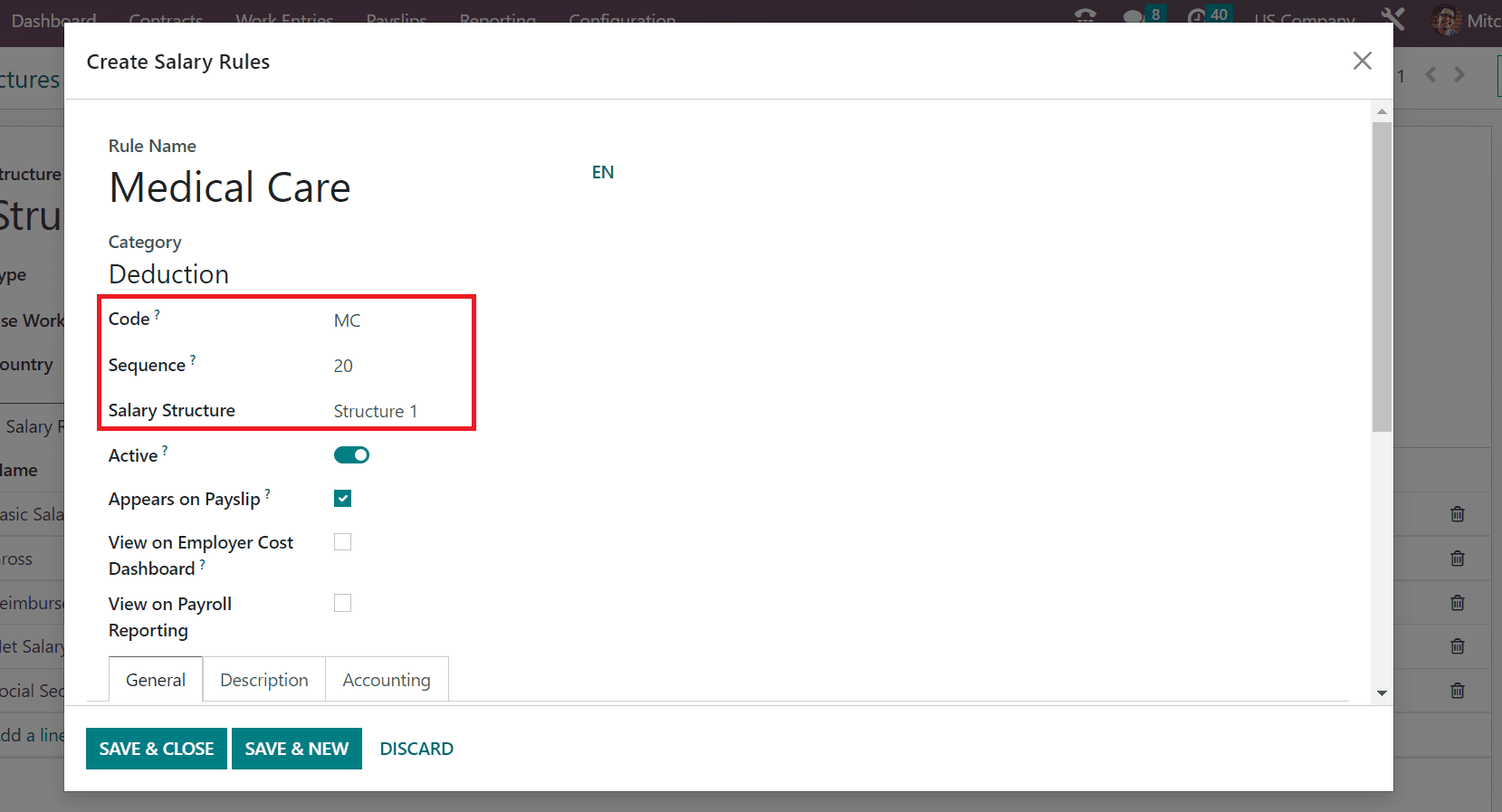

Here, a user must mention the social security tax rate in the US is 6.2% in the Python Condition field. Select SAVE & NEW icon once adding your condition, as shown in the screenshot above. Next, we can apply medical care details on the salary rule page. Apply Medical Care within the Rule Name field and choose Deduction in the Category on Create Salary Rules window.

Now, we can add Code as MC and a sequence number of 20 for salary rule Medical care. You must select Structure 1 in the Salary Structure field for your rule, as defined in the screenshot below.

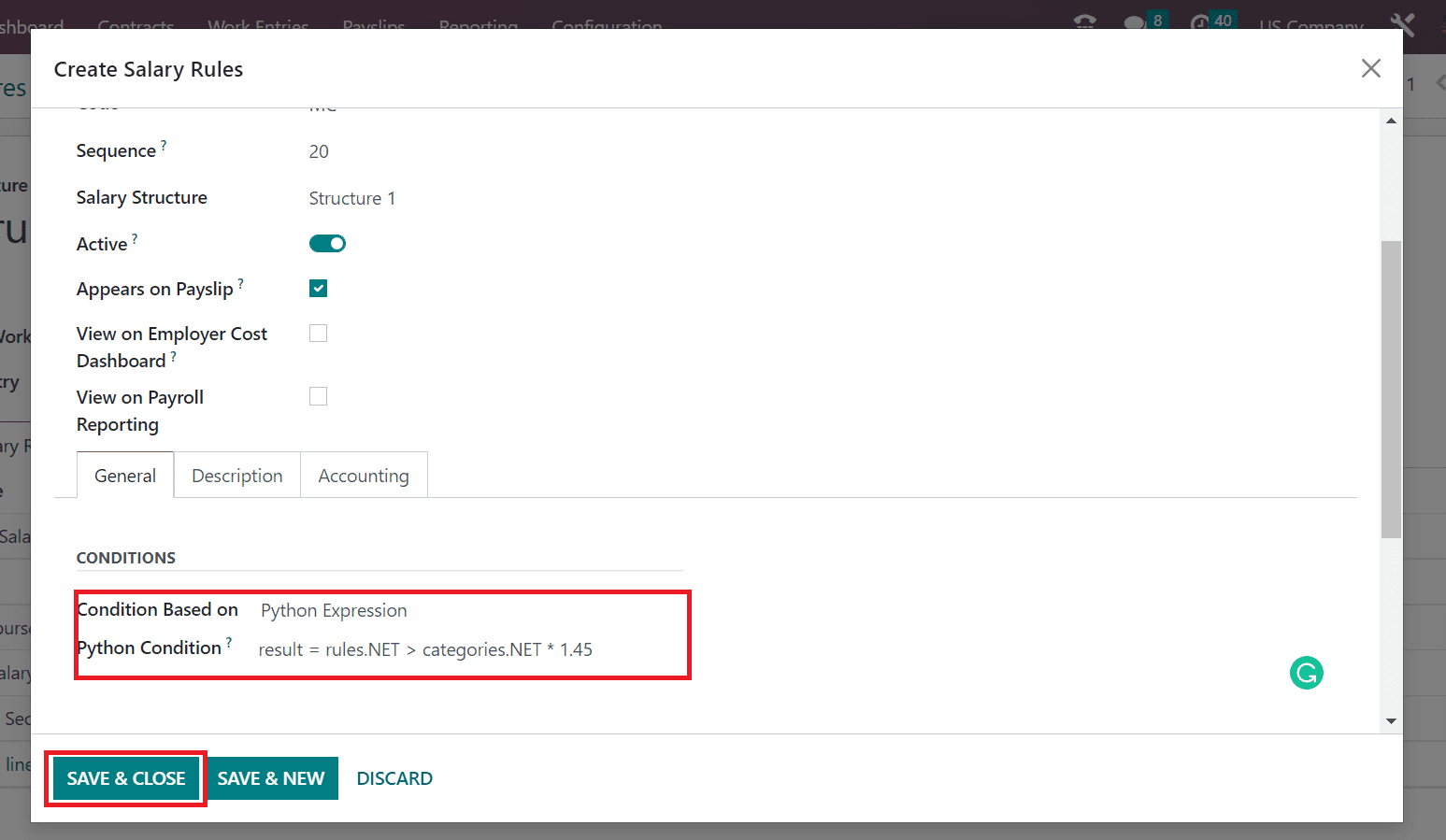

Next, set the condition for the Medical care rule inside the General section. By choosing the Python Expression, we can calculate the salary rule for Medical care using python code. In the Python Condition field, enter the code along with the tax rate of US Medical care is 1.45%.

You can press the SAVE & CLOSE button once you apply each salary rule detail. All the generated rules for your salary structure are viewable below the Salary Rules section.

How to Develop a Payslip for an Employee in a US Company?

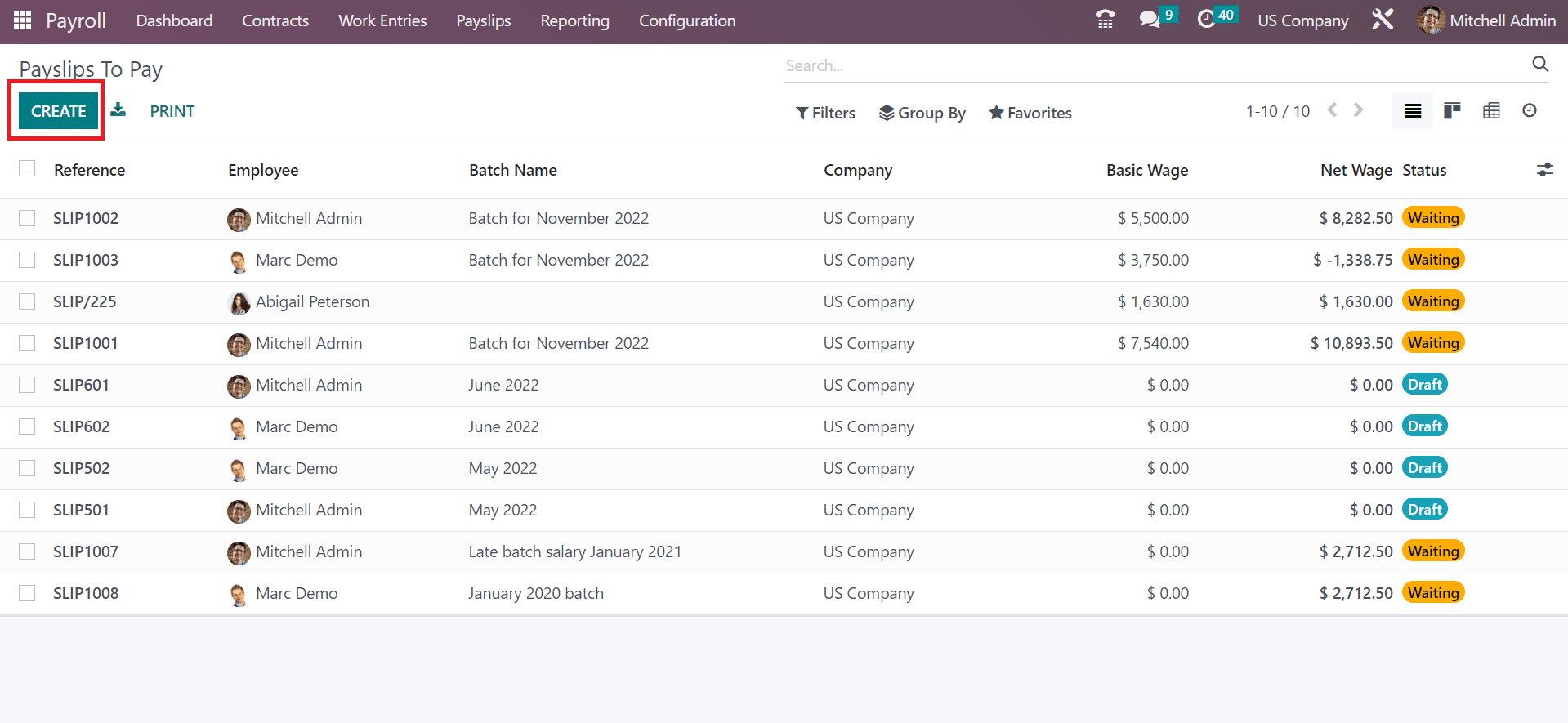

Odoo 16 Payroll module helps users to manage the salary slips of employees in each company. To develop a new one, select the To Pay menu in the Payslips tab, and a list of all salary slips is obtainable to the user. You can view information about each payslip, such as Basic wage, Status, Reference, Company, etc. Click the CREATE icon to define a payslip for an employee as per your salary structure.

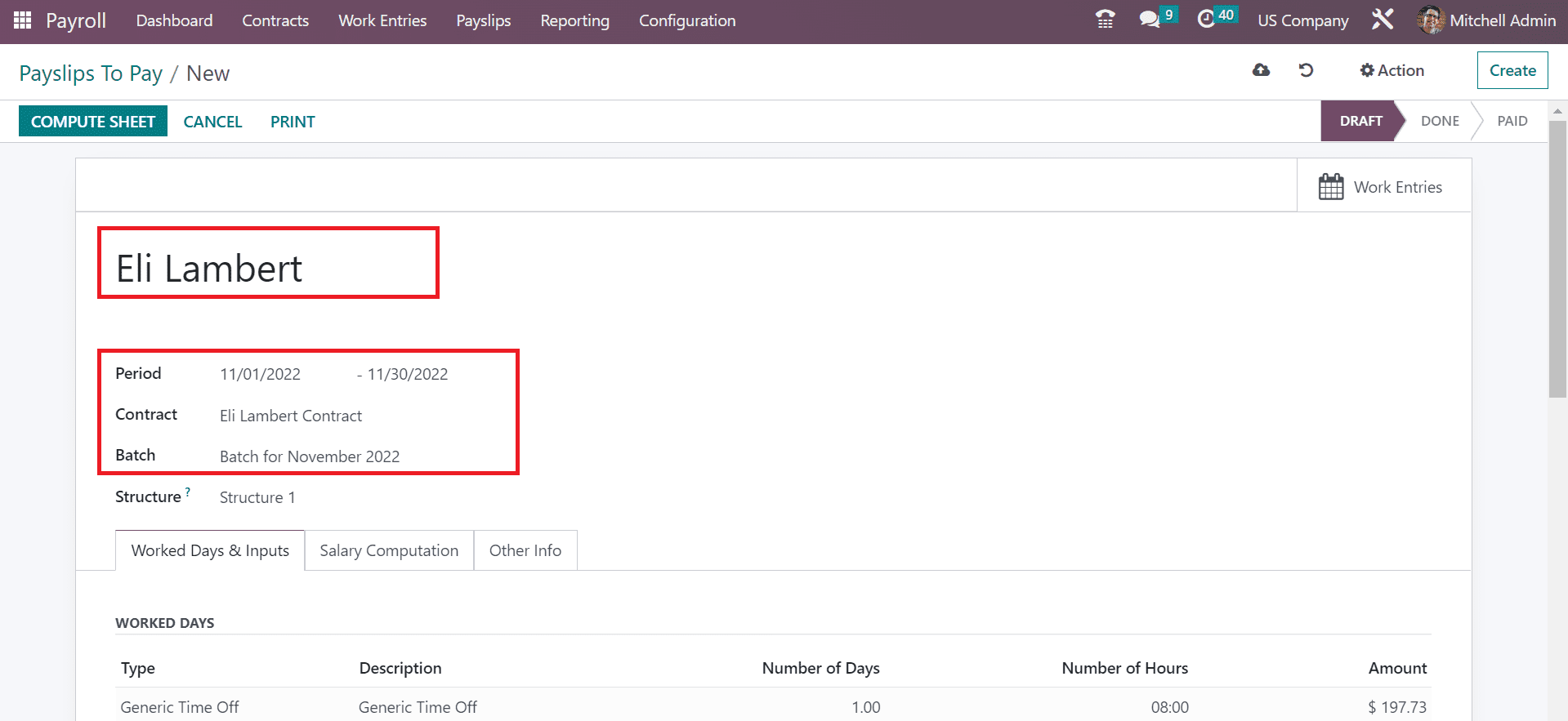

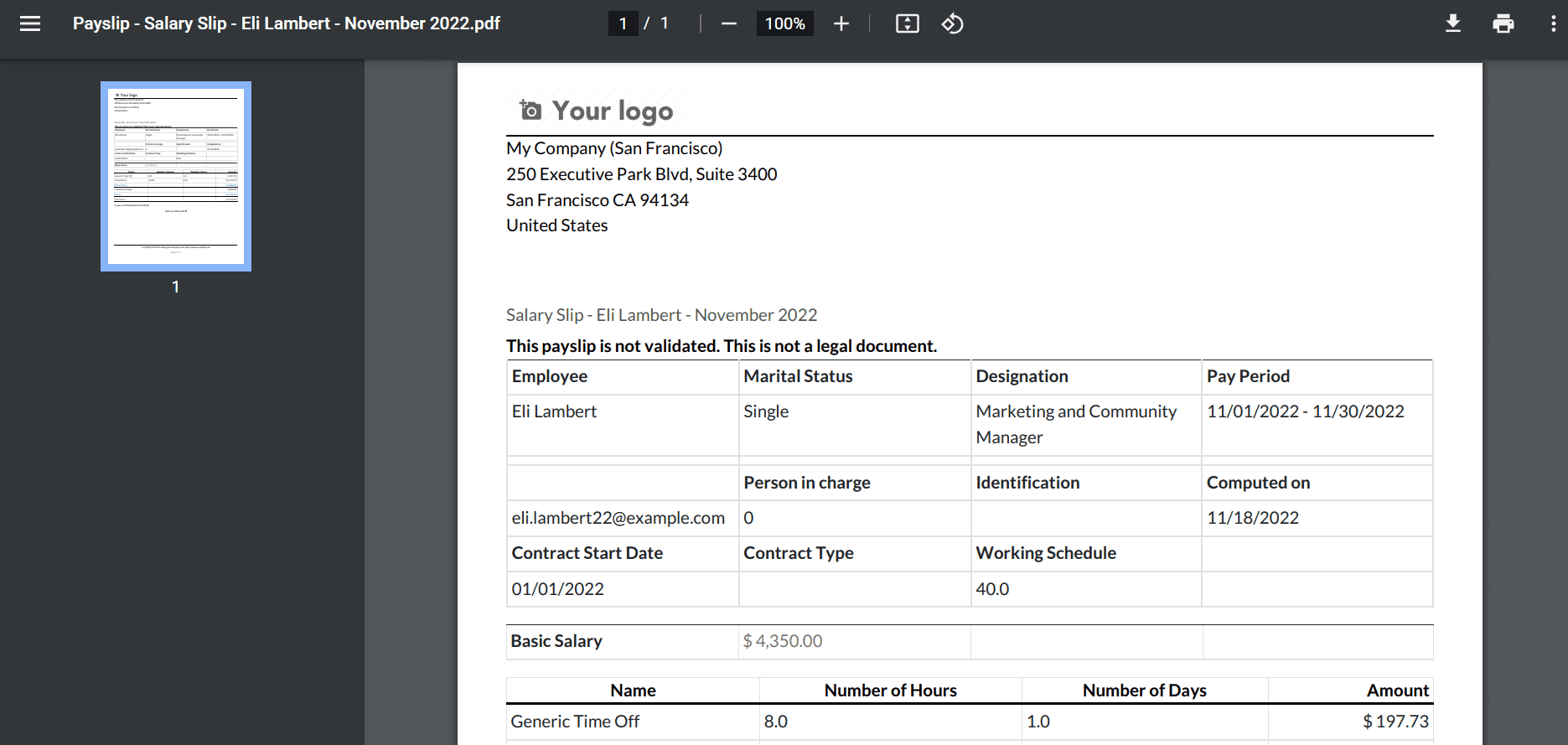

We add the Employee Eli Lambert and set the salary slip interval on the Period field. Moreover, choose the Contract for Eli Lambert and the Batch of a specific month, as demonstrated in the screenshot below.

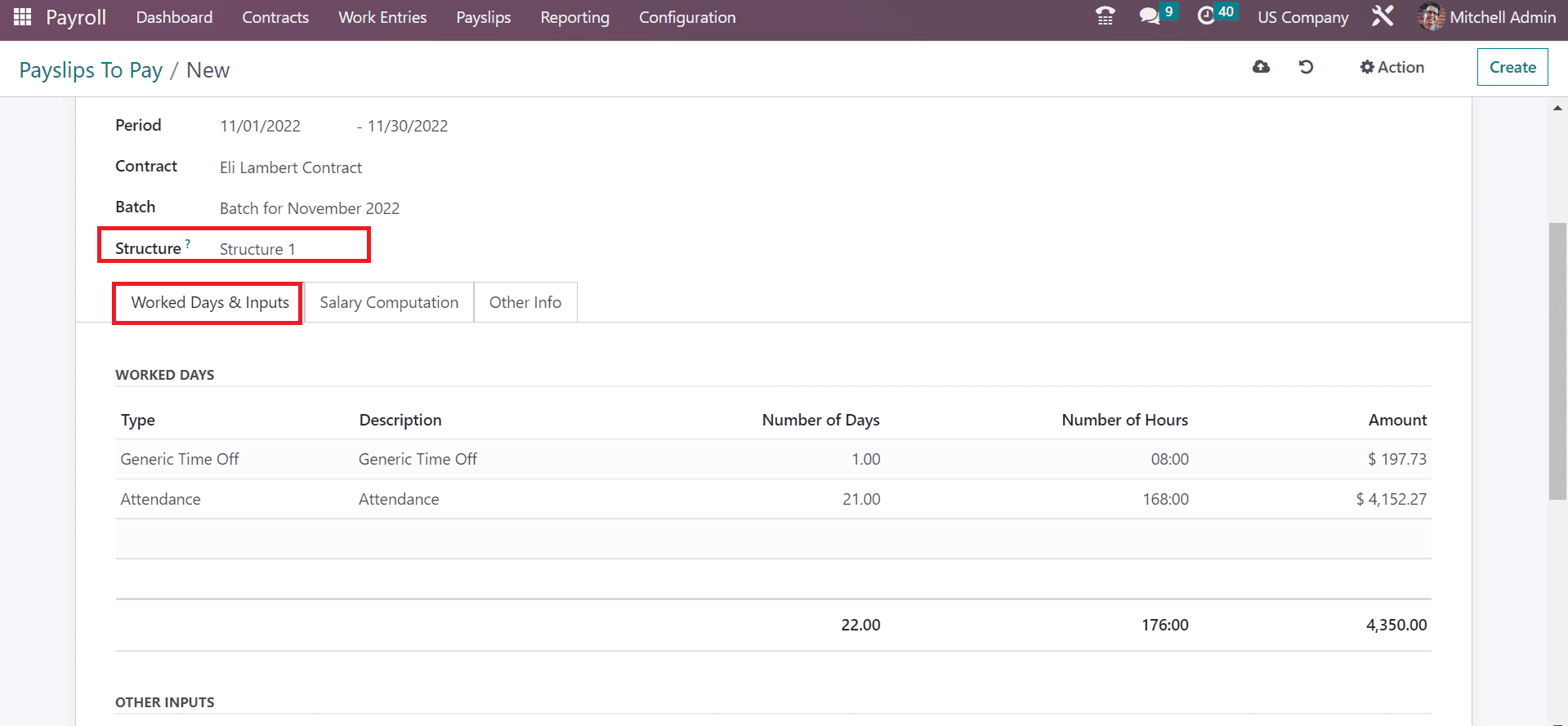

In the Structure field, pick your developed Structure 1 as Structure. We can obtain the worked days' details, including the Amount, Number of Hours, Type, and Description below the Worked Days & Inputs.

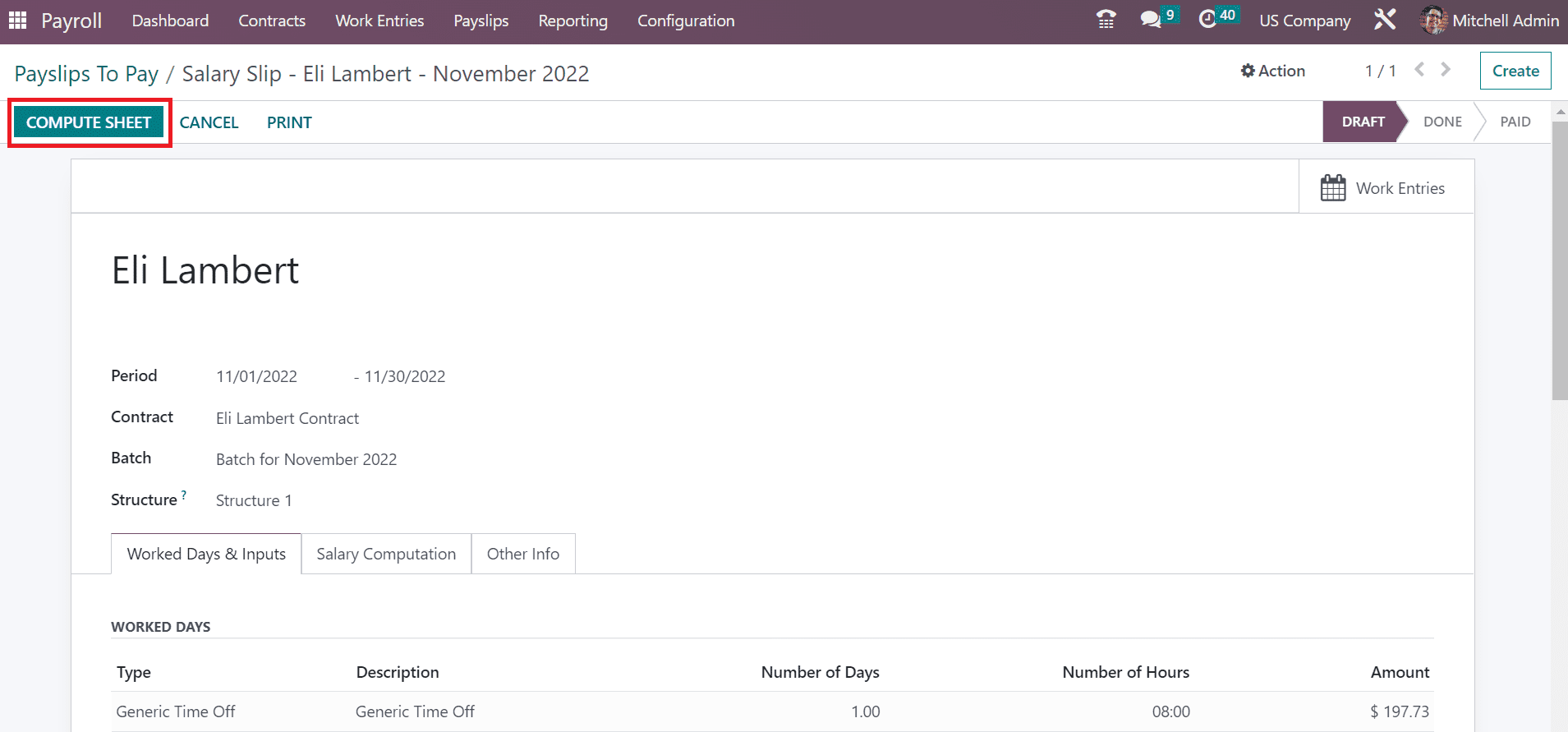

Click on the COMPUTE SHEET icon to calculate the salary rules for your employee.

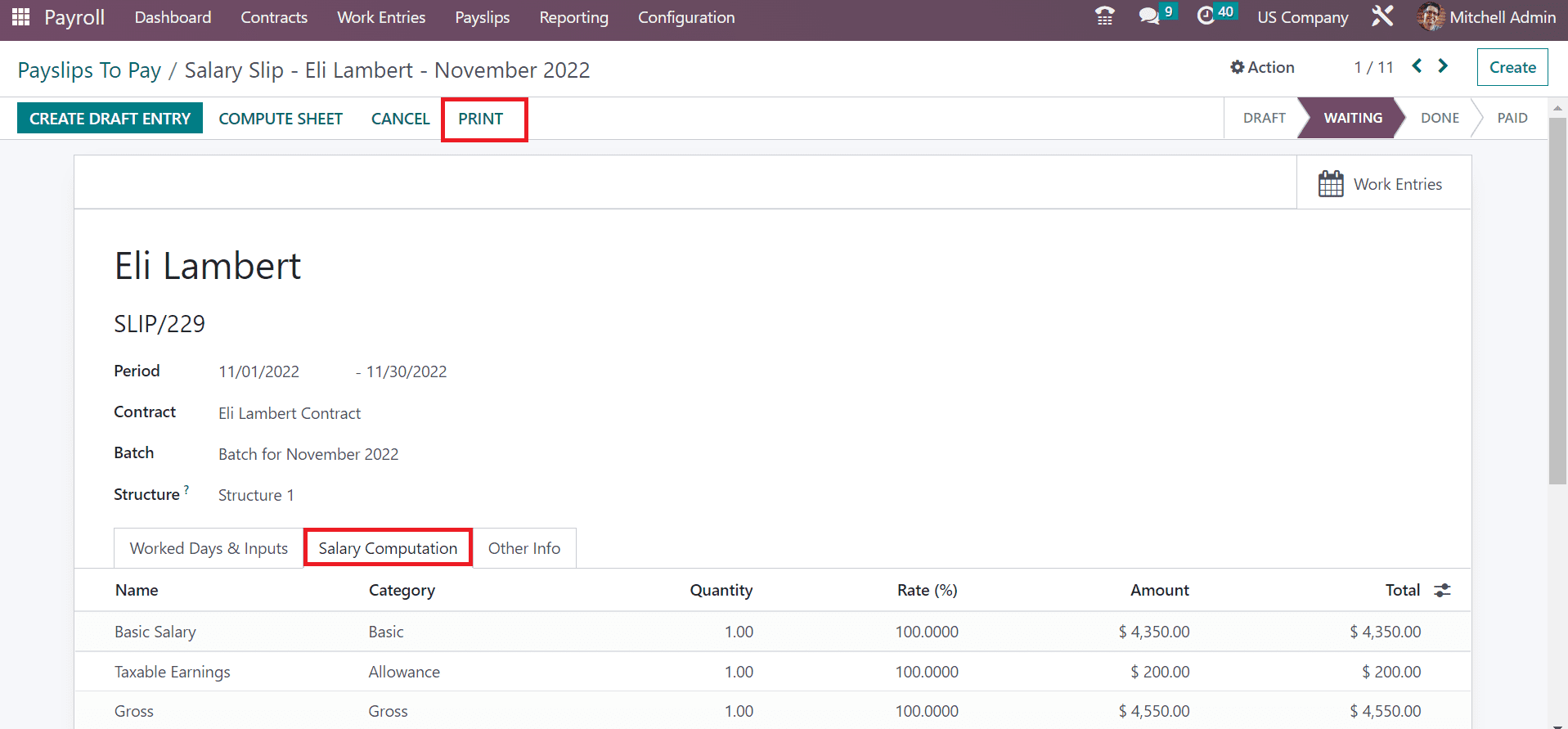

Users can view all calculations under the Salary Computation field. To get the payslip, press the PRINT icon in Payslip to Pay window, as described in the screenshot below.

After pressing the PRINT icon, the salary slip documents are downloaded into your system.

Management of Social security and Medical care taxes for employees has become an easy process with the assistance of Odoo 16 Payroll. You can configure many payslips in an organization with Odoo ERP support.